The latest data from the U.S. Census Bureau and the U.S. Department of Housing and Urban Development showed that residential construction (housing starts) took off in August with high single-digit overall and even double-digit upside gains in the single-family construction segment. Many industry observers attributed the upturn to now more optimistic builders looking to take advantage of improving housing affordability with mortgage rates declining. Many builders believe this will stimulate a big upturn in sales.

See all the latest residential construction data

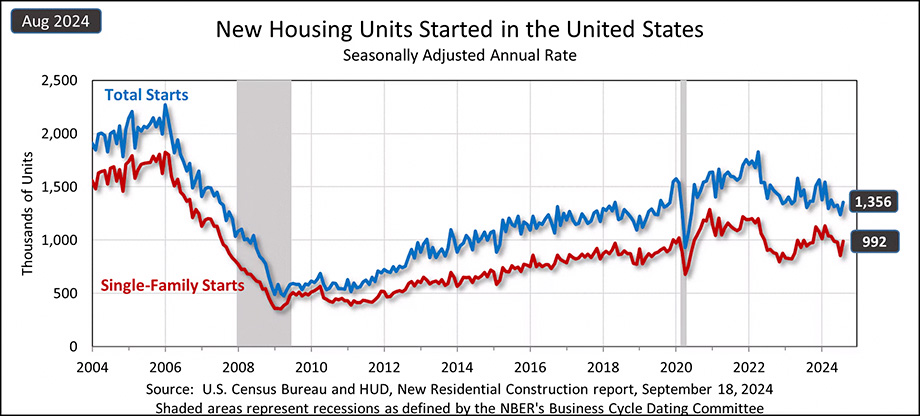

There was a surprising upturn in residential construction, measured as housing starts, in August, with overall starts coming in at 1.356 million units. This rate is 9.6% higher than the revised July figure of 1.237 million units and 3.9% above the 1.305 million units started in August 2023.

Drilling down specifically on single-family starts – a statistic much more meaningful for the custom integration industry – SF starts lept to a rate of 992,000 units. This rate is an impressive 15.8% higher than the revised July SF starts of 857,000 units. The August rate this is year is also 5.2% higher than the rate of 943,000 units in August 2023.

Analysts are Buzzing About the Stronger Than Expected Uptick in Single-Family Starts

There is a lot of discussion surrounding the strong uptick in single-family construction in August. For the previous five months consecutively, the single-family construction starts rate had been continuously declining. According to a report by Reuters, this downward trend came in the wake of a significant uptick in mortgage rates in early Spring that chased buyers away and caused a build-up in housing inventory.

However, this month the Fed cut interest rates – and not by the highly anticipated ¼% rate, but rather by a much more aggressive ½% rate. This caused an almost instantaneous jump in builder optimism that buyers will be returning in droves, and they need to get homes built to take advantage of the changing buying environment.

Some Economists are Nervous Builders are Too Aggressive

However, some economists are nervous that builders may have jumped the gun and were being overly optimistic.

A renewed dip in single-family construction activity is likely over the next few months as homebuilders seem to have responded too aggressively to the slight upturn in new home sales in 2023, and are now left with an excessive level of inventory. Lower mortgage rates will help boost demand for new homes at the margin.

Oliver Allen, Senior U.S. Economist for Pantheon Macroeconomics

Regional Breakdown on Housing Start Activity

Construction starts on a regional basis overall grew in all regions except the Northeast, where a pullback in multi-family starts caused the overall numbers to drop (27.3%). The overall starts in each of the other regions showed growth – Midwest (+29.6%), South (+15.5%), and West (+5.9%).

As far as the tally for single-family starts on a regional basis, all regions showed solid growth led by the Northeast (+47.4%), South (+18.9%), Midwest (+11.6%), and the West (+2.8%).

The Reading on Permits Suggests a Construction Pause May Be Ahead

Overall building permits, a reading that represents a leading indicator for future construction activity, came in at 1.475 million units, 4.9% above the revised rate in July of 1.406 million units. However, this rate is 6.5% lower than the permits issued in August 2023, suggesting a period of digestion over the next month or so.

We see a similar trend in permits issued for single-family construction. In August, this rate came in at 967,000 units, a 2.8% increase over the 941,000 rate of permits issued in July. However, this rate is down 0.5% compared to the 972,000 permits issued for single-family construction in August 2023.

Builders Should Be Careful

In the single-family market, while sales have held up reasonably well, inventories have nonetheless risen substantially. Builders may prefer to keep starts low for a time to work off this inventory. Lower mortgage rates could also help reduce single-family inventories via stronger sales. But sales in the new home market have less room to improve.

Abiel Reinhart, Economist at J.P. Morgan

The National Association of Home Builders is warning builders to consider the possibility of pent-up inventory being suddenly unleashed upon the market. Many owners of existing homes have declined to put their homes up on the market because of a phenomenon known as “rate-lock.”

Rate-Lock Phenomenon is Diminishing, Unleashing Existing Home Inventory

Rate-lock is when a homeowner is carrying a mortgage at a rate lower than they can get on a new home. They feel locked into their current mortgage. So instead of putting their home on the market to sell it so they can upgrade to a newer or larger home, they are waiting for interest rates to come down.

But now rates are coming down to 1½ year lows and so the NAHB believes that this could unleash a potentially huge amount of inventory of existing homes on the market as homeowners no longer feel rate-locked. In a note to its members, the NAHB noted that “…builders will face competition from rising existing home inventory in many markets as the mortgage rate ‘lock-in’ effect softens with lower mortgage rates.”

Leave a Reply