BREAKING NEWS

MQA Limited, the company that invented and markets the Master Quality Authenticated digital music system said to deliver lossless high-res streaming music, has entered “administration” in the U.K. Administration is a form of bankruptcy or protection from creditors similar to Chapter 11 bankruptcy here in the U.S. In the U.K., administration offers an insolvent company time to reorganize, develop a new plan, and – with stakeholder and government approval – an opportunity to exit bankruptcy.

Learn more about this dramatic development with MQA

Longtime readers may recall a detailed series of posts on MQA written by guest poster Bill Leebens back in June/July 2021. Those posts explored the dynamic world of MQA which has both its proponents and detractors. Nonetheless, the company had successfully offered its system to a variety of companies – both brands of gear and at least one streaming service (Tidal) – and was a pretty hot topic in those days.

Now I’ve learned that MQA Limited is insolvent and as a result, has entered into administration. Apparently, the company has lost its main financial backer and needs the administration process to buy it time to seek a new buyer or otherwise come up with a new operating plan.

MQA Statement on Entering Administration

MQA Limited has issued the following statement about the situation…

Following the recent positive reception to MQA’s latest technology (SCL6), there has been increased international interest in buying MQA Ltd. At the same time, MQA’s main financial backer is seeking an exit. In order to be in the best position to pursue market opportunities and expedite this process, the company has undergone a restructuring initiative, which includes entering into administration and is comparable to Chapter 11 in the US.

During this process, MQA continues to trade as usual alongside its partners.

We won’t be commenting further while negotiations take place.

MQA Limited, Company prepared statement

Administration in the U.K. Protects Insolvent Companies from Creditors

According to a U.K. government website, when a company enters administration, it is protected from legal action by individuals or organizations that are debtors of that company. They are prevented from forcing the company into liquidation – although liquidation remains one of the possible eventual outcomes. Basically, the company is allowed to continue, freed of paying its debts, as it comes up with a plan to resolve the situation.

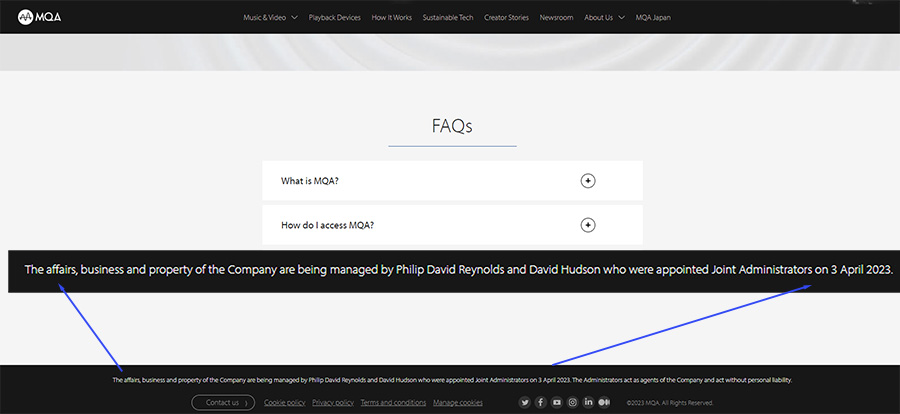

As part of the administration process, a licensed administrator is appointed who takes over control and runs the company. In the case of MQA Limited, Philip David Reynolds and David Hudson, both of FRP Advisory Trading Limited, are the appointed joint administrators

Administrators Must Create Plan to Rectify Situation Within Eight Weeks

Administrators have eight weeks to devise a plan to resolve the insolvency. Once that plan is created it is distributed to all stakeholders (creditors, employees, Companies House [U.K. agency that handles all registrations and incorporations]) for approval or amendment.

According to the official U.K. government website, the range of potential outcomes from administration includes:

- A negotiated CVA (company voluntary agreement) – this is where the debtor (the company under administration) proposes an alternative debt payout and payment schedule to the creditors. At least 75% of the creditors must agree to the revised debt payout and the payment schedule.

- Sell the business as a “going concern” to another company

- Sell the company’s assets, known as a creditors’ voluntary liquidation. Creditors are paid from any proceeds raised and the company is shut down

- Close the company if there are no assets to sell

Can MQA Find a Buyer?

