In a recent filing with the Securities and Exchange Commission, the new Masimo (Nasdaq: MASI) Board of Directors reaffirmed its non-GAAP 3Q and full-year financial guidance as previously provided by the company to investors. It also notified the commission that the Board has officially terminated the employment of former CEO Joe Kiani.

Perhaps most surprisingly, it has additionally filed a major lawsuit against Joe Kiani and RTW Investments alleging, among other things, that they colluded to create a group that violated federal securities laws.

See more on this latest filing with the SEC by the new Masimo Board of Directors

It has been a busy four weeks or so since the Masimo Corporation 2024 Annual Stockholders Meeting in late September. After a pitched, tense, and at times quite nasty proxy battle in the weeks leading up to this event, investors rejected the company’s Board nominees, voting instead to elect Dr. Darlene Solomon and William Jellison – both of whom were nominated by activist investor Quentin Koffey and Politan Capital Management. The value of Masimo stock immediately rose in the wake of this news.

Shortly after the stockholders meeting, the company announced that Chairman, CEO, and Founder Joe Kiani had resigned from the medical products company he founded. Kiani also filed a lawsuit against the company in an attempt to force its payment of his contract, which is said to be worth around $400 million.

The Company Names Michelle Brennan as Interim CEO

The company immediately announced the appointment of Michelle Brennan, another Politan nominee elected to the board at the 2023 Stockholders meeting, as interim CEO of the company while a comprehensive search is launched for a permanent replacement. Brennan comes to the company with an impressive resume, including several years in senior management at medical products powerhouse Johnson & Johnson, and she is said to be wasting no time in meeting with staff and management to keep the operational gears of the company in motion in the wake of Kiani’s departure.

Then last week, Masimo revealed that it has expanded its Board of Directors by appointing two more members, Timothy J. Scannell and Wendy E. Lane. This expansion of the board to eight directors is a proposal that had been actively contemplated by the previous board chaired by Kiani, as Masimo’s previous board configuration was quite a bit smaller than is common in a company this size. This means that six of the eight directors were brought in by the efforts of Quentin Koffey and Politan.

Late Breaking Developments

Now most recently, and ahead of its next earnings report, Masimo notified the SEC that it is reaffirming its previously provided financial guidance for both the third quarter (3Q) and full-year anticipated results. This is probably being done to calm any potential investor jitters with the recent management changes by showing that the company’s finances are progressing according to plan.

Whatever the reason, it is indeed a positive sign.

Interestingly, the Board Announced the Official Termination of Kiani’s Employment

Perhaps the most interesting development, however, is the news that the board has taken the step of officially terminating Kiani’s employment. The company said this step was taken, “Following a review by outside counsel…” That official termination is said to be effective as of October 24, 2024.

I’m not quite sure how to read this news flash. Last we heard, Kiani had already resigned from Masimo as of September 19, 2024, the same day his candidates for the board (which included him, by the way) lost their election to the board. So why is this step necessary?

I First Guessed a Couple of Potential Scenarios; Then I Discovered the Real Reason

I come up with two possible scenarios for this move by the board. First, it could simply be tying up loose ends with an on-the-record official severing of ties to Kiani. The other scenario was that perhaps there was some negotiated settlement regarding his payout, and this caused a resetting of the official date.

However, what I discovered was way beyond my imagination.

The Phrase ‘Outside Counsel’ Caught My Attention

One phrase in the company’s filing kept jumping out at me: “Following a review by outside counsel…” Why, I wondered, did the company feel the need to speak with “outside counsel?”

I decided to use my court access to run a search for cases involving Joe E. Kiani and/or Masimo Corporation. I was looking for Kiani’s lawsuit against the company. But what I found was a doozy!

Filed Last Friday – Masimo Corp v. Joe Kiani et. al.

Filed just last Friday, October 25, 2024, I found this: Masimo Corporation v. Joe E. Kiani, Roderick Wong, Naveen Yalamanchi, RTW Investments LP, RTW Investments GP LLC, RTW Master Fund LTD, RTW Offshore Fund One LP, RTW Innovation Master Fund LTD, RTW Innovation Offshore Fund LTD, RTW Innovation Onshore Fund LTD, and RTW Fund Group GP LLC. October 25th is the day after the board’s official termination date of Kiani on October 24th. I’m pretty sure that’s not a coincidence.

This is a significant lawsuit alleging that Joe Kiani had a secret agreement with the owner and management of RTW Investments “…to secretly manipulate the outcome of a corporate election in violation of the federal securities laws.” Because this suit alleges securities law violations, it was filed in the U.S. District Court, Southern District of New York – a well-known court with a long history of hearing landmark cases surrounding securities and financial matters…such as those related to Wall Street.

Kiani’s ‘Empty Voting’ Scheme is Coming Back to Haunt Him

This lawsuit starts with the matter of a scheme to commit “empty voting,” an issue I reported on initially here (see “#3 – Politan Detects and Calls Out Voting Irregularities; Calls for an Investigation”)…with further details here (See “What’s the Driving Force Behind Today’s Developments?)…and, finally, more here, on the eve of the stockholders meeting (see, “Politan Tells the Chancery Court That Masimo Board & Kiani are in a Voting Conspiracy with RTW Investments”).

