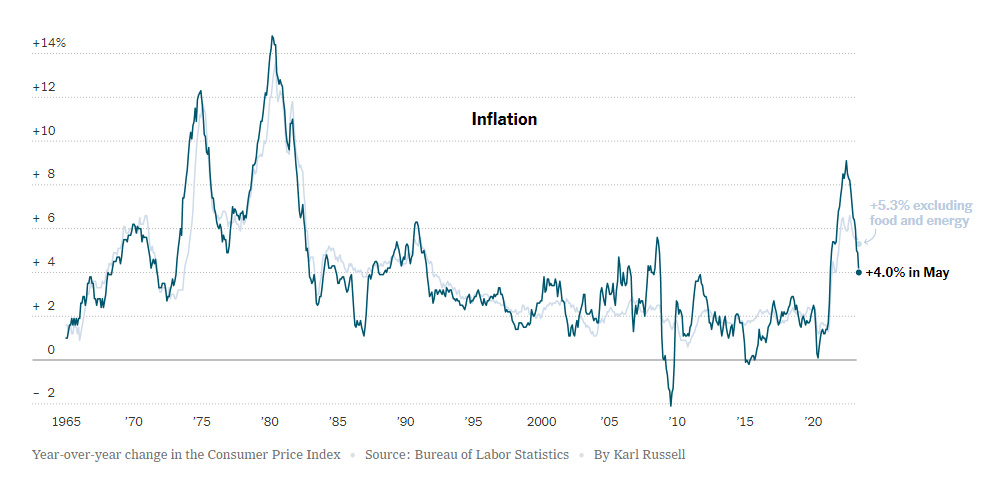

On the face of it, the inflation numbers for May seemed quite positive and an apparent validation of the Federal Reserve Board’s efforts to glide the economy into a “soft landing.” But the overall number, a 4% increase in the broader-based Consumer Price Index turned out to be a bit of an illusion, causing the Fed to leave interest rates at the current level, but forecast two more interest rate increases in 2023.

See more on inflation concerns

For the first time in a year and a half after ten consecutive increases, the Federal Reserve Board (Fed) announced today it will leave the current interest rate unchanged. If they had stopped there, markets would have most likely rallied, but Powell went on to hint that there may be another two rate increases in the back half of 2023. And that news depressed values on Wall St.

All of this, of course, is in reaction to May’s inflation number which came in at a 4.0% increase in the Consumer Price Index (CPI). This rate was below economists’ projections of a 4.1% increase in prices and well below April’s increase of 4.9%. And it is less than half of the peak inflation rate of 9.1% in June 2022.

May’s Inflation Reading was Celebrated, But Fed Still Not Satisfied

The news of May’s rate was celebrated by many when announced yesterday. However, keep in mind that while it is certainly good news that the pace of consumer price increases is decelerating, they are still increasing. Not to mention that we are still way above pre-COVID inflation levels – and it is double the Fed’s preferred target rate of 2% inflation.

Still, upon learning of the lower inflation rate, many predicted that Fed Chairman Jerome Powell would hold interest rates at their current levels, and they were correct. But I’m guessing that Powell is not as happy with the May inflation report as you might think he should be.

What’s Eating the Fed?

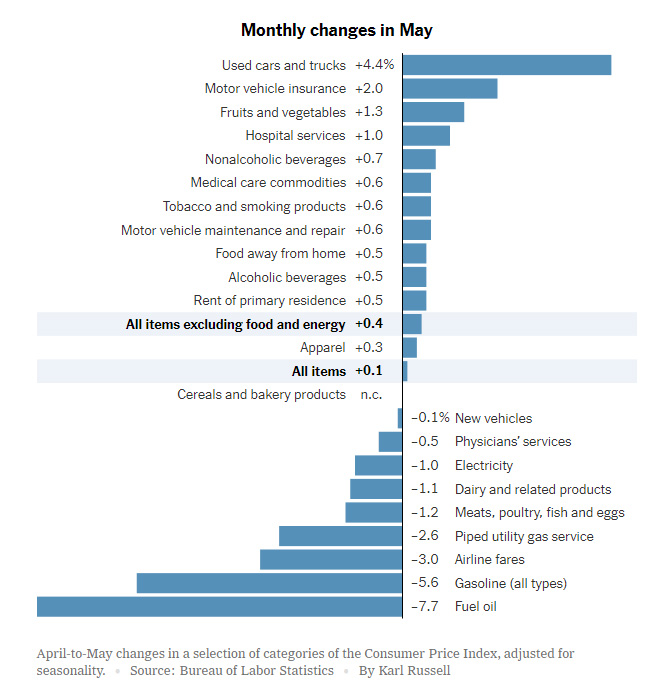

So just what’s eating the Fed? First of all, while you and I watch CPI, the Fed prefers what is known as the “core index” in which categories that exhibit extreme month-to-month volatility in their pricing are stripped out – mostly energy and food costs. In May, the core index came in at a more concerning 5.33% which was not only appreciably higher than the standard CPI, but it was also higher than most economists expected.

Not only that, but several service categories continued to see their prices climb quickly, such as car insurance, moving expenses, and hotel rates. Certain categories that the Fed had been looking to decline, are stubbornly continuing to increase.

Certain Pricing Categories are Stubbornly Resisting Fed’s Moves

And certain categories seem to be resisting the Fed’s efforts to cool their increases. Perhaps the best example of that is grocery prices which overall grew 0.2%, but fruits and vegetables popped up 1.3%. However, some of this was offset by declining egg prices which over the last few months had climbed dramatically, but now in May declined almost 14% as compared to April, according to a report by the Morning Brew.

Still, there are positive signs as well. Increases in rental rates are finally beginning to cool, airfare dropped sharply in May, and a variety of recreation-related items – such as movie tickets and pet care – saw their prices moderate, according to a report by the New York Times.

Fed Keeps Interest Rates Stable to Buy Time for More Assessment

Powell announced that the rate would remain at the current level in order to give the Fed more time to further assess its impact on some of the now-finally-moving prices. Many had hoped that perhaps Powell would signal that the era of interest rate increases was over…but their hopes were dashed on the rocks of reality.

As is the custom of the Fed when they make these announcements, they release updated forward-looking projections, and this time the projections suggested that future increases would most likely be necessary, perhaps as many as two more quarter-point increases in 2023. It was this news that caused a bit of commotion in the financial markets.

I would almost say that the conditions that we need to see in place to get inflation down are coming into place. But the process of that actually working on inflation is going to take some time.

Jerome Powell, Federal Reserve Board Chairman as reported by the Associated Press

Clearly, Progress Has Been Made

Clearly, progress has been made in turning around the U.S. economy – a notoriously difficult task. Hope remains strong for a “soft landing” which means that inflation is brought under control without causing a recession. This is something that has never been successfully accomplished before. Generally, actions the Fed takes to bring prices down can easily slip out of control and cause much damage in the labor market. This time, however, employment is beginning to slow, but holding well.

Another concern for the Fed stems from the recent bank failures of Silicon Valley Bank and Republic Bank. A chill has run through the banking system and lending has tightened up. This is one of the variables that the Fed noted they needed some more time to study the impact of on the overall economy.

Leave a Reply