On Tuesday, Bose Corporation – a privately held manufacturer and marketer of a variety of predominantly audio products like headphones, speakers, soundbars and car audio – announced it has acquired McIntosh Group, a high-end manufacturer of electronics under the McIntosh brand and speakers/phono cartridges under the Sonus faber brand. Terms of the deal were not revealed and a buzz has descended around the industry as to whether this is a good thing or a bad thing.

Learn more about Bose acquiring McIntosh

So when I first heard about this deal yesterday, my thought was largely “meh.” I don’t see the synergies here, and based on the initial announcement from Bose, I am frankly a little suspicious of the motivation for this transaction.

There is a sense of parallelism in this situation. Both of these brands have long storied histories…both were once incredibly powerful brands in their respective markets…both employed unique technological philosophies…and both – at one time – had legions of devoted followers. Also, both of these companies once had incredibly devoted and disciplined founders who created marketing/branding/positioning dictums their teams followed religiously.

Looking Fondly in the Rearview Mirror

Oh…and there’s one other way the histories of these companies echo each other – both of them find their best days behind them.

Chalk it up to the gathering clouds, such as the passing of the founders…leading to the drift away from the original mission…enabled by a regularly rotating carousel of management teams…each with their own opinions on goals and strategies. Add to this – especially in the case of McIntosh – ongoing cycles of ownership changes as it gets kicked down the road like a rusty can between a rotating series of different private equity company owners…all seeking to squeeze more from it for an outsized return. This process rarely includes added investment to build the brand for the long haul. More likely, new PE owners of brands try to squeeze more out of less from the company, to earn greater returns today. Then they’ll sell it later to an unsuspecting new potential owner dazzled by the formerly great brand name.

Looking Outside the Company for New Growth

I strongly suspect that Bose is hoping for a Hail Mary here. Why do I say that? Because the language they use in their official announcement contains thinly veiled references to a simple strategy. “From earbuds and Bluetooth speakers to the most luxurious systems possible for the home and on the road, Bose and McIntosh Group will now offer consumers a breadth of products and experiences for every listening occasion.”

I call that the “soup to nuts” strategy…rarely as compelling as it sounds.

I can see it now – McIntosh earbuds featuring Bose noise-canceling technology. Or how about a high-end soundbar with Sonus faber speakers, McIntosh amplification, and Bose-enhanced surround modes? I hope you can discern that my thoughts here are infused with a healthy dose of sarcasm, but I’ve seen this kind of thinking many times over.

Another Time, Another Private Equity Company Looking for an Easy Win

For example, I saw it when a private equity company acquired Thiel Audio, anxious to launch a line of Bluetooth speakers carrying the Thiel Audio nameplate – eventually changed to Aurora. It didn’t work and last I heard, there was a warehouse full of unsold Aurora Bluetooth speakers.

Over the last six decades we’ve delivered the best premium audio experiences possible; now, with McIntosh Group in our portfolio, we can unlock even more ways to bring music to life in the home, on-the-go and in the car,” said Lila Snyder, CEO of Bose Corporation. “We look forward to honouring the heritage of these brands, investing in their future and pushing the boundaries of audio innovation to bring customers experiences they’ve never heard before.”

Lila Snyder, Bose Corporation CEO since 2020

Opening Up New Opportunities

Now I don’t know if this is Bose’s plan or not, but it is clear that the company intends to drive new markets with new products based on this new business combination.

The combined forces of Bose and McIntosh Group also opens new opportunities in the automotive sector. By leveraging Bose’s 40-plus years of experience in automotive audio, and McIntosh Group’s legacy of performance and design, the brands will work together to expand their research and continue to engineer authentic in-car experiences that redefine automotive sound.

From company release: Bose Corporation Acquires McIntosh Group

Gaining access to their expertise as a pioneer in automotive audio will also help us accelerate our presence and enable us to deliver solutions that are commensurate with our reputation and performance standards.

Daniel Pidgeon, McIntosh Group CEO

Bose Premium Solutions

I have noticed that Bose tends to consider itself a manufacturer of “premium solutions” as if to suggest that this is a meeting of high-end equals. True denizens of the high-end/high-performance segment scoff at the concept that Bose is in any sense of the word a high-end or premium brand.

And while McIntosh still addresses the high-end market, even it is a shadow of its former self. But at least they retain a greater sense of what it takes to market to the high-end electronics segment.

The purchase of the two audio workshops provides Bose access into the high-end luxury audio market.

Lila Snyder, Bose CEO to CNBC

Can McIntosh Help Bose’s Automotive Electronics Biz Hit the Accelerator?

It really appears that Bose is hoping the McIntosh can help its automotive electronics business hit the accelerator. As one source in a position to know told me, “Harman is kicking [Bose’s] ass in automotive electronics.”

