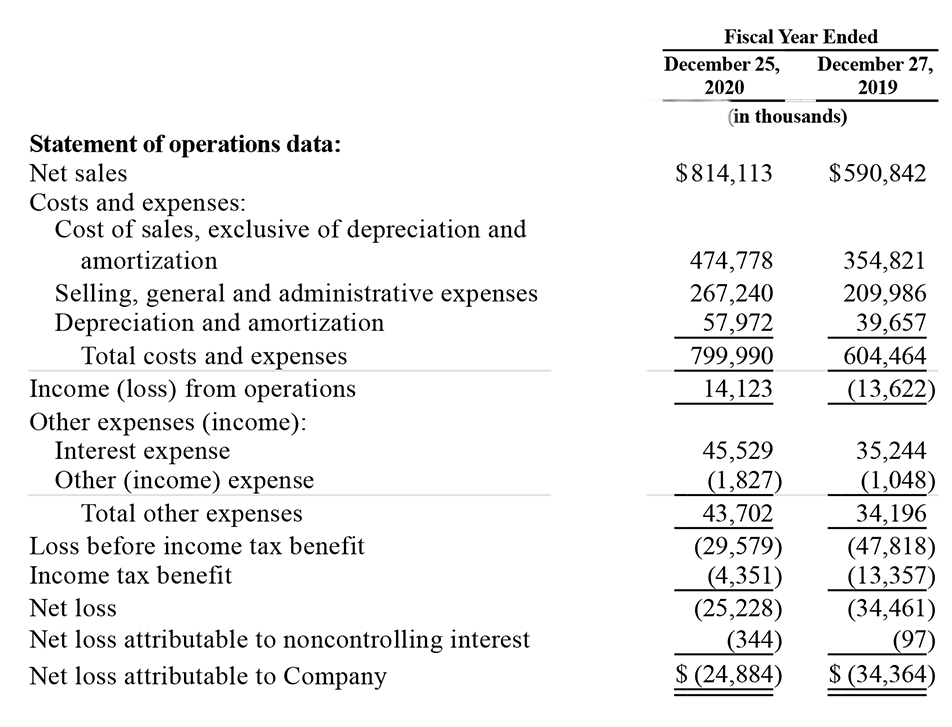

In 2020, Company Revenues Grew 37.8% to $814.1M But With a Net Loss of $25.2M

Snap One Holdings Corp (Snap One) – formerly SnapAV – has filed an S-1 registration with the Securities and Exchange Commission (SEC) in preparation for an initial public offering (IPO) of its stock on a public exchange. In this S-1 filing, we learn much about the company’s current position and what its plan is to grow the operation to even loftier heights.

See more on the Snap One S-1 registration…

Weighing in at a robust 243 pages of densely packed, single-space text, Snap One’s S-1 filing gives us a rare glimpse into just how well the company is doing – visibility we’ve never had before for the private equity-owned industry giant. We have had visibility into one of their divisions – Control4 – which itself had been a public company in the past, but we lost that insight when they were acquired by SnapAV and taken private.

Also, we get a peek at what the company managers present to investors as the strengths of their business model and why that makes them investable. And we get to learn their plans for how they will grow that company – a look into the not-too-distant future. It is a veritable treasure trove of important information about an important company.

It’s About Achieving Scale

If the company is successful with this initial public offering (IPO), it will be traded on the NASDAQ stock exchange with the symbol SNPO. They anticipate selling 15.9 million shares for a maximum of $21.00/share, yielding an aggregate total of about $334.5 million. All of this is disclosed in their S-1 filing.

There are some quite notable items here amongst the many points the company presents. So let’s dig into it and I’ll share some of my thoughts.

Snap One’s ‘Vision’

Snap One’s S-1 filing starts by stating their “vision” which is as follows:

Bringing together people, integrators and products to deliver joy, connectivity and security in our everyday lives.”

“Our Vision” in Snap one S-1/a filing

I have read the entire document, a couple of times now, and I can say that much of what resides there makes a lot of sense. The key concept for Snap One? They believe that by building “scale” they can lead the industry. So where are they at – scale-wise – at the beginning of this plan? We get a lot of answers from the financial data presented.