While the concept of empty voting is a somewhat complex one, what Masimo’s lawsuit against Kiani makes clear is that when a company executive colludes with an outside investment group to illicitly swing a vote of shareholders in his favor rather than to conduct a clean election that truly represents the vote of investors, he crosses the line.

According to the Masimo Lawsuit:

This action arises out of an agreement by RTW and Joe Kiani, Masimo’s founder and former-Chairman and Chief Executive Officer (‘CEO’), to secretly manipulate the outcome of a corporate election in violation of the federal securities laws. Mr. Kiani and RTW understood that there was a serious risk that Mr. Kiani would lose his seat on Masimo’s Board at the 2024 annual meeting of Masimo’s shareholders (the ‘Annual Meeting’) given the longstanding and widespread criticism of his governance of the Company. In an ultimately unsuccessful attempt to preserve Mr. Kiani’s seat, Mr. Kiani and RTW colluded in an ’empty voting’ scheme in an effort to swing the election in his favor. In doing so, Mr. Kiani and RTW formed an undisclosed group holding as much as 19% of Masimo’s common stock and therefore must disgorge their short-swing profits pursuant to Section 16(b) of the Securities Exchange Act…

Masimo Corporations v. Joe E. Kiani, et. al.; Emphasis added

Those are some big allegations…allegations that are likely to attract the attention of agents of the Securities and Exchange Commission (SEC). The lawsuit goes on to lay out in detail, step by step, how “the scheme” worked. As I read it, I wondered how the company would prove its claim. Simple, it turns out, they have evidence (!), including copies of emails and transcripts of text messages.

Masimo Has Evidence of Alleged Wrongdoing by Its Former CEO

Masimo alleges that by allying with RTW and ultimately acquiring as much as 19% of Masimo’s outstanding stock – even if only temporarily – Kiani had formed a Section 13(d) group. That’s important because Section 13(d) groups have very specific reporting requirements that the Kiani/RTW group did not follow, in violation of securities laws. Masimo further alleges that Kiani shared confidential proxy information with RTW, an outside investment company – also a violation of securities law.

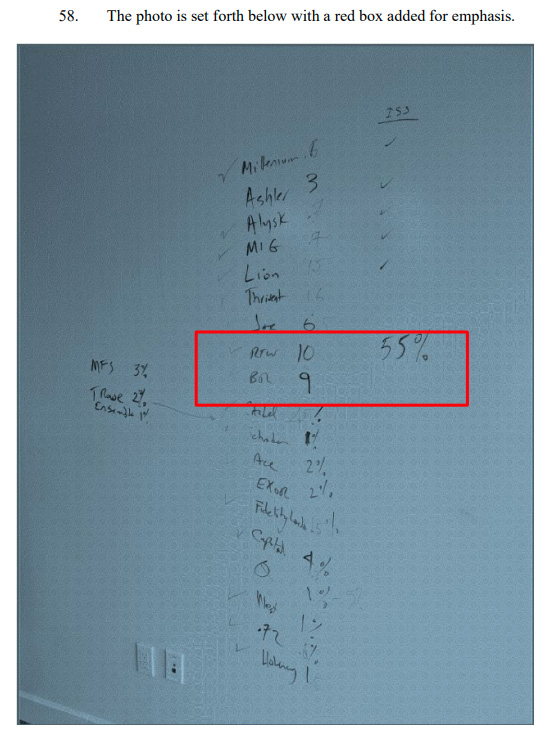

Specifically, the lawsuit includes a photo of a whiteboard that lists the voting totals for multiple large Masimo shareholders – information provided for the proxy participants only – that Kiani sent to an RTW executive to share with them what he expected would be the final vote tally. Masimo superimposed a large red box to highlight particularly damning information, wrongly shared with a non-proxy participant investment company.

What ‘Relief’ Masimo is Requesting From the Court

“Finally, the photo contains confidential information about vote totals available to proxy participants that is not permitted under applicable securities laws to be provided to voting shareholders.” [Masimo Corporation v. Joe E. Kiani, et. al.]

Here is what Masimo is requesting from the courts:

- a. Declaring that Defendants formed a group within the meaning of Section 13(d) of the Exchange Act;

- b. Requiring Defendants to disgorge all short-swing profits made as a result of their group’s empty voting scheme in violation of Section 16(b) of the Exchange Act

- c. Awarding Plaintiff its attorneys’ fees and costs as provided by law

- d. Awarding all such further relief as the Court deems just and proper

A Powerful and Significant Threat to Kiani & RTW

I am not a lawyer, but I think this lawsuit presents a powerful and significant threat to both Joe Kiani and RTW. If the court agrees with Masimo and declares that the defendants had in fact formed a Section 13(d) group, then they will be in violation of several statutorily mandated notifications. The SEC takes a hard stance on those who hide activities that are legally required to be disclosed.

Is this Masimo’s response to Joe Kiani’s demand he receive his $400 million payout, which many feel is unreasonably large? I don’t know, but clearly, he has a new and serious issue to deal with now.

Learn all about Masimo by visiting masimo.com.

Ted, this looks like fun can you post the case number?

Hi Steve,

The case number is 24-cv-08147

Enjoy!

Ted