Resideo Technologies, Inc. (NYSE: REZI) – the new parent company of residential integration company Snap One – recently released the financial results for its third quarter of fiscal 2024, the 90-day period that ended September 28, 2024. While the overall numbers looked fairly strong with revenues increasing 18% to $1.83 billion with gross profit expansion, when looked at organically, the results show a more moderate revenue growth of 4%.

See more on the Resideo results in 3Q/2024

I began following Resideo earlier this year, when in June 2024 the company acquired Snap One, a major provider of a wide range of custom integration gear. Resideo has two major business segments: the rather generically named Products and Services which manufactures its own lines of products in the security and other categories – and ADI Global Distribution, a distributor of security and other low-voltage technology products, primarily in the commercial technology channel. Snap One has been combined with the ADI segment.

The company is still in the early stages of the ramp-up of its integration of the Snap One business into its organization, but the inclusion of Snap One’s numbers certainly has provided a nice boost to Resideo’s results. However, when looking at the results organically by taking Snap One’s contribution out of their numbers, we see a much more modest, but still positive, result.

Upbeat Executives and Upbeat Result

It was clear, however, that the company was quite upbeat about its report this quarter, modest as it was. Why? Because this was a much better result than last quarter. In its 2Q/2024 results, the company reported a 1% drop in revenues and a 40% drop in net income – and that was with the inclusion of Snap One results in its numbers.