In fact, Harman’s successful automotive infotainment systems business is the reason that Samsung acquired the company back in 2016 for $8 billion. The company offers a portfolio of high profile brands to a variety of car manufacturers. This appears to be an effort by Bose to be more competitive by expanding its brand offerings to manufacturers.

McIntosh Once Acquired by Clarion for Its Car Audio Biz

Clarion acquired McIntosh – all the way back in 1990 (I wrote about this here)- specifically for the purpose of launching a McIntosh line of mobile electronics. When that didn’t work out, in 2003 Clarion sold McIntosh off to D&M Holdings who at that time was owned by private equity company Ripplewood Holdings. Then, in 2008, Ripplewood Holdings sold off D&M Holdings – including McIntosh – to Bain Capital.

Then in 2012, Bain Capital sold off McIntosh to Fine Sounds SpA- holding on to the rest of D&M. Fine Sounds, an Italian distributor, worked with an Italian private equity company called Quadrivio as a partner to the transaction.

In fact, McIntosh was recently successful in getting a system placed in the new Jeep Grand Wagoneer, a high-end SUV designed to compete with the Lincoln Navigator, Cadillac Escalade, and Chevrolet Suburban. And Sonus faber has some of their speakers in certain Lamborghini models.

Pressure is Building at Bose as Revenues Continue to Decline

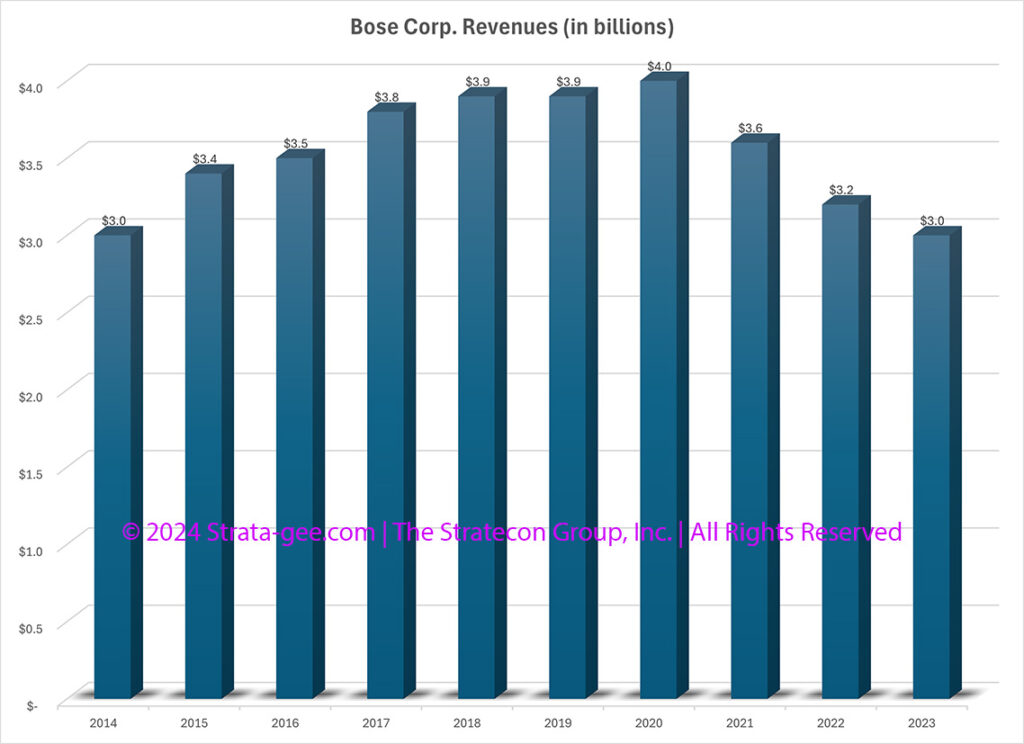

Some commentary on social media about this acquisition have hopefully suggested that a large parent company like Bose can fund a greater research and development effort at McIntosh to help them continue to innovate. But what many don’t know is that Bose’s revenues have been steadily declining since 2020.

According to data from Forbes that I put into the chart above, the company’s revenues have dropped by $1 billion or 25% from 2020 to 2023. Generally, companies suffering through that level of decline don’t find themselves investing more in anything, even R&D. Sources are telling me that company has gone through several rounds of layoffs. Forbes lists the current employment level as 6,000, but I’m not sure that’s a current figure. Financial news network CNBC says the company employes 3,000 people.

McIntosh-Branded Headphones are a Possibility

At the end of the day, it comes down to just what Bose plans to do with McIntosh. The CEO seems open to consider just about anything, with CNBC noting, “Snyder did not rule out the possibility of Bose producing McIntosh-branded headphones or other products.”

We do think there’s a real opportunity around wearables in the luxury and high-performance space as well, which is something that we would expect you to see from us down the road.

