On Wednesday, at a specially convened meeting of the Board of Directors for Onkyo Home Entertainment Co. Ltd. (Onkyo), company directors formally voted to authorize the transfer of Onkyo’s home AV division to the partnership of VOXX, Intl. and Sharp Corporation, in a deal valued at $30.3 million. The transaction is pending shareholder approval. This development represents real progress on a deal that had appeared to be bogged down recently.

See more on this deal as it gets back on track

In documents filed with the financial authorities in Japan, Onkyo revealed that on May 26, 2021 company directors had approved the transfer or sale of Onkyo’s home AV division to VOXX and Sharp. This approval is contingent on the deal being ratified by shareholders in a general meeting that has been scheduled for June 25, 2021. This is the closest that Onkyo has come to actually close on a deal to sell off the division. As I disclosed in a previous post, three previous attempts to sell the company fell through in the later stages after preliminary agreements were reached.

For the purposes of their official filings, Onkyo refers to the matter as a “business transfer” and their agreement with the VOXX & Sharp partners as a “Business Transfer Agreement.” If Onkyo shareholders vote to approve this transfer, then on that June 25th day, the company will become “VOXX International Corporation.”

Background Recital Recounts Years of Difficulties at the Company

NOTE: This post is based on materials out of Japan that have been subject to a machine translation from the original Japanese to English. Keep in mind, machine translation can be a bit imprecise – so some wording may not be exactly correct to the original document. However, it is usually fairly close and over the course of longer documents, you can usually extract a fairly close reading of actions and meanings.

From this document’s recital of the history or background to this deal, we learn some interesting facts.

- The company has been generating “ordinary losses” every year since 2013

- These ordinary losses have disrupted its business by causing “delays in payment of operating debt to business partners.”

- To address this situation, Onkyo “concluded a transfer agreement” with Sound United

- The Sound United deal would have served to “improve financial condition by eliminating payment delays and promptly repay existing loans”

- However, to conclude a definitive agreement with Sound United required the achievement of certain milestones, such as “concluding contracts” and “securing financing.”

- It was, the document revealed, “difficult for both parties to do so” and the “business transfer was canceled”

- Then the company planned to improve its situation by “raising funds through large-scale equity financing”

- But, “due to the slump in stock prices, the amount raised was far below the plan”

- The company also saw results decline “due to the effects of the new coronavirus infection”

- Other factors adding to their woes included “limited production and sales activities” that made it “unable to earn originally planned recurring income”

- Onkyo also experienced “difficulty in collecting debts due to the deterioration of store performance”

- The company “continued to carry out equity financing in the fiscal year ending March 2021.”

- But Onkyo was unable to complete the equity-financing plan because of declining sales from “delays in resolving delays in payment of operating debt and tight supply of parts”

- Further adding to woes was a “decrease in profits” and “the performance was reduced due to the recording of allowance for doubtful accounts due to the deterioration of the business condition of the former US distributor

- With all of this, the company reported its insolvency for both the 2020 and projected 2021 fiscal years

- This insolvency triggered the delisting process from the Tokyo Stock Exchange

The Time Had Come ‘to Consider All Options’

That’s quite a tale of trouble and woe in the path to a deal with VOXX & Sharp. When the equity financing deal fell through, the company realized that they needed “to consider all options for business continuity.” In other words, desperation was setting in and it was time to talk to all comers.

According to this filing, the company approached both VOXX – their then-new U.S. distributor – and Sharp. Sharp makes a lot of sense as the two companies were already connected through their S & O Electronics Sdn. Bhd partnership, in which the two companies jointly own the Onkyo-built factory in Malaysia.

However, on the other hand, it is no longer possible for us to continue our business operations on our own.”

Had the Stars in Heaven Finally Aligned?

Suddenly…it seemed to Onkyo management as if the stars had finally aligned. They had existing business relationships with both parties, although the VOXX relationship was still very, very new – measured in months, not years. Most notably, they believed that the new partners (VOXX & Sharp) will continue “the future development of the home AV business.” So they believe this deal means that the Onkyo, Integra, Pioneer, and Pioneer Elite brands will continue to live on with the new owners’ financial backing.

