All Employees Threaten to Quit (Or Did They?); Politan Calls Out Voting Irregularities; JV Partner Proposes Price for Sound United

Every day brings us closer to the Masimo 2024 Annual Meeting of Stockholders scheduled for July 25th…and virtually every day also brings us more Masimo madness. The proxy war for two seats on the Board of Directors being fought between the company management and activist investor Politan Capital Management continues to heat up. Consequently, we learn new things every week, some of which can be disturbing. This week is no exception as we discover: 1) the company publishes letters from employees that suggest they may all quit; 2) the Joint Venture Partner interested in buying a majority stake in Sound United has offered terms that specify a price range it is willing to pay; and 3) Politan has filed paperwork with the SEC that includes a letter to the Masimo Board of Directors claiming it has detected voting irregularities known as “empty voting.”

See this latest installment of the battle for Masimo…

I find it hard to adequately express to you the intensity of the proxy war raging between Masimo CEO Joe Kiani and his management team and Politan Capital Management CIO Quentin Koffey and his team. There have been multiple back-and-forth filings as each side lobs letters to stockholders, investor presentations, and targeted communications in which each side accuses the other side of lying and presenting their own point-by-point rebuttal. There’s a tremendous amount of paper and pixels getting burned up in this battle.

At odds here are two views of Masimo’s future. Masimo says the company is a disruptive innovator that has delivered solid returns over the years and if you – dear stockholder – stick with us and vote in our two candidates for the Board, you can expect more of the same. The other view held by Politan is here is a company run by a powerful CEO who has hand-picked his Board, who follows his lead no matter where his whims take him. A leader, Politan submits, who has made a massive mistake (acquiring Sound United) that has damaged the company and lowered its value for all investors.

Positions are Similar to Last Year, But the Stakes are Much Higher

The positions are similar to those each side held a year ago leading up to the 2023 Annual Meeting of Stockholders. That proxy battle ended with investors clearly siding with the Politan position, voting both of its candidates to the Board in a landslide – one Politan candidate won 80% of the vote, while the other won 70% of the vote totals. The difference this year is that the stakes are higher – whichever side wins will hold control of the Board and, therefore, the company – which has made this battle substantially more pitched.

There have been many shots fired, but the last two weeks raised three main issues:

- All Employees Threaten to Quit, Maybe – Masimo management has posted several letters, ostensibly from various employee departments, that all contained vague threats to quit the company if Quentin Koffey seizes control.

- How Much Will the JV Partner Pay? – In a bit of a strange filing on Monday, Masimo revealed certain terms that have been proposed both by the company and by the Joint Venture Partner who is supposedly interested in acquiring a majority stake in Masimo Consumer (the Sound United business).

- Politan Calls Out Voting Irregularities – Politan, in a letter to the Masimo Board of Directors (of which, he himself is one) and in a filing with the SEC has called out voting irregularities and demands an immediate Board investigation and other remedies.

#1 – All Masimo Employees Threaten to Quit! Or Did They?

The company circulated copies of three letters, ostensibly from employees of various departments within the company, plus a copy of COO Bilal Muhsin’s conditional resignation that I told you about in a previous post. While there were slight variations between these letters, there was one core paragraph that appeared in all of them and so it seemed as though they may have been pre-written.

There was also a letter from Masimo executive Omar Ahmed which appears to be in response to word that “a handful of people still felt pressured to sign.” Ahmed offered a process where people could notify another company executive (a compliance person) if they wished to have their name removed from the letter.

An example of one of the letters is shown below. Note that it was supposedly “signed” by various regional Presidents and sales managers. This was the shortest of all of the letters, but they all shared the same basic thought – I may quit if Kiani is forced out of the company.

One of the So-Called Employee Letters

To whom it may concern,

Masimo has a history rich in innovation and this innovation have led to improving patient care while also reducing the cost of care. At the forefront of this innovation is Joe Kiani. Joe’s unrelenting passion to solve the ‘unsolvable’ and commitment to patient care permeates the entire organization. Moreover, his vision and leadership are why so many employees work at Masimo. With that said, if Joe is no longer at Masimo, I would have to seriously contemplate if I would like to continue working at Masimo and I am sure many others feel the same.