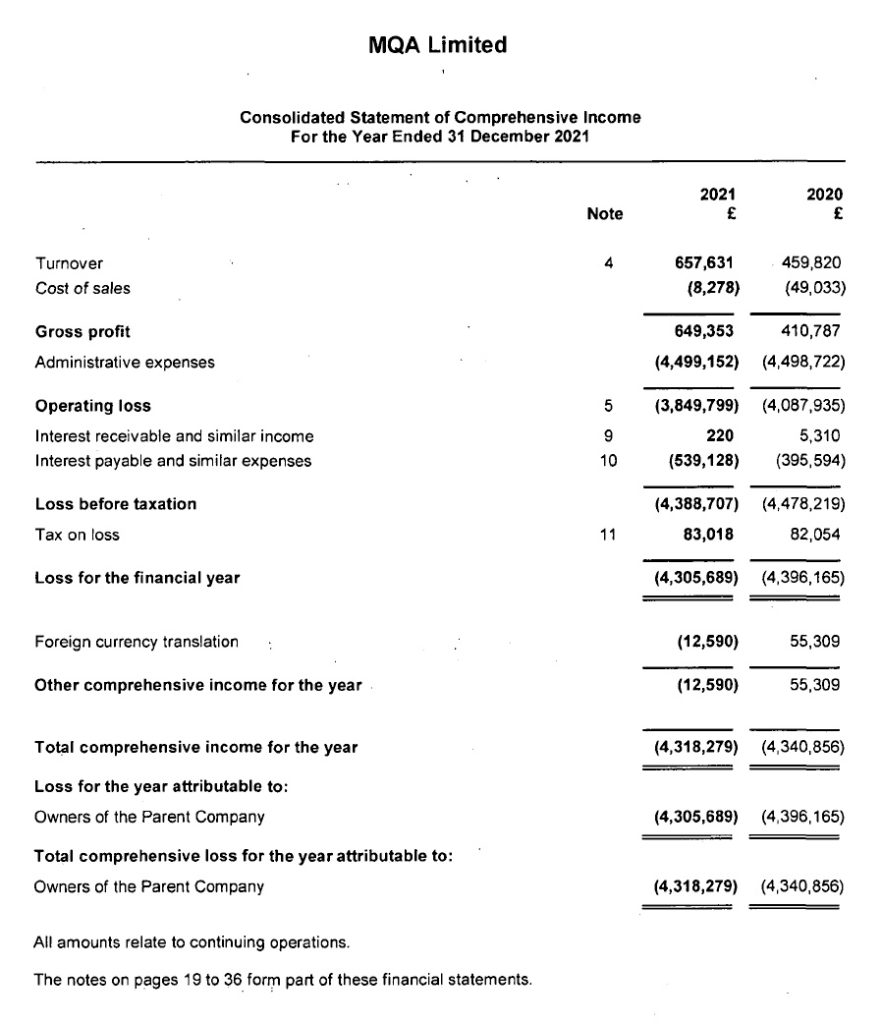

In their statement, MQA referred to “…increased international interest in buying MQA Ltd.” While they don’t name their suitors, it’s hard to figure out what kind of deal could be put together. In looking at the company’s performance for 2021, the most recent year for which they’ve released data, the company generated turnover (revenues) of $675,631 and booked a loss for the year of -£4,305,689 ($5.3 million). The company had a loss of -£4,396,165 in 2020.

What is sure to be an issue with any potential buyer is the company’s overhead, or as they put it, “Administrative expenses” which run about £4.5 million a year. How has the company survived up until now? MQA Limited exists in large part thanks to the generosity of its “founding funder” which is Reinet Investments S.C.A. Reinet is an investment company that was spun off from the massive luxury goods company Richemont S.A. and it has largely been underwriting MQA operations since then.

MQA 2021 Annual Report Warns of the Impact of Loss of Financial Support

Interestingly, back in MQA’a 2021 financial report, the company’s directors note that there is no guarantee of Reinet’s continued support (although they believed it would continue), and if that support were lost, there would be “significant doubt over the company’s and Group’s ability to continue as [a] going concern and therefore its ability to realise its assets and discharge its liabilities in the normal course of business.” In other words…they’d be in big trouble.

Perhaps even more ominously, elsewhere in the 2021 report in a section titled “Group Strategic Report,” the company notes that: “MQA is fortunate to have the continued support of our longtime founding funder, Reinet Investments S.C.A. As of this report, MQA has obtained commitments for operations through Q1 2023.”

Did the 2021 Report Foreshadow the End?

It appears that this notation denotes the end of their relationship with Reinet. An apparent possibility in 2021 that became a reality that has driven them into administration at this time – after the end of Q1 2023.