Onkyo Admits a Hard Reality That ‘…It is No Longer Possible for Us to Continue on Our Own’

The filing notes that the Onkyo board believes that “the consideration is fair.” The “consideration” means the amount that VOXX/Sharp is paying (more on this below) to acquire the home AV business segment. This amount, Onkyo says in the filing, will be used for “repayment of creditors related to the home AV business.” And while that phrase may be music to the creditors’ ears, the company admits that “All of the company’s difficult business conditions, cash flow, and current operating debt payment delays…Is not resolved.”

In other words, this deal will not sweep all their troubles away. It sounds as if the VOXX/Sharp partnership is only acquiring the assets of Onkyo’s home AV business, not the liabilities. Some might come to the conclusion that with this being the case, this deal might not be good enough. But, consider this…

“However, on the other hand, it is no longer possible for us to continue our business operations on our own.”

So this deal will not pay off all of Onkyo’s debts, and that will remain a continuing challenge for them. However, the company promises to continue to make payments, saying: “We will continue to make repayments, and make every effort to pay off debts as soon as possible and to operate our business normally as a company.”

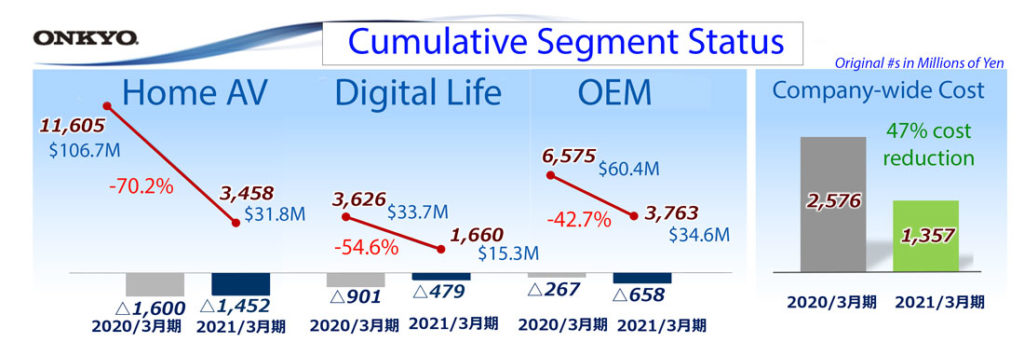

Was the ‘Consideration’ Paid for the Onkyo Home AV Business…Considerate?

In this filing, Onkyo reveals that the consideration being paid by VOXX/Sharp is about ¥3.3 billion or about $30.3 million. That works out to a little less than 1 times sales, as I showed in a previous post that fiscal 2021 global sales for Onkyo’s home AV division came in at $31.8 million. Whether this is generous or stingy almost doesn’t matter at this point for the company, it was most likely the best deal they could get.

Also keep in mind that while VOXX/Sharp has won the worldwide rights to design, manufacture, and sell once great brands like Onkyo, Integra, Pioneer, and Pioneer Elite, it won’t be a cakewalk. There is a lot to be done to revitalize these brands, such as solving their many short- and long-term problems, rebuilding their deeply bruised brand reputations with the market and dealers, and heavy marketing investment to reinstill confidence in their future.

Does VOXX Have What It Takes?

It may take more than VOXX/Sharp realizes to reanimate the once loyal and supportive Onkyo dealer network. It has been a tough few years for Onkyo dealers, many of whom came to believe the brands had become unreliable and stopped spec-ing them into installations. With a promised inventory that showed up months later than initially promised – or not at all – and defective units that couldn’t be repaired as there were no parts available…many dealers felt forced to switch to other brands, including Sound United brands, to fill their market needs. These dealers may not be so quick to come running back, just because the Onkyo brands have a new owner.

On the other hand, I’m convinced that this deal represents the best possible opportunity for Onkyo to get back into action. It just remains to be seen whether VOXX has what it takes to return these brands to their former glory.

Learn more about VOXX International by visiting: voxintl.com.

See the latest on Onkyo products at: onkyousa.com.

Ted, your final question is the key. Will anyone care about these tarnished brands a year orm more from now?

Franklin,

There’s a saying among manufacturers that “Good brands are hard to kill.” While I think that remains true, they are certainly not impossible to kill.

VOXX needs a strong branding strategy to reanimate these once-great nameplates, and so far no one from that camp has articulated a compelling merchandising plan to my knowledge. In fact, I have some unconfirmed reporting that gives me great concern about their posture.

I certainly hope that they realize it is not just simply a matter of providing a firmer financial footing. They need a smarter strategy than that.

