Last week, Snap One Holdings Corp. (Nasdaq: SNPO) released its financial results for the second quarter of fiscal 2023, the 13-week period ending June 30, 2023. The company reported mixed results with a continuing sales decline but with a reduced net loss in the quarter.

See more on the SnapOne 2nd quarter fiscal ’23 report

This latest Snap One quarterly earnings report continued with the theme of sales declines and net losses, as had been established in the previous two quarterly reports. However, in this quarter, we saw a sequential improvement compared to the 1st quarter of fiscal 2023 and fourth quarter of fiscal 2022.

This result was not totally unexpected, as the company has previously identified troubling trends bedeviling its performance. Most notably, they have identified what they call a high level of existing “channel inventory” or an inventory build-up at their customers – the custom integrators across the country – as the biggest cause of the drop in new orders. They also admitted that many of their integrators purchased extra inventory to beat price increases that the company had previously implemented.

Heightened ‘Chanel Inventory’ is Major Culprit

According to Snap One, this heightened channel inventory was largely attributable to integrators previously elevating their inventory purchases in order to hold heightened levels to protect their business from the then-existing supply chain shortages and delivery issues. Snap One tended to not place the blame on slackening end-user demand, but integrators I’ve spoken with have raised this with me as consumers shifted from purchasing products for their homes to investing in experiences such as personal travel, vacations, eating out at restaurants, or taking world cruises – or other luxury experiences.

Because of these business challenges identified in the past quarters, Snap One had previously announced guidance for the investment community for its performance expectations for fiscal 2023. That guidance announced at the beginning of the fiscal 2023 year included an expected decline in net sales of a range of between $1.06 to $1.09 billion. That represents a decline of between -3% to -5.7% as compared to its final fiscal 2022 sales of $1.124 billion.

Snap One management announced that it was affirming this guidance again this quarter, so no changes were made.

2nd Quarter Fiscal ’23 Net Sales Decline -7.6% Due to ‘Inventory Destocking’

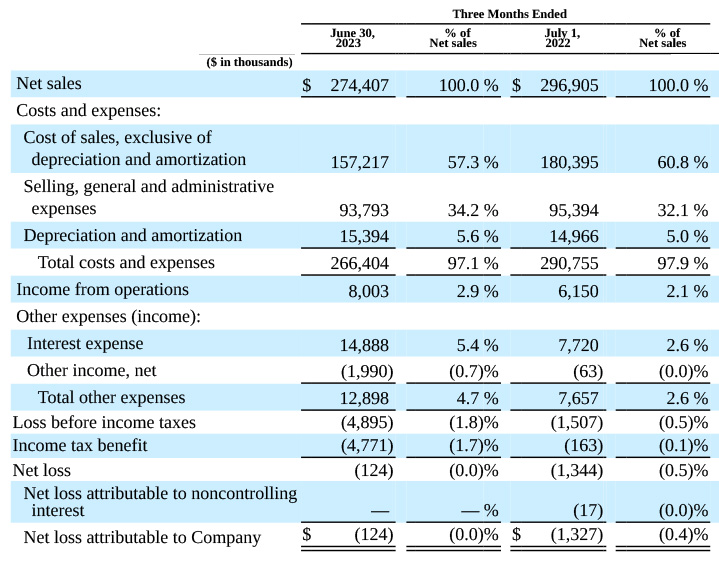

So let’s dig into Snap One’s report for the second quarter of fiscal 2023. Net sales in the quarter came in at $274.4 million, a decline of a not insignificant -$22.5 million or -7.6% as compared to sales of $296.9 million in the same quarter in fiscal 2022. The company said that the quarter definitely continued to be impacted by high levels of “channel inventory destocking” that was “as anticipated.”

Snap One reported a negligible net loss of -$0.1 million, a substantial improvement of +$1.2 million over the net loss of -$1.3 million it booked in the same quarter last year. CEO John Heyman touted the team’s efforts at cost control helping to improve profitability in a challenging macroeconomic environment.

John Heyman: Solid Results in Face of Destocking & Uncertain Macroeconomic Environment

Our team delivered another solid quarter of financial results in the face of channel partners destocking inventory and an uncertain macroeconomic environment. We believe that our differentiated solutions are enabling us to extend our leadership position within the industry and to drive market share gains for Snap One. During the quarter, we focused on driving higher adoption by our partners by introducing new products and related go-to-market initiatives. From a profitability perspective, we continued to drive supply chain efficiencies, as evidenced in this quarter’s results. Accordingly, we remain confident in our operating margin expansion expectations for the year.

