Melrose Industries plc, the British turnaround specialist who acquires underperforming companies to improve their operations and management for resale, is now actively considering selling off the bulk of Nortek in a deal that could be worth $3 billion, according to reports from Bloomberg News and the Financial Times. If they actually execute this sale, it will be a relatively early exit from their ownership of Nortek which they purchased in 2016 for $2.8 billion.

See why Melrose is ready to exit Nortek…

As Strata-gee reported a little over a year ago in late 2018, executives with Melrose were floating the idea to the media of a potential exit from Nortek, the U.S. mini-conglomerate they had purchased only about 24 months earlier. This caught the attention of many, as it would have been an unusually early turnaround and exit for them.

Melrose is a global turnaround expert whose motto is “Buy…Improve…Sell.” They purchased Nortek in 2016 for a total of about $2.8 billion…including the assumption of Nortek’s debt. Melrose largely invests in major industrial companies and the attraction of Nortek was their residential and commercial air handling and HVAC businesses…not their technology holdings.

Fastest Turnaround Ever?

At that time, Melrose’s executives suggested the turnaround at Nortek was one of the fastest they had ever seen in a portfolio company…and insinuated that this was why they could even consider such an early exit. In fact, this may have been a bit of a trial balloon, as a fairly dramatic sequence of events would emerge after that time – that may offer a better explanation as to why this sale was being considered.

Specifically, in 2018 Melrose made one of their most significant acquisitions ever when they purchased one of the U.K.’s largest aerospace and automotive businesses – GKN – for £8 billion. This was a big, surprising deal. In fact, in the U.K. it wouldn’t be a stretch to call it shocking, for – in a significant departure for the company – this was a hostile takeover…and a nasty one at that.

This was One Nasty, ‘Acrimonious Takeover’ Battle

Normally, Melrose engages in friendly negotiations with target companies. But of the GKN acquisition, the Financial Times said: “The GKN deal was one of London’s most acrimonious takeover battles in a decade.”

So perhaps there was a little more to these public musings at the end of 2018. Perhaps the company was already considering gathering their resources by selling off some of their holdings, such that they could go fishing for bigger prey…such as GKN. However, the previous speculation of a Nortek sale by Melrose executives never came to pass – at least not at that time.

Talking Not to the Media, But to Financial Advisers

In any event, back then the discussion by Melrose executives was little more than media musings. Some of it was decidedly self-congratulatory public relations. This time, however, the company is not talking to the media – but rather to some heavy weight financial advisers, such as Citi and Baird, about strategies for selling off Nortek.

Tellingly, Melrose is considering selling off Nortek’s Global HVAC, and Air Quality & Home Solutions segments. It is thought that they could bring the company as much as $3 billion. Not being considered as part of this package is Nortek’s poorly performing Security & Smart Technology business segment.

A Problem Child: Nortek Security & Smart Technology

The fact is, as recently as late last year Melrose was crowing about how they had improved Nortek’s profitability by 40%. But in fact, Melrose had already clearly identified the fact that the S&ST segment was struggling, due in no small part to global trade and tariff issues.

One only has to look back to the financial expectations of those Melrose executives back in 2018. Back then, they suggested to the media that by selling off Nortek, as well as some other selected holdings, they could raise as much as $7.8 billion, as Strata-gee revealed in its previous reporting.

“Now Melrose executives are openly discussing the possibility of a sale of some or all of Nortek soon – perhaps as soon as early next year, only a few months from now. This discussion is part of an overall strategy at Melrose to sell multiple companies from their portfolio to generate as much as £6 billion ($7.8 billion). Melrose paid $2.8 billion for Nortek two years ago.

Strata-gee, October 5, 2018, ‘Melrose Talks of Disposing of Nortek’

Looking at Nearly $1 Billion Less of a Return

These executives speculated that by selling off Nortek, they could raise as much as $3.9 billion, or 50% of the total amount they wanted to raise. And that was selling off ALL of Nortek. Now, the company says it could raise about $3 billion – almost $1 billion less. And that’s with only selling off the cherry part of the company (air handling divisions) and holding on to the less attractive S&ST.

That’s quite a difference in the intervening months. But why?

Turning to Melrose’s Financial Disclosures to Understand What is Going on at Nortek

One clue as to why Nortek is less valuable now may lie in a recent report of their first-half results for 2019. We learn some very interesting things not only about Nortek’s results overall…but with the Security & Smart Technology division specifically.