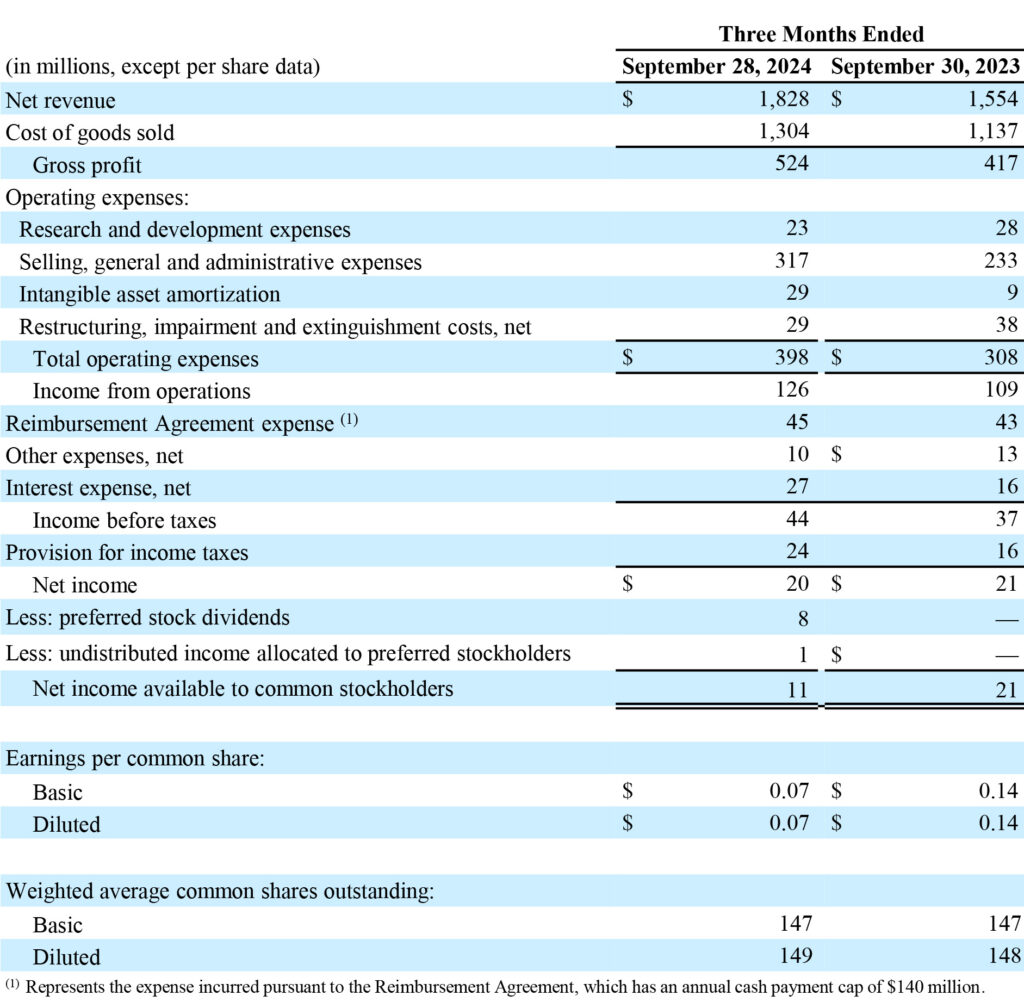

As I noted above, the company reported 3Q net revenues of $1.83 billion, $280 million or 18% more than net revenues of $1.55 billion in the same quarter last year. However, when looking at organic results for more of an apples-to-apples comparison, that $1.83 billion includes $251 million from the newly acquired Snap One, which wasn’t in its numbers last year. When you take that out of its numbers, organic growth was a more sedate $32 million increase or 4%.

The Organic Performance was a More Sedate

Not only that, but the results left kind of a dangling mystery, which I will get to later.

We delivered strong results in the third quarter with organic sales growth at both Products and Solutions and ADI in addition to consolidated Adjusted EBITDA again coming in ahead of our outlook. Products and Solutions continued to drive gross margin accretion, reflecting structural cost improvements. ADI also returned to organic revenue growth driven by improved demand across commercial categories and continued e-commerce expansion. The integration of Snap One is progressing well with the teams focused on cross-selling opportunities and cost reduction actions.

Jay Geldmacher, Resideo’s President and CEO

Let’s Dig Into the Results

As mentioned before, the company booked net revenues of $1.828 billion, an increase of $274 million or 17.6% as compared to net revenues of $1.554 billion in the same quarter in 2023. This overall increase is primarily due to the acquisition of Snap One which added $251 million in net revenue, along with other added revenues of $58 million.

However, the company notes that this gain was partially offset by a drop of $32 million from discontinued operations and a negative $3 million “of unfavorable price impacts driven by the ADI Global Distribution segment.”

A Gross Profit Increase, But Some Expense Increases As Well

The company generated a Gross profit of $524 million, up $107 million or 26% compared to gross profit of $417 million in the quarter last year. Gross margin increased 180 basis points thanks to lower manufacturing costs, favorable impacts from acquisitions (Snap One), and higher pricing. Some of it was offset “by the impact from lower volumes” and an “unfavorable margin mix.”

Manufacturing costs declined, but not all company costs declined. For example, selling, general, and administrative (SG&A) expenses increased by $84 million or 36.1% year-over-year (YoY) – largely due to $76 million of “incremental expenses from the Snap One acquisition, which includes operating expenses and integration costs.” The company also noted that SG&A was impacted by a $7 million increase in bad debt expense and “additional IT costs of $2 million.”

Increases in Intangible Asset Amortization Expense & Interest Expense

Resideo also saw a $20 million increase in intangible asset amortization. This too, is a result of the acquisition of Snap One which gave the company more intangible assets to amortize. In the quarter in 2023, this expense was $9 million, which grew by over 220% to $29 million in the quarter this year.

Another noticeable impact on cost structure was an increase in interest expense. In the quarter this year, interest expense came in at $27 million, up $11 million or 69%. The company notes that this is due “to an increase in our long-term debt…”