John Heyman, Snap One CEO

Heyman, as you can probably tell from his quote above, remained his usual optimistic self. He even suggested that even though the company experienced a -7.6% decline in sales, they were likely growing their share of the market. In a conference call with financial analysts, Heyman and CFO Michael Carlet said they have surveyed their “channel partners” (integrators) and had calculated how much excess inventory there was in the channel overall…and how much had been destocked in the quarter.

Snap One CFO – Ex-‘Destocking’ Our Sales Actually Grew

Carlet told analysts, “After adjusting for our estimates of the channel inventory destocking impact, we believe we delivered year-over-year net sales growth of approximately 8% in the second quarter.”

Carlet didn’t show his work, so I have no idea of how legitimate this claim is – or exactly what formula or numbers he used to arrive at his conclusion. But you could say I’m highly skeptical. However, it is true that this 2nd quarter report is materially improved over the company’s first fiscal quarter.

Other Results of Note

Selling, General, and Administrative Expenses (SG&A) – SG&A expenses declined in dollars to $93.8 million, down -1.7% as compared to SG&A expenses of $95.4 million in the same quarter a year ago. However, these expenses actually increased as a share of revenue from 32.1% in fiscal 2022 to 34.2% in the quarter this year. The reason for this is that they did not decline as much as sales did, and there was also an increased interest expense.

Adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) – Like many public companies, Snap One relies on reporting various non-GAAP (Generally Accepted Accounting Principles) results. Non-GAAP results are where the company creates a special formula to modify a number in a way they believe is more of an accurate picture of their results. I am generally not a fan of such analyses. In any event, the company says the Adjusted EBITDA, a form of profit measurement, was $31.7 million or flat when compared to Adjusted EBITDA of $31.7 million in the same quarter the previous year.

Adjusted Net Income – Yet another non-GAAP calculation by the company, came in at $14.3 million, down -13.3% or -$2.2 million below the Adjusted Net Income of $16.5 million in the 2nd quarter of fiscal 2022. Remember, the company reported a +$1.2 million reduction or improvement in GAAP net loss. That’s the thing about “adjusted” numbers – sometimes they work for you, and sometimes they work against you. They would have been better off sticking with their GAAP net loss profit improvement.

Interest Expense – One line item that caught my attention was Interest Expense. In the second quarter of fiscal 2022, interest expense was $7.7 million. But that has ballooned to $14.9 million this year. That is an expense increase of +$7.2 million or +92.8%. The company says that the reason for this increase is that there were “higher average outstanding balances on our long-term debt and our Revolving Credit Facility as well as a higher interest rate on our long-term debt” as compared to what existed in the quarter last year. That almost doubling in interest expense is a red flag.

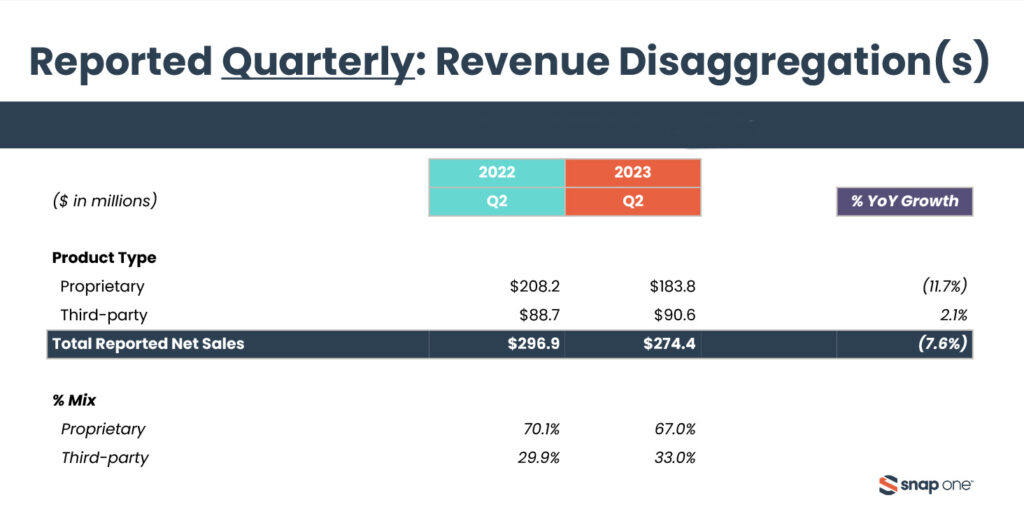

Negative Product Mix Trend – For a few quarters now, Snap One has been providing more detailed revenue disaggregation information, breaking out their sales numbers in important ways. This includes a breakdown between sales of Proprietary products (products designed, manufactured, and distributed under company-owned brands) and Third-Party products (products distributed for other companies’ brands). This is a meaningful comparison because the company has admitted they make more money when they sell their own products.

