Almost weekly now, we are regularly seeing new data showing the dramatic slowdown of the housing market. A case in point is the latest data from the Mortgage Bankers Association which tracks the weekly demand for mortgages for both home purchases and for refinancing. The Association reported that its index hit its lowest level in demand for mortgages in 22-years.

See more on the slide in mortgage demand

The Mortgage Bankers Association (MBA) monitors demand for mortgages on a weekly basis. Based on data they receive from mortgage bankers, commercial banks, and thrifts, the MBA gets direct data on 75% of all mortgages in the U.S. The data is collected for both mortgages issued for purchases, and those issued for refinancing. These are combined in an index to track the overall movement in the market.

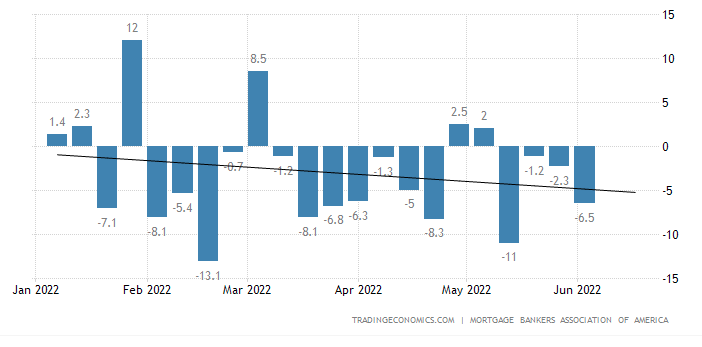

The MBA released a new report yesterday covering the period of the week ending on June 3rd. Their data, like most economic data, is adjusted for seasonality and, in this case, adjusted for the presence of the Memorial Day holiday.

The Market Composite Index at Lowest Level in 22-Years

The Market Composite Index, which measures overall mortgage loan application volume, decreased 6.5% on a seasonally adjusted basis from the previous week. On an unadjusted basis, it dropped 17 percent compared to the previous week. According to the association, this index is at its lowest level in 22 years.

The Refinance Index decreased 6% from the previous week and was 75% below the same week one year ago. The Purchase Index dropped 7% from the previous week on a seasonally adjusted basis. On an unadjusted basis, the Purchase Index dropped 18% as compared to the previous week and finished 21% below the same week a year ago.

Weakness in both purchase and refinance applications pushed the market index down to its lowest level in 22 years. The 30-year fixed rate increased to 5.4 percent after three consecutive declines. While rates were still lower than they were four weeks ago, they remain high enough to still suppress refinance activity. Only government refinances saw a slight increase last week. The purchase market has suffered from persistently low housing inventory and the jump in mortgage rates over the past months. These worsening affordability challenges have been particularly hard on prospective first-time buyers.

Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting

Housing Caught in a Double-Whammy

As the MBA notes, housing is now caught in a double-whammy of rising home prices and now rising mortgage interest rates causing a big decline in home affordability – especially for first-time buyers, a major segment of the market. What’s driving up home prices? Largely, it is due to limited inventory of available homes due to supply chain issues and a still struggling home construction labor market.

And of course, rising interest rates is squelching the refinancing mortgage business as well. Most folks who are considering refinancing are looking for an interest rate advantage to motivate them to refinance their higher-rate mortgages. Now, many of them hold mortgages lower than available refinance rates.

One Bit of Good News

There is one bit of good news in all of this data. While declining affordability dramatically affects the first-time buyer, it is less of an issue for the luxury buyer… So for those of us in the custom integration business, which mostly serves a luxury customer, there’s that at least.

As the MBA’s Kan noted, the 30-year fixed rate increased to 5.4% on mortgages with conforming loan balances of $647,200 or less. The week prior, this rate was 5.33%. Points on the loans also increased to 0.60, up from 0.51 the previous week. Mortgage rates continue to creep up as the Fed adjusts banking rates to try and cool the economy down to depress raging inflation.

The decline in mortgage demand for the week ending June 3rd follows three consecutive weeks with declining mortgage demand.

Leave a Reply