Will Merging Two Stagnant Businesses Reignite Growth?

This morning we learned that Snap One Holdings, Corp. (Nasdaq: SNPO) has been acquired by large security provider Resideo Technologies, Inc. (NYSE: REZI) and private equity company Clayton, Dubilier & Rice (CD&R) in a $1.4 billion deal. If you aren’t familiar with the Resideo name, you may know them by ADI, their distribution wing.

The deal is expected to close in the second half of 2024.

See more on Resideo / ADI / CD&R acquiring Snap One

By now the news is spreading fast, and many integrators are wondering just what this deal means. Resideo – a company that split off from the massive Honeywell Corporation back in 2018 – is a $6.2 billion manufacturer and distributor of a mix of technology products…predominantly security and security-related goods. However, the company also offers comfort, energy management, and water management solutions – which, along with security, they claim are in 150 million homes.

A Leading Wholesale Distributor of ‘Adjacent’ Products

Resideo also says they are a “leading wholesale distributor” of a range of “adjacent” products, such as low-voltage security and life safety products for commercial and residential markets…and “audio visual, networking, wire and cable, and smart home solutions.” The distribution business is done under the ADI Global Distribution brand and represents 57.2% of its revenues, while its manufacturing division is known as “Products and Solutions” and contributes about 42.8% of revenues.

Residio will pay $10.75/share to acquire Snap One. This is a 32% premium compared to the SNPO share closing price of $8.14 last Friday. However, at only a little over 1-times-revenues, most would not consider it a particularly rich deal, with a massive return to owners.

Resideo CEO Quite Complimentary about the Two Companies’ Complementary Businesses

The official announcement says this about the acquisition: “The transaction will combine ADI’s strong position in security products distribution and Snap One’s complementary capabilities in the smart living market and innovative Control4 technology platforms, which is expected to drive increased value for integrators and financial returns.”

Residio is likely looking for a way to stimulate growth, as the company had a stagnant 2023. According to its recent SEC 10-K filing for 2023, Revenues at $6.24 billion were off 2% as compared with revenues of $6.37 billion in 2022. Likewise, Net Income came in at $210 million which is down 25.8% compared to net income of $283 million the year before.

One Stagnant Business Buys Another Stagnant Business; Will Growth Result?

Snap One in its most recent fiscal year also reported a stagnant result, with Net Sales of $1.06 billion down 5.6% from net sales of $1.12 billion in the previous fiscal year. The company also reported a Net Loss of $21.4 million, substantially higher than the net loss of $8.7 million the previous year.

As my report noted, Snap One has lost money every year for the last five years.

So does combining two stagnating companies magically generate growth? That seems unlikely. Rather, this deal is almost certainly one orchestrated by Snap One’s majority owner – private equity company Hellman & Friedman (H&F), who holds 72% of Snap One’s stock. There are H&F executives sitting on the Snap One board.

A Shift in Private Equity Partners – Goodbye H&F, Hello CD&R

Stepping in to help Resideo with financing on this deal is another private equity company, Clayton, Dubilier & Rice which has put in $500 million in the form of a perpetual convertible preferred equity investment. For this investment, CD&R will get a seat on the Resideo Board of Directors.

The acquisition of Snap One is an exciting step in Resideo’s continued transformation through portfolio optimization, operational enhancements and structural cost savings actions. ADI and Snap One are highly complementary businesses and together will meaningfully enhance our strategic and operational capabilities as a significant player in attractive growth categories. We are excited about the enhanced value proposition through increased product breadth, local availability, support services and broad market expertise, as well as the future opportunities this creates for integrators serving residential and commercial markets.

Jay Geldmacher, Resideo President and Chief Executive Officer

A Combined 240 Warehouse Locations in the U.S.

One big benefit for Snap One is that with ADI it instantly gains 195 new warehouse locations. This is far above the number the company had anticipated adding on its own, and when added to its existing 45 current locations means the partners will have a total of 240 warehouse locations in the U.S….at least initially.

Snap One has grown from a startup built by entrepreneurial integrators to an industry leader in smart technology, delivering seamless experiences to consumers and high-quality services and support to our integrators. This is the right next step to capture new opportunities to bring our solutions to market. The future of smart living is here. Demand for connected technology products continues to grow, and Resideo is the right owner to drive our expansion. We believe this transaction will deliver compelling value to our stakeholders and will create opportunities for our people and integrator partners.

John Heyman, Snap One Chief Executive Officer

What to Watch For

Resideo and ADI have had – at best – very little success in custom integration…and that’s being generous. The company’s main strength remains in commercial security and security-related business segments. Whether they can somehow solve Snap One’s lingering stagnation issues and help it reignite its growth – and perhaps even achieve net profitability – remains to be seen.

As you might suspect, ADI is salivating at the thought of adding more of its security products to be sold through Snap One integrators. But do those integrators want to get deeper into the security business? This remains to be seen.

On the other hand, whether Snap One can make a meaningful contribution to growth for Resideo – while it is struggling to drive growth for itself – is also a bit of a question mark. Additionally, there is some crossover between the two companies…some market redundancies with both selling similar products to similar channels. This could actually cause a small reduction in combined revenues.

Market Redundancies or ‘Portfolio Overlap’

On the conference call with analysts, Resideo’s Tom Surran (President of Products & Solutions) acknowledged there was some “portfolio overlap” (i.e. redundancies). Surran says this is mostly in the third-party products that Snap One offers. Resideo would look to replace those brands with its own Resideo brands. However, for Snap One, their third-party brands are growing faster than their proprietary brands…so that could be problematic for them.

