Company Loses Almost 6% of Total Market Value in Just a Few Hours

Nortek, Inc. released the results for its fiscal second quarter after the market’s close on Monday and took the unusual step of issuing optimistic performance guidance for the remainder of the year. The company does not typically release future performance guidance as a matter of policy, but did so in an apparent attempt to calm investor reaction to their troubling report. It didn’t work – investors reacted strongly on Tuesday by driving Nortek’s stock to a close of $75.23 per share, down sharply from the previous close of $79.88. In just a matter of hours, the total market value of Nortek collapsed almost 6%.

Nortek, Inc. released the results for its fiscal second quarter after the market’s close on Monday and took the unusual step of issuing optimistic performance guidance for the remainder of the year. The company does not typically release future performance guidance as a matter of policy, but did so in an apparent attempt to calm investor reaction to their troubling report. It didn’t work – investors reacted strongly on Tuesday by driving Nortek’s stock to a close of $75.23 per share, down sharply from the previous close of $79.88. In just a matter of hours, the total market value of Nortek collapsed almost 6%.

Why did investors react so strongly?…

The value of Nortek’s stock continued to decline in after-hours trading as well. However, in early afternoon trading Wednesday, the company has seen its stock price stabilize with about a .5% increase in the price of its shares. While some analysts associated with brokerage houses remain optimistic on the company’s prospects, investors were clearly shaken by deteriorating results from the company, including an overall revenue decline and continued losses. In addition to that, there was troubling trend shifts from certain company divisions – that were emphasized as the company announced specific actions to attempt to improve performance.

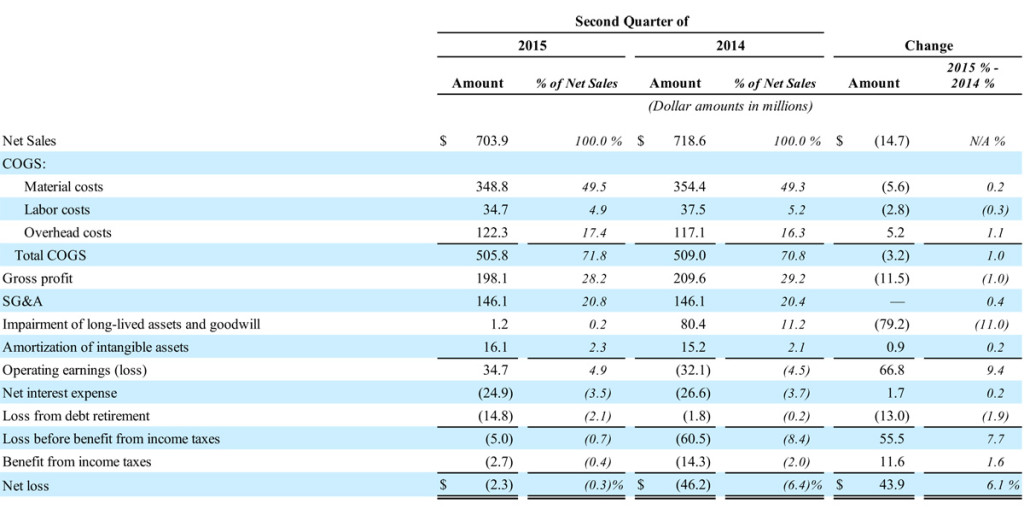

Sales for the second quarter dropped to $703.9 million, down 2% from the $718.6 million in the same quarter the previous year. If you exclude the positive contributions of acquisitions and the impact of foreign currency exchange rates, sales actually declined an even more significant 4.2%. It’s also worth noting that the sales result for the quarter last year had increased an impressive 13.9% over the same quarter in 2013, so the decline this year was a bit of a surprise.

Less Loss = More Good?

Nortek booked a net loss of $2.3 million in Q2, well off a loss of $46.2 million in the quarter last year – a result that the company points to as proof of the positive effect of their overall restructuring efforts. However, here again the dramatic loss last year contrasted to a profit of $11.5 million for the quarter in 2013; so two years later, the company is still showing a loss.