Once again, we see a negative trend that emerged a few quarters ago, where Snap One propriety brands are losing sales momentum compared to third-party brands. In the 2nd quarter of fiscal 2023, propriety products sales came in at $183.8 million which was down -$24.4 million or off -11.7% as compared to sales of $208.2 million in the category in the same quarter last year. Meanwhile, sales of third-party products were at $90.6 million, +$1.9 million or +2.1% over the sales of $88.7 million in the 2nd quarter of fiscal 2022. That means the mix of sales is now down to 67.0% proprietary this year versus 70.1% last year, and up to 33.0% in third-party this year versus 29.9% last year.

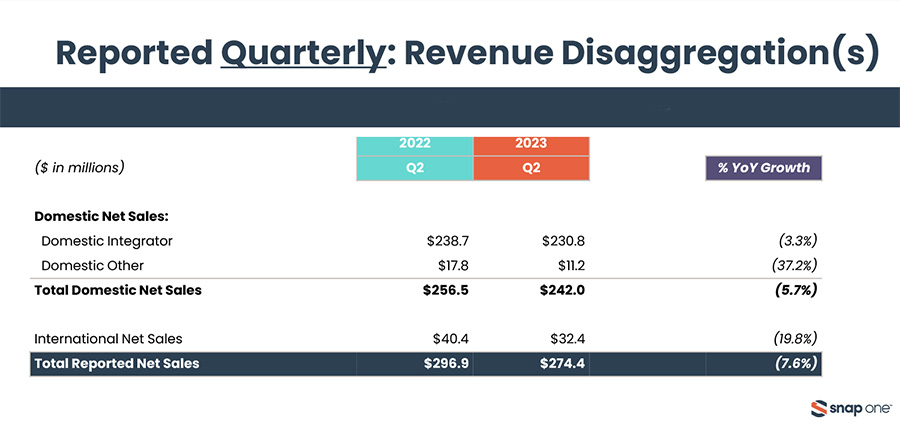

Sales by Geography – Another breakdown or disaggregation of overall sales figures is by geography. This data shared by the company was unexpectedly revealing. According to this latest breakdown, domestic integrator business in the 2nd quarter of fiscal ’23 came in at $230.8 million, down -$7.9 million or -3.3% as compared to domestic integrator sales of $238.7 in the same quarter last year.

But here is something interesting – the company shows the results for something called “Domestic Other.” What is that? According to Snap One’s Form 10-Q filing: “Domestic other is defined as Access Networks revenue and revenue generated through managed transactions with non-integrator customers, such as national accounts.” Domestic Other sales came in at $11.2 million in the second quarter of this year. That was a decline of fully -$6.6 million or -37.2% compared to sales of $17.8 million in the same quarter a year ago. Ouch! Access Networks is a relatively new acquisition by Snap One (acquired in mid-2021) but this is an unexpected slip in their results.

International Sales – The company has previously mentioned its approach to the international market as a significant opportunity for the company. However, in this report, we see that while overall sales were off by -7.6%, International Sales were off -9.9% coming in at $32.4 million in the quarter this year, off -$8 million as compared to sales of $40.4 million in the same quarter last year.

In Conclusion

In a conference call with investment analysts, Snap One made a couple of what I would call dubious points. For example, Heyman at one point declared to analysts while their net sales are down, “We’re winning share.” This suggests that other comparable companies’ sales are down more, but I have not seen data that confirms that.

Also, the company executives told analysts that the company is “growing adoption with new proprietary products. Yet, as I point out above, proprietary products are dropping as a share of their business. Somehow, it seems as if these claims are accurate, we should be able to see that reflected in their numbers. Perhaps they are suggesting that the numbers could have been even worse?

From Destocking to Restocking…Soon (Hopefully)

However, Snap One says they are close to turning the corner on the whole excess channel inventory situation which means the whole “destocking” scenario – where dealers are using inventory out of their warehouses for projects – should begin declining. That would be a significant turning point for the company.

It should also help drive more consistent net sales increases as integrators begin buying new inventory to support their project pipelines now that their warehouses are empty and the supply chain – while not perfect – is much better than it was before. Still, we’re not out of the macroeconomic headwinds yet, although things there (like lower inflation and increasing consumer confidence) are improving as well.

Learn more about Snap One by visiting snapone.com.

Leave a Reply