Snap One Holdings Corp. (NASDAQ: SNPO) announced the results of their fiscal second quarter, the period that ended June 25, 2021. This is the first official report to investors for the newly public company, and Snap One executives were excited to talk about all the positive milestones they achieved in the quarter – first and foremost, launching a successful public offering. Aside from a technical glitch in their conference call with analysts, it was all good news from the company.

See more details on the Snap One quarterly report

Snap One Chief Executive Officer (CEO) John Heyman shared the presentation duties with Chief Financial Officer (CFO) Mike Carlet. Heyman touched on a few key numbers but mostly talked about the company’s operational successes and go-forward strategy. Carlet did a deeper dive into the data behind the numbers and fielded most of the questions on a conference call with financial analysts.

The mood of the presentation was upbeat, as these things tend to be. The company managers clearly felt confident in their results. Snap One benefits from being early in their cycle and performance issues tend to become more challenging when the company begins to annualized their previous numbers. But for now, it’s mostly good news for Snap One.

Key Milestones Achieved in the Second Quarter

The presentation started with a review of key milestones accomplished in the quarter, including:

- July (technically after the quarter) – Successfully completed an initial public offering, selling a little over 15 million shares of common stock at $18 per share. This generated $270 million before various offering expenses and commissions. Most of this amount, around $216 million was used to pay down a term loan, while the rest will be retained for general corporate purposes.

- June – Successfully rebranded the company as Snap One

- June – Received a #1 or #2 position 36 times in 62 categories in the CE Pro 100 Brand Analysis Awards. Also won several Quest for Quality awards.

- June – Upgraded the Control4 OS 3.2.2 for full support of OvrC remote management

- May – Acquired Access Networks

- April – Acquired HCA Distributing

At Snap One our mission is to bring together the best people, partners, and products to make lives more enjoyable, connected, and secure. Today, we are well positioned to provide professional integrators with the leading products, software platforms and technology-enabled workflow solutions to successfully serve their customers and operate their businesses.”

John Heyman, Snap One CEO

Heyman then took several minutes to review the history of the company, realizing that most investment analysts were likely not familiar with the company’s background. I won’t go through all of that here, as most Strata-gee readers are already familiar with Snap One’s background as SnapAV. However, even for analysts, this was likely not entirely necessary, as their S-1 registration included a lot of background information. I guarantee you, these analysts have read that S-1 cover to cover.

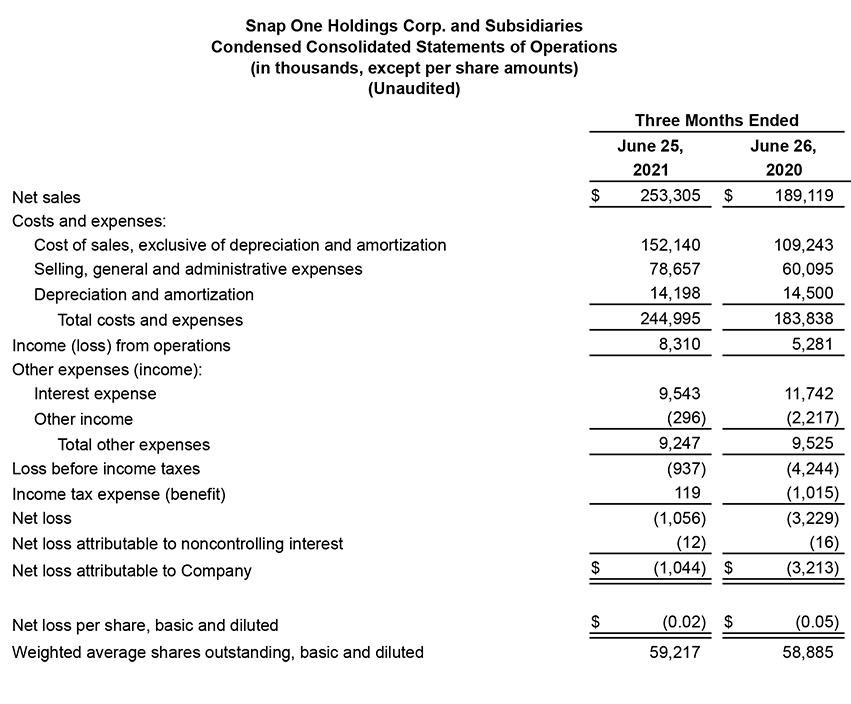

Positive Main Results: Sales Up, Losses Down

From here, Heyman turned to some key numbers. The company saw sales grow 34% to come in at $253 million, well over the $189.1 million in the same quarter the previous year. Much of this growth was driven by the impact of COVID which motivated consumers to upgrade their home systems and networks for 24×7 work-from-home, entertain-at-home, and learn-from-home environments during the pandemic. Sales were somewhat mitigated by supply chain issues, which the company says continues to impact their Q3 business as well.

Snap One booked a net loss of $1.1 million for the quarter, a 67% decrease from the $3.2 million they lost in the second quarter of the last year.

The company said it experienced growth across all product categories, geographic regions, and markets, whether proprietary brands or third-party brands they distribute. The company reminded analysts that their business was negatively impacted during the first half of 2020 as COVID was first rolling out. So the growth in the quarter this year benefits from an easy comparison versus last year’s unusually depressed numbers.

A Red Flag Warning Sign Did Emerge

One red flag warning sign did show up in Snap One’s numbers, however. Remember, sales increased 34%, that’s pretty darn good. But the cost of sales also increased – by a bigger 39%…and that’s not good. Why? Dum-de-dum-dum…cost of sales has been impacted by supply chain issues, including increased costs passed through from suppliers and higher inbound freight costs. And as I noted above, they warned analysts that these supply chain issues are still dogging them – and the entire industry for that matter – as they move into the third quarter.

So what does Snap One think the rest of 2021 holds for them? In a nutshell, they are optimistic. The company is offering guidance – which is their best estimate for how the year will work out. CFO Carlet told analysts in a conference call that the company expects its fiscal year ending on December 31, 2021 (with an extra 53rd week this year) to show sales of between $985 million – to – $1.0 billion, which represents an annual growth rate of between 21.0%-22.8%.

Did You Catch a Problem with the Guidance?

Did you catch something there with that guidance? The analysts did almost immediately. Sales in Q2 grew by 34%, but for the year, they only anticipate 21% or 22% growth. This means they must be expecting growth to slow in the back half of the year. But why?

You are very clever to catch that! And the answer from the Snap One CFO is, “So it’s a little bit murky out there…we saw supply chain challenges accelerate towards the end of the second quarter, and we’re still seeing those today.” He went on to say that they are concerned about the logistical supply chain challenges and because of this, they are a bit cautious going into the second half.

Closing Remarks by a Thankful Heyman

With that, Heyman closed out the call by giving thanks to three groups: 1) Snap One’s dedicated employees, 2) Their network of 16,000 integrators, and 3) to all Snap One investors.

Learn more about Snap One by visiting: snapone.com.

Leave a Reply