Credit rating agency Moody’s Investors Service has downgraded the credit rating of Wirepath LLC (corporate name of SnapAV) from B2 to B3 in the wake of their announced acquisition of Control4. The primary reason for the downgrade is due to the fact that SnapAV will be forced to increase their debt by an additional $390 million to a new high of $683 million in order to close on this acquisition.

See more on SnapAV’s credit downgrade…

Moody’s was clear in their thinking about the impact of this transaction on SnapAV’s financial status – not only reducing the company’s credit rating, but also downgrading their “Probability of Default Rating” to B3-PD from B2-PD. Downgrading the Probability of Default rating, means that there is a increased possibility of default. The outlook, Moody’s says, “remains stable.”

Moody’s noted that the proceeds from this new debt issuance, along with balance sheet cash, and an additional $247 million of new equity from private equity owner Hillman and Friedman will all be combined to fund SnapAV’s acquisition of Control4. Even so, this acquisition will represent a meaningful increase in SnapAV’s debt-to-EBITDA leverage. It will also weaken their cash flow relative to debt, the credit agency added.

[Note: EBITDA stands for earnings before interest, tax, depreciation, and amortization. It is a common measurement of a company’s profitability.]

What Does Moody’s Rating Downgrade Mean?

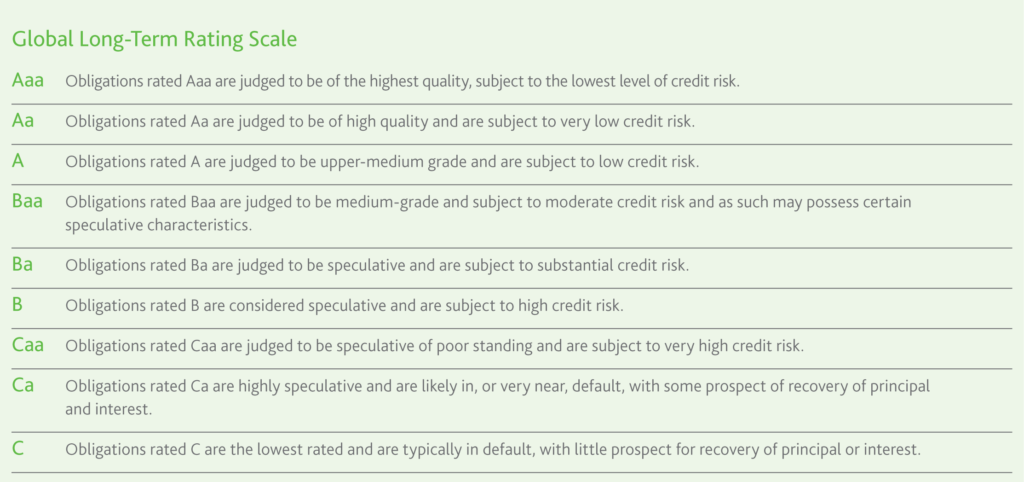

Moody’s Investors Service maintains a scale of creditworthiness with nine levels or steps that run from Aaa on the top end (“the highest quality” with “the lowest level of credit risk”)…to C at the bottom (“the lowest rated” of companies that are “typically in default, with little prospect for recovery…”). Within each of these steps, the agency offers three additional levels – given as a simple 1, 2, 3 – to suggest whether a company is at the top of that rating (1), in the middle of that rating (2), or at the bottom of that rating (3).

Much of this is related to the corporate bonds big companies issue to fund their operations with investors who, in essence, loan them money…and to whom the company pays interest. “Investment grade” bonds, are those from the best, most reliable and stable companies, which often offer relatively low interest payments because your investment is safer. Lower grade bonds typically offer a higher interest rate for the use of your money, because they carry a higher risk.

What’s Below ‘Investment Grade?’

Investment grade runs from Aaa to Baa. Levels below Baa is considered “speculative” and carry higher risk that you may not get your money back. Some in the investment game call these below-investment-grade bonds “junk” bonds. SnapAV, with a B3 credit rating, is in this category.

