Will Exclude Apple Litigation Fees from Future Guidance

On Wednesday, Masimo Corporation (NASAQ: MASI) released preliminary results for its Fiscal 2023 fourth quarter and full-year results and issued new guidance representing its outlook for Fiscal 2024. Even though its final results won’t be announced until next month (February) the company has enough information to issue these preliminary results now, giving investors a better picture of how their fiscal quarter and year will end.

Masimo also announced it would change its formulation for future guidance by excluding the extensive costs associated with its litigation with Apple.

See more on this report from Masimo

Not many public companies release preliminary results as part of their normal reporting processes, the Securities and Exchange Commission does not require it. But Masimo does, and it offers more information for investors to get a peek at how things are going before the final results are published.

Changing Non-GAAP Formulations & Forward Guidance Calculations

The company also provides “guidance” for investors which are estimates of future performance for the company of revenues and income. Masimo in particular makes extensive use of non-GAAP (generally accepted accounting principles), which are formulas applied to actual results to give “adjusted” results that the company management believes give a more accurate picture of the actual operating performance than GAAP reporting. (I don’t necessarily agree with this thinking, but this is how Masimo management looks at its performance.)

But before we get into the forward guidance for fiscal 2024 based on this new formula, which I will only touch on briefly, let’s get into the newly announced preliminary results for this year. Below you’ll see a table that presents actual results for Q4 of fiscal 2022 (last year’s results), the estimated guidance previously issued for Q4 of fiscal 2023, and the preliminary results issued on Wednesday of this week.

Fiscal 23 Q4 Preliminary Results

| Division | FY22Q4 A | FY23Q4 G | FY23Q4 P |

|---|---|---|---|

| Healthcare | $351.9 | $320 – $345 | $336 – $341 |

| Non-Healthcare (Sound United) | $265.1 | $206 – $231 | $205 – $210 |

| GAAP Revenues | $617.0 | $526 – $576 | $541 – $551 |

As you can clearly see here, Masimo’s announced preliminary results for the fourth quarter nestled right in between the outer edges of the guidance range the company had previously provided investors. Investors like this as it says to them that you nailed your forecast. In fact, the day after they released this information, MASI stock value actually traded higher for most of the day, finally closing down slightly (Wall Street overall had a slightly down day as well).

However, you should also notice that the guidance range the company previously provided was below the actual performance of the quarter in Fiscal 2022. This means that while the company hit their forecast, the final result will be lower than the same quarter the previous year.

Fiscal 23 Full Year Preliminary Results

| Division | FY22FY A | FY23FY G | FY23FY P |

|---|---|---|---|

| Healthcare | $1,340.3 | $1,255 – $1,280 | $1,272 – $1,277 |

| Non-Healthcare (Sound United) | $695.5 | $770 – $795 | $769 – $774 |

| GAAP Revenues | $2,035.8 | $2,025 – $2,075 | $2,041 – $2,051 |

As they did in the fourth quarter, the company’s preliminary results came to near the midpoint of the previously provided guidance range. Again, investors like this, and the company saw its stock trading up for most of the day on Thursday (as this post is being written) only to close down slightly on a down day on the Street.

Unlike the quarterly results, however, the company is forecasting a potential increase. But it is likely a modest increase if an increase at all. If we assume the final number hits the midpoint of the latest preliminary result range – $2,046 in this case – then that will represent a small .5% increase over fiscal 2022’s final number of $2,035.8.

Fiscal 2024 Guidance

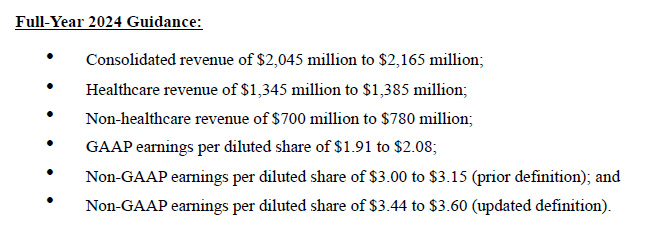

Finally, the company issued its first guidance for Fiscal 2024. Interestingly, we can derive some trending information from this guidance. Refer to the chart shown below for this new go-forward guidance.

What is interesting about this guidance is that, at first glance, it doesn’t seem particularly remarkable…pretty safe really. Consider my analysis above where we assume the Fiscal 2023 will finish with revenues of $2,046 million. The low end of this new guidance is pretty much set there, no increase at all – but then moves up to a top forecast of $2,165 million or $120 million higher.

This Seems to Reveal a Trend

But dig down a little and this seemingly “safe” forecast reveals diverging trends for the company’s two divisions. Masimo says that its Healthcare division will see revenues between $1,345 – $1,385 – a number that is well over its preliminary result for Fiscal 2023 of between $1,272 – $1,277. It is also well over the original guidance for Fiscal 2023 of $1,255 – $1,280.

This seems to suggest that there is some growing momentum on the Healthcare side of their business. Importantly, the Healthcare preliminary results for Fiscal 2023 Q4 of $336 – $341 million is above the analysts’ consensus forecast of $325.8 million. Masimo also beats analysts’ estimates for Fiscal 2023’s full-year results as well. This is a good sign.

But What About the Non-Healthcare (Sound United) Side?

Now compare this with their new guidance for the Non-Healthcare division (Sound United) of $700 – $780 million. In this instance, the low end of the guidance is below the preliminary results for Fiscal 2023 of $769 – $774…while the top end of the range is about the same as the top end of the preliminary result.

This appears to suggest the Non-Healthcare side is either treading water or slowing down. Notably, this division is falling below analysts’ consensus forecasts.

Wall Street analysts have jumped on this and view the situation positively, saying momentum on the Healthcare side is a good thing, as this is the largest division of the company. But it may add some more clouds to Sound United’s future.

Excluding Apple Litigation Expenses from Non-GAAP Calculations

Finally, Masimo has announced it will be taking the cost of litigation with Apple out of its non-GAAP analyses going forward. This will allow them to show better profitability numbers and estimates.

We have been engaged in various legal proceedings against Apple since January 2020, including various proceedings in the federal courts, various proceedings in the U.S. Patent and Trademark Office (the ‘PTO proceedings’), and a proceeding in the U.S. International Trade Commission (the ‘ITC proceeding’). Although we previously excluded only expenses relating to the ITC proceeding from the definition of ‘Litigation related expenses and settlements’, beginning with the first quarter of 2024, we have revised the definition of ‘Litigation related expenses and settlements’ to exclude not only expenses relating to the ITC proceeding, but also all other Apple litigation expenses, including those relating to the federal court proceedings and the PTO proceedings. We believe all of the Apple litigation expenses are unique in nature and not indicative of the Company’s on-going operating performance, and this updated definition will provide more useful information to investors by facilitating period-to-period comparisons of our financial performance that otherwise may be obscured by the significant fluctuations in Apple-related litigation expenses.

From document Masimo Announces Select Preliminary 2023 Financial Results and 2024 Guidance

Learn more about Masimo by visiting masimo.com.

Leave a Reply