AVAD Parent Ingram Micro Reports Fiscal 2nd Quarter Results

Ingram Micro, Inc. reported results for the second quarter and first half of their current fiscal year and it would be easy to be confused by these results. Why? Well, sales were down 3.2%, operating earnings dropped an astonishing 98%, and last year’s net income plunged into a net loss this year. Yet CEO Alain Monié said in accompanying materials, “Our teams are doing a great job…”

Ingram Micro, Inc. reported results for the second quarter and first half of their current fiscal year and it would be easy to be confused by these results. Why? Well, sales were down 3.2%, operating earnings dropped an astonishing 98%, and last year’s net income plunged into a net loss this year. Yet CEO Alain Monié said in accompanying materials, “Our teams are doing a great job…”

Really?!?! See why Monié feels Ingram Micro’s doing a great job…

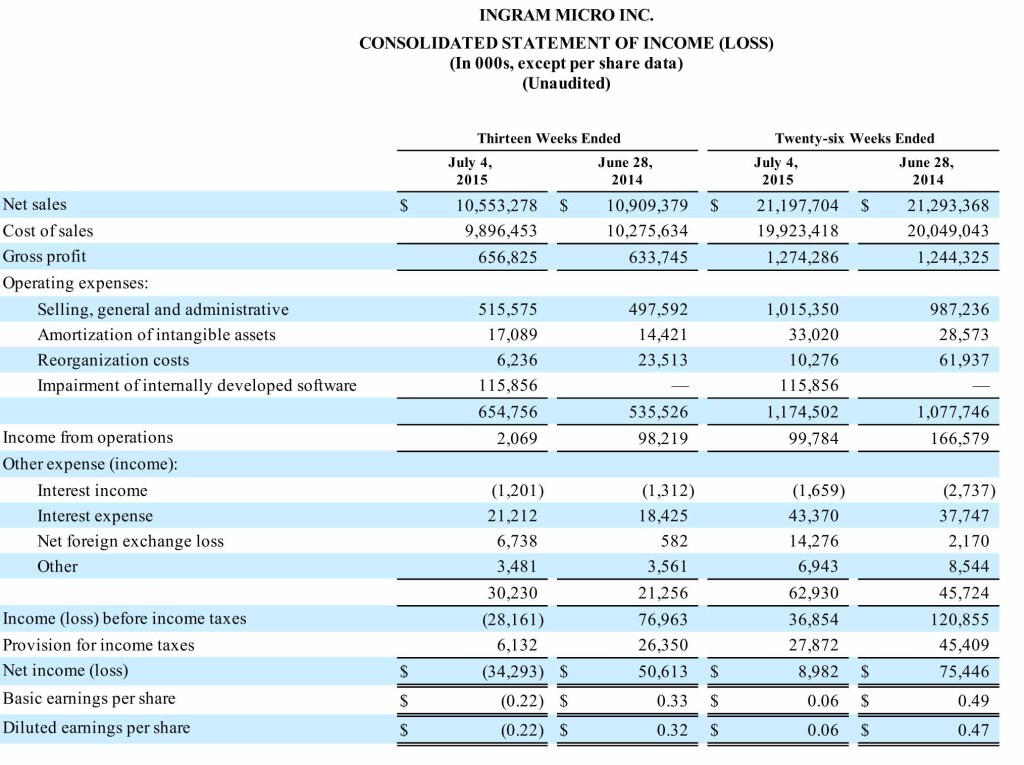

At first blush, Ingram Micro’s results look very troublesome indeed. As noted above, sales for the second quarter dropped to $10.55 billion, or more than 3% down from $10.91 billion in the same quarter the previous year. Operating earnings came in at $2.07 million, off a surprising 98% from earnings of $98.2 million last year. Net earnings fell to a loss of $34.3 million as opposed to a profit of $50.6 million last year.

The results for the first half showed a similar pattern, though with a little less severity. Sales for the half came in at $21.2 billion, essentially flat with sales last year of $21.3 billion. Operating earnings were $99.8 million or 40% below the $166.6 million in earnings for the half last year. Finally, net earnings for the half came in at a thin $8.9 million, off 88% from the net earnings of $75.4 million in the prior year.

