Nortek, Inc., a diversified manufacturer of commercial and residential products largely targeted towards the new construction business, announced on Monday the financial results of the third quarter of their current fiscal year. Overall, the results were mostly positive, although two of their business units saw revenues decline in the quarter. Surprise…surprise…neither of them were the newly designated AVC (Audio Video Control) segment, as you (and we) might have suspected.

Nortek, Inc., a diversified manufacturer of commercial and residential products largely targeted towards the new construction business, announced on Monday the financial results of the third quarter of their current fiscal year. Overall, the results were mostly positive, although two of their business units saw revenues decline in the quarter. Surprise…surprise…neither of them were the newly designated AVC (Audio Video Control) segment, as you (and we) might have suspected.

AVC showed a sales increase. Does this mean AVC has turned a corner in results?…

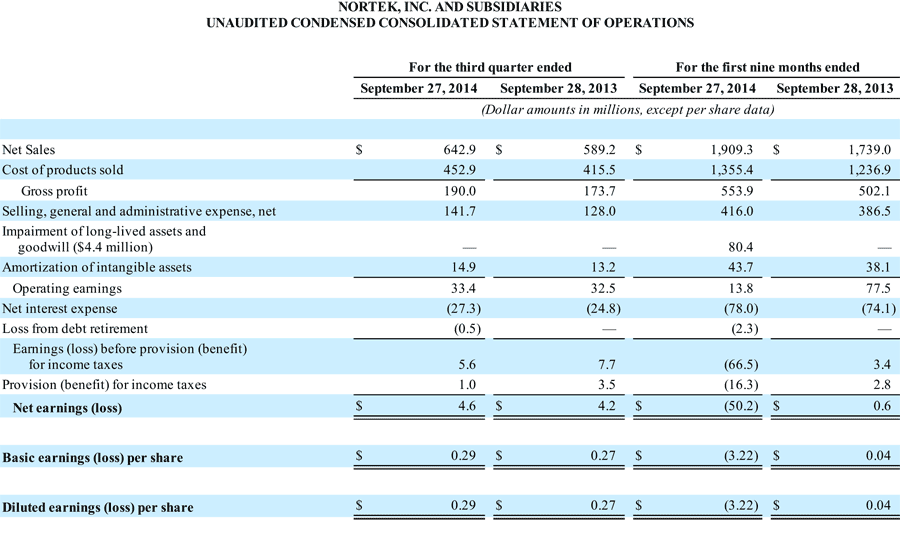

Overall, Nortek reported that Q3 revenues increased 9.1% year-over-year (YoY) coming in at $642.9 million versus the $589.2 million generated during the same quarter a year ago. Contributing to revenue and earnings growth this year is the acquisition of Reznor, which was the former HVAC division of Thomas & Betts. Of the total revenue growth of $53.7 million, $38 million was directly attributable to Reznor. Taking Reznor out of the picture – the “organic” growth (growth from existing businesses) came in at a much more modest 2.6%

Operating earnings reported on a GAAP basis (Generally Accepted Accounting Practices) came in at $33.4 million, or 2.8% over $32.5 million last year. Like revenues, the Reznor acquisition contributed to operating earnings as well, bringing in an additional $1.8 million. Taking Reznor out of the picture and we find that organic operating earnings came in at $31.6 million – down 2.8%.

Would be quite rosy…

The company booked net earnings (GAAP) of $4.6 million for a 9.5% improvement over the $4.2 million in net earnings the same period last year. If we stopped here, the picture would be quite rosy. But we didn’t stop here…

Another business segment reclassification…

First, the company has once again reclassified their business units. Geeze! Like a long novel with too many characters, we have to keep referring back to the cast of characters listing to remind us what each division is and does.

And their troubled AV division…which was just broken out and reclassified in advance of the recent second quarter (Q2) report…has been reclassified again. After only 90-days in existence! In the Q2 report, Nortek referred to this new – and relatively undefined – division as the “AV entities.” Now the the company refers to it as AVC – an acronym for Audio Video Control.

We’re still not sure just precisely which brands are in the AVC segment. As far as we can tell, the company has never identified just specifically which companies make up AVC. Another trade media published a specific definition of AVC – but Nortek-related executives refuse to confirm that report as correct to us – saying the company has not revealed which brands are in that group.