Sincerely,

Stacey Orsat, President, Europe, South Asia, ANZ

From Masimo filing, Schedule 14A Information, Filed July 1, 2024

Nazih Darwish, President, MENAT, South East Asia

Trina Hodge, Regional Sales Manager, West, Australia

Troy Tregilles, Manager, Regional Sales, Australia

Wilhelm Paul, Country Manager, Germany and Austria

While the above letter was the shortest, the longest letter was five paragraphs long and was signed “Masimo Healthcare Engineering.” This included approximately 283 names as signatories, but no titles were included. This longer version adds more detail about Joe Kiani, such as how he “has fostered a culture of creativity and forward thinking,” and how Kiani’s “leadership has propelled us to the forefront of the medtech industry.”

Then this longer version turns a little darker, saying “We wish to convey our deepest concern if Quentin Koffey and Politan Capital take control and Joe Kiani is removed.” Finally, much like the other letters, it finishes with the same vague threat: “We, the undersigned from Masimo Healthcare Engineering, wanted you to be aware that we may not continue with the company if Joe Kiani is replaced by Quentin Koffey and Politan Capital.”

An Email to Politan Says Employees Were Forced to Sign These Letters By Managers

The impact of these letters was undoubtedly lessened by the impact of a previous filing by Politan which published an unsolicited email it had received – supposedly from a family member of a Masimo employee – that said that Masimo company management was pressuring employees to sign letters of support for Joe Kiani.

“Employees are being asked to sign a blank page, without being given a copy of the letter,” the email told Quentin Koffey and Politan. “This approach has caused employee concern and discomfort.”

It is hard to take these Masimo-published letters of support to heart if they were in fact the result of managers pressuring employees to sign. You can see the whole email to Politan (and an additional email from Koffee forwarding the employee email to Masimo General Counsel) near the end of this post.

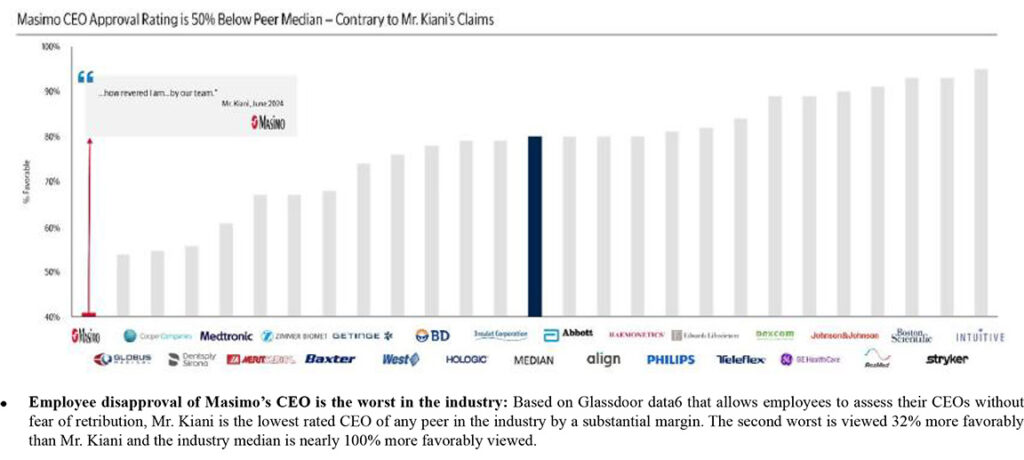

Glassdoor Data Emerges Shows Kiani is the Most Unpopular CEO in MedTech

Why would Masimo resort to such a pressure campaign against its own employees? I can’t say for sure, but it certainly seems likely to me that this allegedly forced letter of support for the Masimo CEO could be in response to Glassdoor data published by Politan showing that Joe Kiani is the most unpopular CEO in the MedTech market.

This stunning result, published in one of the Politan mailings to Masimo investors had to sting. And it may have caused management to worry that such data might influence the investors’ view of Kiani. So if letters appeared from – let’s say – Masimo employees singing Kiani’s virtue and suggesting the employee is so committed to Kiani they may quit the company if he leaves…that just might be the ticket.

#2 – Joint Venture Partner Proposes an Investment Range for Sound United

In a separate SEC filing, Masimo has released more details on its negotiations with a still unnamed Joint Venture Partner that is potentially interested in acquiring a majority interest in Masimo Consumer, the Sound United business. The company updated developments in its filing with the SEC, including actions taken by both Masimo and the potential JV Partner.