There were not any major surprises, although I’ll admit that I did find some small surprises. And the first small surprise I had was with the company’s revenues. For reasons that I can’t specifically share here, I was convinced that Snap One would not launch an IPO until they were at least at $1 billion in revenues. But we learn in this document that they are not at a billion dollars in revenues.

Financial Results from 2020 and 2019

However, Snap One is close to a billion dollars, reporting revenues for 2020 of $814.1, million which was a 37.8% increase over the revenues generated in 2019 of $590.8 million. The company attributes its growth in 2020 primarily to the contribution of a full year of results from their 2019 acquisitions, including MRI, CPD, and Control4. They also added four warehouse locations and achieved greater “ramp up” from existing warehouse locations.

The company also noted particular success in its home technology and security business. Interestingly, when looking at sales growth organically – taking out the impact of acquisitions – sales grew at a much more modest rate of 6.6% on a pro forma basis. So they clearly relied heavily on acquisitions to drive their results.

A Net Loss for 2020, But a Smaller One than 2019s Net Loss

Despite the sales increase, the company reported that it lost money in both years with a total net loss in fiscal 2020 of $25.2 million versus a net loss of $34.5 million the year before. That’s about a 27% reduction in their losses and suggests their business is moving in the right direction…but still has a ways to go.

[Please keep in mind that the Snap One S-1 document was originally filed as a “draft” registration and there are currently four additional revisions – so some of these numbers and other details may change in the final version]

Two Main Ways to Drive ‘Scale’

The company is clearly focused on increasing “scale.” There are two ways to escalate scale – organic growth and inorganic growth. Driving organic growth means increasing revenue by selling more of your existing product – and also by extending your lines into new models to generate more sales. Organic growth is growth through existing internal operations.

Driving scale through inorganic methods refers to growth through mergers and acquisitions. In essence, you are buying your way into a bigger company footprint. Snap One has pursued both means and intends to pursue this strategy into the future. In the last five years, Snap One has engaged in “more than ten acquisitions,” including the very large acquisition of Control4 for $680 million in 2019.

A Delicate Dance When You Prance with Lady Debt

Growth through acquisition is a legitimate way to scale – but it is an expensive way to scale – a fact made clear by the large amount of long-term debt carried by Snap One (more on this later). And this debt has consequences, as I told you about in a post on the conservative rating from credit rating agency Moody’s Investors Service on the company earlier this year (who gave the then SnapAV a “speculative” rating). Just one year earlier in 2019, Moody’s had downgraded SnapAV’s credit status – it’s a delicate dance when you prance with Lady Debt.

By the way, in the post earlier this year Moody’s estimated Snap One’s revenues at $786 million, which was pretty close to how they finished out the year.

Fast Facts from Snap One S-1 Filing

- The company currently has a “loyal and growing” base of 16,000 integrators

- They say they are “transacting” with “over 20%” of then entire integration channel

- Offers more than 2,800 proprietary SKUs

- Releases more than 450 new products a year

- Has a large stable of brands, such as Control4, OvrC, 4Sight, NEEO, Parasol, WattBox, Araknis Networks, Triad and more

