Claims Company is Violating Its Own Bylaws & Delaware Law

On Tuesday, I told you that Joe Kiani and Masimo Directors filed a lawsuit against Politan Capital Management and Quentin Koffey, asking the courts to force Poltian to correct what it claims are material misrepresentations in Politan’s proxy materials provided to Masimo stockholders. Late Wednesday, Politan returned fire, filing its own countersuit – but in a much more strategic way…

See more on Politan countersuing Masimo

I thought I was done on the Masimo beat this week, and then last evening a new filing appeared as each side engages in fast-response-tactics in their total war proxy battle over two open seats on the Masimo Board of Directors. On Tuesday, Masimo sued Politan in a confusing action claiming they needed a judge to order Politan to stop making misstatements. The company also postponed its 2024 Annual Meeting of Stockholders to September, originally scheduled to take place in just days, on August 25.

Why was I confused about the Masimo suit? Because as I’ve watched both sides make their case, each has been careful to select the actual data that best supports its case. I have not seen any “made up” or otherwise falsified data promoted. Politan has definitely published some inconvenient truths about Masimo’s and Sound United’s performance, but it was all based on actual data. So how could Masimo go to court and ask a judge to force Politan to stop the misstatements?

Koffey: This Matter Has Nothing to Do with ‘Misstatements’

The answer seems to have been supplied by Politan who noted this litigation had nothing to do with “misstatements” – it was all a red herring attempt to disrupt a shareholders’ vote that was already in progress. Masimo, in effect, made up the misstatement charge to try and justify a two-month delay.

So now it’s Politan’s turn, and it looks like a typically savvy strategic move by the activist investment group. There are two reasons why Politan’s response is savvy. First, Masimo filed its action against Politan in Federal Court in California. But Politan filed its countersuit – against Masimo and three of its directors – in the Delaware Court of Chancery where it has already won a judgment against Masimo management, and where a Chancery judge was literally shocked over certain terms of an overly generous employment agreement between the company and Joe Kiani.

Politan Forced into Taking Legal Action to Protect Shareholders’ Voting Rights

Second, according to Politan, Masimo is suing for the sole purpose of slowing down the voting process and buying itself more time. But Politan’s suit – as you might imagine – is on behalf of shareholders and attempts to maintain or speed up the process of completing the proxy vote. Politan is asking the Chancery Court for:

- 1) “a determination that the director Defendants breached their fiduciary duties by postponing the 2024 Annual Meeting”

- 2) “an order that the Issuer [Masimo] must hold the 2024 Annual Meeting as soon as possible”

- 3) “an order that as a matter of Delaware law the Issuer must hold the 2024 Annual Meeting as soon as possible”

- 4) “a declaration that the Defendants are estopped from rejecting the nominations of Politan’s nominees to the 2024 Annual Meeting”

- 5) “an appropriate status quo order to prevent the Defendants from taking any material action with respect to the business of the Issuer before the 2024 Annual Meeting”

A Delaware Court is Likely to Uphold Delaware Law

Politan says that Masimo has violated its own Bylaws by postponing the Annual Meeting. Perhaps more importantly, Politan also says that Masimo has violated Delaware law (Masimo is a Delaware Corporation) as well, which they say requires an annual meeting at no more than 13 months later than the previous annual meeting. The July 25th date was 13 months after the last annual meeting, Politan says.

I’m not an expert in Delaware corporate law, but I believe that Politan has done its homework and this fact dramatically increases its odds of success with the countersuit

Politan says this about its countersuit…

The Complaint seeks to protect the stockholders franchise and prevent the manipulation of the corporate machinery to unnecessarily delay the 2024 Annual Meeting and entrench the incumbent directors in office.

Politan Amendment No. 13 to Schedule 13D, filed August 17, 2024

The countersuit also informs the court that Masimo directors decided to postpone Masimo’s annual meeting just as the news emerged that two leading investor advisory companies were recommending investors vote for Politan’s candidates for director – clearly inferring that Masimo felt the need to slow the momentum down…but in so doing ended up acting against its Bylaws, Delaware law, and investors’ best interests…

One Last Important Point

Oh…and one last thing. Take another look at that five-item list of “asks” by Politan of the Delaware Chancery Court and pay particular attention to item number 5 – requesting a “status quo” order from the courts. While it doesn’t say this explicitly, I think Quentin Koffey is asking the courts for a status quo order to block Masimo from cutting a deal before the annual meeting (and Board vote) to sell Sound United to the unnamed third party supposedly interested in acquiring a majority stake in the audio division – especially a deal that would likely include terms overly favorable to Joe Kiani.

Perhaps Koffey has information that this was the real reason for Masimo’s legacy (Kiani-allied) directors to add two months of delay prior to the annual meeting. Or perhaps he just suspects it could be so. In any event, a status quo order from the court would prevent just such a transaction from taking place.

See more on Politan Capital Management by visiting politanmgmnt.com.

Learn more about Masimo at masimo.com.

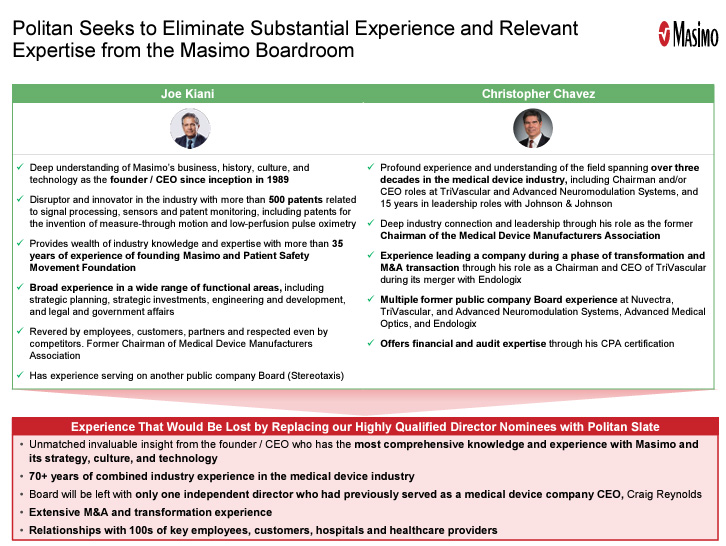

Ted, what does Christopher Chavez’s CPA certification mean? His current status with the Texas Board of Accountancy is Issued non practice, retired.

Hi Steve,

I don’t really know much beyond what Masimo has released about Mr. Chavez’s experience. Mainly, Joe Kiani refers to Chavez’s CEO experience as his main qualification. While Politan looks for subject matter expertise (such as technical expertise, or substantial acquisition experience) while Kiani prefers to recruit CEOs as directors.

Ted