New data from GfK’s annual FutureBuy survey of shoppers shows a dramatic turn in the effect of “showrooming” (shoppers looking at/picking items in stores, then buying them online) with a decided edge going to brick-and-mortar retailers. The survey tracks omni-channel shoppers – both those engaged in showrooming and those that conduct “webrooming” (shopping an item online, but then buying it in a retail store) – in 17 countries and across 15 product segments…including consumer electronics.

New data from GfK’s annual FutureBuy survey of shoppers shows a dramatic turn in the effect of “showrooming” (shoppers looking at/picking items in stores, then buying them online) with a decided edge going to brick-and-mortar retailers. The survey tracks omni-channel shoppers – both those engaged in showrooming and those that conduct “webrooming” (shopping an item online, but then buying it in a retail store) – in 17 countries and across 15 product segments…including consumer electronics.

See the surprising results showing a significant swing in favor of retailers…

The FutureBuy survey by GfK has been conducted every year since 2009 and it offers a huge amount of data. GfK tracks responses from shoppers by country, by product category, and by age range. They also track online use by device – home computer, work computer, smartphone, and tablet.

This level of detail helps to show greater detail in their results – especially by age-range or “generation” of shopper. GfK tracks four major generation of shoppers – Generation Z (18-24 years old); Generation Y (25-34 years old); Generation X (35-49 years old), and Boomers (50-68 years old.)

Appears to be abating…

This year, the trend of omni-channel shoppers favoring showrooming (to the dismay of retailers), appears to be abating. The percentage of shoppers who say they showroom has shown a significant decline, from 37% last year to 28% this year.

This year, the trend of omni-channel shoppers favoring showrooming (to the dismay of retailers), appears to be abating. The percentage of shoppers who say they showroom has shown a significant decline, from 37% last year to 28% this year.

But perhaps more importantly, the percentage of shoppers who say they webroom has jumped to 41%. This is good news for retailers who have complained for several year about how their retail locations were being unwittingly turned into showrooms for online merchants.

Many retailers affected…

While the showrooming effect was most pronounced in major electronics retail chains such as Best Buy – we’ve had many medium and even smaller retailers tell us that they suffered from the showrooming problem as well. Now, however, the tide appears to be turning in retailers favor.

While the showrooming effect was most pronounced in major electronics retail chains such as Best Buy – we’ve had many medium and even smaller retailers tell us that they suffered from the showrooming problem as well. Now, however, the tide appears to be turning in retailers favor.

In reviewing GfK’s data broken down by age generation, we see that three of the four generations they track report using smartphones to engage in more webrooming than showrooming…often by a wide margin. Only Generation Z engages in slightly more showrooming than webrooming (39% vs. 34%).

Shoppers say why they do it…

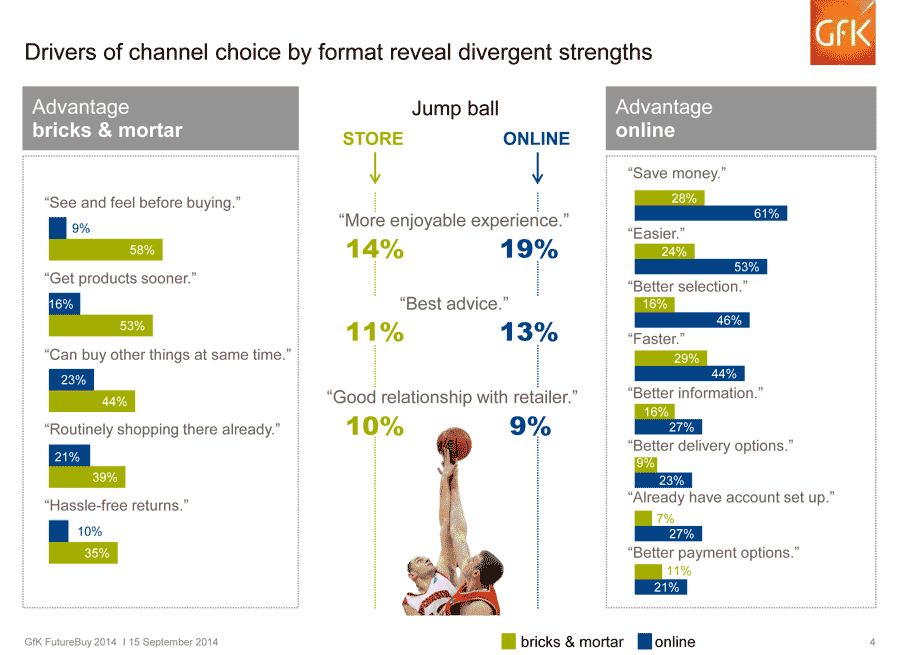

Shoppers also revealed to the researchers what their motivating factors were to drive both their showrooming and webrooming activities. Those who preferred to purchase their products at a retailer after researching the product online favored the following attributes: “see and feel before buying” (58% prefer bricks and mortar, vs. 9% online), “get products sooner” (53% vs. 16%), and “hassle-free returns” (35% vs. 10%).

Those leaning more towards purchasing from online merchants after shopping an item in a retail showroom favored the following attributes: “save money” (61% prefer online vs. 10% bricks and mortar), “easier” (53% vs. 24%), and “better selection” (46% vs. 16%).

More shoppers go omni-channel…

Aside from the showrooming and webrooming issue, the survey revealed some other interesting trends as well. For example, the number of all shoppers turning to omni-channel shoppers took a big jump – increasing 7% for a total of 44% of all US shoppers.

And omni-channel activities used to be limited to big-ticket purchases. However, in this latest survey, the data showed that other lower-priced, smaller goods were the subject of omni-channel shoppers. Product categories such as Beauty and Personal Care, Lawn and Garden, and Food & Beverage saw increases in omni-channel shopping as reported by 39%/29%/22% of the survey respondents.

By the way, consumer electronics has almost always been the number one product category that attracts omni-channel shoppers. While the overall average for all categories is 44%…in consumer electronics it is 65%. But what is really interesting is that this number for 2014 is actually down a statistically significant 5% from the reading for last year.

The swing to smartphones…

The data also show a big swing towards shoppers using smartphones and tablets for their online shopping. In fact, using a home computer to shop online dropped 15% from 78% to 63% versus 2013’s survey. But use of smartphones almost doubled, jumping from 8% to 15%…and use of tablets did double, jumping from 5% to 10%.

“The big takeaway from this year’s FutureBuy study is how dynamic the shopper environment has become.” said John Beier, Executive Vice President of GfK’s Shopper and Retail Strategy team in North America in a prepared statement. “We are seeing double-digit point changes in metrics designed to measure relatively foundational behaviors, such as omni-channel and devices used to shop.”

Big survey – big data…

The FutureBuy survey is a large one with a lot of data. The geographic markets covered are: Argentina, Australia, Brazil, Bulgaria, Canada, China, Columbia, France, Germany, Japan, Korea, Mexico, Poland, Romania, Russia, Spain, and the U.S.

The product categories covered by this survey include: Beauty & personal care, packaged food/beverage, household washing/cleaning products, OTC healthcare, consumer electronics, mobile phones, home appliances, financial services, healthcare services, meals at restaurants, automotive, toys, apparel, home improvement, home and garden.

To learn more about GfK and its surveys, visit: www.gfk.com.

Leave a Reply