- Has products installed in approximately 345,000 homes

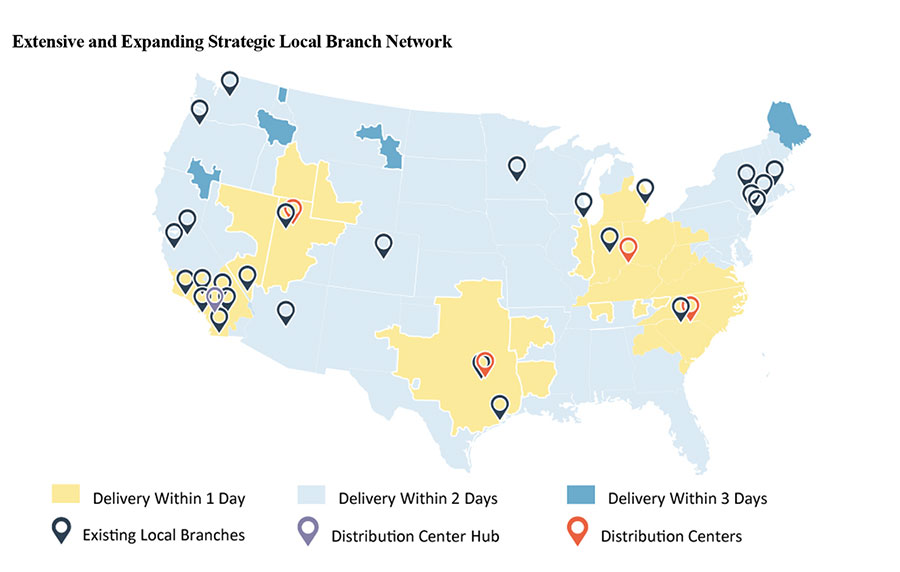

- Quick ships to 99% of the country within two days

Snap One likes to make the claim that it was “founded by integrators for integrators.” You find that claim three or four times throughout the document. That statement was true back at their origination, with founder Jay Faison launching SnapAV after running a successful North Carolina-based integration company. But as you look at the current management and Board of directors’ resumes, it clearly isn’t true anymore. The majority owner of Snap One is Hellman and Friedman, a large private equity group – and a significant percentage of the management and the company Board is either direct Hellman and Friedman folks or managers directly or indirectly from the private equity world.

Snap One’s ‘Only Here’ Strategy

The company says the linchpin of their strategy is called “Only Here.”

“We believe that Only Here can integrators access a leading comprehensive suite of products and software solutions that enable a ‘one-stop shop’ experience. Only Here can integrators support their customers via our industry-leading remote management software platform, which reaches approximately 345,000 active homes and businesses as of March 26, 2021. Only Here can inegrators enjoy the convenience of an e-commerce centric, omnichannel offering to support their workflow. Only Here can our third-party product partners efficiently access our expansive integrator network and connect with the broader Snap One product and software ecosystem.”

Snap One S-1 filing

Furthermore, Snap One tells investors that they believe that their Only Here strategy “becomes embedded into integrators’ workflow throughout the project lifecycle, creating re-occurring spending patterns that strengthen our integrator relationships and enhance our revenue visibility from our integrator base. Snap One was founded by integrators for integrators and we believe our Only Here experience makes us our integrators’ partner of choice.”

In the Beginning

I want to draw to your attention that with this document and the company management’s new strategy, we’ve seen the organization come full circle. In the beginning, the initial concept was a disintermediation strategy – which is kind of a “cut out the middleman” approach. In those early days, SnapAV looked around and realized that most industry manufacturers were simply flying to China, picking generic, off-the-shelf products, like in-wall and in-ceiling speakers, and then silk-screening their brand names on the products and reselling them here in the United States. Of course, they would mark the products up because their brand name carries value.

But integrators know that the end-user is not brand-centric or even, for the most part, brand aware. So SnapAV could easily fly to China, pick out the products they want, and stamp their own brand on it – effectively cutting out the middleman…and his margin. This saved them a ton of money on the products used in their integration business, and they turned around and sold the products to other integrators at very profitable pricing – as they didn’t have to price legacy manufacturing overhead into their products.

All gear was brought into one warehouse and sold through their e-commerce site to keep selling costs low. The more effective they were at squeezing cost out of the formula, the more money they could make – and the more profit they could pass on to the end-integrator. It was – in those days – truly by integrators for integrators.

Current Strategy is an About-Face; Assuming More Cost and Risk

Now, the current management, desperate to build scale, is re-intermediating structure – and the commensurate cost load – back into the process. Most manufacturers contract with regional distributors around the country to market and sell their products. This gives them a national footprint at a marginal cost of the program for the distributor. But Snap One, to control more of the process, Snap has decided to buy up distributors around the country which gives them local delivery and support capabilities. As a result, their cost structure is much higher than previously when they largely relied on only their e-commerce solutions and shipping from one central location. And their costs are arguably higher than other manufacturers who outsource the distribution function.

Another factor to consider that could be meaningful is that when you contract with a distributor to sell to integrators and dealers around the country, the distributor carries the responsibility and risk of extending the credit to the dealer. But with Snap One owning their own local distributors, they are bearing that credit risk of extending terms to integrators and dealers.

