Sales of newly constructed homes virtually collapsed in April in a double-digit decline that surprised economists and added to the growing evidence that the housing market is entering a downturn. This downturn in housing adds to growing concerns of a recession, as it comes on the heels of the tech industry decline, and new retailer warnings of slackening demand and supply chain driven cost increases.

See the surprising numbers out of the housing market today

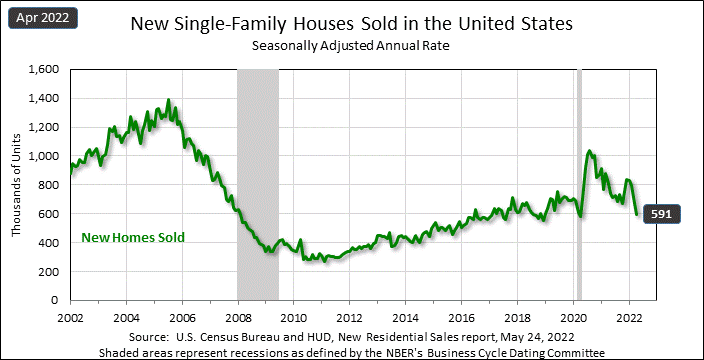

The U.S. Census Bureau and the U.S. Department of Housing and Urban Development jointly released the latest reading on the housing market with their report on Monthly New Residential Sales. According to the report, sales of newly constructed single-family houses in April came in at a seasonally adjusted annual rate of 591,000 units. This rate is a surprising -16.6% below the rate in March of 709,000 units and an eye-popping -26.9% lower than the pandemic-fueled rate of new home sales in April 2021 of 809,000 units.

More importantly, this rate was well below that anticipated by industry analysts, who had forecast an increased rate of sales of around 750,000 units according to CNBC. The government also revised the March figure downward.

More Evidence of an Economic Downturn

It is a concerning development that adds to evidence of a downward turn in the overall housing market. Just last week, I reported that housing starts – the beginning of construction of new homes – had declined in April. This was the second straight month in a row that construction of new homes declined.

It looks like more declines are imminent in the upcoming months…

Lawrence Yun, National Association of Realtors Economist on Existing Home Sales

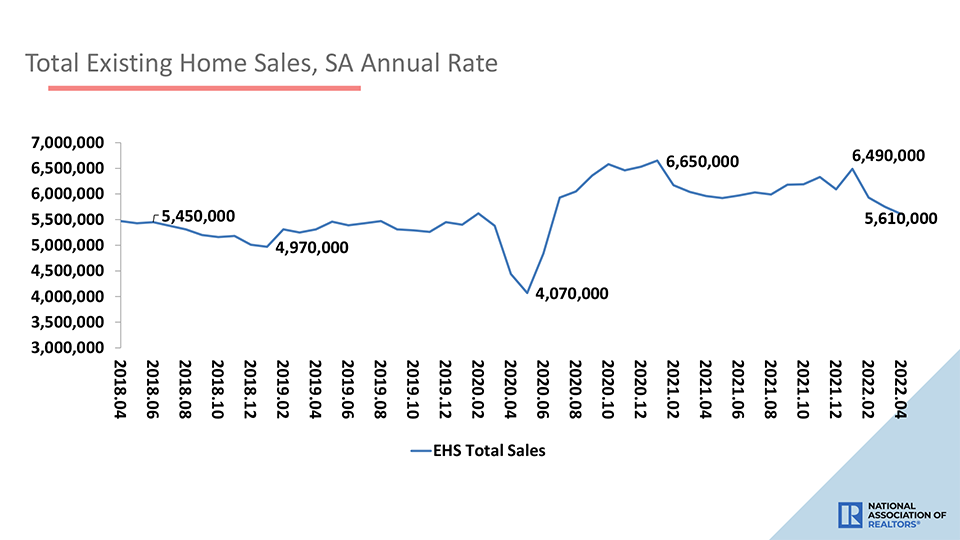

On the same day my report on housing starts was posted, the National Association of Realtors (NAR) reported that existing home sales in April had declined by -2.4% from the previous month and by -5.9% over April 2021 sales. This was the third straight monthly decline in existing home sales. Citing higher home prices and rising mortgage rates, NAR economist Lawrence Yun said in a prepared release, “It looks like more declines are imminent in the upcoming months, and we’ll likely return to the pre-pandemic home sales activity after the remarkable surge over the past two years.”

The Fourth Month in a Row of Declining Sales of Newly Constructed Homes

This latest government data showed that the median sales price of a new home rose to $450,600 – almost 20% higher than it was in April 2021. This is likely due to a couple of variables – first, inflation is a factor; second, higher mortgage interest rates are driving up the cost of home ownership for first-time buyers, shifting the mix of sales to those buyers trading up or paying cash at the higher end of the market.

This was the fourth straight month in a row that sales of newly constructed homes declined. As a result of softening sales, the inventory of new homes available for sale has increased to a nine-month supply. According to CNBC, a six-month supply is considered balanced between buyers and sellers.

The Latest in a Series of Market Shifts

Investors are becoming more concerned as the turn of housing was just the latest news in a series of market shifts. During the last couple of months, Tech has seen its fortunes decline as the end of the pandemic sucked a lot of the mojo that had been driving the segment. Then, last week, retailers like Walmart and Target turned in results well below expectations, citing slowing demand and the impact of supply chain issues on their cost structure.

Today, Best Buy came in with sales and profit declines in their latest Fiscal report and they also warned of slackening demand and increased supply chain costs. Perhaps even more surprising, Snap, Inc., the company that operates the popular SnapChat app, announced yesterday that it would likely miss its revenue and profit targets in the second quarter. As a result, the company said it must slow its hiring plans for this year.

A Deterioration ‘Further and Faster’ Than Anticipated

Like many companies, we continue to face rising inflation and interest rates, supply chain shortages and labor disruptions, platform policy changes, the impact of the war in Ukraine, and more. The macro environment has deteriorated further and faster than we anticipated.”

Evan Spiegel, CEO of Snap, Inc.

The Snap news hit Wall Street hard, coming on the heels of so many other disappointing corporate results. Snap stock closed at $12.79 a share on Tuesday, down more than 43%.

The concern for most economists is not so much that the U.S. economy is heading for a recession, likely in 2023. A recession now is pretty much expected. From the website, Bankrate.com:

Probability of Recession Ticks Higher, Say Economists

“The probability of a recession over the next 12 months is now 30%, the highest since 2020, according to the latest Bloomberg monthly survey of economists. That’s up slightly from 27.5% in April and double the odds economists predicted just three months ago.”

The bigger concern is a growing fear on Wall Street that the country may be heading towards stagflation – a period that combines slow economic growth and rising unemployment – with persistently rising prices. It is a bit of an unusual condition as typically inflation slows the economy which forces prices to drop. However, the U.S. experienced a persistent and damaging period of stagflation during the mid-1970s.

Leave a Reply