Sales of newly constructed single-family homes dropped to a two-year low in October as rising mortgage rates and persistent high prices impacted the affordability of available homes and served to keep buyers on the sidelines. Some experts also noted that elevated hurricane activity also kept buyers away, especially in the South region.

Get all the details on new home sales in October

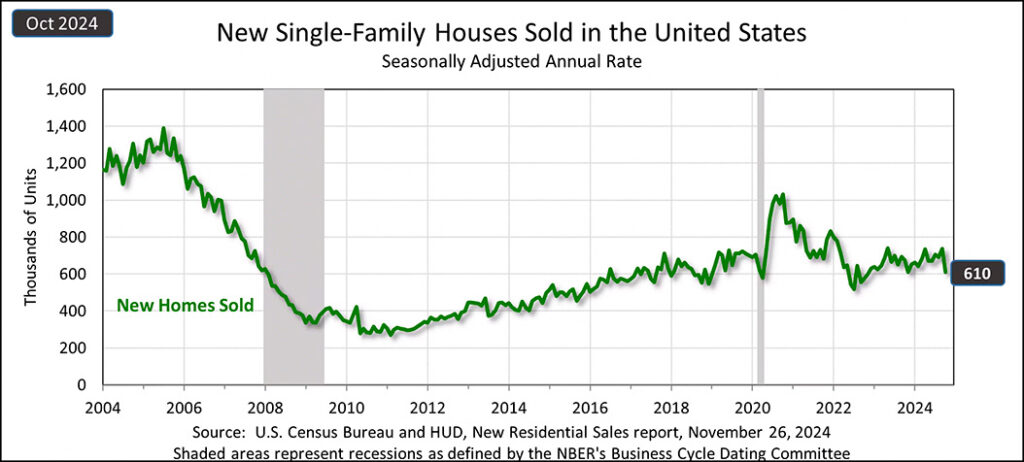

New data released by the U.S. Census Bureau and the U.S. Department of Housing and Urban Development showed that sales of new single-family homes in October came in at a seasonally adjusted annual rate of 610,000 units. This rate is 17.3% below the revised September rate of 738,000 units and is 9.4% lower than the sales of 673,000 units in October 2023.

This is the lowest rate of sales of new single-family homes in two years – since December 2022.

Economists Expected a Much Smaller Decline

According to the Reuters News Agency, a poll of economists had estimated that the October new home sales rate would come in at around 725,000 units, so the actual result was well below their estimate. Sales of new homes are counted when buyers sign a purchase contract and, as Reuters notes, can be volatile from month to month.

There was wide variability in sales results when looked at on a regional basis. The Northeast region, for example, had an increase of 53.3% over September results, while the Mid-west only booked a 1.4% increase. However, the much larger South region saw sales drop by a substantial 27.7% and the West also had new home sales decline by 9.0%.

What’s Spooking Buyers?

So what is spooking buyers? Most analysts are pointing to mortgage rates beginning to increase again. At the end of September, in the wake of the Fed beginning to cut interest rates, mortgage rates had dropped to 6.08%. But now, the latest reading on rates puts that figure at 6.72% at the end of October. Since most homes are purchased with mortgages, increases in rates raise homeowner’s monthly payments and can cause some buyers to wait for rates to decline again.

Along these lines, inflation, which is now well below its post-pandemic highs, has nonetheless begun to drift up again, from a reading of 2.3% to 2.6%. And there is some growing anxiety that the incoming administration’s aggressive tariff policy will fuel greater increases in inflation.

NAHB Economist Offers His Perspective

Says National Association of Home Builders Chief Economist Robert Dietz, “Due to lingering inflation pressure and possible future policy risks for prices, long-term interest rates remain elevated even as the Fed reduces short-term rates. The 10-year Treasury is near 4.4% — the highest level since the start of July.”

Dietz adds, “Ongoing elevated mortgage rates, combined with higher home prices, leave housing affordability in crisis-level conditions. The NAHB/Wells Fargo Cost of Housing Index (CHI) indicates that for the typical family, 38% of their income is required to buy a median-priced new or existing home. Low-income families would require three-quarters of their income. These affordability conditions are holding back home sales volume…”

Will the Fed Halt Interest Rate Declines?

Some industry analysts are suggesting these newly negative impacts will cause the Fed to reduce the number of, or lower the level of, their future interest rate adjustments – which could itself impact any form of sales recovery. Last week, mortgage rates climbed again, now sitting at 6.84%.

Meanwhile, the median sales price for a new home increased to $437,300, a 2.5% increase over the median price of $426,800 in September.

Leave a Reply