Red Flags: Residential Market is ‘Softening’; Consumers are ‘Cautious’; Channel Inventory ‘Destocking’

Snap One Holdings Corp. (NASDAQ: SNPO) released their fiscal 2022 fourth quarter and full-year results after the close of the market on Tuesday and held a conference call for investment analysts shortly afterward with more details. The company produced a prodigious amount of data that they suggest shows success in the face of adversity, and forecast a decline in their performance in fiscal 2023.

They also said the industry slowed down in 2022 and will continue to be slow for the first three quarters of 2023.

See more on the latest Snap One earnings report and forecast

Fiscal 2022, Snap One CEO John Heyman suggested, was “a year largely defined by global market uncertainty.” It was a sobering way to begin his prepared statement that accompanied their formal report of the company’s fourth quarter and full-year results. But it was also the beginning of a clear-eyed assessment of a company, and industrywide, residential AV-segment slowdown as a result of integrators stocking up in early 2022 to beat price increases and to protect themselves from component outages due to supply chain issues – only then to slow back half purchases as they drew down their inventory.

And that negative situation will continue into 2023, Snap One management says.

‘Normalization’ Won’t Begin to Arrive Until the Second Half of 2023

The company’s analysis of fiscal 2022 was full of glowing praise for their team who, in spite of this uncertainty, were able to deliver positive results in 2022. But there was no mistaking the seriousness of the expectation for a continued slowdown in the first three quarters of 2023. The company does not expect to see results begin to normalize until the third quarter at the earliest – with full normalization to be achieved in the last quarter of the year.

This means that for Snap One, and by extension the industry, 2023 is going to be another tough year. So let’s dig into the numbers, shall we?

Q4 Net Sales Declined; What About Organic Results?

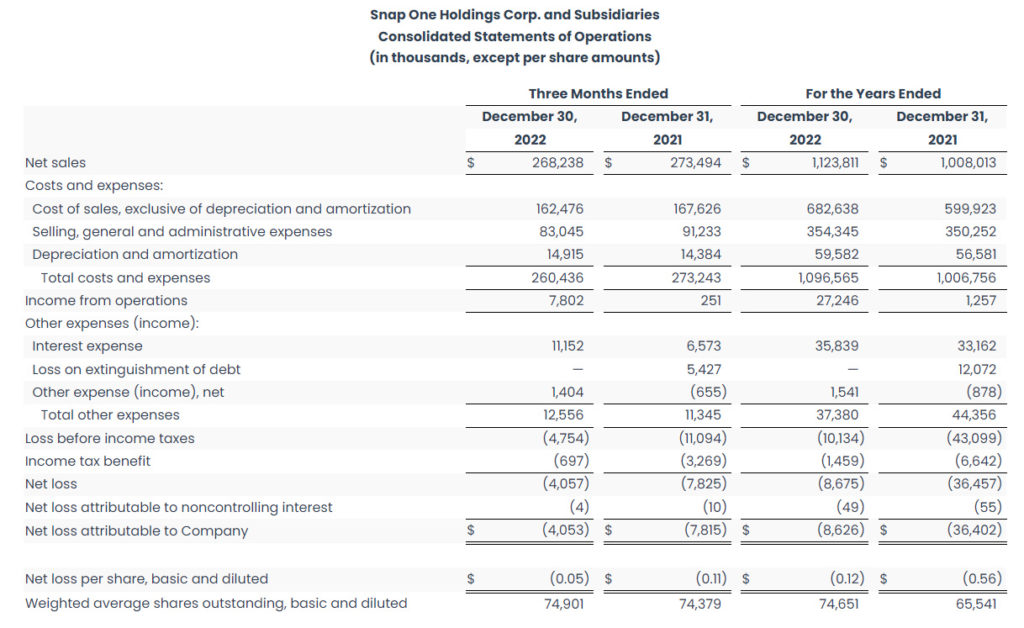

In the fourth quarter of fiscal 2022, net sales declined to $268.2 million or -1.9% compared to revenues of $273.5 million in the fourth quarter of fiscal 2021. Snap One likes to note that in fiscal 2021, Q4 had one additional week – disregard the sales for that extra week in ’21 and their net sales actually increased by 5% they say. Maybe…but if you want to be really fair in that judgment, you should provide an “organic” analysis that strips out new sources of revenue in this year’s numbers that weren’t there last year. I suspect that would be a very interesting analysis.

