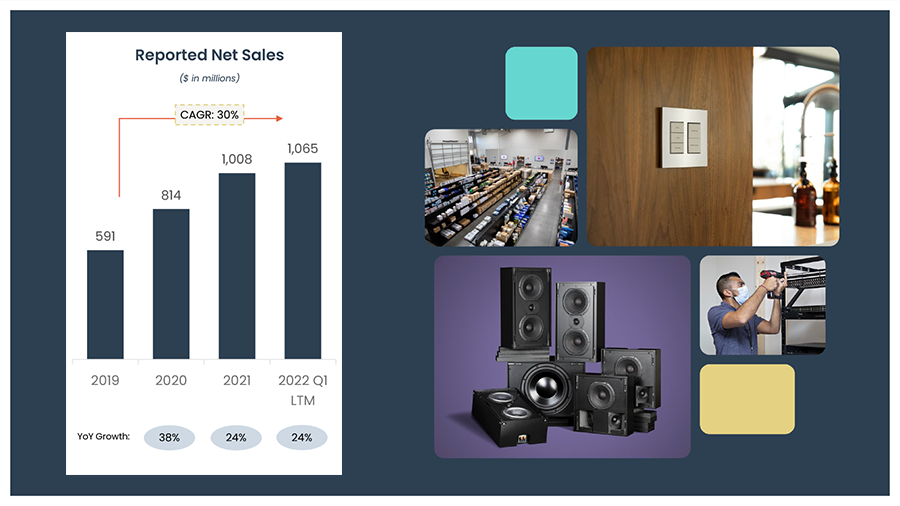

At the end of last week, Snap One Holdings Corp. released the results of their fiscal 2022 first quarter, a period which ended April 1, 2022, with comparisons to the same quarter last year, which ended on March 26, 2021. The company showed good revenue growth in the quarter but is still dealing with a net loss – albeit less of one than in 2021.

See the details on the Snap One fiscal Q1 results

Snap One’s CEO John Heyman, really a no-nonsense kind of guy, sounded fairly upbeat as he discussed the company’s first quarter results on a conference call with investment analysts last week. Considering the many emerging headwinds that we are all facing, such as inflation, supply chain challenges, war in Ukraine, and lingering COVID issues, Heyman and CFO Mike Carlet seemed optimistic as they revealed their financial results.

But as good as their report was, there were also some – black clouds would not be the way to put it – perhaps gray clouds that sometimes reveal vexing factors the company seeks to underplay. More on some of these later.

Revenues Up 25.8% as Company Claims Solid Execution of Plan

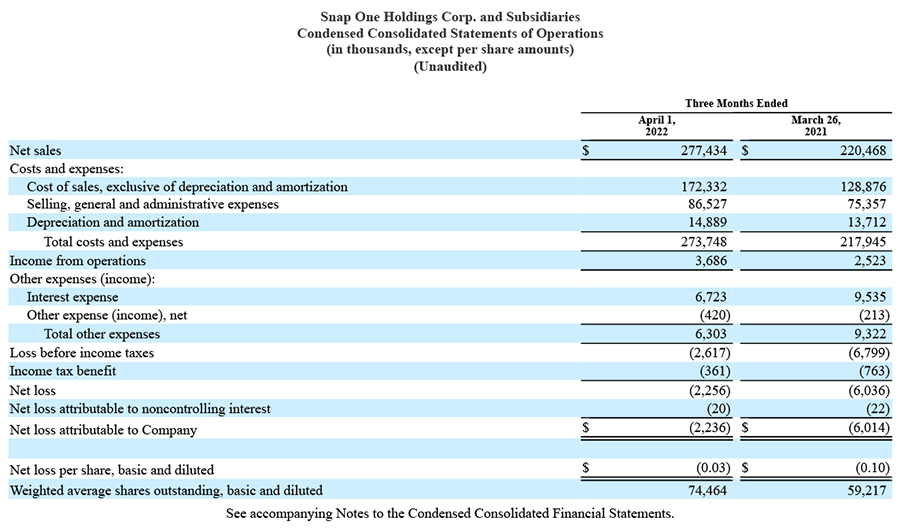

The company reported that its net sales in the first quarter of Fiscal 2022 came in at $277.4 million, fully 25.8% higher than net sales of $220.5 million in the same quarter last year. Contribution margin, a non-GAAP analysis that some companies like to use – Harman Ind. was famous for this analysis that equals net sales minus variable costs – came in at 37.9% in the quarter which is down from the first quarter last year when the contribution margin was a robust 41.5%.

SIDE NOTE FOR NEW STRATA-GEE SUBSCRIBERS: Over the last 180 days or so, Strata-gee has signed up many, many new subscribers and for that reason, I’m adding this extra explanatory note. Long time Strata-gee subscribers and readers likely know that I am personally not a big fan of public companies’ reliance on “non-GAAP” analyses or “adjusted” numbers where they devise new formulas based on unique, non-obvious assumptions to present different results data – they say for clarity. Still, I suspect the real reason for this effort is to help their performance look a little better. Snap One was no different, presenting several non-GAAP analyses…most of which I ignore in this post. I go into contribution margin here, because I am aware of several companies in Tech that use this tool.