On May 7, 2024, the company signed a non-binding term sheet with the potential JV Partner. This term sheet contemplated that Masimo “would sell the majority stake of its consumer audio and consumer health business” to this JV Partner in exchange for a cash payment to Masimo. The JV Partner would additionally contribute cash for operations of the company, referred to in other filings as NewCo or ConsumerCo.

A Crazy ‘Purchase Price Range’ is Offered for Majority Interest in Sound United

This development, the signing of the original term sheet, we already knew about. But what we didn’t know is that on July 2, 2024, the JV Partner sent a new non-binding term sheet – the company refers to this as a Term Sheet Confirmation – with a new set of proposed terms. According to the filing, the JV Partner has proposed – among other things – a “purchase price range” of $850 – $950 million. That offer range is on a “cash and debt free basis.”

The filing notes that this new term sheet also contains “certain additional terms and conditions of the Potential JV pertaining to the proposed valuation, potential strategic partners and due diligence matters.” None of these very important details were laid out in this document.

JV Partner Raises the Idea of Additional ‘Potential Strategic Partners’

However, the phrase “potential strategic partners” caught my eye. In the original concept of this deal, the JV Partner was to be the majority owner, with Masimo as the sole minority owner. This appears to suggest other parties could be included…maybe to slice the division apart…or perhaps to serve as a replacement for Masimo, should the new Board not want further participation in the joint venture. Although the filing goes on to add that “…as one or two other companies may join the Potential JV.” This is new news, as Kiani previously said there were no other interested parties.

There are many additional matters to sort out, including the issue of transfer of Intellectual Property to this new company and which partner carries the immense cost of the Apple litigation (Masimo says it will retain this obligation), and more.

Is Sound United Really Worth Almost $2 Billion??

Having said that, I was surprised by the price range Masimo said was proposed by the potential JV Partner. Why would they dangle paying (potentially) $950 million for a 51% majority interest in a company whose financial results have been deteriorating over several quarters now…and is only expected to generate total revenues of between $700-$780 million for all of 2024? That implies a total enterprise value of around $1.9 billion. I just don’t see it.

Yet Masimo’s filing says that the JV Partner’s Proposed Term Sheet’s purchase price “…is less than that provided in the [original Masimo] Term Sheet, and Masimo intends to negotiate for a higher price.”

Politan: Potential JV Partner is a Friend of Joe Kiani

One other point on this topic – Politan alleges that the unnamed JV Partner was NOT an organically discovered potential partner, it is in fact a company that is run by a friend of Joe Kiani. Politan’s material also notes that “Mr. Kiani entered into a confidentiality agreement with a JV counterparty without informing the Board…” Not only that, but Politan notes that Kiani “…signed a term sheet with the counterparty without providing any information to the Board, not even the name of the counterparty.”

Koffey and Politan say that the “Company does not deny that there is no separation process, solely negotiations with a single JV counterparty.” It is conducting this matter in a way that is “replete with related party conflicts and risky IP transfers.”

If Politan is correct, and the potential JV Partner is actually someone associated with Joe Kiani, then it would seem unlikely that it is a company with an audio-centric background. It’s hard to see how this would help drive greater success in the Sound United audio brands.

#3 – Politan Detects and Calls Out Voting Irregularities; Calls for an Investigation

Perhaps one of the biggest surprises in all the back-and-forth recently was a July 3rd letter from Quentin Koffey on Politan Capital Management letterhead to the Board of Directors of Masimo Corporation. This letter was also encapsulated in a special Schedule 13D filing with the SEC. This letter contained a potentially explosive allegation that Politan had detected voting irregularities that may represent a practice known as “empty voting.”

I’m writing this letter to express serious concerns regarding a possible ongoing scheme to manipulate the outcome of the upcoming Annual Meeting of Stockholders.

First line of Quentin Koffey letter to Masimo Board on voting irregularities Politan detected

‘Empty Voting’ May Have Occurred

Koffey’s letter goes on to describe what may be an attempt to unduly influence an election for the benefit of Joe Kiani and his chosen Board candidate (Kiani is the other Board candidate on management’s slate). After noting the irregularity that caused a red flag, he suggested he may have found a case of “record date capture” and “empty voting.” The SEC defines empty voting as “acquiring voting rights over shares but having little or no economic interest in the shares.”