How Does It Feel?

So how does Ingram Micro’s management feel about these results?

“Our teams are doing a great job delivering increasingly rich and innovative products and services to our customers and vendor partners through product and macro-economic cycles,” said Alain Monié, CEO of Ingram Micro. “The results are evident in our second quarter performance, as we grew revenue 5 percent in local currencies, strongly leveraged our cost basis to improve non-GAAP operating margin by 9 basis points and at the same time generated excellent operating cash flow.”

Of GAAP and Non

As a public company, Ingram Micro must report results based on what is known as generally accepted accounting principles (GAAP). But companies are also allowed to create additional analyses called non-GAAP analyses, in which the numbers are altered by pulling out certain temporary, non-recurring items (i.e. effects of acquisitions, restructuring costs, etc.), as long as they identify what items are eliminated and offer a reconciliation with GAAP numbers.

This can often make reading financial results tedious and confusing, but managements argue that the inclusion of non-GAAP analyses gives a truer picture of actual results. In this case, pulling out the impact of currency exchange rates, Ingram Micro says that rather than their sales dropping 3% in the second quarter – they actually increased 5%. In addition to that, instead of dropping 98% in the quarter, operating earnings on a non-GAAP basis actually increased 3%…and even 12% on a currency neutral basis.

Significant Restructuring Steps Taken

This is a much different picture of their results. In fact, the Ingram Micro board is so happy with the performance, the company has decided to pay a quarterly dividend to investors of $0.10 per share starting in the third quarter. The board has also authorized a $300 million share buyback program – a program in which the company buys back shares of its stock to reduce dilution.

We learned some interesting things from the quarterly report for this quarter, including the fact that Ingram Micro has begun to take significant actions to implement a previously announced cost savings program – or company restructuring. Using their best corporate-speak, Ingram Micro says it’s “implementing lean corporate initiatives and further empowering individual countries where much of the actual business motion occurs.”

These initiatives are hoped to “enable the organization to get closer to customers and partners and support more rapid decision-making at the country level, while producing additional efficiency and productivity gains.” Reading between the lines, we’d guess that the company has laid off a layer of middle management and told the individual countries, “You’re on your own.”

Pulling the Plug on 7-Year Effort

The company began cutting staff in July and says it will realize cost savings of around $5 million in the third quarter and $10 million in the fourth quarter. Costs associated with implementing the program are expected to be somewhere between $50-60 million. Ultimately, when fully annualized, the program is expected to reduce company overhead by $100 million in 2016.

Yet another item in this latest report caught us by surprise. Ingram Micro has been in the process of rolling out an all-new enterprise resource planning (ERP) system over the last seven years. Although several powerful software suites exist for this purpose, Ingram was devising their own software system. Now…they’ve decided to scrap it.

Saying that new technologies have emerged that allow “legacy systems and diverse applications to easily be connected in a modular way” and allows them “to be part of a flexible, powerful and efficient solution,” the company has scrapped the system they were developing and booked a $115.9 million charge to write off the cost.

The company also noted these other accomplishments in the quarter:

- The company continues to expand in the Middle East, acquiring a majority interest in Arabian Applied Technology, a tech distributor in Saudi Arabia that it expects to contribute about $200 million to revenues.

- Ingram Micro continues to expand the availability of its Cloud Marketplace, now available in 13 countries.

- The company says it has repurchased 4.7 million shares of its stock for a total of $119 million as part of its share repurchase program.

The company is continuing to expand through acquisitions, mostly to further their global expansion goals. In March, the company acquired Tech Data Peru S.A.C. and Tech Data Chile S.A. expanding their South American operations. And as mentioned above, in June Ingram Micro acquired Arabian Applied Technology, a distribution company operating in Saudi Arabia.

But the company also has a strategy to increase their service operations and, to this end, in February Ingram Micro acquired a majority stake in Anovo Expansion SAS which is a provider of “device lifecycle services.” And in May they acquired a European mobile device trade-in business, part of the reverse logistics market.

See more on Ingram Micro and its products and services at: www.ingrammicro.com.

Leave a Reply