Snyder to CNBC

Since the company has no experience in the high-end audio market, I looked to the CEO’s background to see if there are any clues as to her sensitivity to the unique requirements of the high-end specialty channel. Unfortunately, it doesn’t look as though she has any personal insights to bring to the plan. Prior to joining Bose as CEO in 2020, Snyder held executive positions at Pitney Bowes, an office products company. And prior to that, she was a partner at business consultants McKinsey & Company for 15 years.

Acquisitions Like This Can Be a Long Shot

I wish them good luck, but I’m not optimistic about the ultimate results of this partnership. Studies have shown over the years that between 8 to 9 out of every 10 acquisitions fail to increase shareholder value. Even in the best of circumstances, success is a long shot. I’m not sure that Bose/McIntosh is a “best of circumstances” scenario.

Learn more about Bose by visiting bose.com.

See more on what the McIntosh Group offers at mcintoshgroup.com.

I began my career in audio at a McIntosh dealer in 1973. At the time, at age 21, I thought McIntosh was overrated, outperformed by Crown, a brand then riding high. I learned to respect the brand as I got more familiar, and recognized the consistency with which they approached product development. The Clarion years were not their best, but under subsequent ownership they have definitely gotten their groove back. I hope the Bose acquisition brings both brands increased focus, and success. I don’t mind the idea of a McIntosh/Sonus Faber/Bose collaboration if it produces a brilliant product. What McIntosh is missing is an integrated streaming platform. Perhaps Bose can help with that.

I think it’s very simple. Highlander Partners found the exit they were seeking.

McIntosh is now owned not by a PE company, but a manufacturer in an adjacent space in a similar industry.

This is probably a good thing but will depend on how much debt and goodwill came with the deal. And how well Bose leadership understand high end audio, which it appears is not much.

Your assertion that McIntosh’s best days are behind them is off key at best. If new product introductions are indication they are doing quite well. Used equipment values lead the industry, which is indicative of the long term value consumers find in their products. Very few audio companies, if any, have survived for 75 years so they are doing some things right.

Bose, on the other hand, maybe not so much.

Do you have any indication of McIntosh’s actual sales, OI, or cash flow? I’d love to see how they are doing.

McIntosh has garnered some high end auto sound positions at Maserati and Lamborghini in addition to their position in high end Jeep vehicles.

Bose has been losing positions to Harman.

Anyway a bit of a shock to hear McIntosh and Bose in the same sentence.

As Bose did their analysis, they must have developed a plan for the Binghamton, NY plant. I believe their true intentions for the McIntosh brand , and where this story really is headed, hinge on what happens to that facility and the team there. You may recall the grossly misguided decisions made by the acquirers of THIEL to walk away from that factory and everything in it ….. boom! It was forever destroyed.

Bose Corp. majority stocks are held by MIT in keeping with Prof. Bose’s vision. So you could say MIT bought McIntosh. Academics if involved don’t have a clue about high end audio and would surely mess things up. Hopefully, they won’t Apple-ize the brand and reduce the quality. It really does not make sense to produce Bose-Mac hybrid headphones or ear buds as the market is saturated with great brands. To Bluetooth Mac is a shame and is so pedestrian. No need for it. On another note why have the blue meters in the autos, the driver is already distracted and the girl or wife in the passenger seat could care less. Imagine the cost of trading in the auto every two years. A 5000.00 or more audio system ?

Chris Connaker over at Audiophile Style asked me why I thought it was a good move. Note the three core technologies.

Good for the Mcintosh Group

· Bought by a stable well-funded private company with experience in audio. Far better than ownership by a private equity firm.

· About a third of Bose’s business is automotive. Both Mcintosh and Sonus Faber have entered the automotive market and Bose technology, and development experience could help them expand their presence in the luxury auto market.

Good for Bose

· Bose revenues have dipped slightly and buying the Mcintosh Group will help them grow.

· Bose needs access to the luxury audio market and the easiest way to enter it is to buy a storied company like Mcintosh.

Good for everyone

· Bose has three core technologies: noise cancellation, immersive sound and hear what you want to hear.

o You still want to hear the motor of your Lamborghini with the radio on.

o DSP will be better able to fine tune and adjust your audio system.

Steve H addressed some positive points – always welcome.

As a shop owner that was (Bose) & is (McIntosh) involved as a service provider – it’s an obvious reality that one of these is NOT like the other.

The simple realization of “after the sale” support of these 2 different brands leads one to wonder which direction both brands will head in the future: repair shop or recycle bins. Even through multiple transitions, Mac has consistently provided service support as an accepted (and expected) part of the price tag.

Referring to McIntosh as a rusty can is simply wrong, they are in an enviable position in their end of the market.. Continuing ownership changes were never good, but McIntosh has proven itself to be a survivor and remains the dominant large scale luxury electronics line in the world. They have successfully maintained a dominant role in the market in the last ten years. No other high-end luxury manufacturer has the gall to offer a $1,500 light box with their logo, and have it sell.

