The Future of Sound United Continues to Hang in the Balance

SEE STORY UPDATE NEAR END – It is total pandemonium in Masimo land as the company and Politan are engaged in a massive and really, really ugly proxy war ahead of the company’s annual meeting scheduled for July 25, 2024, at the Masimo headquarters in Irvine, CA. Details in dueling proxy filings so far have revealed many things we didn’t know up to now. And almost none of what has been revealed…is good.

Company CEO Kiani is in a fight for his professional life…Sound United is dangling in the wind of an uncertain future – and, frankly, even the entire company’s path forward is a question mark.

See More on matters at Masimo and the Sound United situation…

For weeks now, signs have appeared of trouble between Masimo Corporation (Nasdaq: MASI) and its Chairman and CEO Joe Kiani…and activist investor Politan Capital Management and its Managing Partner and Chief Investment Officer Quentin Koffey. Recently filed proxy materials have served to put things into context, and revealed an astonishing level of detail of the behind-the-scenes battles that have been ongoing for months now.

Masimo CEO Kiani is Ready for the Fight This Time

In reviewing some of the previous SEC filings and now the latest proxy filings, a couple of things are coming through loud and clear. First, if Masimo CEO Joe Kiani got caught off guard last year by the professionally ruthless campaign by activist investor Politan and Koffey to successfully gain seats on the board, he is ready for it this year. And that has resulted in a more vigorous and aggressive battle this go-round.

Second, if Koffey initially had any sincere intention of making an effort to work with Kiani and other company managers to effect change at the company (as he initially claimed he was), that appears to be completely out the window now. It very much looks to me as though there is not the slightest shred of trust between Kiani and Koffy. As a result, the gloves are off…and the resulting battles are getting increasingly intense.

Two Masimo Directors Suddenly Left the Board

How brutal has it gotten? Things have gotten so brutal that two of the Masimo directors – one a legacy director and one who recently joined the board (not through Politan) – have resigned their appointments. Why did they resign? One said it was for “personal” reasons…another cited “personal health issues.” I suspect, as happens in any war, they are collateral damage from the epic war and bloody battles in which they were embroiled.

Much of the recent back-and-forth between Masimo and Politan was made in an effort to head off the very proxy war that has begun. There were private dinners between Joe Kiani and Quentin Koffey where (according to Koffey) Kiani tried to buy him off, offering to buy all his stock at a “substantial premium” in exchange for Koffey’s agreement to not purchase more shares and never run a proxy contest in the future [Politan proxy, describing a January 29, 2024 dinner]. Politan says that Koffey “flatly rejected this idea.”

Since that dinner meeting, there have been three major efforts, two by Craig Reynolds, the lead Masimo independent director, and one by Robert Chapek, to offer Koffey a deal to avoid the turmoil of a proxy battle. Those efforts all failed.

Trying to Provide Some Focus

But I’m getting ahead of myself…let’s start at this point in time. The amount of material that has been generated in this new phase of the battle between the Masimo management and the Politan activists is overwhelming. I don’t use that word lightly…remember, I’m used to following court battles that run for years and generate a lot of paper.

For the purposes of this story, I’m going to make an effort to focus just on the key issues that were revealed in the recent proxy filings by both Masimo and Politan. Normally, I’d like to share everything, but that’s just not possible – Politan’s proxy filing is 50 dense pages of single-spaced text…and Masimo’s proxy filing is 167 pages long.

Dueling Narratives

Years ago, I was chatting with a friend of mine who is a police officer. One day, he said to me, “You know, it’s really true what they say about policing.” What’s that? I asked. “The job of policing is hours of boredom punctuated by moments of terror.” I was reminded of this comment as I waded through the Masimo and Politan filings.

Spending more than a day reading and digesting these two documents, I can tell you I was struck by how much material there was…and how much of it was petty, annoying drivel. There are silly battles, such as who came up with the idea of splitting off the consumer (Sound United) division first? Both Kiani and Koffey claim that, and spend too much time trying to make the case.