The strategy is one that Snap One likes to call an omni-channel approach – a term stolen from the retail business where consumers can shop from a retailer’s website then buy, pick-up, and if necessary, return items to a local store. Snap One has recast that into the professional B2B integration realm which gives integrators will-call capability or quick delivery opportunities. Integrators can also receive training and interact with a local sales team. But the company bears the cost of all of those large-footprint buildings/real estate, loaded with costly inventory that must be efficiently handled, and staffed with multiple sales, operations, and support personnel.

Using 3rd Party Products to Fill in Assortment Holes

According to the filing, Snap One derives 70% of its revenues from its own proprietary brands. The other 30% of revenues come from third-party brands that help to fill in the gaps in their proprietary lines assortment. This was an essential part of creating a one-stop-shop for integrators.

Some of the third-party brands that Snap One distributes include Alphabet (Google), Amazon, KEF, Klipsch, Lutron, Samsung, Sony, Sonos, Ubiquiti, and Yamaha. The company admits that these partnerships generate lower margins for them – such that when their sales of third-party goods increase, the shift in profit profile deflates their profits.

Market Opportunity

Using data from market researcher Frost & Sullivan, Snap One believes it has tremendous opportunity for further growth. Noting that the technology channel is comprised of both the DIY (do-it-yourself) sub-market and the DIFM (do-it-for-me) sub-market, the company has clearly chosen to side-step the DIY to fully target and support the DIFM sub-market. The company says that DIFM is characterized by “consumers with higher expectations, more complicated projects, higher disposable income, and greater use of professionals, contractors and service providers in other parts of their lives.”

Snap One notes that these more qualified DIFM customers typically spend anywhere from $10,000-to-$20,000 on their projects. According to Frost & Sullivan, the “integrator spend” in the U.S. DIFM sub-market will grow from $43 billion in 2020 to $65.2 billion by 2025 for a compound annual growth rate of 8.7%. This total market number includes home technology, security, and commercial channels.

Competitors

The company notes that the smart home market is a highly fragmented one and they have a wide range of competitors. They specifically named as their prime competitors: Alarm.com, Amazon, Apple, Crestron, Logitech, Savant, Sonos and Ubiquiti. Interestingly, they are partnered with some of these same competitors as their distributor, including Amazon, Sonos, and Ubiquiti.

What Differentiates Snap One?

The company points to two key factors that they feel differentiates them from their competitors. These differentiators are:

- End-to-End Product Ecosystem – A comprehensive assortment of “connected, infrastructure, entertainment and software solutions” for an exceptional experience for the end-user. This ecosystem includes:

- Proprietary Products and Software – A broad range of over 2,800 proprietary SKUs

- Third-Party Products – The company fills our their assortment by distributing an assortment that includes brands like Alphabet (Google), Amazon, KEF, Klipsch, Lutron, Samsung, Sony, Sonos, Ubiquiti and Yamaha

- Technology-Enabled Workflow Solutions – Using cloud and software based workflow tools, the company says it offers better support to integrators throughout their projects’ lifecycle

- Integrator Job Lifecycle Service and Support – Snap One offers a variety of support including training and certifications, online research, on-the-job technical help, and post installation support

- Cloud-Based Software – The company offers software tools like Control4 Composer for system configuration and OvrC for remote troubleshooting and support

- Omni-Channel Model – An e-commerce platform and 26 local branches for whatever style of operation integrators prefer

Snap One’s Growth Strategy

The company identified five tactics that they believe will offer them substantial growth in the near future. I list them below with a brief description drawn from the much more extensive text they provided.

Consistent Innovation with New Products, Software, and Solutions – Saying they are tight with their dealers, as well as glean product demand data from their cloud-systems, the company promises to continue to innovate and invest in their “product suite and software.”

Drive Wallet Share Gains with Existing Integrators – The company says that the average “spend” from their 16,000 dealers is $40,000/year with purchases across eight different product categories. But, they add, their top 10% of dealers spend a more robust $240,000 with them annually across 17 different product categories. And according to Frost & Sullivan, the average across all DIFM integrators in this country is $600,000. All of this suggests to Snap One management that they have a lot of room to grow their wallet share or share of the integrator’s business.

Grow Our Network of Integrators – Even though they already are doing business with 16,000 integrators, Snap One says that they will grow this network even larger. They will also target adjacent integration channels such as security integrators and commercial integrators. Perhaps their greatest opportunity is in international markets where the company currently has quite a low adoption rate outside of the U.S.