“SnapAV’s B3 CFR [corporate family rating] broadly reflects the company’s high debt-to-EBITDA leverage of about 7x and modest free cash flow to debt of about 1.8% based on March 31, 2019 LTM [last twelve months] results (pro forma for the company’s acquisition of Control4)… Though Moody’s expects SnapAV to continue to realize mid-to-high single digit organic revenue growth rates with EBITDA margins in the 15% range, cash flow generation is expected to be only modest as the company incurs expenses associated with integrating and restructuring certain functions of the combined SnapAV and Control4 businesses, as well as incremental interest expense.”

“Moody’s downgrades SnapAV to B3, outlook stable” report from Moody’s Investors Service

How Bad is a Debt-to-Earnings Ratio of 7x?

Note that Moody’s mentions first and foremost that SnapAV’s debt-to-EBITDA ratio is at a 7x. This means that they are carrying 7 times their earnings in debt. But what does that mean? You can get a sense that Moody’s calling them out on this 7x leverage means it is bad…but how bad?

“A high ratio of net debt to EBITDA reveals a company that’s deep in debt. It will have a lower credit rating and be forced to offer higher yields on bonds. Generally, a ratio of 4 or higher is considered too high, though the benchmarks of specific industries should be weighed, as well.”

Investopedia

We Find Out Just How Big SnapAV Really Is

The emphasis indicated in the quote above by the bold text was in the original quote. Investopedia says a 4x debt-t-EBITDA level is “too high.” SnapAV’s is almost double that amount at 7x leverage. It’s kind gof like someone who earns $100,000 a year carrying $700,000 in credit card debt. Believe me, anyone finding themselves in that situation would be in deep trouble with that much debt.

From the Moody’s announcement, we learn quite a bit we didn’t know before. For example, I have heard much speculation from many in the industry about just how much business SnapAV is actually doing. Now we know. According to the Moody’s document, SnapAV had revenues of $748 million in the last twelve months. This means if they are successful in acquiring Control4, the new company will have a combined revenue of over $1 billion.

Moody’s says they’ve taken SnapAV’s status into consideration as part of their analysis, noting “SnapAV’s strong market presence and the enhancement of scale, global distribution and market share that the acquisition of Control4 will provide.” The credit agency also let it be known that they understand SnapAV’s unique business model, which they say was mostly designed to take retailers out of the equation.

“SnapAV’s direct-to-integrator sales model is designed to eliminate the risk of intermediation by lower-cost retail providers by replacing traditional design, manufacturing, and distribution roles with a fully integrated platform based on a highly efficient e-commerce platform. The company’s distribution infrastructure allows a degree of price protection for customers, who are able to realize stronger margins as a result of being a member of the SnapAV network.”

Moody’s Investors Service announcement

Not Even SnapAV is Impervious to Outside Influences

Still, as good as this model may (or may not) be, Moody’s doesn’t see it as impervious to impact from outside influences. “While this model provides for a strong base of repeat business with professional installers, Moody’s believes that the overall market for high-end home electronics is susceptible to macroeconomic swings in the form of housing market strength and consumer discretionary spend. SnapAV also faces competition from other producers of control systems (such as Crestron and Savant), electronics OEMs, big box electronics retailers, the small number of integrators who are not part of its network, and, to a lesser extent, technologically inclined homeowners.”

There are some tough words there by Moody’s. Yet, the credit agency’s outlook for SnapAV – even in the face of this downgrade – was listed as “remains stable.” Why? They explained this rating as well, saying that their expectation is that SnapAV will continue to experience “strong rates of revenue growth” with “wallet share growth” in its existing market, an increase in its “distribution capabilities,” and that it will begin to “cross sell products” in both of Control4/SnapAV markets.

What If Things Don’t Turn Out ‘Rosy’?

If all of this rosy outlook happens, then debt pressures could begin to subside over the next twelve to eighteen month time period, resulting in upgrades to their credit down the road. But what if they don’t?

“The ratings could be downgraded” Moody’s added.

Leave a Reply