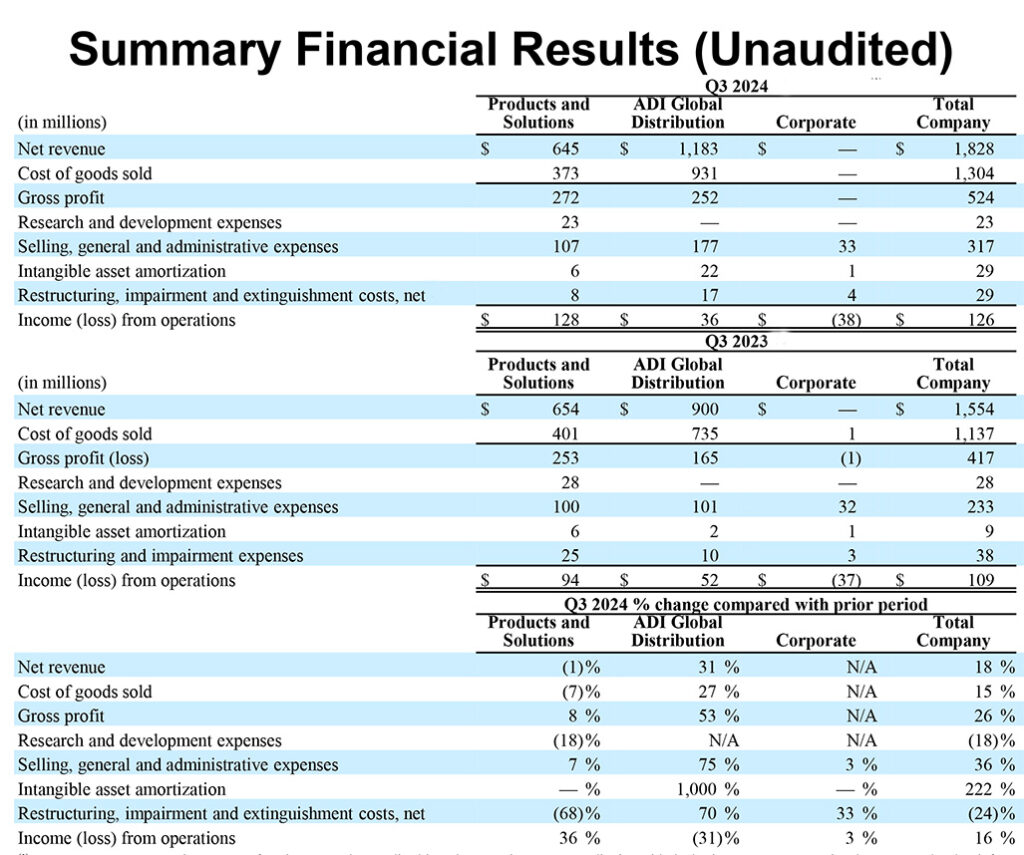

Segment Results – Products and Solutions

Resideo’s Products and Solutions segment saw net revenue decline by $9 million or 1%, coming in at $645 million versus $654 million in the quarter the previous year. The company says that this decline is largely due to the divestiture of its Genesis business in 4Q of 2023.

On the other hand, income from operations increased $34 million to $128 million, a 36% increase over income from operations of $94 million in the same quarter in 2023. The increase was largely due to a concerted effort by the company to control its costs, such as material, freight, and manufacturing.

Segment Results – ADI Global Distribution

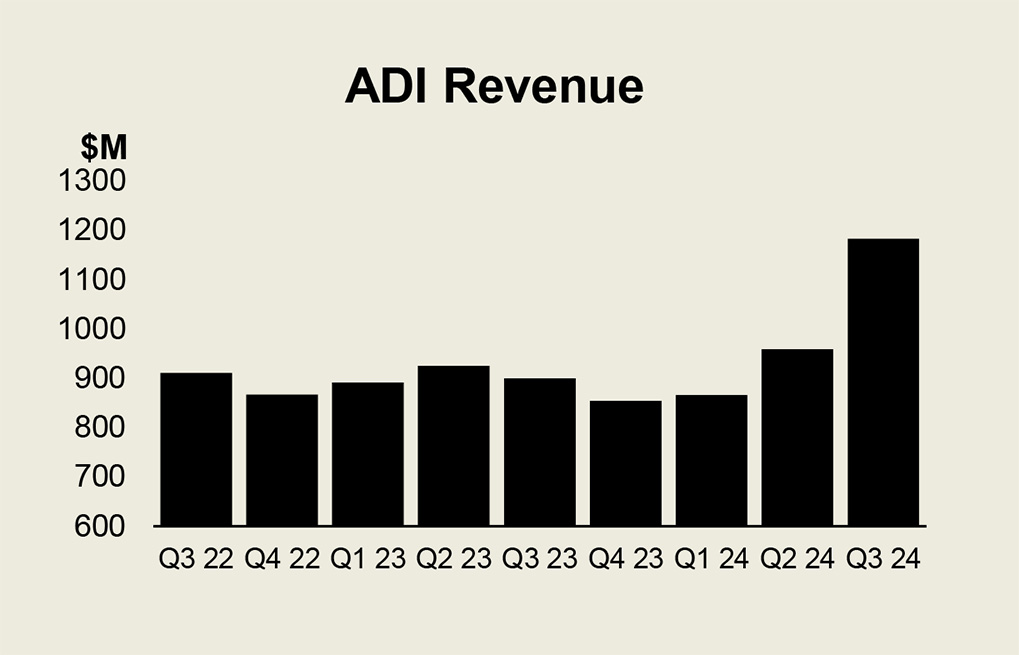

Interestingly, we see an opposite trend from ADI which experienced a significant net revenue increase of $283 million or 31.4% to $1.183 billion as compared to net revenues of $900 million in the same quarter last year. As mentioned earlier, this is largely due to the $251 million of revenue as a result of its acquisition of Snap One…as well as an additional $41 million from added sales of other products.