My father once told me that when someone offers you something at “fire sale” prices, it means that any remaining value has already gone up in flames. You will be left with nothing but the burned out shell…

Thanks for your thoughts!

Ted

I strongly feel that the old way of doing business has got to change in order for well established brands like Onkyo and Pioneer to become profitable and grow. This company is in need of an “undercover boss” episode to find out what internal bottle necks exist and improve them. You will be surprised as to what you can find out.

From a dealer’s perspective, one major business gap is supporting the dealer network with standardized product content data that dealers can use to publish on their own websites. This information should be provided in a csv file or MS Excel Spreadsheet. Dealers should not have to spend time or pay someone to find and then copy and paste this information to their websites. If this data content is provided, the dealer network can have the products uploaded and quickly listed onto their websites and therefore concentrate on selling and buying more product.

I’ve been saying this for years yet all of the old school brands choose to ignore this dealer request. If I had this information as a dealer, my sales would be up over 200%.

B2B: I recommend Onkyo to have a B2B website where dealers can places their orders. It would be great if the B2B would display inventory and eta for back orders.

It’s time to change the way the industry supports their dealer network.

1. Dealer Network Support = Higher Sales

2. Remove bottlenecks = Reduce Costs

My background with 20+ years as a Sr. Business Systems Analyst and IT Specialist, I have more business area improvement ideas, and identified some risks and how to mitigate them.

Hopefully VOXX will improve and grow Onkyo and Pioneer.

Seen the latest from Voxx today?

I did… The only surprise there is the news that Pioneer & Pioneer Elite are not part of the APA (asset purchase agreement.) No doubt, the new negotiations are to get the license reassigned to VOXX.

Ted

Not really a surprise, as Onkyo Pioneer Corp is a licensee of the Pioneer and Elite brand names from Pioneer Corp., so it would stand to reason that Voxx/Sharp would have to enter into separate negotiations with Pioneer to continue designing and manufacturing those brands under OHEC. It’s not like Pioneer would say no: much like Onkyo, what options do they have? None and less. What I’m curious about is whether or not Sharp is still a shareholder of Pioneer…

Hi MrSatyre,

I would say the surprise is not so much that Onkyo was a Pioneer licensee. Rather, I think the surprise is that Pioneer and Pioneer Elite were not included as part of the original deal. This is something that Onkyo and VOXX – both public companies that are supposed to disclose anything that could have a financial impact – have not previously revealed until this late date. Not only that, but some dealers have told me that they were led to believe that those brands were in fact included in this deal. (Some even said they were “promised” this.)

As far as Pioneer’s options, if it is Pioneer’s option (Onkyo could have right-of-assignment), all I can say is this – despite the logic of your comment, nothing’s a done deal…until the deal is done.

While you may be right that this is a likely outcome, it is not guaranteed.

THANKS for sharing your thoughts!

Ted

As one would expect from me, I look at a different slice of this pie: the product development and technology side of things. As others more into that side of the business have noted above, it is about branding, dealer confidence, and as my father used to say “Closing the sale” to both dealers and consumers.

However, in today’s complex market, market, product and technology are critical. My recollection of the part that S&O played was transferring the designs from “Headquarters” into products and building them. How much of the engineering and design teams in Japan are left? Even then, with slimmer orders in recent years, where does Onkyo and S&O stand in the supply chain queue? Can they get the key parts that everyone has trouble getting? Do they have the staff to design around issues caused by the AKM fire? Do they have ready to roll products for season with the latest HDMI, HDCP, gaming (e.g. VRR), HDR and other the other features needed in a “check box”-centric buyer’s world?

Just as we need two political parties, we need more than a few brands for core and specialist A/V brands. However, I am concerned that this all is evidence of underlying problems in the business as a whole. I hope not.

There is other thing my father would always ask me: “Did you make your numbers?” Can they? Will they? for the sake of the industry I hope so.

Mike,

You raise a good point about engineering resources. After years of business decline, they are likely – to some extent – in some state of depletion.

With Onkyo selling off the Home Electronics division, certainly certain dedicated engineers go to VOXX/Sharp as part of that deal. However, I can tell you historically that many of those same engineers worked in the OEM division as well. Onkyo is retaining that division. So how do they split up that pie?

As far as supply chain issues, of course Onkyo remains impacted by that…as does everyone else. Perhaps it will get slightly better under a VOXX, but that by itself does not manufacture more chips.

Thanks for your thoughts!

Ted