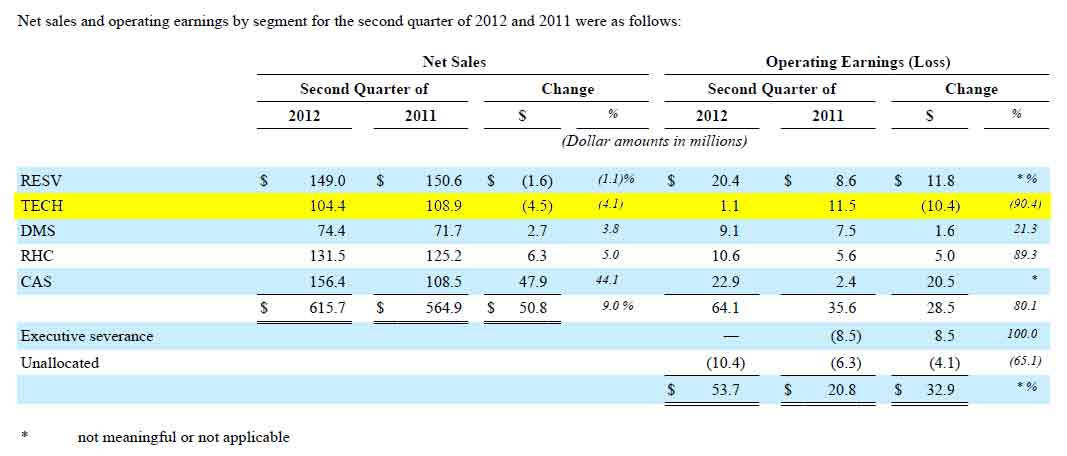

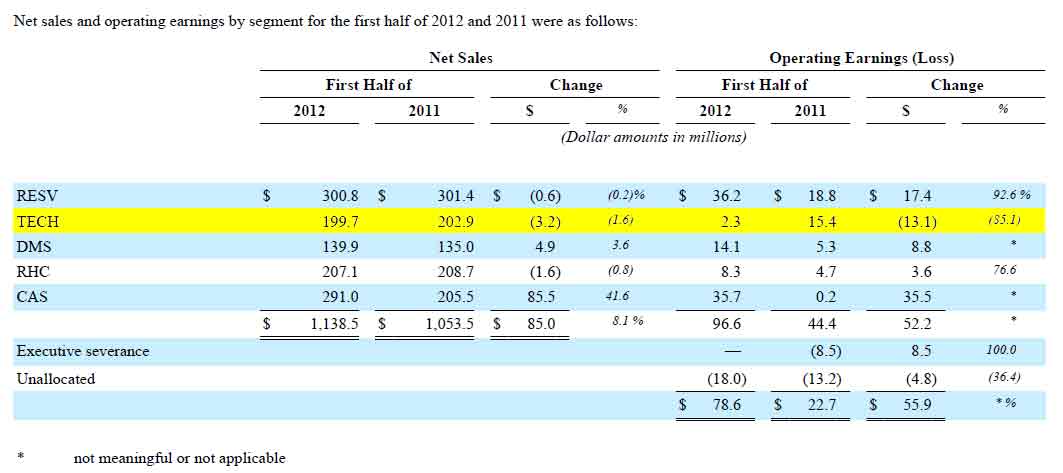

At the end of last week, Nortek, Inc. reported their financial results for the fiscal second quarter and first half. While at first blush the overall numbers look good – sales up 9% in Q2 and 8% in 1st Half and returning to profitability for both periods – digging deeper shows that their technology business unit (TECH) and residential ventilation business unit (RESV) are not yet participating in the company’s turnaround. Given the significant amount of restructuring of their TECH segment, this result is troubling.

At the end of last week, Nortek, Inc. reported their financial results for the fiscal second quarter and first half. While at first blush the overall numbers look good – sales up 9% in Q2 and 8% in 1st Half and returning to profitability for both periods – digging deeper shows that their technology business unit (TECH) and residential ventilation business unit (RESV) are not yet participating in the company’s turnaround. Given the significant amount of restructuring of their TECH segment, this result is troubling.

The company has decided to reorganize their business units, primarily to break out mounts from the TECH division. So as of the second quarter, Nortek’s reporting segments going forward will consist of:

- The Residential Ventilation Segment (RESV)

- The Technology Solutions Segment (TECH)

- The Display Mount Solutions Segment (DMS)

- The Residential Heating and Cooling Segment (RHC)

- The Commercial Air Solutions Segment (CAS)

Commercial air is cruising…

As we have reported previously, the company has been benefiting substantially from a new line of commercial air handling products that have been very well received by customers. In fact, the results of the CAS segment have been largely responsible for driving the overall company’s success.