This should be a good move for McIntosh if Daniel Pidgeon is shown the door and Charlie Randall remains at the helm of McIntosh. He is their heart and soul and has guided them through the obstacle course of ownership groups, a journey that probably would have shipwrecked the company under different leadership.

It will be interesting to see what happens with Sonus faber, which is producing its best products ever.

Highland Partners was the wrong owner, and they foolishly let some very good people go when sales were not growing. Growth is expected, but if sales grow 15% one year it will not necessarily grow 19% the next year just because it is expected. Particularly when it comes to expensive, luxury entertainment products.

This may be a “hail mary” play for Bose, they need something to animate them, to provide a different vision, and to turn the boat around. I can’t think of a different acquisition that would make sense for them.

When I joined Harvey Electronics in 91, I came to fully appreciate the importance of the McIntosh brand.

Harvey was the #1 or # 2 dealer in country, at our peak we hit 800K per annum. I experienced several changes in control and management. The brand was so important to my company that when Charlie was announced as the new president, I was so concerned about an engineer taking over that I called the marketing person and demanded a meeting ASAP. I drove to Binghamton to meet Charlie and take the measure of the man. I drove home convinced that he was the right man for job. All these years later, I’m proud to say Charlie was the right choice. He maintained the essence of McIntosh and to this day I believe it remains the only true aspirational audio brand in the market. I have a very vivid memory of a young man, probably a broker who had received his bonus plunking down his Amex and saying I can finally afford a Mac system. I can’t name another high brand with that magic. You can argue about sound etc. But the brand stands above all the others, I can’t name the #2 in brand recognition neither can the consumer. All this is long way of saying that the new ownership would be well served by locking Charlie into a good contract and not fiddling with the brand.

Franklin,

Well said, my friend!

Ted

Thanks Ted

“It also has shuttered its Pro division in reaction to changing markets”

The Pro Division was not shuttered.

https://www.boseprofessional.com/

John,

Indeed it was…within Bose Corporation, anyway. Bose Professional is owned by Transom Capital and is not associated with Bose Corporation.

Bose Corp dumped the division more than a year ago.

Was that a test? Or a trick?

Ted

NO!!!!! PLEASE NOOOOO!!!!! Bose will send McInstosh manufacturing to f china!!! It’s a matter of time…. PATHETIC!!!

McIntosh is not a fading high-end electronics brand, it is the dominant one by far. My observation is that Sonus Faber has captured significant share recently as turmoil rocks other speaker brands. The problem McIntosh Group faces is the relatively small scale of the high-end segment and the overall decline of traditional component audio/video. Growth can be had through market share gains, but there’s a limit to that and I suspect McIntosh has been at it for years now. Brand extending products haven’t done well, from anecdotal reports, because they are not seen as “real McIntosh”. The brand is a prisoner of its own success, which is not unusual.

It is often said that Sony lost out to the Apple iPod and this set them back decades. In a similar way, Bose lost out to SONOS (the first major new audio brand of the 21st century) and it has never closed the gap. A TV with a sound bar, often Sonos, graces many a luxury home these days not because the owners can’t afford better but because this fits their UX/UI needs. We can stream all the entertainment we need directly from our television with a huge, family friendly GUI, or from our smart phone. Who needs a cumbersome stack of electronics that only dad can operate? Sound quality has consistently lost out to convenience.

Of course, it is possible to combine sound quality and convenience in our new streaming world. Sonus faber has introduced an active streaming speaker, as have others. KEF has done well with such models and Focal recently introduced the active/streaming DIVA UTOPIA. The problem is such products don’t jibe well with the large amplifiers that are the heart of the McIntosh brand. That’s not an easily fixable problem.

I imagine this is mostly an automotive play. As with Harman brands, McIntosh and Sonus faber can be exploited in this context and Bose does bring experience and relationships to the party. That, however, is not a fast development track nor is it a quick revenue generator at the luxury level where these brands fit. Harman is massively dominant, leaving little room for others. I believe that Mac’s Jeep partnership is with Alpine (it’s with some Tier One supplier that isn’’t Harman), so that’s a complication.

This will be yet another interesting development to watch. McIntosh is a great American brand and Sonus faber has its own unique history. I wish them both well!

Doug nails it right on the head! Personally, I know of nobody more qualified to make such a statement.

I can recall Doug shlepping in products that were trying to compete with McIntosh.

Happy Thanksgiving to all

The audio world is evolving. Sonos was a game changer and the Chi-Fi brands like Fosi Audio are too. Enormous hunks of iron like McIntosh amps are slated for the tar pits…..but the game has years to play out during which there is time to adapt. I hope they do!