Tech Data, one of the largest technology distributors in the U.S. and globally, has been acquired by Apollo Global Management, a private equity powerhouse, in a deal valued at $5.4 billion. The deal announced today, is expected to close by mid-2020.

Read more on this mega-deal with Tech Data

Clearwater, FL-based Tech Data’s outstanding stock will be purchased by an affiliate of funds managed by Apollo Global Management for $130 per share, a 24.5% premium to the 30-day weighted average closing price of their common stock on October 15th. Tech Data is the largest public company headquartered in the Tampa Bay area. Or should I say “was,” as this transaction means that the company will no longer be a public company as this deal takes it private.

It is interesting that the gauge used to value this deal is the closing price of Tech Data’s stock on October 15th. Last month word leaked out that Apollo was considering buying the company, a rumor that officials from both companies refused to comment on. With this announcement, it appears that that rumor had some real teeth and truly was more than just a rumor.

“Over our 45-year history, Tech Data has grown to become one of the largest and most respected technology distributors in the world. This agreement reflects the significant progress we have made in our strategy of delivering higher value and positions us for continued growth and success. This investment by funds managed by one of the world’s leading global alternative investment managers will afford us additional resources to accelerate our ability to bring to market the technology products and solutions the world needs to connect, grow and advance. The transaction will enable us to build on our success, making Tech Data a growth platform and enabling us to further differentiate and expand our end-to-end solutions and provide our channel partners with unparalleled reach, efficiency and expertise.”

Rich Hume, Chief executive officer of Tech Data

Apollo – An ‘Alternative Investment Manager’

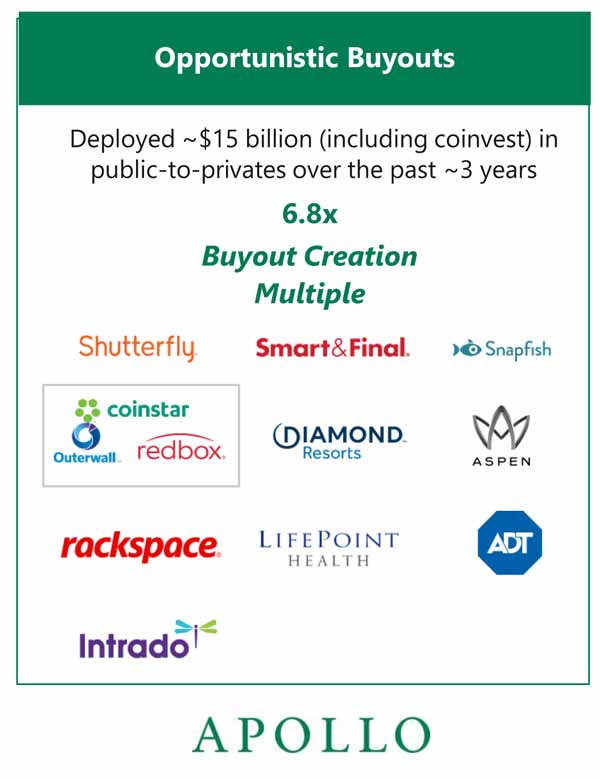

Apollo, which describes itself as a “global alternative investment manager” has wide ranging investments in multiple industries with more than $77 billion in assets under management. Major industries of interest include consumer goods and services, financial services, chemicals. natural resources, consumer and retail, leisure, manufacturing and industrial, media, telecom, and technology.

The company lists several portfolio companies in technology, including Rackspace, Charter Communications, DishTV, Cablecom, Coinstar, Redbox, Hughes Telematics, Intelsat, Shutterfly, and more. But mainly Strata-gee readers will be familiar with security giant ADT, and specialty lighting supplier Lumileds. Apollo lists both ADT and Lumileds as “opportunistic buyouts.”

“Through this investment, we are committed to expanding Tech Data’s position as a trusted partner to the world’s leading technology vendors while providing best-in-class customer service. As a private company with our sponsorship and a strong balance sheet, Tech Data will have significant financial and strategic flexibility to drive growth going forward.”

Matt Nord, Co-lead Partner of Apollo Private Equity

Tech Data Board Unanimously Voted in Favor of the Deal

Tech Data’s Board of Directors has voted unanimously in favor of this transaction. As this deal will ultimately need to be approved by shareholders, the Board is recommending shareholders vote to approve this deal, in part because it represents a significant premium over the value of the shares they hold.

“This agreement follows a process of consideration of Apollo’s proposal by the Board that included review and discussion of strategic alternatives with the Board’s financial and legal advisors. The transaction delivers significant cash value to our shareholders and creates exciting opportunities for our colleagues, channel partners and other key constituents.”

Charles E. (“Eddie”) Adair, Lead independent director of the Tech Data Board of Directors

Deal Includes a ‘Go-Shop’ Provision

This deal includes a “go-shop” provision in which Tech Data is permitted to seek other potential partners with the possibility of a better deal causing this one to be cancelled. The company has until December 9, 2019 to solicit these competing proposals.

Assuming no superior offer emerges, and subject to the typical satisfaction of certain closing conditions, the company plans to hold a special shareholders meeting to vote on this transaction. If a majority of shareholders vote in favor, then upon execution of the purchase of shares, the company will become private.

Tech Data said in a statement that after this transaction closes, Rich Hume will continue on as CEO and the company intends to remain headquartered in Clearwater, FL.

Learn more about Tech Data by visiting: www.techdata.com.

Leave a Reply