And yet, after hours of reading this petty name-calling, you’ll suddenly stumble across something surprising or even shocking. Now you can see why my friend’s statement about policing came to mind.

Background Sections Tell Two Different Stories

Keep in mind, these proxy documents are filed with the Securities and Exchange Commission (SEC). Each of them contain a section called, “Background of the [or ‘to the’] Solicitation,” which is a running diary of significant events, letters, phone calls, meetings, etc. leading up to this moment. These diaries tend to be date-based and so…in theory…it should be easy to match them up. But it is surprisingly difficult, as one side will report events the other side makes no reference to and vice versa. And even when you do find events that match, the narrative from each side can be completely different.

Were they even in the same meeting?

Masimo actually filed their proxy statement first, on May 31, 2024. This was followed by Politan’s filing on June 3, 2024.

Perspective Matters

You also quickly identify that each side has a unique perspective they want to present and they position their narrative to support that perspective. So, for example, Politan wants investors to view Kiani as completely unrestrained and out of control…and attempting to interfere with Politan board members’ participation. The Politan version recounts events from that perspective.

Masimo, on the other hand, wants to portray Politan and Koffey as self-interested minority shareholders who own 9% of the company, hold 40% of the board, but want to seize control of the board (and therefore the company) and fire the CEO and dismantle the company, for their own unique benefit.

All of this adds to the often mind-numbing tedium of the text as they each snipe at the other, writing cheap shots, and wasting a lot of ink (or pixels, depending on how you’re consuming it) on silly positioning language. In fact, the narratives sometimes contradict each other. That shouldn’t happen in an SEC filing where there are serious consequences if the regulators determine someone is lying.

The First Surprise? The Entire Company was Put Up for Sale in 2023

The very first disputed version of events happens on the very first page of each company’s Background section. The first point in Masimo’s narrative included the following text. “At the 2023 Annual Meeting, the Company’s stockholders elected Mr. Koffey and Ms. Brennan to the Board.” This statement led to the following added commentary…

Following the 2023 Annual Meeting, the Company commenced a formal review of strategic alternatives, including a potential whole company sale, with financial and legal advisors assisting with its review. The strategic review built on prior reviews conducted by the Company over the years, and through the rest of 2023 until January 2024, the Company had discussions with multiple potential whole company sale counterparties consisting of both strategic acquirors and financial sponsors, as to which the Board was fully apprised, but none of these discussions led to the parties reaching a mutually agreeable transaction.

Masimo, Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Politan Accuses Masimo of Misrepresenting the Situation

Before I show you Politan’s version of this section, did you catch the big surprise? The board authorized Kiani to pursue a sale of the entire company. He launched a process that continued until January of 2024 or around six months. I guess by selling the whole company, the issue of what to do with Sound United becomes someone else’s problem.

Politan had this same event in their Background as well. But, it was quite different, with a major emphasis on dates as this was the period leading up to the 2023 Annual Shareholders Meeting. It started with this: “On Friday, June 23, 2023, preliminary vote totals indicated that Politan’s [director] nominees would both be elected to the Board at the upcoming Monday’s 2023 Annual Meeting.” Then they added…

One Event…Two Versions

On Saturday, June 24, 2023, the Board met to delegate authority to Mr. Kiani to pursue and carry out a sale of the entire Company without any obligation to provide process updates to the Board or to obtain any additional Board approvals to retain financial or other advisors. The Board also concurrently made determinations about the Lead Independent Director and committee assignments. To date, Ms. Brennan and Mr. Koffey have only been provided redacted minutes from this Board meeting. The Company Proxy Statement dates this Board decision to after the 2023 Annual Meeting, but it occurred beforehand without the knowledge or involvement of Ms. Brennan and Mr. Koffey, despite it having at that point been clear that they would almost certainly be elected to the Board in just two days. In fact, Ms. Brennan and Mr. Koffey did not even receive a substantive update about the process until the first in-person Board meeting, which occurred on October 31, 2023—more than four months after Mr. Kiani had started the sale process.