As we reported above, while the company’s overall sales grew 9% in the quarter and 8% in the half, this is mostly due to the CAS segments sales growth of 44% in the quarter and 41% in the half. The new DMS segment showed growth as well, although with more modest 3.8% growth in the quarter and 3.6% growth in the half.

TECH’s the Debbie Downer…

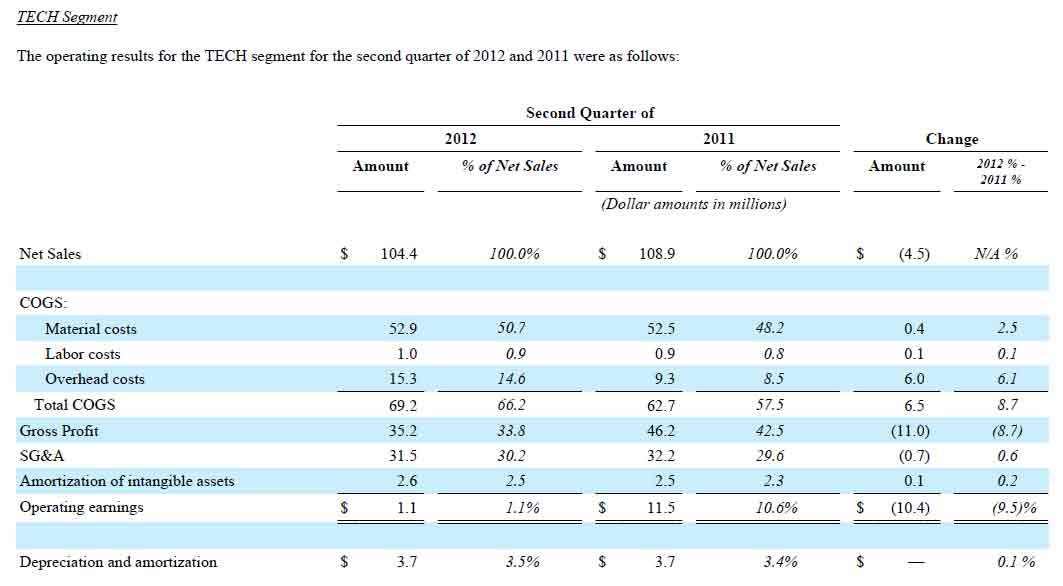

But the Debbie Downer was clearly the TECH segment which saw sales decline over 4% for the quarter and almost 2% for the half. More alarming than that, Operating Profits in the TECH segment dropped over 90% in the quarter and 85% for the half!

These results are surprising given the fact that the company has dramatically restructured the TECH segment, consolidating several independent operating companies such as Niles, Xantech, Elan and others into the AVC Group – a move designed to better leverage expenses and drive profitability. Also, the company had hoped to improve market leverage making the consolidated lines stronger than the individual companies were.

Round 1…round 2…

After a first round of restructuring, the company engaged in a second restructuring of the TECH segment, replacing Mark Terry, the former ex-Harman executive brought in to initiate the restructuring – and handing the reins to Sean Burke. SpeakerCraft, Proficient, and Panamax/Furman were all folded into the burgeoning AVC Group.

Yet the results seem in contravention to this thinking. In fact, the company experienced a significant decline in gross margins and an increase in costs. In other words, the actual results were opposite of the expected results of the major consolidations the division has endured.

A specific customer…

In discussing the results for the TECH segment, the company’s management indicated that the sales decline was specifically attributed to lower shipments to a certain customer (not specified). This resulted in a sales decline of $7.6 million for the quarter and $9.5 million for the half.

The company also discussed the ongoing restructuring and expressed great confidence that they will ultimately be able to both reduce costs in the segment and improve sales with a refined and ultimately more powerful line-up of fewer products. However, Nortek is still in the process of fully digesting the consolidation.

Redundant and poorly received…

As part of the process, they have decided to discontinue redundant or poorly received products. This decision resulted in a $2.2 million write-down of these devalued goods. In addition to this, the company says that SG&A expenses were inflated by approximately $0.3 million for severance costs.

For those Nortek TECH segment employees holding their breath in hopes of surviving the restructuring – good news. The company says that it anticipates completing that part of the process by the end of the third quarter. However, they are earmarking a substantial $5-6 million for costs associated with vacating premises and further severance for staff cuts.

Inflated costs…

Cost of Goods Sold (COGS) were inflated in the second quarter and first half, the company said, largely as the result of the discontinuation of a product line that was poorly received by customers. This discontinuation resulted in a cost increase of $1.1 million in the quarter and $3.7 million in the half.

Finally, the company said that COGS was also impacted by costs associated with previous acquisitions. All-in-all a disturbing result for a segment that has gone through significant restructuring. Apparently, more is needed before the financial results will begin to bear fruit.

For more information, see: www.nortek-inc.com.

Leave a Reply