Explaining in precise detail just what these concepts are is beyond the scope of this article, but suffice it to say that they are a method of decoupling the economic interest of stock ownership from the voting rights that stock ownership imbues on the owner. In this manner, a party could derive enhanced voting power that is not connected to the economic interest of that stock.

That decoupling can be achieved in multiple ways, one example is to buy stock by a set record date for the purposes of voting in some exercise of governance, but at the same time, borrowing and shorting that stock. Technically, you have achieved the right to vote those shares, but the practice eliminates the economic exposure.

Koffey’s Letter Noted the Following…

We have observed that a brokerage firm associated with an investor who is a friend of Mr. Kiani voted a major position – approximately 9.9 percent of the company’s outstanding stock – in favor of the company’s nominees. The number of shares voted at this brokerage firm exceeded the shares publicly reported to be owned by this investor by several multiples. That excess amount was accumulated at the brokerage in the period running up to the record date and then disposed of out of the same brokerage right after the record date.

Upon reviewing this data…we believe it is likely that this investor has engaged in a pattern of trading that is known as “record date capture” and “empty voting” that provides the investor the ability to vote shares of which they do not have economic exposure. This trading strategy involves purchasing shares to be able to hold them on the record date and therefore be entitled to vote them, while simultaneously borrowing and shorting an equivalent number of offsetting shares in order to eliminate economic exposure to the stock. In these instances, the position is closed shortly after the record date, once the right to vote has been secured. Empty voting at this scale threatens to distort corporate democracy at Masimo, as a stockholder whose votes are divorced from their economic interests may not vote in a manner that is in the best interests of the company and all its stockholders.

In light of these circumstances, we ask the Board to set a new record date for stockholders entitled to vote at the meeting. Based on the advice of counsel, we believe that if the Board acts promptly, it can set a new record date without having to move the Annual Meeting. We also believe the Board should investigate what, if any, contact Mr. Kiani has had with this investor. It is highly concerning that such a large position (just below the Section 16 threshold) should exist unknown to other shareholders and for just a brief period of time coinciding with the record date. It is also suspicious that the position was held at a broker associated with a friend of Mr. Kiani and was voted in its entirety much earlier than voting by third parties typically occurs (the only two major proxies that had been delivered as of Monday belonged to this investor and Mr. Kiani). The Board should unambiguously direct that Mr. Kiani cannot participate in, or encourage, any schemes that would undermine the ability of stockholders of the company to vote in a fair election.

Selected portions of Politan Letter to Masimo Board of Directors, Re: Empty Voting [Emphasis in 2nd paragraph is mine; in the 3rd paragraph was in the original letter]

Legacy Director Denies Kiani Had Anything to Do With Scheme, But Investigation is Pending

Five days later, Koffey received a response from Lead Independent Director Craig Reynolds who, after chiding Koffey for not mentioning he had already received a response from the Masimo Corporate Secretary indicating the company was already looking into the matter, said there would be a Board meeting to discuss the issue. He then went on to assure Koffey that neither Kiani nor any other member of management (or the non-Politan Board members) “had any agreement, arrangement or understanding related to the trading or voting of the shares in question.”

Reynolds also went on to suggest that simply due to a large block of votes “cast in favor of Mr. Kiani and Mr. Chavez is not a compelling reason to change a properly established record date, which would disenfranchise Masimo stockholders.”

More an Issue of Ethics Than Legality

To my knowledge, empty voting is not illegal, but many consider it unethical. The SEC has studied the practice for years and may ultimately develop new regulations surrounding the practice. Ironically, empty voting is a tactic that is often utilized by activists seeking greater impact on the vote. In any event, the practical result of this incident discovered by Koffey and made by the unnamed investor is to effectively double Kiani’s vote which would top Politan’s vote share total which was roughly equivalent of Kiani’s holdings alone.

It comes down to how other stockholders vote. So we have a little extra drama…and I can’t predict the outcome. But no matter who wins, it is unlikely to be a landslide on a scale like last year’s vote – no matter which way it goes.

The plot thickens…

See more on Masimo by visiting masimo.com.

Thank you for the great coverage of this proxy fight at Masimo. You are the only writer I have found that is diving into the details and capturing the intensity and madness of it all.