Politan Capital Management/Masimo Corp.; Proxy Statement Pursuant to Section 14(a) of the Securities Exchage Act of 1934

There you go…one event, two versions. Who is correct? I don’t know, but someone is misrepresenting the situation. And virtually the entirety of each document is like this – almost no common agreement on the narrative of the last several month period.

In any event, what follows are my key takeaways from the filings and the troubling situation in which Masimo now finds itself embroiled.

Board Dysfunction – ‘Politan’ Directors vs ‘Legacy’ Masimo Directors

Remember all that back and forth I mentioned previously? The board got directly involved in that. In fact, the CEOs (Kiani & Koffey), the companies (Masimo & Politan), attorneys for the companies, members of the Masimo board on the Masimo side, and members of the board on the Politan side…all got involved in a vigorous back and forth discussion and negotiation.

What has emerged from all of this is that the board is not functioning well. The Politan board members (known as the “newly-elected directors” in Politan’s filing) complained of ineffective onboarding procedures (while Masimo’s proxy describes a detailed onboarding process that was conducted), and poor briefing routine with not enough time left for questions-and-answers. Consequently, the Politan directors refused to sign off on key documents, such as the company’s 10-Q and 10-K SEC filings. They say it is Masimo’s fault for not giving them all the details that they asked for.

Board Expands and Two Non-Politan Directors Join the Board

The company expanded the board from five members to seven (a proposal ratified by shareholders at the annual meeting) and conducted a search for two new board members to be appointed which yielded Mr. Rolf A. Classon and Mr. Robert A. Chapek (formerly with Disney) who ultimately were both appointed to the board. Classon was appointed to the board in November 2023 and Chapek was appointed in January 2024.

The newly-elected (Politan) directors objected to both of these appointments due to “a total absence of a legitimate search process.” However, Masimo noted that the Nominating and Governance Committee (called the “NomGov Committee” in Masimo’s proxy) had retained Heidrick & Struggles, a well-known and respected director search firm, who provided several qualified candidates for review. Both Politan directors saw all the resumes and interviewed the candidates. Koffey had additionally suggested potential candidates and the NomGov committee included them in the selection process.

January 2024: Plan for Spin-Off of Sound United, a Seeming Common Goal, Turns Into a Battle

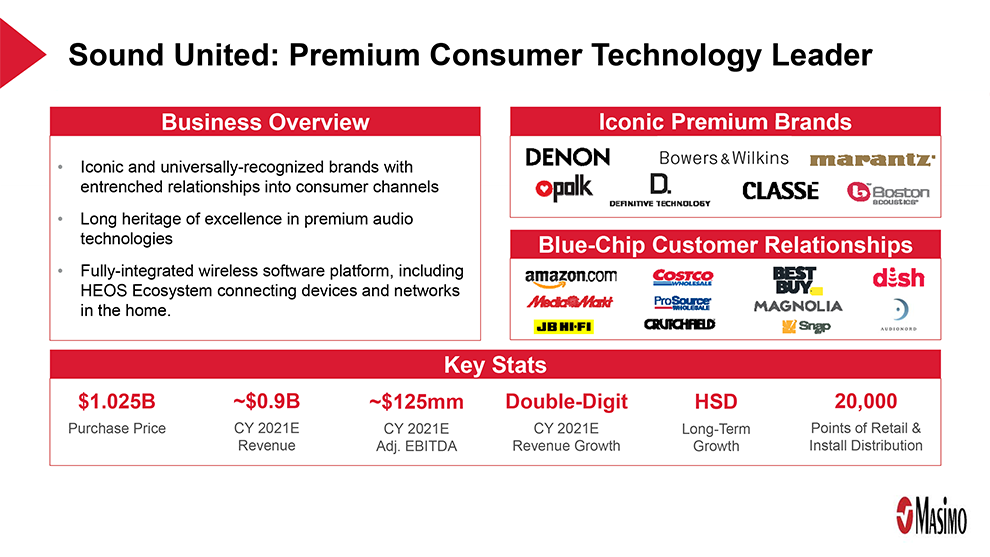

From the Masimo proxy, we learn that at the end of January, Kiani and Koffey met for dinner and here Kiani proposed a spin-off of the consumer division to create two separate public companies (known in the documents as “ConsumerCo” and “ProfessionalCo”) each “with a distinctive investment profile that would allow investors greater flexibility with respect to their holdings of Masimo.”