Gray Clouds: Branches Have Lower Margins and Supply Chain Hits Results

CFO Mike Carlett said that the reason contribution margin came down as a percentage (it increased in total dollars) was “primarily related to our local brand expansion and growth strategy, which drove a change in product mix as our local branch footprint skews towards third-party product sales.” Also impacting the contribution margin percentage are “increased componentry and logistics costs related to the broader industry-side supply chain challenges.”

More and more now, public companies are reporting depressed results from supply chain issues, the impact of inflation, and continuing labor shortages. Just yesterday Walmart profits dropped 25% over these issues, only to be followed by Target with basically the same issues. Wall Street is getting spooked that a recession is approaching.

-$2.3 Million Net Loss; Growing Number of Integrators and Selling More To Them

Snap One also reported that they had a net loss of -$2.3 million, which was a much smaller loss than the -$6.0 million the company lost in the first quarter of 2021. But why are they losing money? This is not a new company, it is a combination of two presumably profitable companies (SnapAV & Control4). No detailed explanation is given for the continued losses other than to say they believe they will break into profits as their business “scales.” Yet, they’re already a billion-dollar company…isn’t that enough scale?

In addition to the issue of cost increases resulting from dealing with the supply chain, the company also noted that its finances are now impacted by the heightened costs of being a public company.

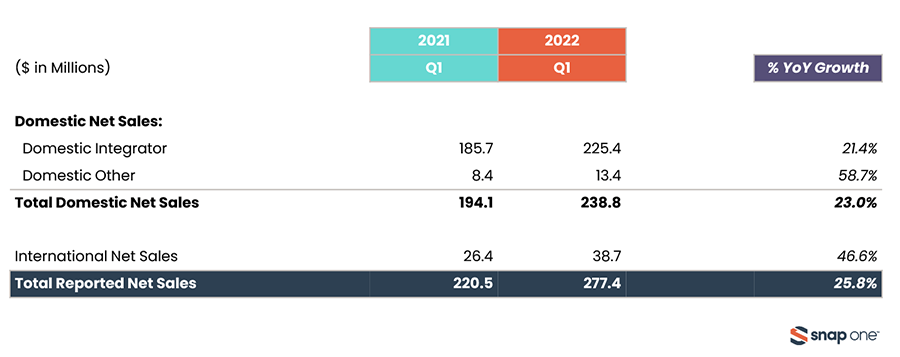

The Snap One executives said that net sales grew in all geographies, markets, and product categories. Consistent with their overarching growth strategy, the company says they increased the number of integrators and increased their “spend” per integrator to drive sales growth. They also noted that about 5% of growth in net sales came from two recent acquisitions – Access Networks, a U.S. networking company, and Staub Electronics, a Canadian distributor.

More Branches + Pricing Increase er Adjustment = More Sales; Another Price Increase Announced

Also helping sales, the company had expanded its number of local branches and implemented a price increase that when combined with an earlier price increase arguably added around 8% or more to sales. And speaking of price increases, the company announced earlier in the week another new round of price increases (Heyman called it a price “adjustment”) of an additional 8% (blended) to take effect on June 6. He said this increase was “in line with recent competitive moves.”

The company highlighted several accomplishments in the first quarter of the year. They are…

- Acquired Staub Electronics – January 2022 – This was Snap One’s (and SnapAV’s before them) distributor in Canada. In January, the company decided to acquire them for $26.4 million.

- Launched a single Partner Rewards loyalty program – The company believes this loyalty program will allow to guide integrators purchases where they want them.

- Received 17 CE Pro Quest for Quality awards – When an analyst asked Heyman what the QFQ awards they won were for, and what were the awards they didn’t win were for, he seemed a little thrown by that. He said they are “revered” for tech support, and then started talking about their internal surveys. He asked Mike Carlet if he knew which awards they didn’t win. Carlet was a little hazy as well, “I think [we didn’t win] a couple around like social media presence, maybe around lead generation for integrators…”

- Opened a new local branch – The company opened a new facility in Rockville, MD for the Washington D.C. market. They now have 31 warehouses in the U.S. and two in Canada.

- Hired a new CIO – Snap One hired a new Chief Information Officer named Maneet Singh.

Robust, secular demand for smart living experiences continues to propel our business forward as our team delivered yet another strong performance in the first quarter. While market pressures and supply chain challenges from the last few quarters have persisted, we are pushing forward with our strategic objectives to position Snap One and our integrators to capitalize on the long-term market opportunity.