Why? Because in 2022, the company opened a total of eight new “branches” (warehouse locations) and acquired two new Canadian branches (through the acquisition of Canadian distributor Staub). Snap One also acquired Clare Controls and Parasol in fiscal 2022. So all of these ten new sales outlets and two new brands contributed to their net sales results in 2022, but not in 2021. We can’t get a true sense of the success of their continuing operations without an apples-to-apples organic analysis. If you’re going to take out that extra week from 2021, then take out all of those new sales contributions in ’22 that weren’t in the numbers in 2021.

Q4 Net Loss Improved, But Analysts are Looking for Profit

Anyway, in the fourth quarter of ’22, net losses decreased (improved) to -$4.1 million, 48.1% better than the loss in the fourth quarter ’21 of -$7.8 million. Yes, I get it. A reduced loss is a better result – but the fact is that many analysts had expected Snap One to be profitable in 2022…and they still haven’t gotten there yet.

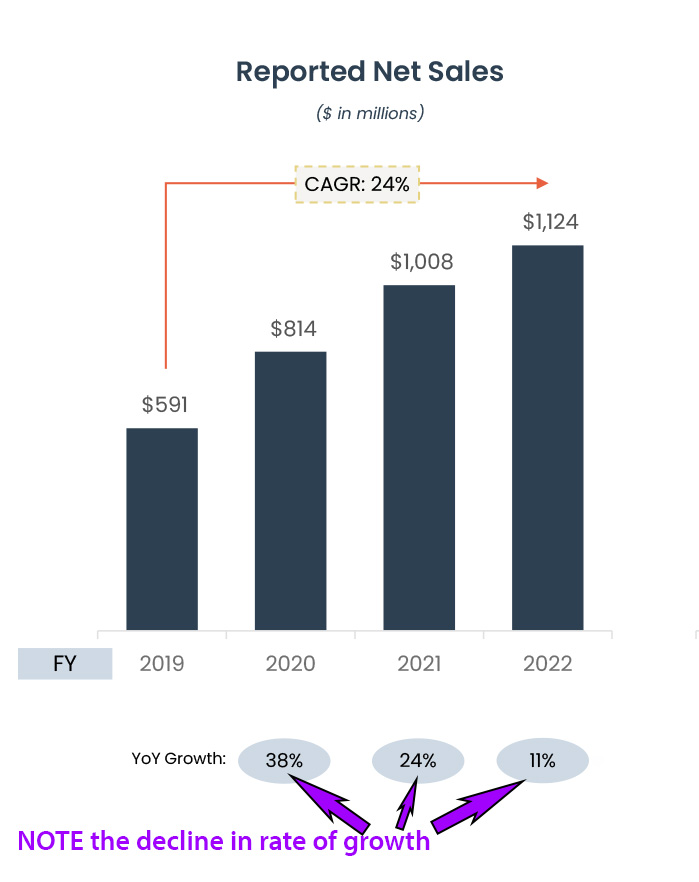

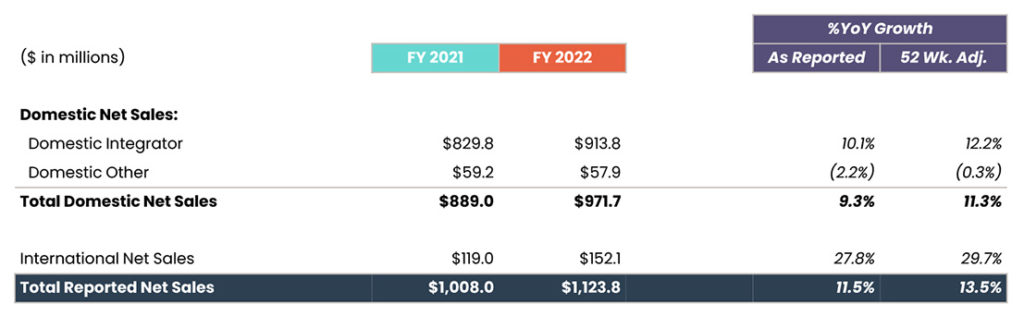

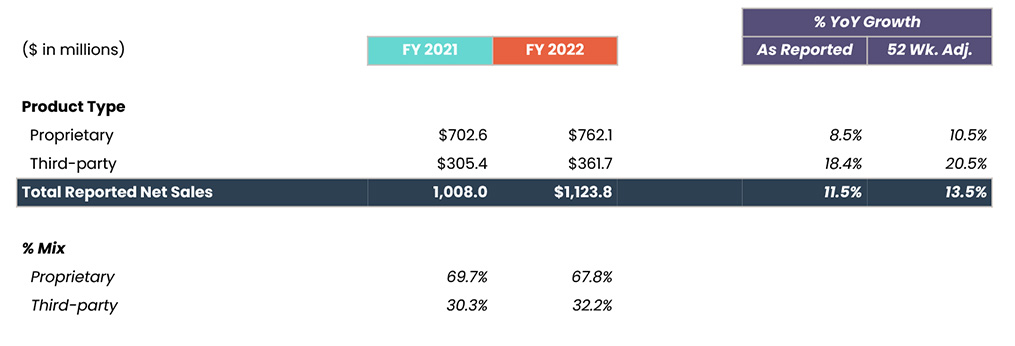

For their fiscal 2022 full-year results, the company had net sales of $1.124 billion, an 11.5% increase over net sales of $1.008 billion in fiscal 2021. That sales gain jumps to +13.5% over fiscal 2021 if you want to take out 2021’s extra week…which I don’t.

Full Year Net Loss Improved as Well; Is There a Path to Profit?

As we saw in the quarterly results, the company also reduced its net losses in fiscal ’22 full year results, coming in at -$8.7 million or way less than the net loss of -$36.5 million in fiscal ’21.

In a year largely defined by global market uncertainty, our team’s steadfast commitment to our growth strategy delivered positive results in 2022. After a resilient fourth quarter, we closed 2022 with $1.124 billion of net sales, $8.7 million of net loss and $114.1 million of adjusted EBITDA, representing 11.5%, 76.2% and 3.0% year-over-year improvement, respectively. During the year our team successfully navigated inflationary and supply chain challenges, made significant investments into our product offerings and services capabilities, expanded our distribution presence both domestically and internationally, and continued to position the company for sustained long-term growth.