Head of ADI Rob Aarnes told financial analysts that these increases came largely from growth in the commercial segment, and added support from large customers, such as Lowes. Aarnes said that this was the strongest daily sales average in ADI’s history. He also noted that the company’s largest category – video surveillance – “returned to growth.” However, the segment leader noted that its sales growth was “partially offset by residential audio visual headwinds” in the quarter.

I was interested to discover that while ADI’s overall revenue increased by 31%, its income from operations decreased by 31%, coming in at $36 million versus $52 million in the quarter last year. All that extra revenue did not lead to greater income from operations because of an “unfavorable sales mix of $7 million, incremental operating loss of $8 million from the acquisition of Snap One, higher restructuring costs of $5 million, higher operational costs of $2 million, and integration costs of $2 million…”

One Mystery, Net Income

One mystery to this whole report is the company’s net income. Net income in the third quarter came in at $11 million, down $10 million or 48% compared to net income of $21 million in the same quarter last year. As far as I could find, the company offered no explanation anywhere in their report for why or how that happened.

As I was scratching my head trying to figure that out, I heard one of the financial analysts on the earnings call ask that exact question. Eric Woodring of Morgan Stanley started out by asking the executives to explain what is changing fundamentally in the market that’s causing this performance to improve. “[B]ecause…not too long ago, this business was declining year over year”…and is this momentum sustainable?

“And if you could just [add] in why that isn’t translating into better margins? I know you talked about competition and kind of inflation pricing going away, but just help us understand why, if the underlying demand backdrop is so strong, why you can’t capture that pricing.”

If Net Revenues are So Strong, Why Don’t Net Profits Follow?

Woodring is asking, if your net revenues are increasing so strongly (+18% overall), why is your net income declining (-48%)? Why aren’t you able to see your profits benefit from all that growth? That’s a really good question…and it was a question that Aarnes gave a long circuitous answer to that talked all around it, but didn’t answer it.

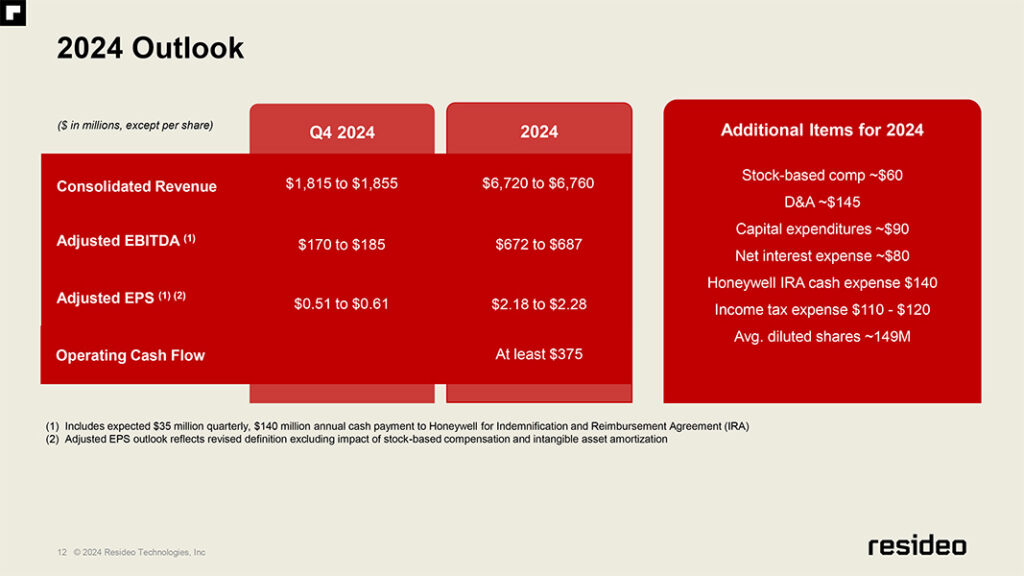

Still, the executives were really upbeat about this quarter’s results. And considering where they have been, they should be. Resideo has a couple of more quarters where revenues should continue to leap ahead thanks to the Snap One acquisition. But then they will begin to anniversary their own numbers – and that could lead to new challenges.

Learn more about Resideo by visiting resideo.com.

Leave a Reply