Five Steps to Take Now to Protect Your Business

Five Steps to Take Now to Protect Your Business

Occasionally, I’ll chat with an integrator or other industry colleague about that ugly shared nightmare experience, otherwise known as the recession of 2007-2009. This recession, unlike others in the past, zeroed in like a torpedo on the residential construction market and dramatically reshaped the custom integration industry. For those of you joining the industry since that time, you dodged the bullet…but you also missed the lessons that survivors were forced to learn in order to keep afloat.

Why you need to prepare now for the next recession…

Business experts will tell you that there are only three stages on the business cycle – boom…bubble…bust. After the bust…rinse and repeat. Most people appreciate the first stage…the boom cycle…where business just grows and grows and grows. Our industry certainly did experience a huge boom cycle during an amazing run from 2000-2005, when unreasonably easy credit and a housing industry ready to do anything to get you into a home combined to drive residential construction to never-before-seen levels. For those of us living through that…it was a five-to-six year long party. Integrators struggled to keep up with their ever-growing pipeline of projects. Dealers were hiring just about anyone who walked through their door and buying products in bulk for their many upcoming projects. It was truly boom times in custom integration.

Then…What Almost Everyone Misses, The Puff of Smoke from the Volcano

But most people miss is what comes next – the bubble cycle. And that is too bad – because that lack of awareness positions us to take a fall…and a hard fall at that. During a bubble cycle, business continues to grow, but soften. However, if you look closely…very closely…you can see that certain fundamentals that underpin the pace of growth are beginning to erode. In effect, you’re holding an outdoor barbecue and having so much fun that you don’t notice that puff of smoke starting to rise out of the volcano you live next to.

Then, in 2006, it all came to an abrupt halt. Because of the nature of our industry, we actually had a bit of a delayed reaction. Most integrators work on future projects that are months or even years out, and for this reason, many did not feel the full impact of the collapse of housing construction until 2009. How bad was it? CEPro reported that integrators’ median revenues dropped 51% in 2009. In fact, many integrators and manufacturers went out of business during this time. The housing market had collapsed, and household formation was almost non-existent. Back then, most integrators were doing nearly 100% of their projects in new construction…and that new construction had basically stopped.

If Only We Had Seen the Signs of What Was Coming

If only integrators had seen the warning signs that they were in a bubble. They could have taken steps to better prepare for the inevitable burst of the bubble – making it a little easier to ride out the storm. Maybe some of those caught off-guard, with a little advanced warning, could have responded quicker in order to survive.

But why am I telling you all of this? Business is strong now and the economy is good. Why should you care about what happened more than ten years ago? Because…once again, as it did toward the end of 2005, certain economic and business fundamentals are turning negative. This is your “Heads Up” moment. The time to begin preparations for the next downturn has come.

So what’s going on? The canary in the coal mine are the many economists who specialize in the consumer market. They are sounding the alarm. REMEMBER, a massive 70% of our entire U.S. economy is based on consumer spending. When consumers get spooked, they stop spending. And when consumers stop spending, the country goes into a recession.

Here’s Your Chance to See The Gathering Storm Ahead

Here are some looming “dark clouds” suggestive of a gathering storm that has economists pointing to an approaching economic slowdown:

- Budget Deficits – A recent report by the non-partisan Congressional Budget Office estimates that during the period of 2018 – to – 2027, the U.S. budget deficit will increase by fully $1.6 trillion to a total of $11.7 trillion budgetary shortfall. This increase is largely due to the recent tax code changes passed by Congress. Economists say, this deficit could become a huge drag on the economy…and it incrementally starts right now.

- Trade Instability – It’s hard to watch any news report nowadays and not hear more reports about tariffs being imposed by either the U.S. administration, or as retaliatory tariffs from China, the EU, and other countries. Just like a tax increase, these have already resulted in significant increases in the price of goods, including consumer goods: “…everything from Cokes to vacuum cleaners,” says a report from the New York Times. Economists are saying this reality could throw cold water on consumer purchasing.

- Interest Rates – The Federal Reserve Board has begun a normalization of interest rates which for years have been held to historic lows to help stimulate the economy. Economists anticipate at least two more interest rate increases this year, and more in the future. This causes credit cards, variable rate mortgages and the like to take a bigger bite out of the consumer’s wallet.

- Inflation – CPI is beginning to creep up, and that’s even before the impact of tariffs are fully realized. This means overall, goods are beginning to cost consumers more.

- Gasoline – So far in 2018, gas prices have risen by 20% at the pump. As a majority of Americans have some level of commute to work, this is a direct hit to their wallet. The longer your commute, the bigger the hit. If your job includes travel like, say, a rep or a distributor, then your company is feeling a heavy hit from increased outlays for gas.

A Double Whammy for Consumers

Many of these items combine to create a double whammy for consumers. For example, a recent government report on growth in workers average hourly earnings noted:

“Over the past 12 months, average hourly earnings have increased by 2.7%. [But] from June 2017 to June 2018, the Consumer Price Index for All Urban Consumers (CPI-U) increased by 2.8% (on a seasonally adjusted basis.)” – Bureau of Labor Statistics

So the good news about consumer earnings increasing 2.7% is wiped out by the news that inflation is up a larger 2.8%, putting the consumer at a net loss in earnings.