Here is what I can say from my observations and experiences while working there for many, many years. It is very obvious to a majority of Masimo employees that Joe and most of the upper execs are not qualified to run a company of this size and need to be demoted to a more appropriate role with proper mentorship and guidance by more qualified candidates or they should be let go. Joe makes poor business decisions regularly and has clearly become overtaken with power and greed which goes against his own company’s guiding principles. Joe is obviously desperate and will stop at nothing to win or come out of this on top somehow. I know many people that still work there, they were absolutely pressured to sign that letter. My guess is 95% of the people that signed will not give up their jobs and walk out the door with Joe, many can’t stand him anymore. They want to see a company that was once great be turned around by proper leadership that will treat employees right and operate in the best interest of the business, while keeping shareholders in mind. Unlike the current leadership, lining their pockets while depriving the hardworking (many would say overworked) employees their meager bonuses and merit increases when they were the ones that ran the company poorly.

As a shareholder, I am grateful for Politan and believe they will win by a landslide again. If they had not come forward to wage this war and bring all of this to light, Joe could have gone on unchecked and continue running Masimo into the ground.

Speaking as a present employee I really couldn’t express the situation better then myself, other then to add that what has been written is 100% accurate and it is ludicrous to imagine ANYONE other then a small handful of legacy sycophants with fat RSU grants leaving the company just because Joe and Bilal take their balls and go home, . Anyone you talk to inside who has read Politan’s proxy material explaining how they intend to right the ship fully support this plan and will work hard to make it a success and maximize shareholder value while doing what is right for patient care. Furthermore, we look forward to working under the leadership of people with the kind of experience and reputations Michelle Brennan and Darlene Solomon have.

As I follow this very interesting saga there seems to perhaps be a little confusion regarding exactly what the interested party is offering to buy for their 950 million. When it was originally announced it was said to be for a majority stake in Masi’s consumer business. What that majority stake was, 51% or up to 99%, was not disclosed. In today’s Zack’s article, where they mentioned that the 950 million would be a loss for Masi, this would seem to infer that it was for a complete acquisition. Also important to understand that what is being discussed is Masi’s complete consumer division, which includes their healthcare consumer products as well as the Sound United component. I have no idea about the size of thei healthcare component. I have also heard conjecture that the obviously major entity who is talking about the purchase is actually more interested in the healthcare business than the audio. We shall see….

Hi Sandy,

Thanks for sharing your thoughts. A couple of things… You are correct, the concept of purchasing a majority stake in a company technically means acquiring a 51%-to-99% ownership share. In all public filings on this matter, the target share percentages have never been disclosed…likely due to that being a point of negotiation by the parties. I saw the Zack’s story that I believe you are referring to, and it sounds to me that they are not saying it is a full sale, rather just reminding their readers that Masimo paid over $1 billion for Sound United and if all they get is $850-$950 million for its disposal, well, that is less. But I can see why you say that statement implies it is a total sale.

If Zacks has an inside source telling them otherwise, well then I could have that wrong. However, I’d like to point out that all publicly available filings from both Politan and Masimo refer to this unnamed third party as its Potential JV Partner. If it was a total sale of the division, I don’t believe they would be calling them a potential joint venture partner.

In Joe Kiani’s negotiations with Quentin Koffey on the separation, it was clear that his intention was to keep Sound United (Masimo Consumer) in the Masimo family…just spun off the Masimo books. Politan clearly wants a full and clean divestiture of the entire business. Kiani was hoping to remain a key executive of both companies.

Finally, you are also correct that the nascent Consumer Health products go along as part of this separation. Products in the Consumer Health unit right now includes: Stork baby monitoring and the Freedom Watch. There are plans to offer a line of hearing aids in this unit as well, sometime in the future. In a recent filing by Politan, Quentin Koffey – who, remember, is also a Masimo Director – noted that the Freedom watch has yet to launch due to manufacturing problems. He also said that the Stork baby monitor is generating $0 in revenues…a total failure so far. I am not sure when the hearing aids are expected to be available.

If Koffey’s information is accurate, and he has been pretty careful with the facts in his filings, then the Consumer Health unit does not appear to amount to much at all, if anything. In any event, it is already included in the numbers, such as it is.

I take your point that if the JV is 1% Masimo / 99% 3rd party…than a $850 million – to – $950 million valuation is more reasonable. But think about this – the Potential JV Partner wants an all-cash/no debt deal. I haven’t checked lately, but Sound United at one time was carrying quite a bit of debt (in the U.S. and in Japan). If Masimo has to eat that debt, the “take” on this transaction is even lower…perhaps much lower.

As you say: we shall indeed see…

Ted