I’ve put together a compendium of data that emerged this week that continues to point to the reality of a slowing economy. The picture gets clearer as more economic measures, including non-traditional measures like the Fluffy Puppy Indicator and home foreclosures reinforce the thinking of economists that more drastic action by the Fed to get inflation under control may lead us into the “R” word…recession.

See my compendium of some new, and some non-traditional data on the economy

I have collected a compendium of new data that tends to suggest our economy is not only slowing down, but to a far greater degree than recognized up to now. So what follows, in no particular order, are the data points that emerged (mostly) this week.

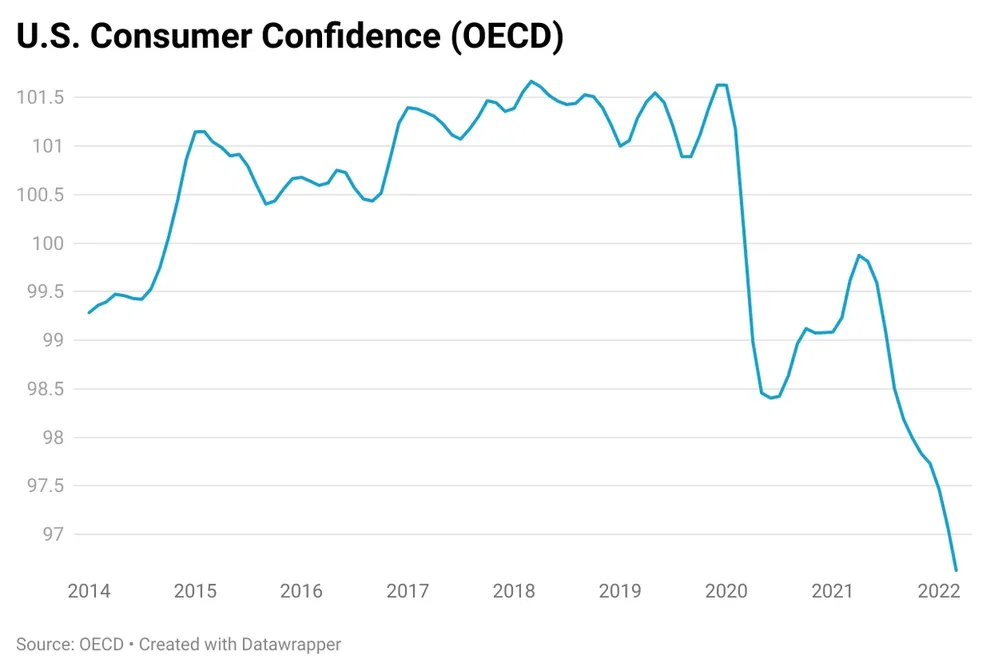

U. S. Consumer Confidence (OECD)

Yet another reading on how consumers are feeling about the economy has come out, and like the others before it that I’ve reported on, it shows a decided downturn in the sentiment of consumers. This one is a reading from an international group known as the Organisation for Economic Co-Operation and Development (OECD) seems to follow some of the others I’ve recently commented on.

This survey, as reported by the newsletter Money Scoop, asks people to rate their thoughts on their financial expectations, their employment status, and how easily they can save. Ratings above 100 mean the consumer is feeling good for their immediate outlook and for the economy. It means that they are likely to spend on big purchases over the next year. But a reading of under 100, as we have here, suggests that consumers will cut their spending and try to boost their savings. MS says that due to the impact of inflation and the war in Ukraine, consumers came in with a rating of 96 – well under 100.

The Fluffy Puppy Indicator

From Yahoo Finance, we learn about something called the Fluffy Puppy Indicator – a silly-sounding economic indicator that gained new significance in 2020/2021 due to the pandemic. What does the pandemic have to do with puppies you ask? Well it turns out that during the pandemic, as bored families tried to figure out what to do for fun, many purchased pets – like cats and dogs.

As a result of so many Americans purchasing pets during the pandemic, the pet food and pet supplies industries had boom times and massive sales increases. Now we learn that inflation is pushing consumers to cut back, with sky high prices on food and gas. And, it turns out, our shiny new pets are NOT immune from the cutbacks. Sales of pet supplies – non-food items that pets don’t need to live – dropped 1.9% in the month ended April 9. That’s way below the 12-week average increase of 3.6%. Pet grooming also dropped an impressive 19.2%, while dog accessories plunged 12.1%. Pet beds declined 12.7%.

Am I joshing you? No I am not. Yahoo quotes Mike Wilson, a Morgan Stanley analyst, who said that this analysis shows the types of purchases that “are exactly the kinds of things we think will suffer first [in a slowdown].” Wilson expects a recession in 2023. At least people are still feeding their pets!

Netflix

You may have heard what a rough couple of weeks Netflix has had. In fact, their latest report on subscriber growth was the worst they reported in ten years because subscribers did not grow, they lost 200,000 subscribers. As the bellwether for streaming services overall, this had a massive impact on the market and Netflix stock has dropped an amazing 66.6% YTD making it the worst performer in the S&P 500. Just last week, its stock plummeted 45.9%, its worst performance since it went public in 2002.

Why watch what happens to Netflix? Well, for the same reason Peloton was a high-flying performer during the pandemic, housebound consumers signed up like crazy for all of the streaming services. And now Netflix, the gold standard in the category, is taking a beating. Its clear that consumer trends are changing dramatically in this post-pandemic period. Even Disney is considering adding an ad-supported free tier to their service!

Foreclosures Hit Their Highest Level Post-Pandemic

Finally, the latest report from foreclosure data firm ATTOM shows that a new post-pandemic record has been set in property foreclosures. In the first quarter of this year, foreclosure paperwork was filed on 78,271 properties. This rate is 39% higher than the previous quarter and 132% higher than the same quarter a year ago.

Mostly, this increase in foreclosures is due to the expiration of a government moratorium on foreclosures during the pandemic. However, ATTOM also points to the Consumer Financial Protection Bureau’s enhanced mortgage serving guidelines. As bad as that number may sound, it is still lower than the level of foreclosures during the pre-pandemic period. Top 5 markets for foreclosures are: Chicago, IL; New York, NY; Los Angeles, CA; Houston, TX; and Philadelphia, PA.

Leave a Reply