The company has been in the midst of a radical restructuring of their businesses that is scheduled to be completed by the end of 2015. This restructuring included shifting manufacturing, exiting businesses, consolidating other businesses, and outsourcing warehousing & logistics.However, as we shall see, it has been a bumpy road on the way to positive results from all of this restructuring – and new disruptions may show that management overreached.

Results for the first half of the year follow a similar pattern as the quarterly results. Sales were essentially flat, growing to $1.277 billion in the half, or less than 1% higher than the $1.266 billion for the same period last year. The net loss for the half was $16.2 million as compared to a $54.8 million loss last year.

Depending on your viewpoint, these top-level results were either so-so or even good considering the reduction in losses. While the results for sales and profits did miss analysts estimates, why was the response from investors so negative?

First: A Problem, but Not a Surprise

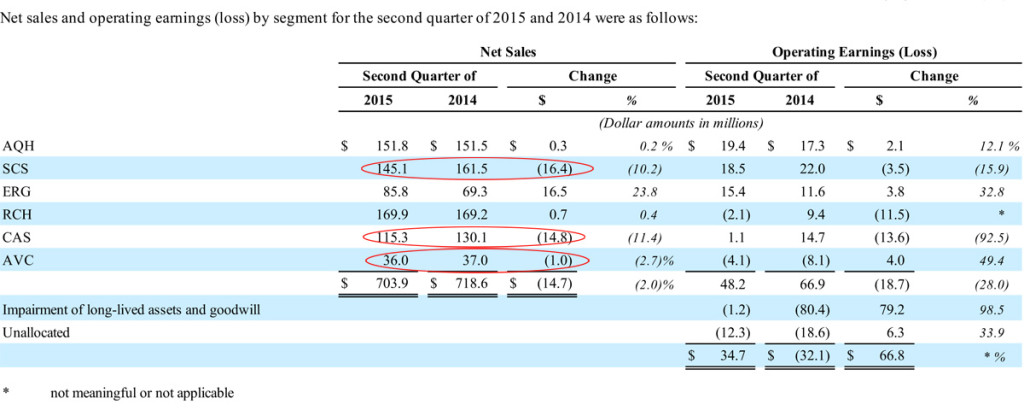

Nortek has five major operating segments: the Air Quality and Home Solutions segment (AQH), the Security and Control Solutions segment (SCS), the Ergonomic and Productivity Solutions segment (ERG), the Residential and Commercial HVAC segment (RCH), and the Custom and Commercial Air Solutions segment (CAS). In addition to these major segments, the company also maintains tracking on a minor segment they call Audio, Video and Control Solutions segment (AVC). It is this last minor segment that most closely correlates to what we know as their Core Brands business in the custom integration business.

In revealing their results from the first quarter of this year, we learned that the company had a new problem in their CAS segment. As we reported in our post in May about the 2015 first quarter results:

Company President and CEO Michael Clarke told analysts that the company has seen a major decline in orders from a “major semiconductor capital equipment customer.” This caused the CAS segment to book the largest sales decrease and the largest loss of any of their segments.

CAS Restructuring

To address this problem, the company told analysts earlier this year that they will embark upon another restructuring specific to that division that will take several quarters to work through. The cost to restructure CAS was projected to be $15-20 million and when complete would mean a drop in revenues of $55-65 million annually. Ouch.

In the second quarter, we see the pain continuing from the CAS segment problems. Sales in the CAS dropped to $115.3 million, more than 11% less than the $130.1 million the segment booked in the quarter last year. Operating earnings in CAS declined from $14.7 million last year to just $1.1 million this year.

But the company’s materials noted that this CAS result was not a huge surprise: “The decrease reflected the anticipated decline in sales to a major U.S. semiconductor capital equipment customer…” Anticipated, because they told us about it a couple of months ago.

Nasty Surprise #1

But in discussing the results from the second quarter this year, the company acknowledged a new and we would say nasty surprise.

“Although four of our five major segments performed as expected this quarter with some solid underlying growth fundamentals, a temporary operational setback in our HVAC business weighed on our overall sales and profitability,” said President and Chief Executive Officer Michael J. Clarke.

