Is this the beginning of a new trend? After a notable jump in September, which some suggested may have been a bit of a fluke, residential construction – known as housing starts – actually surprised some industry analysts by jumping again in October. And while the amount of increase was more modest, that there was another month of increase may indicate the beginning of a new trend. Yet other data calls into question just where residential construction is heading. Read on to see that data…

See more on housing starts in October & declining homebuilder confidence

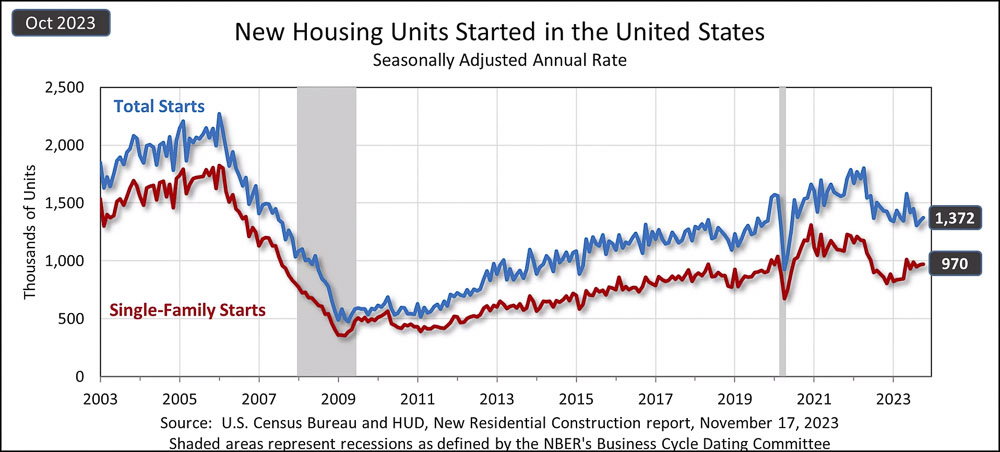

The U.S. Census Bureau and the U.S. Department of Housing and Urban Development announced this week that overall housing starts in October came in at 1.372 million units on a seasonally adjusted annual rate, an increase of 1.9% over the revised September rate of 1.346 million units. However, this reading was still 4.2% below the rate of 1.432 million units in October 2022.

Regarding that 1.372 million rate for overall starts – economists polled by Reuters had predicted that starts would have started slipping to a rate of 1.350 million units. So the actual result exceeded economists’ expectations by growing 1.9% instead of declining.

A More Reliable Indicator – Single-Family Starts

Single-family housing starts – a metric more meaningful for the custom integration market – also increased, coming in at 970,000 units or 0.2% above the revised September rate of 968,000 units. This month’s rate is also 13% higher than the rate of 858,000 units started in the same month last year.

Housing has been bobbing around like a corked bottle caught in the swirling currents at the junction of two fast-moving rivers – sometimes UP and other times DOWN. Hurting housing construction are historically high home prices which are artificially inflated due to a lack of available inventory and sky-high mortgage rates due to the Fed raising interest rates to try and slow inflation. This double-headed monster serves to make new homes less affordable for a large swatch of shoppers.

Survey of Homebuilder Confidence Drops

These factors may help explain why a recent survey of homebuilders found that homebuilder confidence slipped to its lowest level in almost a year (11 months). That survey by the National Association of Home Builders called the Housing Market Index (HMI) noted that “builders anticipated lower sales over the next six months,” according to the Reuters News Agency. The reason for that low confidence appears to be that mortgage rates seem stuck above 7%, a historically high level they hit in August.

But, at the same time, that lack of available inventory helps fuel higher demand for more home construction. It’s a perplexing mix that leaves that corked bottle bobbing along.

Regional Residential Construction Starts Mixed

Overall housing starts are mixed regionally with the Northeast down 14.5%…the Midwest up 28.4%…the South down 6.8%…and the West up 12.5%. Compare these numbers with the regional numbers for single-family starts with the Northeast up 12.0%…the Midwest down 0.9%…the South down 4.9%…and the West up 12.3%.

Interestingly, although the NAHB’s HMI survey said builders were projecting poor sales over the next six months, in fact building permits issued – a leading indicator of near-future construction activity – actually increased both overall and for single-family home construction. Overall permits issued in October were at 1.487 million units which is a 1.1% increase over the 1.471 million permits issued in September.

Increased Permits Issued Bodes Well for Future Construction

Single-family permits issued registered a seasonally adjusted annual rate of 968,000 units, a 0.5% increase over the rate of 963,000 units in September. The number of permits issued suggests that even though builders expect soft sales on finished homes, the need to build inventory continues.

Homebuilders have an opportunity to capitalize on the low supply of homes on the market. If mortgage rates move lower in the latter half of next year, we could see some improved demand for residential real estate.

Jeffrey Roach, Chief Economist at LPL Financial in Charlotte, NC

Some real estate market analysts suggest that there is growing pressure on the market due to the inventory shortage. These analysts say that if mortgage rates begin to decline even a little, demand could explode for new homes. Now that recent data suggests inflation is moderating and that the Fed may be done lifting interest rates – that market condition is brewing.

Existing Home Inventory is Low Driving Demand to New Homes

Another factor increasing demand for new homes is that the high mortgage rates are preventing current homeowners from listing their existing homes for sale. The thinking is that many of them have low- to very low-rate mortgages, and they don’t want to exchange that for a more expensive mortgage as they seek to upgrade to a more expensive home. So existing homeowners are staying on the sidelines until mortgage rates decline more substantially.

This drives those searching for a home now into builders’ showrooms on new homes.

Our view that the supply of second-hand homes on the market will remain limited over the next two years means demand will continue to be diverted to new builds.

Thomas Ryan, Property Economists at Capital Economics

The most “reliable indicator” of the housing market is jobs. We’re starting to see a consistent month-over-month growth in the unemployment numbers. If interest rates stay high, we can probably expect unemployment to worsen thru 2024. Of course, this is the Fed’s objective in raising rates – kill growth, stabilize inflation. Moreover, RE market dynamics are highly local. In the 2006-12 crash, some areas lost >50% home value, while some lost 5-10%. The same outcome is probably true today.

The number of moving parts in the housing equation is breathtaking. Pandemic, Qualitative Easing, 3% home loan rates (now 7.5%!), housing starts, rent appreciation (and depreciation!), record high number of homes owned by non-occupant investors, record low unemployment (but now rising), rapid changes in social norms (far higher acceptable mortgage ratios), record high personal and govt debt levels (and worsening), increasing debt default rates, bank loan tightening, China housing crisis (and its direct impact on the West), commercial real estate free-fall (and its impact on single-family homes), unsustainable rental rates nationwide …….. and that’s just the tip of the iceberg :-)

But the bottom line is jobs. Jobs down, home demand / prices down.