John Heyman, Snap One CEO

As long-time readers of Strata-gee know, I am not a fan of “adjusted” results. That’s why, although there are many adjusted numbers in the Snap One report, you don’t see many of them here.

‘Adjusted’ EBITDA

As there is no set formula for adjusted numbers, companies devise their own calculations that best serve their purposes – usually to make results look better than they truly were. While this is a popular game played by many – if not most – publicly traded companies, I believe in GAAP (generally accepted accounting principles) which levels the playing field and allows for real neutral comparisons to be made.

But, unfortunately, I can’t escape it here to give you a full report. So one popular measure of profitability is EBITDA (pronounced ee BIT’ dah) which stands for Earnings Before Interest, Tax, Depreciation, and Amortization. Snap One uses an “adjusted EBITDA” – again a non-GAAP formulation – both in their performance reporting…and in their forward guidance.

In fiscal 2022, Snap One reported an adjusted EBITDA of $114.1 million, up 3% as compared to an adjusted EBITDA of $110.8 million in fiscal 2021. See, doesn’t that sound so much better than the GAAP-defined actual net loss of -$8.7 million?

Snap One Remains ‘Cautious’ Due to ‘Lingering Headwinds’

Based on what the company experienced in 2022, Heyman said in their prepared statement that when looking at their anticipated performance for fiscal 2023, “…we believe that it is prudent to acknowledge and adjust to economic conditions, and we remain cautious of lingering headwinds in an uncertain global economy.”

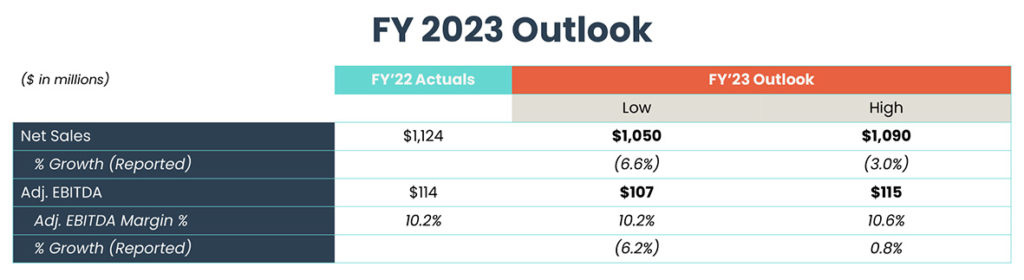

With that, he dropped the boom – Snap One will see revenue and profit declines in 2023. One thing that Wall Street takes seriously is companies issuing negative forecasts – and that is just what Snap One did. Here is their forward guidance for fiscal 2023:

That Sinking Feeling

As you can see, the company expects to have net sales decline in 2023 anywhere between -3.0% to -6.6% from last year’s $1.124 billion to between $1.050-to-$1.090 billion this year. Most analysts, when provided a range of results, simply use the midpoint in their analysis. So in this case, analysts expect this year’s $1.124 billion of revenues to drop to $1.09 billion – a -4.8% decline.

