MQA Limited has notified Companies House, the U.K. government agency that is roughly equivalent to our Securities and Exchange Commission, that it has changed its name. After nine years as MQA Limited, the company will now be known as Wave Realisations Limited.

See more on this new change of name for MQA Limited

In April, I told you about MQA Limited entering a process called “Administration” which is a form of receivership or bankruptcy. In this process, an administrator takes over running the company and either sells it, disposes of assets, or otherwise implements a reorganization plan that is satisfactory to creditors. Then, just in September, I shared with you that Lenbrook was acquiring the company.

The administrator currently running MQA is Phillip David Reynolds of FRP Advisory Trading Limited. On September 25, 2023, Reynolds filed two forms with the Companies House. The first was form NM01 – “Notice of change of name by resolution.” A simple form, it confirms that the existing company name is MQA Limited and the proposed name is Wave Realisations Limited. Companies House rules dictate that the company name change is not final until a formal corporate resolution is included.

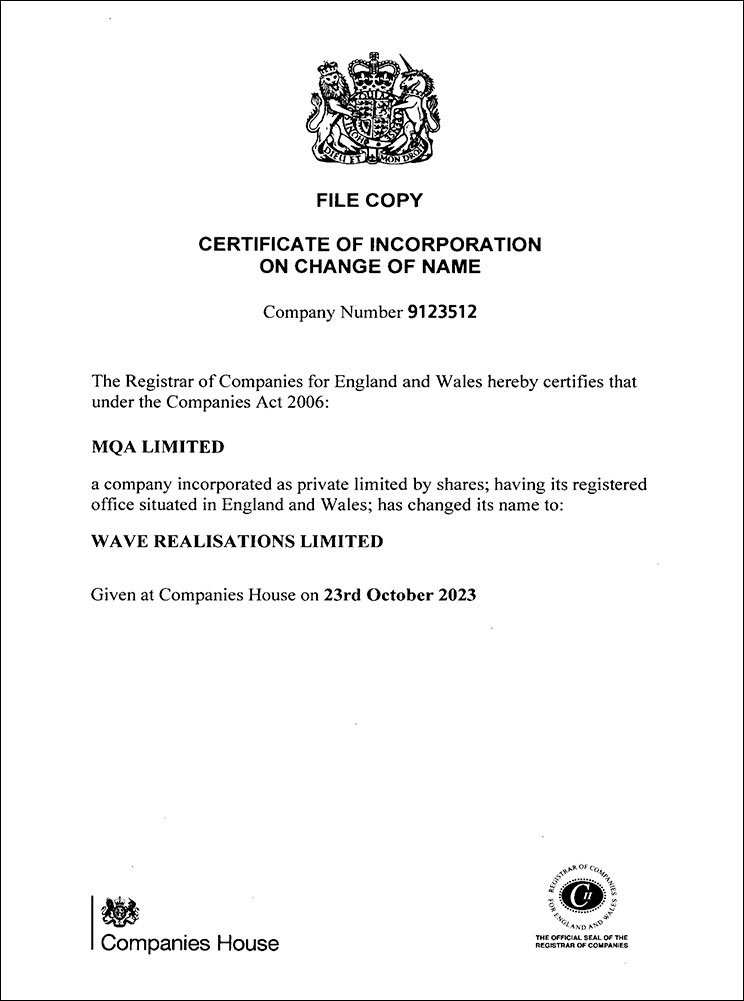

Company Receives a New Certificate of Incorporation on Change of Name

This takes us to the second filing, “Written Special Resolution on Change of Name.” This is another simple form notifying Companies House that the required written resolution to change the name of the company “was agreed and passed by the members” on September 25, 2023. It was also signed by administrator Phillip David Reynolds.

MQA was then awarded a “Certificate of Incorporation on Change of Name” from the Registrar of Companies for England and Wales. You can see a copy of that certificate below.

Separately on the Companies House website listing for MQA, there is a tab marked “People” which lists a total of seven officers of the company, five of whom have resigned. These resignations occurred over a period of time going as far back as October 2014 (Nigel Lloyd Dolby)…to the much more current April 2023 (Reed Smith Corporate Services Ltd and Sean David Jagoe).

Two Named Directors are Familiar Names

This leaves just two company officers listed: Michael John Jbara and John Robert Stuart. It is not clear when the page was last updated, but Michael John Jbara is listed as a director for two organizations: MQA Trustees Limited and Wave Realisations Limited. Similarly, John Robert Stuart (better known as Bob Stuart) is also shown as a director for the same two organizations.

Curiously, I found no mention anywhere of Lenbrook. I’m not sure how to process that, but it could simply be that the paperwork related to the change of ownership is still in process. I have reached out to Lenbrook for comment but they didn’t get back to me before this story was posted.