Housing Turns Down – Another Torpedo Heading Our Way

But here is what you really need to know. Remember that wonderful housing rebound that we’ve enjoyed in the period after the trough in 2009 until recently? Its beginning to turn down again. Consider the following:

- Residential Housing Starts – In June, single-family housing starts dropped a startling 12.9% [revised down just today. Originally reported as a 9.1% drop] below their rate in May. This is the lowest level of housing construction starts in 7 months.

- New Home Sales – Another troubling sign – sales of new single-family homes also dropped a meaningful 5.3% in June. This is the lowest rate for new home sales since October 2017.

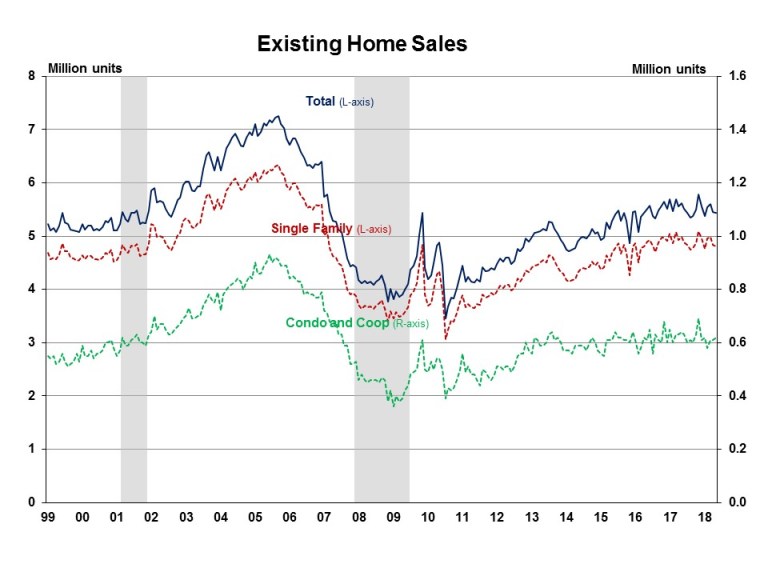

- Existing Home Sales – And sales of existing homes are beginning to drop as well. In June, existing home sales were off .6%. This was the third consecutive month in a row where sales of existing homes dropped. Why? At least in part, this decline is due to lack of inventory.

- Housing Prices – Even as sales dropped, according to the National Association of Realtors the median price of an existing home increased from $243,800 in the first quarter of 2018 to $266,600 in the second quarter. This is a 9.4% increase in the median price of homes in just one quarter…a big move.

Interest rates are increasing, meaning mortgages are getting more expensive. Existing home inventories are decreasing, leading to an increase in median home prices and making homes more expensive. Put these together and you find that housing affordability – a key indicator on the health of the housing market – is declining. In fact, according to the National Association of Home Builders, housing affordability is at a 10-year low.

Put these housing numbers into a tumbler, mix in the economic data – shaken, not stirred – and what do you pour out? Trouble. As that same NYTimes report on the economy put it: “You may recall what happened the last time housing slumped, in 2007.” I do remember.

You know the old saying, “Those who fail to learn the lessons of history are doomed to repeat it.”

Five Steps to Prepare for a Market Downturn

I would argue that now is the time to plan for a downturn. But just what steps should you take to prepare for a possible major economic event?

- Build Cash Reserves – In a down economy, cash is king. So hoard cash by: selling off excess inventory to convert unneeded goods into cold hard cash; hold off on that expansion you’ve been saving for, keep it in cash; delay adding another vehicle, or adding another line…keep your cash close at hand and pad your cash cushion as much as possible.

- Delay Expansion Decisions – Certainly some decisions are time sensitive, but many of our decisions are delayable. Hold off on expanding your facility until clearer signs of further growth signal an economic all-clear. Thinking about expanding your staff? Hold off on that, perhaps add hours to your current team. They’ll make more money and potentially be happier. Yes, you’ll pay a little more, but you’ll pay far less than full salaries and benefits for new people – a win-win for you and your existing staff. Consider offering bonuses for a fully engaged staff to take on more. Again, this will be much less out of pocket than the payroll load of staffing up.

- Work with an Agency to Hire on a Temporary Basis – Want to follow our advice on holding off on hiring, but you’re in a bind on existing or already booked upcoming projects? Consider working with one or more of the industry-centric staffing services that can “rent” you a staff on a temporary or by-the-job basis. You have them when you need them, but when the projects are done, they are gone and off of your books.

- Do a Full Business Review with Your Accountant – Now is a great time to do a full review of your books with your certified public accountant. Accountants are a great resource for ideas on ways to cut some easily overlooked overhead and improve cash flow. You should be doing this on a regular basis with your accountant anyway – but now is a great time for a recheck, challenging her or him to help get your books in order.

- Don’t Panic – Last but not least, don’t panic. The first step in protecting yourself is simply to be aware of the need to do so. You’ll find that as you put your mind to it – perhaps brainstorming with your managers and staff, as well – you’ll be able to come up with a lot of ideas for ways to build cash reserves, tighten your belt and cut overhead, and steel your business for the downturn that is inevitably coming, sooner or later.

There is an old quote from John F. Kennedy that goes something like this: “The time to buy an umbrella…is when the sun is shining.” In this case, I’d say the time to prepare for a downturn…is while business is good.

Do you have more ideas on ways to prepare your business for a downturn? Share them with Strata-gee readers by leaving a comment in the “Comment on This Post” box below this story.

Leave a Reply