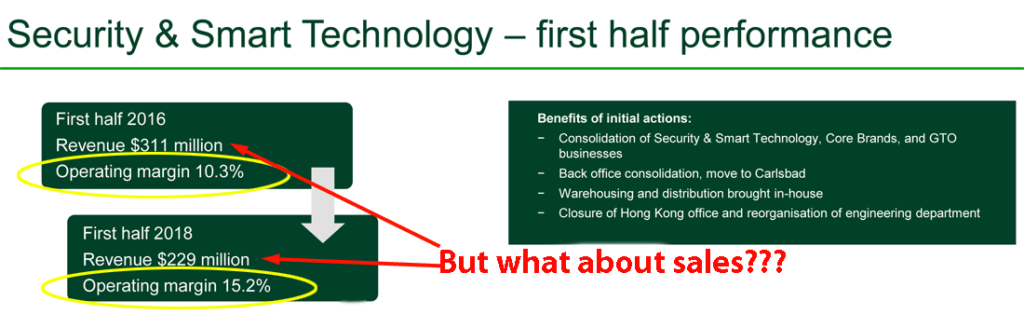

Early on, the improvement in profitability in the S&ST division was impressive. In an analysis for investors, the company said that operating margins improved an astonishing 4.9% from 2016 to 2018. That is, my friends, HUGE and something for Melrose to be justifiably proud of.

How Melrose Improved Nortek’s Profitability

How did they accomplish this feat? Melrose called out four tactics they employed to make this massive improvement in operating margin.

- Consolidated the previously separate divisions of Security & Smart Technology, Core Brands, and GTO

- Back office consolidation, move to Carlsbad (facility consolidation)

- Warehousing & distribution brought in-house (a dramatic repudiation of previous management’s plans of outsourcing these functions)

- Closure of Hong Kong office and reorganization of engineering department

But What About Sales? THIS Should Have Been a Big Warning Sign for Melrose

Notice something about these moves? Yep…they are all cost-side adjustments. No sales-side initiatives to drive greater market share, driving sales, and improving leverage of existing operations. They improved operating margins by only cutting costs. This is fine, if sales are growing…or at least stable. However, it was not a great surprise when I discovered that sales actually declined between 2016 and 2018.

The S&ST division saw first-half sales drop from $311 million to $229 million over that two-year period. This $82 million (-26%) drop in sales should have been a warning sign to Melrose.

Let’s move forward in our analysis. We saw the dramatic improvement in first-half operating margins during the two-year period from 2016-2018; so what happened the next year moving into 2019?

Nortek S&ST Results Continue to Decline in 2019

Well, simply put, sales continued to decline another $29 million (down another -13%). I guess some financial types might look at that as an acceptable trade off, as long as operating margins continued to improve. But that didn’t happen. Operating margin in the first half of 2019 dropped from a rate of 15.2% to 8.8%. Not only is that a huge 42% drop in margin rate…it is lower than the operating margin they inherited when they acquired the company in 2016 from the previous management.

We also learn from this chart that the company has taken an impairment charge of $220 million, writing down the value of the S&ST division from $720 million to $500 million.

Things seem to be going backward in Nortek’s Security & Smart Technology division. Keep in mind, this is happening during Melrose’s watch.

List of Excuses: ‘A Perfect Storm’ Melrose Says

Melrose offered a list of excuses for the less-than-stellar performance. They call this list the “perfect storm” that has “eroded benefits.” These include the impact of tariffs, the weight of an increased business with a low-margin customer, the negative impact of moving production away from China (with a promise of ‘long-term benefits’), product launch delays, and more. You can see the entire list in the graphic above.

Given this glimpse of shocking results, it seems likely that the reason that Melrose chose not to include Nortek’s S&ST business into this divestiture is because it would dilute the value of the deal. And it would seem that Melrose is looking to maximize the benefit of this sale.

‘A Significant Positive’ – Freeing Up Melrose Managers

The main benefit to Melrose of a divestiture of Nortek is that it would free up their managers to focus their attention on the GKN turnaround, the bigger deal. In discussing the possibility of a Nortek divestiture with investors, an analyst at Citigroup, Inc. said in a research note that divesting Nortek would be a “significant positive” for Melrose for just this reason.

According to the Financial Times, “chunky corporate buyers” like United Technologies and Johnson Controls have expressed some interest in Nortek.

Since Acquiring GKN, Melrose has been Losing Money

Since acquiring GKN, Melrose’s corporate results have been in the red. Bloomberg News reached out to a Melrose spokesperson who declined to comment on the story. Melrose also declined to speak with the Financial Times.

Rumor of the deal drove the value of Melrose’s stock up 1.6%. Learn more about Melrose at: www.melroseplc.net.

Leave a Reply