Resideo & Snap One Deal Expected to Close Friday, June 14th

Resideo Technologies, Inc. (NYSE: REZI), a manufacturer and distributor of security and related products for business and home – and soon to be the new owner of Snap One and Control4 – announced its fiscal 2024, first quarter financial results. Considering the looming event that will make Resideo an important partner to many in the custom integration business – the closing of its acquisition of Snap One/Control4 on Friday, June 14, 2024 – I am launching a more detailed coverage of the company.

So…given that Resideo is about to spend $1.4 billion, or 20% of their gross revenues – to acquire Snap One, you’d think that things must be going really, really well for Resideo. But are they???

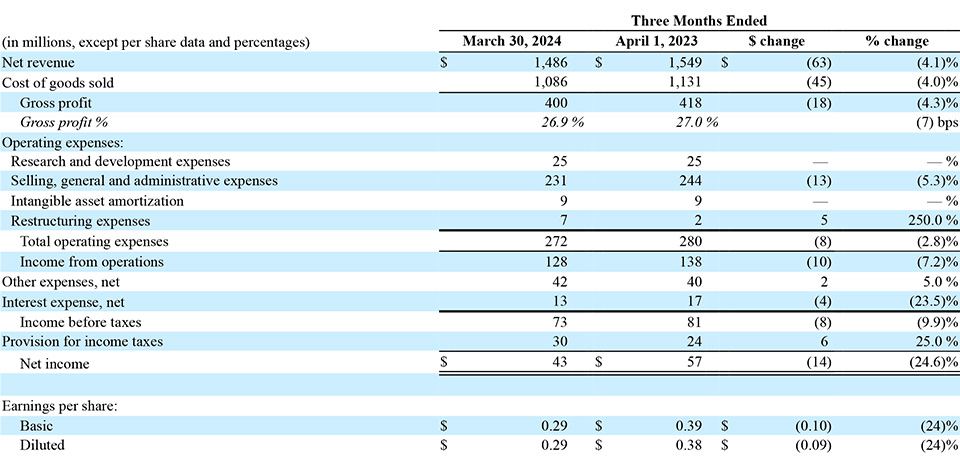

See how Resideo did in its first quarter of fiscal 2024

When Strata-gee first announced the acquisition of Snap One by Resideo Technologies, I asked the question – “Will merging two stagnant companies reignite growth?” It’s a serious question based on the fiscal 2023 report by Resideo of its financial results for last year and my usual close eye on Snap One’s results. It was clear that both organizations were experiencing a softening of their business. With these realities, I was skeptical of this union…to say the least.

Has This Fiscal Year Seen a Resurgence Compared to Last Year?

If you missed it, you may want to review my article from two months ago. Now we have even more information as Resideo has released its financial results for the first quarter of fiscal 2024. As they stand on the verge of consummating their $1.4 billion acquisition, how has business been for them in this new fiscal year?

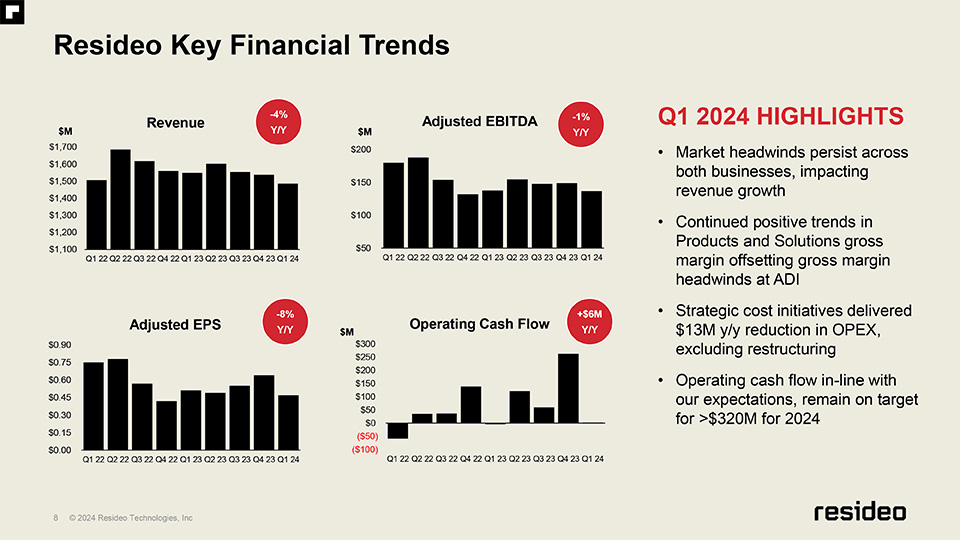

All I can say is…more of the same. Resideo’s business in the first quarter was much like last year, stagnant. Although to be fair, the company made some headway on the profit front, based on layoffs to reduce headcount.