ConsumerCo would embody the Sound United and consumer health products. ProfessionalCo would be the professional healthcare business.

In the Politan proxy, it snarkily noted that “Mr. Kiani then revived the idea proposed by Politan nearly a year earlier to separate the consumer business from the rest of the company.” This launched a series of discussions first between Kiani and Koffey, who – surprisingly – rather quickly agreed to terms of the separation as broadly conceived. The negotiation over the terms of the separation was turned over to lawyers and certain board members.

Kiani and Koffey Agreed to High-Level Terms…Initially

In February, these were the terms that the two parties agreed to [from the Masimo Proxy]:

- ProfessionalCo would hold the hospital and hospital to home businesses of Masimo and ConsumerCo would hold the Sound United and consumer health businesses of Masimo

- ConsumerCo would receive sufficient cash for its initial operating needs

- The governance of ProfessionalCo and ConsumerCo was to include Mr. Kiani serving as Chairman and CEO of ConsumerCo with other board membership to be decided later

- Mr. Kiani and Mr. Koffey would be subject to a lock up of their stock in ProfessionalCo and ConsumerCo for a period of time after closing the potential transaction

- Mr. Kiani would receive all payments due under his existing employment agreement

- Mr. Kiani would hold either voting control or majority ownership of ConsumerCo in exchange for a consideration to be determined later

Note that the discussions – as presented by this term sheet known as the February Term Sheet – contemplate Kiani moving to ConsumerCo, although the negotiation included further discussion of a continuing role of some type for Kiani with ProfessionalCo – either as a “special advisor” to ProfessionalCo or as a member of its board. One revision in a round of negotiations proposed Kiani would be both a special advisor and a board member of ProfessionalCo.

Special Board Committee Convened to Work Out Spin-Off Details; Koffey in Charge

The company decided to create a special committee of the board to parse out and negotiate the “related party” issues to this transaction. That committee included Masimo directors Mr. Classon, Mr. Reynolds…and Politan directors Ms. Brennan and Mr. Koffey. Quentin Koffey was named Chair of the committee. Here is where things went off the rails.

The special committee came back to Kiani with a new terms sheet called the March Term Sheet that, according to the Masimo proxy, substantially deviated from the February Term Sheet and presented a deal that didn’t make sense anymore to Kiani. The Masimo proxy did not enumerate the changed terms, but, whatever they were, they appeared to close out any possibility of a deal.

Changed Terms Yielded a ConsumerCo That was No Longer Viable

“Mr. Kiani expressed his view that the March Term Sheet presented terms that created a ConsumerCo that was not viable because it would not be sufficiently capitalized or have access to assets that would allow ConsumerCo to pursue a viable standalone market strategy.” [Masimo proxy]

Not surprisingly, the Politan proxy points the finger at Kiani.

Mr. Kiani’s counsel responded on February 3, 2024 with a substantially revised term sheet that significantly expanded on Mr. Kiani’s earlier positions. Mr. Kiani’s demands at this stage included: that the Company’s corporate headquarters and corporate jet be included in the spun off assets; that the Company contribute up to $150 million in cash plus working capital to the new consumer entity; that the new entity have a class of 20:1 supermajority voting stock that would confer majority voting control to Mr. Kiani, granted to him without additional consideration; that the new entity be incorporated in Nevada; that Mr. Kiani’s departure to head the consumer business result in the immediate acceleration and pay out of the Special Payment in his Employment Agreement; that Mr. Kiani be Executive Chairman of the new entity but that a chief executive officer would also be selected and compensated; that certain unspecified intellectual property of the Company be shared or licensed between the Company and the new consumer entity; and that Mr. Kiani receive additional compensation to serve as a special advisor to the Company. Mr. Kiani later informed the Board verbally that he wanted the consumer business to take the name “Masimo” and that the remaining (historical) business of the Company should be renamed.