For Years, MQA Required Support of Generous Investor

As with the listing of company officers, I also found a listing of “Persons with significant control.” As I have previously pointed out, MQA lost millions of dollars a year due to high “administrative expenses.” For example, in fiscal 2021 – the last year for which we have numbers – the company booked administrative expenses of £4,499,152 (just under $5.5 million) leading to a net loss for the year of £4,305,689 ($5.2 million). This loss is on revenues of £657,631 ($798,041).

The only way the company was able to operate continuously all those years was through the generous support of a key investor. That investor was Reinet Investments S.C.A., an investment group specializing in various luxury businesses.

Data Shows Reinet Still Controls Majority; Update May be Coming

In my search this week, I found that Companies House still lists Reinet under “Persons with significant control.” Reinet is said to hold “more than 50% but less than 75%” of shares in Wave Realisations. It also holds more than 50% but less than 75% of the voting rights. Finally, Reinet is said to hold the “right to appoint and remove directors.”

Again, as elsewhere on the site, I saw no reference to Lenbrook, the new owner of the company. However, clearly, there are organizational things in motion. A name change is a big deal for any company and I will be interested to get an understanding of the meaning of this move by the company.

For More Information

I will update this story as I get more information.

See more on MQA at mqa.co.uk.

Learn more about the world of Lenbrook at lenbrook.com.

Ted,

MQA Ltd changed their name but are still the same company with accounts and conformation statements still overdue. And still in Administration.

Lenbrook purchased IP from the Administrators. Lenbrook’s press release announcing the acquisition talks about MQA and SCL6.

It would be hard to sell MQA Ltd because they indemnified Universal and Warner for legal fees defending against BlueSplike LLC. The Los Angeles law firm defending them is listed as one of the larger creditors. Those cases are going forward with the only issue is whether MQA infringes on their patents.

Finally, we don’t know if Reinet or the Labels still own stock in the company.

The administrators should be reporting their activities since their June 2, 2023, report.

Steve

Get thee gone Satan!

What is really possible in state-of-the-art high end audio suffers from pretenders who certainly improve things for lowest common denominator audio because it’s business, but do a real disservice as to what has been achieved by some companies. The unseemly demise of MQA should serve as a warning to investors seeking quick bucks from audio yes?

Often makes me wonder how/why a company with irreversible fortunes and massive losses continue to pay directors £400k/yr. over £2m in administration costs/yr should clearly have been shed a long time ago, since they were making no in-roads to reading out of their predicament.

Lenbrooke are likely moving the old MQA company formation to one side by putting it under a different name.

Then they will form a brand new MQA company, with no legacy legal issues to move forward with.

They will then transfer the relavant assets to the new company and leave the old one as a shell or wound up.

That way they get to put some clear distance between the two entities.

The new company will be called something like xxx MQA xxx Ltd.

A sensible strategic move on the part of Lenbrooke.

Ted, time for an update. Can you imagine the response if Lenbrook had announced the price when they announced the acquisition of MQA Ltd.’s IP.

MQA Ltd was required to change their name as a condition of purchasing the IP and equipment.

Muse and Reinet were the only remaining shareholders. The administrator’s preliminary proposal was incorrect and corrected it in a subsequent report.

What I’ve reported.

Lenbrook bought the MQA IP for $75k, The SCL6 IP for $25k and equipment for $25k. From the Administrator’s Progress Report with Pounds converted to dollars. November 11, 2023 SHF

I was heavily criticized for wanting MQA Ltd liquidated and the IP in someone’s hands who wouldn’t use it. With a lot of help and Companies House database, MQA Ltd. will be liquidated. But Lenbrook purchased the IP and intends to use it. Why?

· Lenbrook lost (confidential settlement) a patent infringement case against Sonos in 2020. They have to pay Sonos royalties for a license on all BluOS enabled devices they sell. They may believe they can use MQA Ltd.’s IP to get around Sonos patents and stop paying royalties.

· NAD paid significant royalties and licensing fees to MQA Ltd. Now they don’t have to.

· PSB has wireless headphones in the pipeline and would be hard to impossible to change course and use a different technology than SCL6.

To complete our quest, we have the following in our favor.

· Tidal is a big drag on Block Inc.’s earnings. Tidal’s revenues have been flat since 2020. A death sentence in the technology sector. A good case can be made to kill it anytime Jack Dorsey is willing to listen.

· MQA is now old technology and people like shiny new technology.

· The high-end audio press does not have the status and influence to promote MQA to anyone except those on the wrong side of the audiophile bell curve.

· Lenbrook has consistently overstated the market for high resolution audio. Clouding their judgement on the value of MQA Ltd.’s IP. September 21, 2023 AS October 3, 2023 SHF

Maybe Lenbrook was right. $25k for needed technology to launch headphones in Q1 2014 seems like a good price. And no royalties.

$75k for MQA? Plug in purchase price, Lenbrook’s savings, Royalties from Tidal, Roon etc. and licensing fees into an Internal Rate of Return worksheet. You probably get a nice return on your investment.

The gold may be transferred intellectual property. Those Sonos royalties could go away.