Let’s Dig Into the Details

So let’s dig into the details. The company currently operates two separate business units: Products and Solutions (technology product manufacturing) and ADI Global Distribution (technology product distribution). In fiscal 2023, the company reported that Revenues were $6.24 billion a decline of $130 million or 2% compared to revenues of $6.37 billion in fiscal 2022. Net Income for Fiscal 2023 was $210 million, down $73 million or 25.8% as compared to Net Income of $283 million in Fiscal 2022.

How about this year? In the first quarter of fiscal 2024, Net Revenues were $1.49 billion which was down $60 million or 4% as compared to Net Revenues of $1.55 billion in the same quarter last year. Gross Profit came in at $400 million which was down $18 million or 4.3% as compared to Gross Profit of $418 million in the quarter last year.

Performance within Products and Solutions drove first quarter Adjusted EBITDA to the higher end of our outlook range. We continue to deliver gross margin and profitability improvements within Products and Solutions despite market demand that remains constrained by higher interest rates and slower housing turnover. ADI’s business trends improved as the quarter progressed and momentum continues on key strategic initiatives around growing exclusive brands sales and enhancing digital capabilities.

Jay Geldmacher, Resideo’s President and CEO

Every Form of GAAP Income was Down

Income from Operations in the quarter this year was $128 million, down $10 million or 7.2% compared to Income from Operations of $138 million the same quarter last year. And Net Income in Q1 was $43 million, down $14 million or 24.6% as compared to Net Income of $57 million in the first quarter of fiscal 2023.

We continued to execute on our transformation work through organic and inorganic actions. We took further steps in optimizing our manufacturing footprint and we have improved structural costs through restructuring and focused expense controls. We expect our planned acquisition of Snap One will bring immediate value to Resideo by adding highly complementary business capabilities that expand opportunities in attractive growth categories and accelerate ADI’s expansion of higher margin proprietary products.

Geldmacher, continued

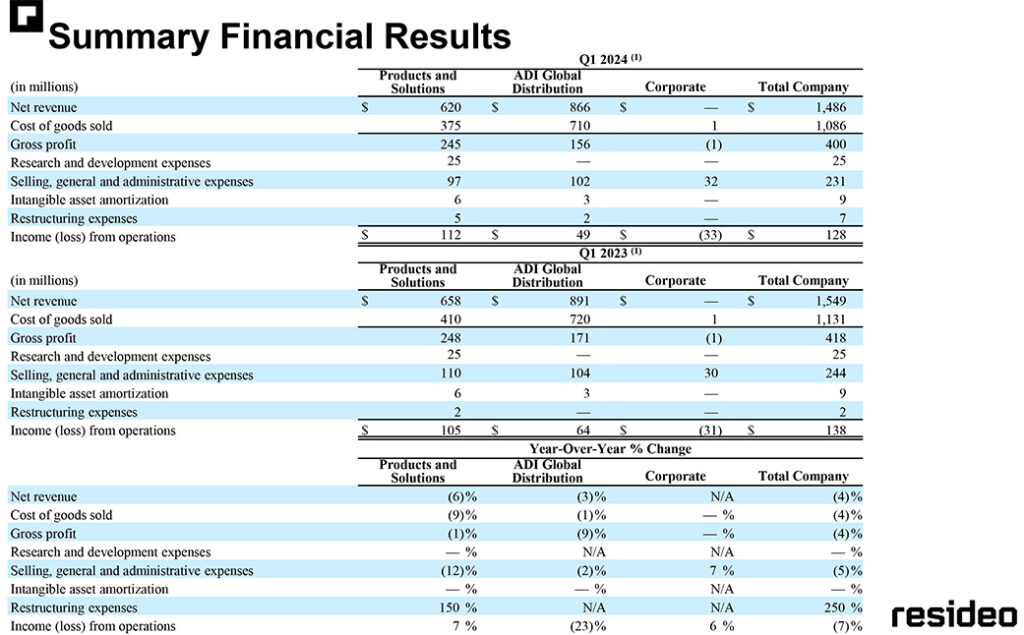

The Devil is in the Disaggregation

The company provided a disaggregated breakdown on key results and here it was easy to see some dramatic differences between its two divisions. For example, the manufacturing division (Products and Solutions) saw a greater drop in revenues, down 6% in the quarter, twice as bad as ADIs revenue decline of 3%. But ADI saw a 9% drop in Gross Profit vs. a 1% drop in Product and Solutions. This was due to the company embarking on major initiatives including a significant restructuring and other expense controls.

