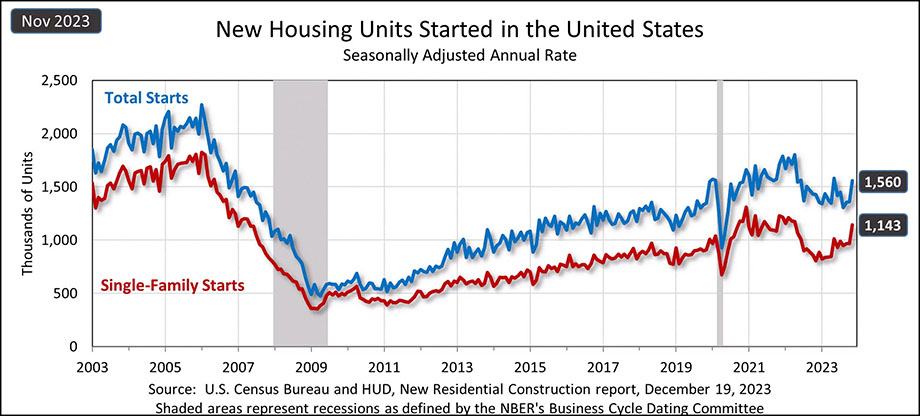

The latest data on residential construction, a government reading known as housing starts, took a surprising jump in November according to the recently released information from the U.S. Census Bureau and the U.S. Department of Housing and Urban Development. Housing starts jumped an impressive 14.8% in November as compared to the revised October reading – a huge statistical leap.

See more on the jump in November housing starts

The economy over the last couple of years has basically been a good one for most consumers, with historically low unemployment, abundant job openings, and good wage growth offsetting the impact of high inflation for most and leading to strong ongoing consumer spending. However, the economy has been pretty ugly for one segment – home builders.

Caught in the steel pincers of crazy high costs for building materials, along with vexing labor shortages on the one hand … and high mortgage rates with low inventory killing off buyer demand for new homes on the other hand – building activity dropped off precipitously. However, it appears the earth has shifted in November.

A ‘Soft Landing’ Appears Possible

Thanks to moderating inflation, the Fed began to halt its program of increasing interest rates leading many industry analysts to suggest the Fed’s monetary tightening program may be coming to an end. And maybe…just maybe…the economy is headed toward the much desired “soft landing” – an enchanting concept that has been dreamed about but never actually happened before.

It is against the backdrop of a perceived positive change in these market factors in November that appears to have motivated builders to increase construction activity. As noted above, overall housing starts in November came in at a seasonally adjusted annual rate of 1.560 million units. This is 14.8% higher than the revised rate in October of 1.359 million units and 9.3% over the rate of 1.427 million units in November 2022.

Lower Mortgage Rates ‘Likely’ to Draw Buyers Back into the Market

According to a report in the New York Times, declining mortgage rates are “likely to draw potential buyers back into the housing market.”

Single-family housing starts, a metric more meaningful to the custom integration industry, in November came in at 1.143 million units, an even greater 18% increase over the revised October rate of 969K units. Not only that, but the November rate on single-family starts is a staggering 42.2% higher than the 804K rate in November 2022. These are big increases, folks!

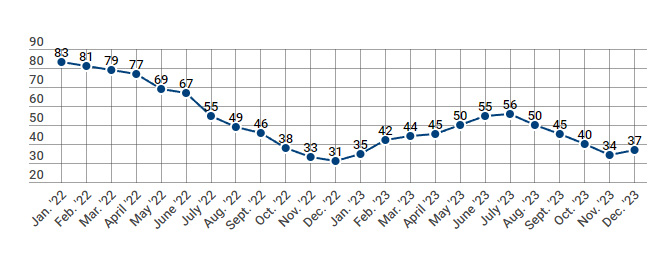

Builder Sentiment has First Positive Increase in Months

The NAHB’s Chief Economist Robert Dietz said that in November – and after declining for a few months – builder sentiment reversed course and started heading in a more positive direction by increasing three full percentage points in the month. While the overall reading is still low, it is clear that builder sentiment is improving as a result of this new more positive environment for housing.

On a regional basis, single-family starts increased in all regions but the West, where at 243K units it was off -0.8% compared to starts of 245K units in the month a year ago. In all other regions, single-family starts were up substantially – Northeast single-family starts were 83K vs. 58K for a 43.1% increase; Midwest starts were 174K vs. 116K for a 50% increase; and South starts came in at 643K vs. 550K for a 16.9% increase.

Mixed Results with Building Permits

Interestingly, when it comes to building permits being issued, a leading indicator of future construction activity, there was a split result in November. Overall building permits this November came in at 1.460 million, which is 2.5% below the revised rate in October of 1.498 million permits issued. However, this rate is 4.1% above the rate of 1.402 million permits issued in November 2022.

Single-family authorizations in November were at a rate of 976K, which is 0.7% above the revised October rate of 969K permits. This rate is 22.8% above the authorizations of 795K in the same month last year.

A Positive Economic Signal as Mortgage Rates Decline

What most analysts make clear about this development in housing construction is a linkage to mortgage rates. In late October, the rate for the popular 30-year mortgage was 7.79%…a 23-year high. Then, in November, the mortgage rate began to decline…and decline in a meaningful way. By last week, the rate for the same mortgage had dropped to 6.95%, a significant decline.

In the most recent decision from the Fed, which was a non-decision (leaving rates where they were), Jerome Powell announced that there may be as many as three interest rate declines in 2024. Since Powell made that announcement, the stock market has been flying, as investors are convinced that a looser monetary policy is at hand.

Leave a Reply