Subterfuge…

Why the subterfuge? We have no idea. But in any event, here is the new breakdown:

| Old Segment Name | Old I.D. | New Segment Name | New I.D. |

|---|---|---|---|

| Residential Ventilation | RESV | Air Quality and Home Solutions | AQH |

| Technology Solutions | TECH | Security and Control Solutions | SCS |

| Display Mount Solutions | DMS | Ergonomic and Productivity Solutions | ERG |

| Residential Heating and Cooling | RHC | Residential and Commercial HVAC | RCH |

| Custom & Engineered Solutions | CES | Custom and Commercial Air Solutions | CAS |

| AV Entities | AV | Audio, Video and Control | AVC |

There probably is a good explanation as to why these designations keep changing, but the company doesn’t offers it in their materials. And, once again, Nortek provided a definition of the new AVC group in these new materials, but, once again, did not list precisely which specific brands are in the group.

“The AVC segments manufacture and distribute a broad array of products primarily for the residential audio/video and professional video signal management markets. The principal product categories in these segments include residential audio/video equipment (including architectural speakers and power conditioners, among other products), home control equipment, and professional video signal management solutions.”

A little troubling…

However, we find it troubling that Nortek management seems to treat AVC a little differently as compared to the other segments. For example, the company or its executives will, from-time-to-time, talk about their FIVE major segments. If you count the segments in our table above, there are six. A simple error? We don’t think so. Even when presenting the list of renamed business segments in their 10-Q, Nortek presented the first five in the table format…and only added a mention of the AVC segment in associated text paragraphs.

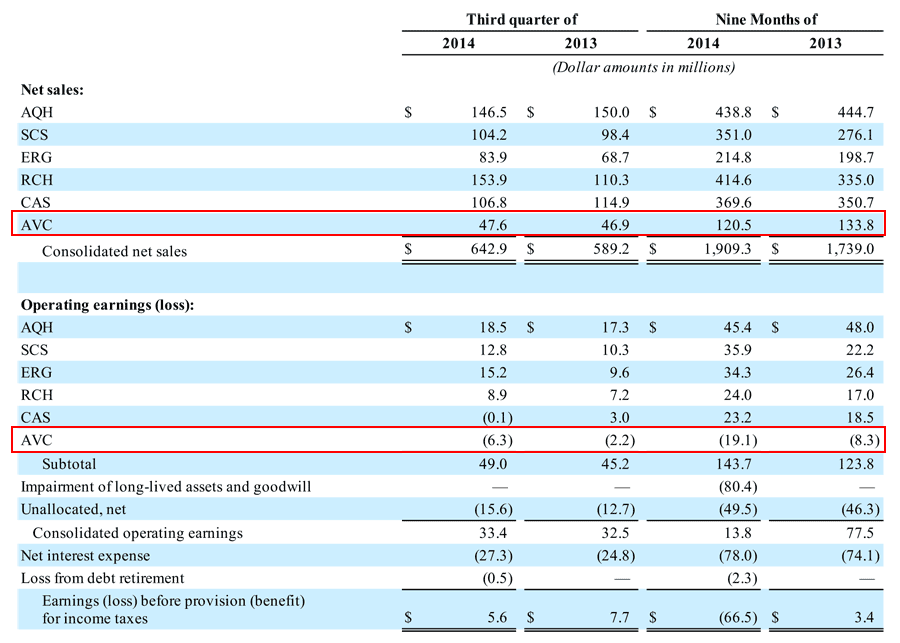

In a deeper dive in their fiscal results, we discovered that two of their major segments reported revenue declines – AQH (sales down 2.3% to $146.5 million from $150 million the previous year) and CAS (sales down a significant 7.0% to $106.8 million from $114.9 million). The company said that the AHQ decline was the result of their exiting a product line – as well as suffering foreign exchange losses. In the case of the CAS segment, the company said that they are “seeing softness in certain end markets.”

AV revenues actually increased…

But AVC – a company segment that has experienced declines for quite some time – actually showed a revenue increase…albeit a slim one. According to the Nortek 10-Q, AVC revenues for Q3 came in at $47.6 million, up $700,000 or 1.5% over $46.9 million in the same quarter last year.

When we first saw this result, we were hopeful that this represented a “bottom” with AV revenues finally ceasing their declines. However, when we saw the company’s analysis of AVC’s results for the quarter, our hopes were quickly dashed on the rocks of reality. That 1.5% AVC growth – “…was driven by sales of video products for a specific customer project.” So, in other words, this growth was due to an exceptional event…not good solid growth in organic sales.

Weakened demand…

Worse yet, Nortek management, in discussing the AVC segment’s results in the 10-Q filing, surmised that:

“Continued weakened demand for our audio, video and control products contributed to the decline in operating results for the entities included within the combined AVC segments… The decline in demand was driven, in part, by technology changes that affect certain product categories that the business compete in. This has caused demand to shift from certain of our legacy products to newer technologies.”

YTD results, more of the story…

The company also reported results for the first three fiscal quarters of the year (year-to-date, YTD), and the picture for AVC is certainly no rosier in this analysis. Nortek saw an overall increase in YTD revenues of 9.8% from $1.739 billion last year to $1.909 billion this year. But the AVC segment saw revenues decline 9.9% from $133.8 million last year to $120.5 million this year.