Efficiently Expand Software Solutions and Subscription-Based Revenue Models – They will try to get their OvrC software into more homes and create more programs for subscription-based monitoring and troubleshooting services.

Pursue Accretive Acquisitions – As I mentioned above, the company has had more than ten acquisitions in the last five years. This has caused a big increase in revenues, although at the cost of a big increase in debt as well. Still, they plan on pursuing more acquisitions – including more local distribution operations.

Risk Factors

The company offered a ton of Risk Factors to warn investors of. There were more in this document than I’ve ever seen before, but I want to highlight just three of them.

- “We currently rely on contract manufacturers” – I don’t care who you are or how big you are, when your source of supply is via contract manufacturing, that means you do not have total control of your products. Yes, many companies use CMs and there are some fine CM manufacturers out there. But this is a legitimate risk factor.

- “Our substantial indebtedness could materially adversely affect our financial condition” – This is clearly one of the biggest risk factors Snap One has. According to the filing, the company is carrying $670.9 million in term debt. In addition to this, they have another $60 million in a revolving credit facility of which about $5 million has been used. Of this total debt amount, a huge $637.8 million is due in 2024. That’s a big nut to crack…

- “We are controlled by Hellman & Friedman, whose interests may be different from the interests of other holders of our securities.” Hellman & Friedman will likely continue as the majority owners of Snap One after the IPO, and their people hold several seats on the Board of Directors. This means that outside investors in the aggregate will be minority owners. So H&F will call the shots as they see fit.

Acquisition Details

This S-1 registration included information on some of the more recent acquisitions by Snap One.

Access Networks – In May 2021, Snap One acquired ANLA, Inc., or Access Networks, a networking solutions provider. They paid $38.1 million for Access Networks and there is a provision for another $2.0 million “contingent consideration” based on the company achieving certain financial targets.

HCA Distributing – In February 2021, the company acquired HCA Distributing, a Rocky Mountain distribution company. They paid a remarkably low price of only $1,350,000 for substantially all of its assets.

Marketing Representatives, Inc. (MRI) – In March 2019, the company acquired MRI, a specialty distributor based in New England, for an all-cash deal valued at $9,260,000, net of cash of 201,000.

Custom Plus Distributing, Inc. (CPD) – In July of 2019, Snap One acquired CPD, a distributor in the Pacific Northwest, for a total consideration of $12.5 million, net of cash of $814,000.

Control4 Corporation – In August of 2019, the company acquired Control4 Corporation, one of the top control and home automation providers in the industry, for a significant $563 million, net of cash of $21.3 million

So How Did the Acquired Companies Perform for Snap One?

So just how did Snap One’s 2019 acquisitions work out? The company revealed their results based on the staggered time frame of when each of them was fully acquired and contributing to Snap One. Interestingly, only one of the three companies made money, and that was MRI up in New England. You can see the results in the table below.

| Company | Time Period | Net Sales | Net Income (Loss) |

| MRI | March 14, 2019 to December 27, 2019 | $26,854,000 | $825,000 |

| CPD | July 17, 2019 to December 27, 2019 | $15,693,000 | $(300,000) |

| Control4 | August 1, 2019 to December 27, 2019 | $108,377,000 | $(8,084,000) |

Does Bigger Automatically Mean Better?

Clearly, Snap One is making the calculation that bigger means better and they will take all means to continuously scale their business – adding more dealers, adding more categories, adding more products, adding more locations, and buying up more companies. But does bigger truly equal better?

That answer to that question will have to come from the integration community itself. For integrators, it can be a big risk to put all of their eggs into just one basket. And for Snap One, to take that strategy means that the company must be the best at everything that they do – a tall order that would strain the best resourced and managed companies in the world.

So far, the company has been successful at driving revenues up and will likely hit the $1 billion mark in 2021. But at the end of the day, can they drive continuously push to grow their revenues and margins – and at the same time maintain their product innovation and quality and their historically strong relationship with integrators. This is even a bigger question now that Snap One is driven by professional business managers…not the founding integrators.

That remains to be seen…

See more on Snap One by visiting: snapone.com.

Leave a Reply