Most likely, Resideo plans to reduce headcount at Snap One to eliminate some operational redundancies that inevitably exist in an acquisition such as this one. By lowering shared costs, profits can rebound.

‘Financial Synergies’

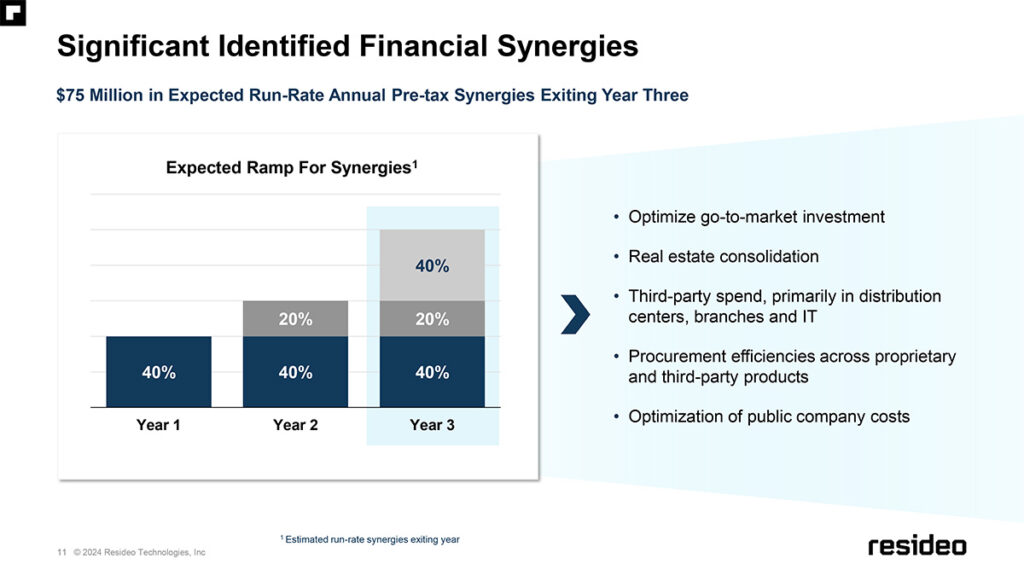

In fact, on the conference call with the investment community, Resideo executives said it has identified $75 million of “synergies” over the next three years. These synergies are all cost-side synergies, Resideo CFO Tom Trunzo told investment analysts.

…we have identified $75 million of annual run rate synergies by the end of year three. This number includes a combination of cost reductions across corporate and business functions, optimization of physical locations and assets, supply chain and sourcing efficiencies

Tony Trunzo, Resideo Chief Financial Officer

As you can see, “cost reductions across corporate and business functions” appears to refer to a headcount reduction of duplicative roles. “Optimization of physical locations” suggests merging warehouse operations where facilities overlap, also likely with headcount reductions. Finally, “supply chain and sourcing efficiencies” probably refers to joint component ordering to reduce prices, as well as combining freight shipments to lower shipping costs and the like.

Snap One CEO Tells Dealers Not to Worry, Control4 & Triad Remain Exclusive (For Now)

In a message to dealers, John Heyman assured them, “…this does not change the exclusivity of Control4 or Triad brands that will continue to require authorization and certification for professional integrators.” You know this is Rule 101 from the acquisition playbook – tell everyone “Nothing is going to change.”

While Heyman may be sincere in that sentiment now, in a few months he will no longer be the boss. He will have other way more powerful masters to answer to. And that almost certainly means changes. Serious. Meaningful. Potentially Problematic. Change.

What Did Wall Street Think of this Exciting Deal?

So how did Wall Street investors view this deal? Apparently, not too kindly. Shares in REZI actually lost value on Monday, the day the deal was announced before the market opened. While the NYSE index saw the average stock lose about three-quarters of one percent on Monday, Resideo stock declined a significant 3.51% to close down at $20.34.

This may not be as dramatic as Masimo’s impact when it acquired Sound United, but it still looks like a pretty solid thumbs-down reaction from the investment community on the day the company trumpeted the news of this Snap One acquisition.

See more on Snap One at snapone.com.

Learn more about Resideo and its products by visiting resideo.com.

As always, well covered Ted!

There is going to be some turmoil and consolidation in the near future, no doubt. I think in the long run this will be a good thing for the industry. Dealers will have more access to products and will be able to strengthen their business by expanding smartly into other channels. Independent distributors, like the Powerhouse group, will have an opportunity to strengthen their relationships with their dealers and suppliers.

One thing ADI is very good at is maintaining dealer programs. Good luck trying to buy Sonos from them if you aren’t an approved dealer. While there is little doubt that Control4 will be expanded to other dealers and other channels, ADI will do it by requiring training, authorization, etc.

The real upside for ADI in this is that they have been focused on two areas, exclusive brands and services that generate RMR for the company. They now have both in spades.

Of course the downside will be reduction in redundancy. Many locations will close, people will be cut, etc. It will put some very talented people in the market for other companies to scoop up.

It will create a void in the industry. It will be interesting to see where the next “Snap One” will come from .

There will be winners and losers in this, as there always is. It will be an interesting year coming up to say the least.

For Strata-gee readers who don’t know Mr. Blanchard, he was an executive at ADI for several years and after he left, did business with them as a supplier as well. Randy knows the company extremely well and I always pay attention to his perspective on such matters.

Thanks for contributing Randy!!

Ted