So this cost-cutting effort led to the P&S unit actually enjoying a 7% increase in Income from Operations, while ADI saw its Income from Operations drop 23%. The problem for the company is that ADI is a substantially larger division, so its results have an outsize impact on the overall numbers.

Here is what the company’s report had to say about each of their major divisions [refer to table above]…

Product and Solutions

Regarding the Net Revenue decline in the unit of $38 million or 6%, Resideo said: “Volumes declined in Air and Security product categories, impacted by lower activity in EMEA and continued low levels of housing turnover in the U.S. These headwinds were largely offset by strong performance at First Alert, particularly with home builder customers, and continued price realization.”

Regarding a profit improvement in the segment, the company noted: “Continued progress on structural gross margin improvements through labor reductions and material cost controls and lower selling, general and administrative expenses drove the higher profitability despite volumes remaining a headwind.”

ADI Global Distribution

Regarding a 3% or $25 million drop in Net Revenue, the report noted: “ADI had volume declines in several categories including residential security, access control and video, partially offset by expansion in fire and data communications. ADI’s e-commerce channel grew 1% in the first quarter 2024 compared to the prior year period, representing 21% of total ADI revenue.”

On the profit side, the company noted: “Lower revenue and reduced gross margin drove the year-over-year decline in profitability.”

It Wasn’t a Good Quarter for Snap One Either

Let me remind the reader that Resideo just closed on an acquisition of Snap One, a company that reported a $6 million or 2.4% decline in sales in its first quarter of fiscal 2024. And perhaps even more problematic, is the fact that Snap One saw its first quarter Net Loss increase 58% from a Net Loss last year of $14.5 million…to a Net Loss this year of $22.9 million.

Resideo’s profits declined in the quarter this year, but at least they were still profitable. So, not only did they buy a company that lost money in the first quarter of this year, but Snap One has lost money every year since they went public. And Resideo paid a 32% premium to acquire them.

Why Snap One’s Board Decided to Do the Deal

In documents filed with the SEC, Snap One admitted that one of the reason’s the Board approved the sale to Resideo is they took “into account the company’s recent underperformance.”1 This led the Board to believe that the sale of the company was the better deal.

Also revealed in this document were several conversations at both companies on the perceived “synergies” of this business combination. As someone who has been directly involved in acquisitions and other business assessments, I can tell you I wish I had a dollar for every time I heard the word synergy given as the motivation for an acquisition.

The ‘Synergy’ Cesspool

I’ve come to believe that synergy is not only a figment of many an acquirer’s imagination, but it is more likely a cesspool for them to fall into, and I think statistics would back me up on that.

Whenever I hear of one company seeking to acquire another company, I will say it is likely to fail. No, I am not Nostradamus…it is just a reality. Multiple studies over multiple years have shown that somewhere between 7-9 out of every 10 acquisitions fail. And the number one reason they fail is because the participants – especially acquirers – get excited about the prospect of doing a deal. It’s in that excitement that danger lurks. Enthusiasm causes them to mentally suspend the attention to detail required for the vigorous detective work necessary in a comprehensive, logical, and objective due diligence process to determine if the match is truly a good one, and not just misplaced over-optimism.

You’ve Got to Want to Find the Skeletons

When you’re excited about doing a deal, you suspend disbelief, ignore warning signs & red flags, don’t look for every skeleton hidden in every closet or crawlspace, and focus on pushing through to a conclusion, rather than making a reasoned analysis to determine if the deal even makes sense in the first place.

See more on Snap One by visiting snapone.com.

Learn more on Resideo Technologies and its products at resideo.com.

- Form DEFM14C for Snap One Holdings Corp., filed May 24, 2024, page 24 ↩︎

Leave a Reply