When most of us think about the Fed (the Federal Reserve Board), we think about Chairman Jerome Powell setting bank rates that can have a major impact on the U.S. economy. But what you may not know is that the Fed is a prodigious monitor and relayer of economic data. New data points have come to my attention that show increasing pressure as consumer debt levels and delinquency rates continue to rise – a condition impacting the everyday average American consumer. I felt compelled to share this data with you so you can begin tracking it on your radar screens as well.

See the new data on the consumer market I find troubling

This week, the Federal Reserve Bank of New York’s Center for Microeconomic Data issued its Quarterly Report on Household Debt and Credit – just a little something I read when I need to escape the daily pressures of life! The report this quarter included data from the Fed’s nationally representative Consumer Credit Panel. It was, at best, concerning…and at worst, alarming.

First, remember that fully 70% of the U.S. GDP is based on consumer activity. Consumer spending is hands-down the most critical economic component that many Americans, including those of us in Tech, rely upon for our livelihoods. We want consumers to feel confident, because a confident consumer spends his or her disposable income. An apprehensive or fearful consumer will choose to save his or her money until conditions improve.

The Impact of a ‘Transition’

One sign of a transition from a recessionary period to a healthier economy is consumer spending, including spending via various debt vehicles like credit card balances, auto loans, home mortgages, and the like. As these numbers creep up, it is typically a good sign of a healthy, flowing, and growing economy…to a point.

As credit card and loan balances keep growing, consumers begin to experience uncomfortable levels of debt Ultimately, this situation leads to what the Fed calls a “transition to delinquency.” When that happens, trouble has just come knocking on our door.

The Fed Raises a Red Flag

In this quarter’s report, the Fed has raised a red flag.

In the first quarter of 2024, credit card and auto loan transition rates into serious delinquency continued to rise across all age groups. An increasing number of borrowers missed credit card payments, revealing worsening financial distress among some households.

Joelle Scally, Regional Economic Principal, Household & Public Policy Research Div., New York Fed

What the Fed’s Data Shows

For several quarters now, economists have been amazed at how consumers kept spending, even during a time of high inflation. It seemed as though the consumer was impervious to bad news and…just. kept. spending. Well now the data suggests we may be getting to the other side of that trend…a transition to delinquency.

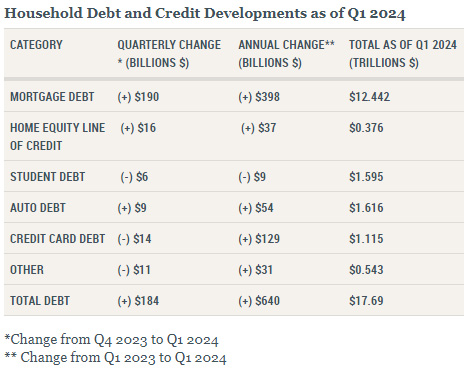

The Fed’s new report shows that total household debt in the first quarter of 2024 increased by $184 billion or 1.1% as compared to the fourth quarter of 2023. Total household debt now stands at $17.69 trillion…with a “T”…

Debt Reaching Critical Trillion Dollar Levels in Multiple Categories

Another example: mortgage balances rose by $190 billion QoQ and now stands at $12.44 trillion. Balances on consumer’s home equity lines of credit (HELOC) increased by $16 billion in the quarter – its eighth consecutive quarterly increase since Q1 of 2022. Auto loan balances increased by $9 billion in the quarter, continuing on an upward trajectory that started back in 2020. Total auto loan balances stand at $1.62 trillion.

Interestingly, credit card balances in the first quarter of this year actually decreased by $14 billion and now stand at $1.12 trillion. Perhaps this is a sign of a pullback in consumer spending, as consumers hit their credit limits on their cards.

The Proof? Delinquency Rates are Rising

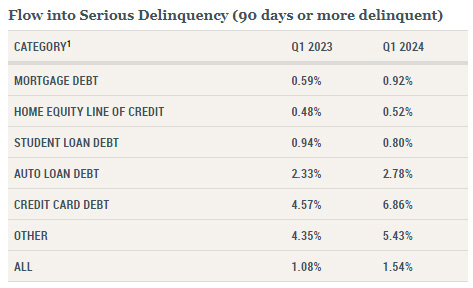

Here is the bottom line – as the Fed notes, aggregate delinquincy rates rose in Q1 of 2024, with 3.2% of all outstanding debt (all those trillions and trillions of debt dollars) “are in some stage of delinquency at the end of March,” the Fed says. In fact, delinquency transition rates of ALL forms of debt rose in the quarter. This is a clear sign of a stressed consumer.

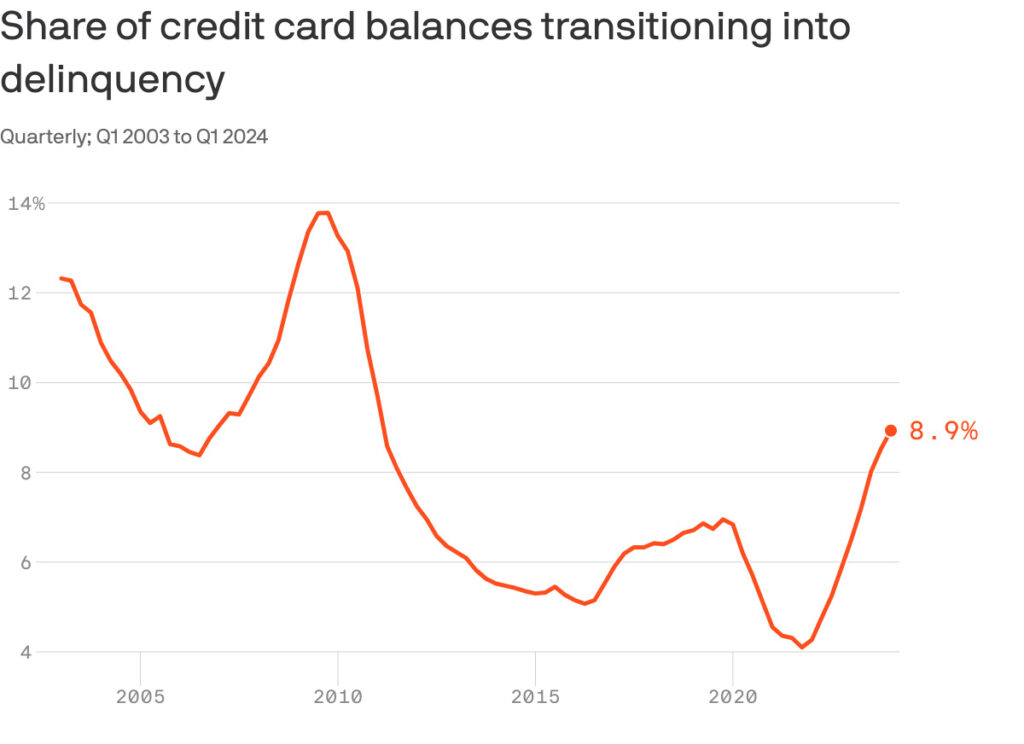

Especially in the case of credit card and car loan debt, the Fed notes that 8.9% (see that chart at the top of this story) – a big number – of credit card balances and 7.9% of auto loan balances have transitioned into delinquency. This is a big deal and worth your attention. These delinquency rates are beginning to approach the level we experienced during the Great Recession of 2009/2010 and could suggest a stronger consumer pullback in the near future.

You may want to continue to watch your radar screen as this data further develops…

Leave a Reply