Politan Proxy

Each Lays the Blame on the Other; Directors Begin to Resign

Once again, each side points the finger at the other for causing the deal to be called off. The special committee was dissolved.

On February 13th, Masimo legacy director Mr. Mikkelson notified the board that he had decided to resign from the board effective February 29, 2024. The reason for resigning was “due to personal reasons.”

Then, on May 3, 2024, a relatively new Masimo director Mr. Classon notified the board that he had decided to resign from the board and the audit committee as well, effective May 10, 2024. The reason given for his resignation was “personal health reasons.”

A Joint Venture Partner Emerges

In March [Masimo proxy] – on March 20, 2024 [Politan proxy] Masimo entered into a confidentiality agreement with a potential joint venture partner in connection to the spin-off of Sound United. [Politan proxy]. This potential JV partner is someone that Masimo had been in discussion with who was potentially interested in taking a majority ownership position as part of the spin-off from the company [Masimo proxy].

Politan complained that the “full board knew nothing about the existence of the joint venture partner or any discussions that had occurred.” Later in the document, Politan is angered when Kiani refuses to reveal the identity of the potential JV partner. Finally, Kiani reveals the identity after Politan signs a confidentiality agreement – and also after, according to Politan, it threatened to sue Masimo for the information under Delaware corporate law [Politan proxy.].

Who is the JV Partner that Wants to be the Majority Owner of Sound United?

We never learn the identity of this potential JV partner in either of these documents. But further detailed discussions and analysis were performed by Masimo. The board has also considered a proposed non-binding term sheet for a deal.

A frustrated Koffey proposes stopping all action for the spin-off of Sound United until after the shareholder meeting. Both documents refer to this as the “Standstill Proposal.” On May 16, 2024, the board approved the Standstill Proposal.

Politan Formally Nominates Two More Board Candidates

With the two sides at loggerheads, Politan decided to pull the trigger and nominate two new director candidates for the board. If these directors are voted in by stockholders, Politan will seize control of the Masimo board.

At this point, the Masimo Background Section ends…but the Politan Background Section goes on with some interesting additional information. This additional information included a couple of blockbuster revelations.

When Politan notified Masimo it had decided to go ahead and nominate two new candidates for the open board seat, its notice said this, “In disclosing their nominees, the Politan Parties also announced their support of a strategic review of the separation of the consumer business, while also noting that they have ‘serious concerns given the lack of basic governance and oversight we have observed since joining the Board.'” Then Politan added that they have “serious concerns that Mr. Kiani, without proper oversight, will seek to push through a spin-off with poor corporate governance and intellectual property arrangements where assets are allocated in such a manner designed to maintain his control and influence of both separated companies.”

Blockbuster Revelation #1 – Kiani Pledges $400 Million of His Stock as Collateral for a Personal Loan

On April 29, 2024, it was disclosed that 2,972,778 shares of common stock beneficially owned by Joe Kiani were pledged as collateral for a personal loan. That number of shares is equal to about 6% of all Masimo Common Stock outstanding and is roughly valued at $400 million. This transaction also represents about 75% of Kiani’s entire Masimo stock ownership.

Politan’s proxy notes that the company’s executive compensation policy states that Kiani must get approval from the Compensation Committee before he can make such a pledge and no such vote by the committee was taken. Perhaps more importantly, “other than the public disclosures, members of the current Board do not know the purpose for which Mr. Kiani’s shares are pledged or what the terms of the pledge entail, including the ways in which Mr. Kiani could liquidate the shares.” [Politan proxy]

I’m not sure why Politan chose to call that interesting fact out. But I have to admit, it is intriguing. Is Kiani building a personal war chest? Is he raising funds to buy into ConsumerCo with the JV partner? We just don’t know.