For now, the company says it has no further comment. We have no choice but to wait for an indication of which potential suitors are contemplating acquiring the struggling company – or if that process fails…what comes next.

Learn more about MQA Limited by visiting mqa.co.uk.

I am glad that no matter how scientific propaganda is cloaked in numbers and general obfuscation to chase revenue, these “advances` do nothing to advance the state of the art in pure audio. Unfortunately there are few companies pursuing this even as current technology makes it more possible than ever.

Ted, you are late to the party. I confirmed in 2016 rumors that Bob Stuart had lost a lot of money. I distributed a summary of operating income to recording and mastering engineers starting in 2018 of just how poorly Meridian and MQA Ltd had performed. It worked and only a few engineers adopted MQA.

I talked with Bill Leebens about this and all he did was write pro MQA puff pieces for you in 2021.

It is my opinion you are focusing on debt when the real problem is lack of revenue.

Hi Steve,

Thanks for your comments and thanks for your contribution to Bill’s articles. I don’t think I’m too late to the party, MQA only entered administration on April 3rd and announced it on April 5th.

Thanks especially for confirming the fact that Bill Leebens got the editorial balance on his MQA series exactly correct. I know this because MQA detractors like yourself call that series a “puff piece,” while MQA proponents call the exact same series a “hit job.” When both sides disapprove, I’d say we got the balance just about right.

Regarding your assertion that in 2016 “…Bob Stuart had lost a lot of money,” I’d like to offer this observation. I’ve been in the business of technology my whole career, and your point that MQA lost money in 2016 suggests a lack of understanding of the process of establishing a new technological platform, as MQA was trying to do. Had you told me that in 2016, I would have said, “Of course they lost a lot of money. That is to be expected.” At that point, they were only about 24 months into their journey.

The business of innovation is always cost heavy upfront. Engineers are expensive and potential world-changing innovation takes months to years of tinkering. I would not expect them to be profitable at that point. Amazon, for example, now the most successful online retailer, took nine years to achieve profitability. This kind of long cycle to profitability is more the norm…than is instant profitability.

On top of that, it is a long selling cycle to shift an entire industry to move to an entirely new platform – especially a premium, step-up higher performance platform.

I would expect costs to exceed revenues for the first few years. Financially, they were fine until they lost their source of funding. Then – and only then – did debt become an issue. My focus on the debt – as you put it – is due to the reality of where they are at this point. They entered administration to stave off the creditors who might have been able to force them into liquidation.

If they find a new source of funding, they could achieve a new lease on life. Or if they find a company to buy them, they could live to see another day. Otherwise, the future is bleak.

However, I would agree with you that their inability to bend the revenue curve upwards quickly enough is an issue. Revenues for the last three years failed to gain significant traction and they have struggled to achieve leverage over their fixed costs. On the other hand, COVID might have had something to do with that – at least in terms of whipsawing demand.

Thanks again for sharing your thoughts.

Ted

Ted, the last time Meridian had an operating profit with Bob Stuart on the board was more than 20 years ago. That was the year ending May 31, 2002. There were no operating profits until after he resigned his board position during the year ending June 4, 2017.

I made two bets. One that Bob Stuart can’t execute, the second the audio market greatly overstates how many people are interested in premium audio. So far I’m right on both counts.

Finally, I keep a checklist of what makes a successful startup on my computer. Bob Stuart has never checked many boxes. But what do I know, I grew up in the Silicon Forest around the tech industry and will celebrate my 37th year as a CPA this October.

Steve,

Just to clarify…my story is about MQA specifically. I haven’t studied Meridian.

As far as your judgment on Bob Stuart specifically, I’ll quote my father – Never judge someone until you’ve walked a mile in their shoes.

You are a CPA…that tells me much about your outlook. Bob is an engineer…that tells me much about his outlook as well. We all have job titles, but they are often better viewed as a personality types.

Thanks for reading!

Ted

There are plenty of people interested in premium audio. Unfortunately they looked at MQA and decided they weren’t interested in a proprietary format that’s equivalent to (or bested by) an equally high-resolution (and completely open-source) FLAC file.

Smoke & Mirrors!

At one point reality catches up with you.

Ted – Per your quote :

” Range of potential outcomes from administration includes:”

1. A negotiated CVA (company voluntary agreement) – this is where the debtor (the company under administration) proposes an alternative debt payout and payment schedule to the creditors. At least 75% of the creditors must agree to the revised debt payout and the payment schedule.