And YTD operating earnings for Nortek declined from $77.5 million last year to $13.8 million this year. Most of that decline was due to writeoffs associated with the AVC segment – but at least the company remained profitable on a operating basis. But AVC group booked a YTD operating loss of $8.3 million last year…that more than doubled this year to $19.1 million.

“In our AV businesses – the new residential products we introduced at the CEDIA show in September were received very well…winning 12 awards,” President and CEO Michael J. Clarke told analysts and investors on a conference call. “These products are now shipping. On the pro side of the business, we’re gaining some traction during the quarter including some new customer relationships. At the same time, we’ve made good progress in improving operational processes and reducing overhead costs where appropriate. We believe that these initiatives position the AV businesses for improved performance going forward.”

AV downplayed…

Although seemingly positive, these comments from Clarke were delivered dryly and dispassionately. For most of the management presentation during the analyst conference call, the AVC segment was – more or less – downplayed.

Or worse. During Nortek CFO Al Hall’s presentation, several statistics – including organic sales and adjusted EBITDA (earnings before income tax, depreciation, and amortization) – were made based on “excluding AV.” Issues with AVC and CAS notwithstanding, Nortek management remains overall optimistic.

Feel pretty good…

“Given where we are today, we feel pretty good about the fourth quarter,” CFO Hall told analysts. “The Reznor acquisition is expected to have a meaningful contribution to the quarter’s results – given that its fourth and first quarters tend to be its strongest, primarily due to seasonal factors.”

Much of Hall’s presentation was centered around reassuring analysts and investors that the dramatic infrastructure overhaul is progressing nicely, and though it won’t be complete until 2016 – the company is already beginning to feel the effect with lower costs and improved margins.

According to Hall, when their operational restructuring is complete, the company expects costs to be reduced $48 million – to – $60 million a year. For 2014, the company expects to realize a cost reduction of between $15 million – to – $20 million…even with the program only partially implemented.

Then the Q&A session started…

Wrapping up the management presentation, Hall sounded calmly confident. Then the question-and-answer session opened up…

While, in general, most analysts were respectful with their questions, it was clear that for some of them, the company’s talking around the AVC problem was insufficient. And it wasn’t long before the questions zeroed in on AVC.

What are you doing?…

“You talked about looking at what you have to do to get the profitability at least back on track with AV – or at least cut the losses – can you be any more specific with regards to what actions you’re taking at this point,” asked Jeffrey Keppler with Imperial Capital.

Clarke answered sounding a little nervous and talking very quickly: “Yeah, yeah…obviously we’ve looked at the standard things. We’ve looked at the S,G&A…we’ve looked at projects that we don’t think they’ll take off…we’ve put new management in some of the areas. We’re just doing the general, ‘Looking at the business.’ The big one is the new products area – if you don’t have great products it doesn’t matter what you do – so we’re spending a lot of time investing into new products and drilling down to make sure those new products fit into the organization. Another one we’re doing is putting in systems increasing our B-to-B capability, customer portals, etc. like that – making it easier to get our products to our customers…increasing the services. So it’s a series of things we’re doing with our businesses.”

What are you thinking?…

“Can you just give us an update on the audio/visual, or what you now calling audio/visual & control systems, when we last spoke there was some talk about possibly divesting pieces of that,” asked an analyst with Deutche Bank. “It sounds like you have some new products that were launched – can you just give us an update on the thinking there?”

Clarke, beginning to sound wearied by questions about AVC, took this question as well. “Yeah…um…I think focus has been on fixing the business and getting new products out. I mean that’s been our big focus…so we haven’t really discussed with regards to whether we’re going to sell the business or do anything with the business . Our major focus is to turn this business around and drive the performance of the business. And as I said earlier to some other question, a big one is to look at those products and see if they fit.”

When will AV at least hit breakeven?…

Yet another analyst asked: “On the AV segment, obviously you’re making some changes there to improve profitability, could you give us kind of a timeline on when maybe we can get to sort of a breakeven type number? Are you looking at mid- to late-next year, or perhaps earlier than that?”

Again, after a pause, Clarke once again stepped in to handle yet another AVC question: “Yeah, it’s probably – I mean we’d like to get it sooner – but we probably think it will be the first or second quarter next year when we feel that that will be sort of the break even and we’re more solid in the business.”

Clarke’s voice kind of trailed off when answering the last question – making him sound slightly weary of the topic. But from the sound of it, the analysts appear to be warming up to the AV issue…even sharpening their questions on the topic.

See more about Nortek at: www.nortek-inc.com.

Leave a Reply