Uh-oh. Often, we find that small comments like this from management can have big meaning. So digging deeper, Clarke went on to explain, “The key challenge we faced this quarter, however, was an unexpected decline in HVAC segment shipment levels primarily during April and May, due to the inability of our third-party warehousing and logistics provider in the residential part of the business to keep up with the level of order activity during our peak season.”

From Profit to Loss

So what was the result of this snafu? Sales for HVAC were basically flat, coming in at $169.9 million in the quarter versus $169.2 million last year. “Organic” sales (taking out impact of acquisitions and foreign exchange) declined an astonishing $14.3 million or 8.3%. Operating earnings were slammed, dropping from a profit of $9.4 million to a loss of $2.1 million. An alarming reversal and a disappointing turn of events with this new reality that their outsourced partner didn’t perform.

It’s important to remember that this “third-party warehousing and logistics provider” was a significant part of the operational improvement initiatives put into place by this very management. It was widely anticipated that by closing down their internal distribution centers and moving to an expert provider, costs would drop and service would improve. But this result conflicts with that plan. So when the problem arose, Nortek quickly took action.

“We immediately addressed the issue by bringing our internal HVAC distribution back online, and shipments increased substantially in June as a result,” Clarke said. “Nevertheless, we were unable to fully recover from the lost shipments during the quarter. Based on our current order flow, backlog and constant communication with our customers, we believe we have put this issue largely behind us. We expect a return to normal shipping performance in the HVAC segment in the second half of 2015.”

A Surprising Un-restructuring

But what this sequence of events means is that Nortek has gone “back to the future” in the HVAC segment – taking the responsibility for handling warehousing, distribution and logistics back from their outsourcer to handle it themselves internally. Although the company made no comment during their presentation to analysts of just what this un-restructuring means for the company’s overhead and cost structure – it’s hard not to question the move, as it runs counter to the rather boldly and oft-proclaimed benefits of their own restructuring plan.

During a question-and-answer session on a conference call with analysts, Daniel Mannes, an analyst with Avondale Partners apparently had the same idea: “On the distributor for your resi business, by bringing it back in-house, are there any notable dis-economies since you’re bringing it back in? I mean, obviously you outsourced for a reason. Or anything we should think about, as it may result in less overall savings versus your plan otherwise?”

Nasty Surprise #2

The company was not done, as there was another nasty surprise to be revealed. In previous reports, the company’s golden child has been its Security and Control Solutions segment. Spearheaded by its Linear division, the company has had strong growth in this segment and shifted resources to make specific acquisitions to continue to feed it.

But in a review of the segment-by-segment performance, we were surprised to see SCS had an unexpected sales decline this quarter. And a big one. Sales for the SCS segment fell to $145.1 million or more than 10% down from the $161.5 million booked in the same quarter last year. Operating earnings also dropped to $18.5 million or 16% lower than the $22.0 million last year.

The company noted that the segment was up against “a difficult comparison to the prior year when we shipped a large concentration of orders in the second quarter of 2014.” The problem is, our notes show no comment from the company last year that suggested the level of sales in 2014 Q2 was unusual and likely to not be repeated. Hence, it’s anothher nasty surprise.

Numera to the Rescue?

It is possible that this factor weighed even heavier on the market that the distribution and logistics snafu. The security business is a key one for the company and was a significant driver of growth for the whole organization. A hint of trouble is bound to make investors extremely nervous.

To address the issue, Nortek announced that it has acquired Numera, Inc., a provider of mobile personal emergency response and telehealth systems. The company feels that the Numera acquisition will help fuel further growth in the SCS division by adding a capability previously not available to it.

“We have combined Numera’s mobile PERS and telehealth technologies with our traditional PERS and security offering,” Clarke told analysts. “This should put us at the forefront of today’s age-in-place technology trends. It also positions us to realize top-line synergies by cross-selling between Nortek’s existing dealer network and Numera’s client base.”