2. Sell the business as a “going concern” to another company

3. Sell the company’s assets, known as a creditors’ voluntary liquidation. Creditors are paid from any proceeds raised and the company is shut down

4. Close the company if there are no assets to sell

– Can you list the potential outcomes for our industry ?

– How does this affect the end user ?

– Who benefits if they close ? Tidal ? Apple Music ?

Thanks,

Tom

Hi Tom,

The “Range of potential outcomes from administration” is not my opinion, it is specifically defined by U.K. rules surrounding administration. Just wanted to clarify that…

So your questions as to “the potential outcomes for our industry” are all fairly opaque and hard to assess. MQA is only employed by one major streaming service – Tidal. According to recent data, Tidal has 5 million subscribers. MQA, a premium upgrade, is only available on its highest of three tiers. I haven’t seen a breakdown of how many subscribers Tidal has for each tier – but if MQA were to disappear, then top tier listeners would most likely lose access to it. Although the top tier would likely be readjusted to still present a higher quality sound without MQA.

The company has had some good success in convincing equipment manufacturers to add MQA decoding circuitry. You can see the list at this link… So if MQA content was to become unavailable, that feature would become useless. Here too, I can’t say how many would be affected. I have seen no data on how many users of the gear from these brands actually use the MQA feature regularly.

Who “benefits” if they close? Creditors for the most part. Tidal wouldn’t necessarily benefit, but they probably won’t be hurt much. Apple Music has its own higher-tier sound quality level – so it might benefit from slightly less competition…but I don’t know how much competition MQA represented to them.

I don’t know if this is responsive to your questions or not. As far as your questions in general, I call your attention to a quote from famous philosopher Yogi Berra – “It’s tough to make predictions, especially about the future!”

Ted

MQA started in 2014. Given the nature of their business, you would expect material losses during the startup period. How long should this take? Maybe 3-5 years. They’re now a 9 year old company bleeding money while maintaining huge overhead expenses. Either their business model and forecasts were inaccurate or their investors simply lost confidence.

Thanks Ted for the clarification – YOU ALWAYS Spot on ! KEEP it up -:)

T

Ted,

Very true but as Co-Founder, CTO and Chairman of Meridian, Bob does have ultimate accountability for the company’s performance. Remember the saying, “The Buck Stops Here”!

It would be interesting to view Meridian’s financial statements. I believe they’re still backed by Reinet.

Peter

Peter

I’m not defending Bob Stuart, I have never met him. My only point is – as I believe you know – innovation is hard. And the more novel the innovation, the harder it is to succeed.

And while I give you your points, in my experience a business failure – much like a business success – is rarely due to solely one person.

Thanks!

Ted

But, after nine years of heavy losses and out of control spending, you would assume that a chief executive would be reading their year end financial statements and reacting accordingly. Also, where was the Board of Directors? I know some of the Reinet executives; they’re very smart and talented people. I’m sure they just didn’t wake up one day and say we’re pulling out.

Hey Everybody,

This situation appears to be evolving in real time. Apparently Tidal announced during an AMA on Reddit that they will be adding high-resolution FLAC as an option for HiFi+ members, Tidal’s top tier. Although they do not say explicitly they are cutting ties with MQA, the timing appears to suggest they felt the need to hedge their bets as MQA has entered the U.K. version of bankruptcy.

See more on this in a story on Sound and Vision here… https://www.soundandvision.com/content/tidal-adopting-hi-res-flac-hifi-plus-subscribers

Ted

I’m going to lay down a chip on this one. MQA gets bought by Dolby. Bob Stuart and Dolby have had success together in the past.

MQA is a logical solution for bandwidth-limited streaming services because it delivers high-quality audio while consuming less data. Dolby could benefit from purchasing MQA’s intellectual property and scaling the technology to market to solidify its position as a leader in high-fidelity audio and tap into a new and growing market, like immersive music or live-streaming content

Interesting thought, Steve. Tidal’s CEO in a Reddit AMA made it clear that the attraction of MQA to them was the compelling combination of streaming efficiency with sound quality. Setting aside the controversy over whether MQA delivers on its promises, I would imagine there would be a lot of companies/organizations with a similar interest.

Thanks for sharing your thoughts!

Ted

Unlikely. Today most people can stream full-bandwidth files (FLAC, etc). This wasn’t the case in 2014. I don’t see Dolby or anyone else acquiring MQA. It’s a technology rendered moot by ever-increasing delivery bandwidth.

Plausible