Blockbuster Revelation #2 – DOJ and SEC Launch Investigations

Politan revealed that Masimo has previously received a subpoena from the Department of Justice (DOJ) dated February 21, 2024. The subpoena seeks “documents and information related to the Company’s Rad-G and Rad-97 products.” The DOJ is also said to be looking for information “relating to complaints surrounding the products and the Company’s decision to recall select Rad-G products in 2024.”

In March, the company received a new “civil investigative demand” from the DOJ pursuant to the “False Claims Act, 31 U.S.C. §§ 3729-3733,” dated March 25, 2024. In this matter, the DOJ is seeking documents and information related to customer returns of the Rad-G and Rad-97 products, “including returns related to the Company’s recall of select Rad-G products” in 2024.

Separately, the Securities and Exchange Commission (SEC) has served the company with a subpoena dated March 26, 2024 seeking documents and information relating to “allegations of potential accounting irregularities and internal control deficiencies.” These allegations were from “employees within the Company’s accounting department.” Yikes!

Masimo Says It is Cooperating with the Authorities

Masimo says it is cooperating with “the government” on “each of the subpoenas and the investigative demand.” The company subsequently disclosed these investigations in notes deep inside its Fiscal 2024 first quarter 10-Q filing. However, no separate announcements or public statement or filings about the matter were ever made by Masimo management. AND, according to Politan, even the board was not told about these investigations which it knew about in February and March, until April 30, 2024…about six weeks later. [Politan proxy]

>>>STORY UPDATE – June 7, 2024 – As this story was about to be published, Masimo issued a “Form 8-K Current Report” revealing the existence of the DOJ investigations. The company noted that it had issued a “voluntary recall of select Rad-G products in connection with an issue that can result in an unintentional change in the power state of the device.” The report adds, “approximately 7,350 Rad-G units sold in the U.S. are subject to recall, and approximately 20,250 Rad-G units sold outside the U.S. are subject to the recall.” This is clearly in response to Politan revealing the existence of these investigations in its proxy filing.

Why Did Politan Call Attention to Those Last Two Revelations?

So what was the point of Politan revealing those last two facts. They don’t specifically relate to board governance issues – maybe tangentially but not specifically. This is Quentin Koffey finding those matters that the company is either deliberately underplaying or outright hiding because they are embarrassing or revealing something that will raise uncomfortable questions for management.

For example, the company had not issued any form of 8-K report on the investigations (see “Story Update” box above). Yes, they “technically” revealed it by mentioning it in the Fiscal 2024 Q1 10-Q SEC filing…but it was essentially buried deep in the notes section. I read that 10-Q and missed it myself. There is no question in my mind that the company sought to technically meet the requirements of the SEC, but to do so in a way that made it very hard for investors to discover.

Government investigations are a big deal and a separate announcement of this news was clearly indicated. Masimo management chose not to do so. This causes investors to question management’s motives. An investor might think to themselves, if Masimo management hid an important issue like that from me…what else are they hiding?

Koffey’s 3D Chess Versus Kiani’s Checkers

The same can be said for Joe Kiani choosing to pledge most of his stock holdings as collateral for a personal loan, and allegedly violating company compensation policy to do so. This plays to Politan’s narrative that the CEO is running this company like his personal playground with no consideration to policies…or to investors’ concerns. And with no effective oversight by the board.

Koffey is playing 3D chess, Kiani is playing checkers. Both are games of strategy, but one is a higher level of strategy than the other.

Learn more about Masimo by visiting masimo.com.

https://cafepharma.com/boards/threads/house-of-cards-jokers-wild.690704/

There is so much more to this story. Now that they are digging, they’ll find all of it.