Nortek purchased Numera in an all-cash deal for $12 million up front, with the possibility of an additional $28 million payment if the new addition hits certain unspecified performance targets. Time will tell if the Numera acquisition will move enough numbers to drive the entire segment.

AVC Segment is Still an Underperformer

Finally, results for AVC continue to be disappointing. Nortek’s AVC business continues to see sales declines and the segment is still generating losses. Despite significant effort to restructure the business over the last year, these results have still not come around.

Net sales for AVC in the second quarter came in at $36.0 million, down 2.7% from the $37.0 million in the same quarter last year. The segment generated an operating loss of $4.1 million, which is much less than the $8.1 million operating loss in the quarter last year. But it is still losing money.

It is important to remember that AVC includes Core Brands with no fewer than ten brands including: Elan, SpeakerCraft, Niles, Sunfire, Proficient, Panamax, Furman, BlueBolt, Korus, and Xantech. Several of these brands were once huge pillars of the custom integration industry.

But this isn’t even the entire segment. Although the company has never specifically identified just exactly which brands are in the AVC segment, we now know that TV One (along with Magenta Research) were also part of it.

Yet Another Surprise

And we now know this because of yet another surprise – the company has sold off – perhaps dumped is more accurate – the TV One businesses to a group of the company’s managers. We say dumped, because the company basically gave it to them for free.

“There was no substantial cash consideration received in connection with the transaction and we expect to record a loss on the sale of approximately $3.0 million to $4.0 million in the third quarter of 2015,” the company’s materials disclose.

Yes, that’s right, in the sale of TV One Broadcast Sales Corporation, TV One Limited, and Magenta Research Ltd., to a consortium of the brand’s managers, no value was set, no cash changed hands…and Nortek will lose money on the deal. In a pro forma analysis of the impact of the transaction, we learn that in 2014 the collective group of companies (referred to as the TV One businesses) generated sales of $20.3 million…and operating losses of $23.9 million.

So by unbundling the TV One business from AVC, profits should improve…as the group was generating substantial losses. Of course, sales will suffer as well.

Gefen is being Folded into Core Brands in Another Reorganization

In 2014, AVC had sales of $162.6 million with an operating loss of $19.2 million. So by eliminating the TV One businesses, sales will depress to around $142.6 million, but the combined entity would appear to offer operating earnings of a few million dollars.

And to help the Core Brands entity with sales, the company announced it was restructuring it yet again (we’ve lost count on how many times it’s been restructured) and will add the Gefen brand to the mix. However, this is not likely completely good news for Gefen employees as the company notes it will exit certain Gefen product categories, likely commercial products. The company is earmarking between $6.0 million to $8.0 million for costs related to this restructuring…mostly for severance and inventory write-downs.

Nortek explained these last two moves by saying the commercial business is out…but residential is in. Clarke surprised us by saying AVC’s residential business is doing well.

Commercial is Out, Residential is In

“Let me now switch to the AV business, which we began restructuring this time last year,” Clarke told analysts. “We have three businesses in the group, one residential, and two focused on the professional or commercial markets. The residential business performed well in the quarter, delivering double-digit sales growth and positive adjusted EBITDA compared to the significant losses this time last year. New management, business processes and, of course, great new product platforms are taking hold hard of the business.”

Although he didn’t specifically name the entities, he clearly appeared to be referring to the TV One businesses and Gefen as the commercial entities – although Gefen offers both commercial and residential products. Clarke then talked of divesting of one of the commercial businesses (TV One) and discontinuing products and folding the other (Gefen) into their residential business (Core Brands).

Nowhere in the SEC filings by Nortek, Inc. can we find numbers to verify Clarke’s assertion of a 10% increase in their residential businesses, as their numbers aren’t broken down that way. However, this seems to indicate that in a refreshing turn of events, Core Brands may in fact have experienced a bit of a turnaround in market share.

Nortek also announced another impairment charge of $1.2 million to yet again reduce the value of the AVC segment, largely for resetting the value of property and equipment to zero. In the second quarter of last year, the company booked an $80 million charge, principally to write off goodwill for the segment.

So why did investors react so strongly? Because investors don’t like surprises.

Leave a Reply