And, as compared to last year’s adjusted EBITDA of $114 million, the company has set a range from up $1 million ($115 million) to down $7 million ($107 million) for 2023 – or from essentially flat +0.8%…to down -6.2%. Again, assuming the midpoint – analysts will put their adjusted earnings projection at $111 million or down -2.63%. And although the company does not provide net income projections, it’s looking much like another year of losses for Snap One.

Disaggregation Data

As they started last year, Snap One now shares more data disaggregating their totals for greater clarity on their business. In Fiscal 2021, the company says it was doing business with 20 thousand domestic integrators, each of whom purchased an average of $41,500 in the year. This year, the company says it is now doing business with 20,100 integrators, each of whom purchases an average of $45,500 in gear from the company. This means the company increased its number of customers by a slim 0.5% and their “spend” by 9.6%.

The company also disaggregates its business between proprietary products and third-party product sales. Proprietary products are those products designed, manufactured, and sold under a proprietary Snap One brand. Third-party products are items from other brands distributed through the Snap One distribution system. As you might suspect, the company earns a higher profit on its own proprietary products than they do on third-party products.

Lower Margin Third-Party Products Grow Share Against Snap One Brands

So it is a continuing challenge that the share of their business is increasing at a greater pace on lower margin third-party products as compared with their proprietary brands. While sales in both categories of products grew in fiscal 2022, proprietary products grew 8.5% while third-party products grew 18.4% – more than double the pace of their in-house brands. This trend results in a margin depression, and I would argue should be a red flag for the company, and I suspect it is.

The conference call with analysts discussing their Q4 and full-year results for 2022 was a full one-hour long event – a bit unusual compared to others I’ve been on. On this call, CEO John Heyman and CFO Michael Carlet were pretty direct and fairly sanguine in their response to some really good questions from some major analysts.

Managers Were Sanguine in Conference Call with Analysts

Here is a compendium of major points made during the call with analysts:

>On How Snap One Will Grow – “Our growth algorithm is simple – continue to attract more integrator partners and capture more of their spend by building new products and driving adoption of our ecosystems. This formula will drive our growth over the next decade, and we will remain focused on executing this strategy while managing through the near-term uncertainty.” John Heyman

>On How Integrators’ Inventory Levels Impacted Business – In past conference calls, Heyman admitted that previous price increases by the company incentivized integrators to buy heavily to beat the price increase and to carry inventory so they were sure to have what they needed for upcoming installations in the face of industrywide supply chain issues. This front-loaded 2022 and caused a slowdown in the back half. He reminded analysts: “While the industry continues to reduce inventory levels in the channel, we saw integrator partner activity remain steady through Q4 as they worked against healthy backlogs in their own businesses. The channel inventory buildup helped sales in the first half of 2022, but has been a continuing headwind for us since then as integrators deplete inventory.” Heyman referred to this concept as integrators’ “destocking.”

The State of the Residential CI Channel

>On the State of the Residential CI Market and Consumers – “As to the economy and its impact on our business, as we discussed last quarter, we saw some softening around our residential end market resulting in lower sales volumes relative to the first half of ’22. We continue to see signs of end-consumer cautiousness and elevated levels of channel inventory, which impacted our integrator partners’ purchasing habits.” John Heyman

>On How Snap One Quietly Used OvrC Data Analysis to Track Integrator Installation Times – “Since our last call, we have leveraged our OvrC software to see when products purchased by the integrator are actually put into service. With the benefit of this added visibility, we now believe inventory in the channel peaked towards the end of Q2 of ’22 but [at a level] well above the high end of the range we’ve previously communicated. Since then, we have seen strong signs of destocking across the channel and expect to reach a normalized state in the second half of ’23.” John Heyman