John Heyman, Snap One CEO

My Favorite Announcement (No, Really, I Mean It)

But probably my favorite announcement made by the company – and I mean that sincerely – is that it will offer, on an ongoing basis, more disaggregation data on their revenue to provide a little more transparency on how and where their revenue is generated. In the past, they offered revenue solely on the basis of domestic and international sales. Now, they will further break down domestic revenue between domestic integrator revenue and domestic “other” revenue.

As you might suspect, domestic integrator revenue is just that, sales transacted on a direct to integrator basis. Domestic other revenue represents sales through recently acquired entities and revenue generated through managed transactions with non-integrator customers, such as National Accounts. They didn’t provide any detail on who the national accounts are, and how that “recently acquired entities” revenue gets added back into the mix.

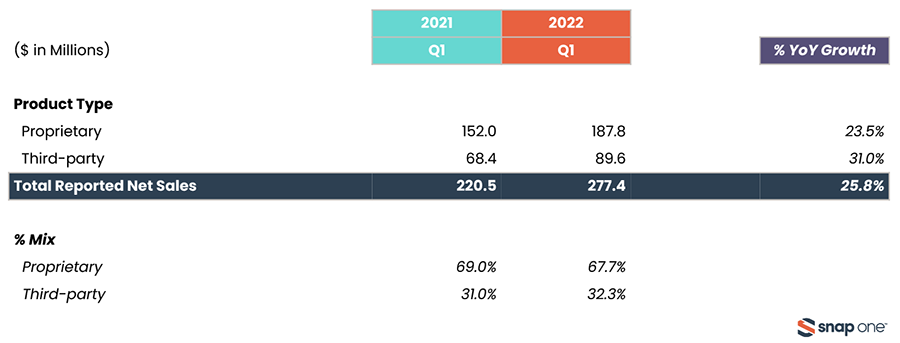

New Breakdown on Revenue by Product Type – Proprietary or 3rd Party

They will also disaggregate revenue by product type. The company has two types of products they sell – proprietary products and third-party products. Proprietary products are those designed, engineered, manufactured, and sold under one of the proprietary brand names directly owned by Snap One. Third-party products are outside brands that the company distributes through its local branches.

Snap One noted that they make more money on their proprietary products, which represented 67.7% of net sales in the first fiscal quarter. However, it’s worth noting that this was down from the first quarter of 2021 when Snap One proprietary products represented 69% of net sales.

The decrease in proprietary sales mix is driven by the growth of third-party products outpacing the growth of proprietary products, primarily related to our strategic efforts to expand our local branch network where we typically sell more third-party products than proprietary products.

Mike Carlet, Snap One Chief Financial Officer

A Formula Flaw?

This may be a small flaw in their formula. The company intends to open around 10 new warehouses a year. If their warehouses tend to sell a product mix heavier in third-party products with lower margins, this will challenge their company-wide margins on an ongoing basis.

Finally, the company notes that they will reveal a couple of new KPIs or key performance indicators. While the product mix disaggregation will be reported on a quarterly basis, the company will report on the count of transacting domestic integrators and the spend per transacting integrator on an annual basis.

List of Snap One Integrators is 20,000 Strong…and Growing

With this announcement, Snap One revealed that they have “approximately 20,000 domestic integrators” who “spend $41,500 on average.” Those numbers, on a year-over-year basis, represent growth of 11.7% and 8.4% respectively. That is to say, there are 11.7% more integrators in 2022 than in 2021, and they are buying 8.4% more Snap One products, compared to the same quarter in the previous year.

I appreciate the fact that the company is being a little more transparent with its data. For folks like me, and stock market analysts, this is quite helpful. Of course, it opens them up to questions on these KPIs. And that is just what Stephen Volkmann, an equity analyst with Jefferies, LLC did.

Did Sales REALLY Increase? Or Just Prices?

Volkmann noted that the new KPI revealed that the “spend per integrator” went up 8.4%, and that was about the same as what the company indicated their price increases had been. “I may be comparing apples and oranges, but it looks like that was probably almost all priced based on the pricing data that you gave. So I’m curious, did the spend per integrator kind of go up on a unit volume basis?”

In other words, Volkmann suspected that the whole increase was not so much a “sales” increase, but just a price increase – which is why he asked if they had actually sold more units. CFO Mike Carlet verbally stumbled as he tried to figure out a way to answer that question. Finally, he said, “So [you are] absolutely spot on with that observation, but very much driven by the supply chain challenges that we have.”

Another gray cloud spoiling Snap One’s otherwise bright sunny day…

Learn more about Snap One by visiting: snapone.com.

The danger of the supply chain challenges is exacerbated when they run out of one critical component of a system. They can’t get their factories to deliver landscape amplifiers until August 20 for the 1KW unit and sometime in December for the 2KW version. I have several landscape systems sold and couldn’t wait until the summer selling season passed. I searched far and wide and found a good alternative in our backyard, pun intended…

That’s now into 2023 for both amplifiers, last I heard from our regional reps…