Changes Snap One Made Due to Challenging Economy

>Adjustments to Operations ‘Given the Uncertain Macro Backdrop’ – Heyman told analysts that the company has proactively taken steps to adjust its operating plan. Here’s what he’s told analysts the company has done recently: “Number ONE, we’re eliminating inefficiencies in the business from the COVID time period. As input costs, freight rates, and other supply chain factors normalize, we are driving an improvement in our contribution margin rate. TWO, we expect more research and development efficiency by not having to redesign products in response to componentry availability challenges. THREE, we completed a strategic repositioning of our sales force to increase integrator partner coverage and identified other areas of efficiency in the business. And FOUR, we’re being diligent with costs in our business, ranging from warehouse operation consolidation to reducing travel expenses.” John Heyman

>‘A Strategic Repositioning of our Sales Force’ Means Layoffs – Note that item three above refers to staff layoffs that Strata-gee told readers about back in January. At the time, the company declined to comment on my report, but now they’ve revealed it to analysts. The company says that the workforce reduction was about 3% of their total staffing in the first quarter of 2023.

A Contraction in Home AV

>In Answering an Analyst Question About Slow Growth in Integrator Base (only 100 added in 2022) – “When we think about growth, we continue to see good growth in security and commercial. We actually saw a little bit of contraction in the home AV side of the transacting integrator accounts… As we think about next year (2023), we’re prioritizing our share of wallet and growing our sales with our existing partners. We’re certainly not giving up on adding more tiers. In fact, just given the normal churn in the business…we know that we need to add over 1,000 integrators just to stay flat.” But for 2023, “…we’re expecting integrator count to be relatively flat…” Michael Carlet

What Did Wall Street Think?

The bottom line, Snap One is predicting a tough 2023 for both the industry and the company. Their current model suggests a decline in Q1, a decline in Q2, a slightly down-to-flat Q3, and a slightly up Q4. Of course, this depends on the changing and challenging macroeconomic environment as well.

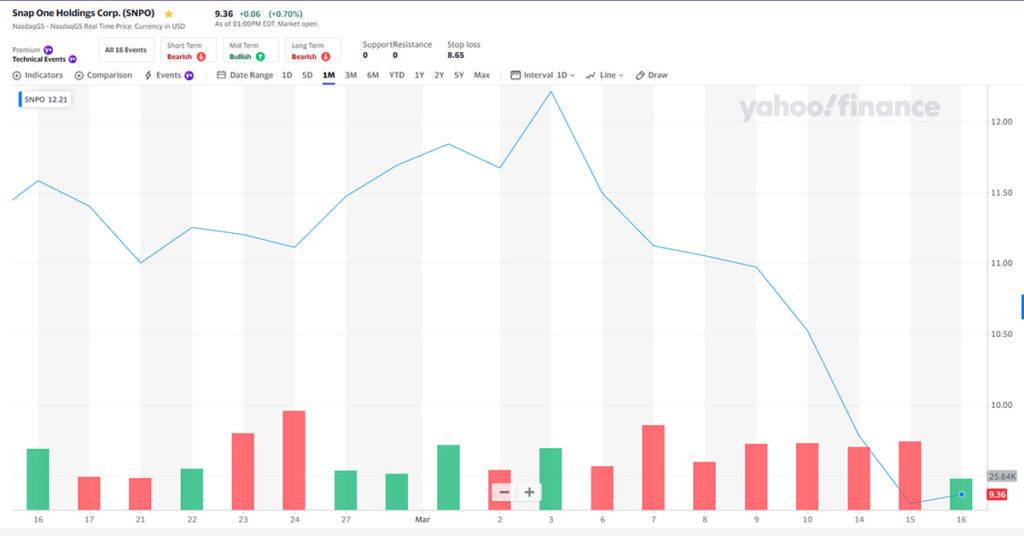

What did Wall Street think of Snap One’s report? Well on a day when the Nasdaq average increased slightly, the value of Snap One shares dropped on Wednesday by almost 5% to close at $9.30 per share. On March 3rd, shares of Snap One were valued at $12.21/share.

Snap One’s Report Matches What I’ve Been Hearing

This report by Snap One jives with what I’ve been hearing across the industry. Integrators have told me their pipelines are thinning and manufacturers tell me they are noticing slowing demand. This may all be part of the post-pandemic adjustment period.

Learn more about Snap One by visiting snapone.com.

Spot on your analysis.