On Tuesday, Sonos, Inc. [Nasdaq: SONO] reported its first quarter, fiscal 2024 results for the period that ended December 30, 2023. While the actual numbers were a bit of a mixed bag with revenues down – even though the company embarked on a strong holiday promotional push – the company booked strong gross profit improvements and generated more cash beating Wall Street estimates. This resulted in a big jump in its share price on the next trading day.

See more on the performance of Sonos in Q1 of fiscal 2024

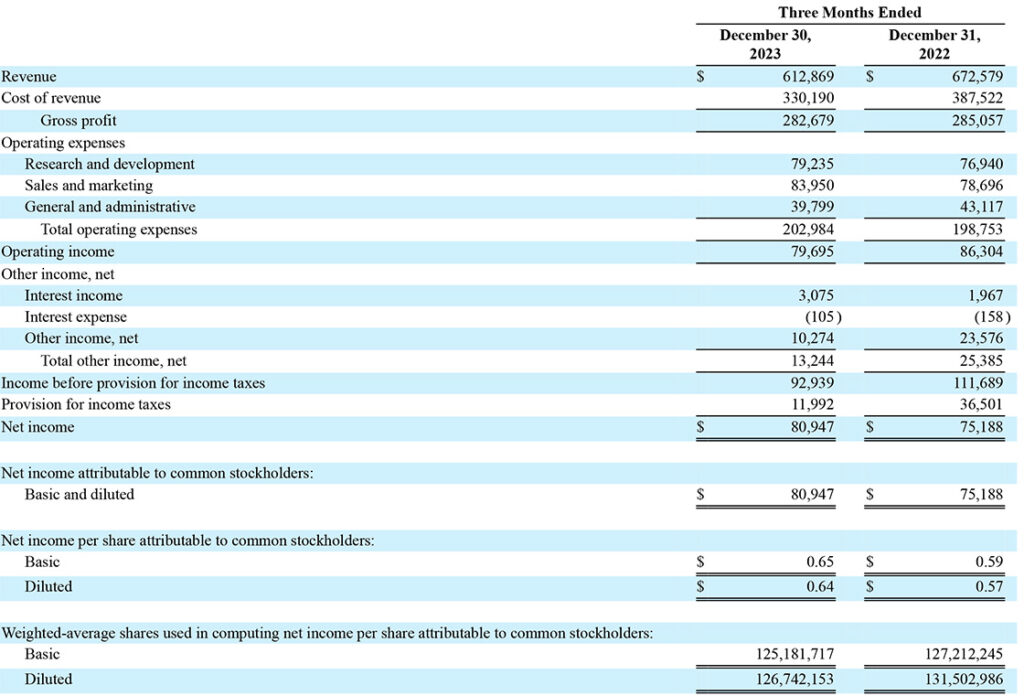

A leading consumer electronics brand, Sonos has for several quarters been reporting soft consumer demand and negative YoY sales comparisons period by period. Once again, the company struggled with sales, even in the face of investing in a greater marketing spend to goose holiday sales. The company said their marketing efforts helped, but overall sales in the quarter were $612.9 million, a decline of $59.7 million or down 8.9% as compared to sales of $672.6 million in the same quarter the previous year.

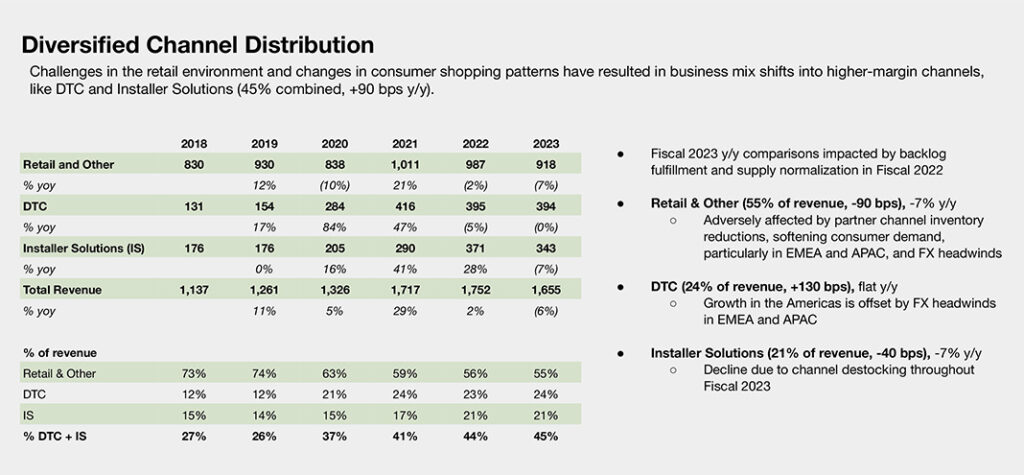

This quarter, however, they did not at first attribute the decline to softening consumer demand – at least not directly – but rather said the drop was the result of “declines in our retail and other channels, as our channel partners normalized ordering levels.” This sounds a bit like Snap One’s “destocking” concept, where dealers are selling out of their existing inventory rather than ordering new gear.

Revenues are Still Haunted by Soft Consumer Demand

But then the company did add that the decrease was also due to “softer demand across all regions and challenging market conditions.” However, sales were helped by a favorable trend in currency exchange rates. On a constant currency basis (taking out the effect of currency exchange fluctuations) sales were actually down 10.5% YoY as compared to the first quarter of fiscal 2023.

Fortunately for Sonos, as bad as this result was, it was better then they had previously forecast and so, in Wall Street speak, this was a win…they beat expectations. And so an ebullient CEO Patrick Spence talked about their big Q1 “win” and suggested that they were gaining market share on competitors, adding more households and selling more per household.

Excited About Entering New ‘Multi-Billion Dollar’ Category, But Won’t Say What It Is

Spence also once again teased that the company would be entering a new multi-billion category in the third quarter of this year. This new category, which is widely rumored to be headphones, will add at least $100 million to their revenues in fiscal 2024.

But what he really wanted to talk about was how the company knocked it out of the park in terms of profits. The company was able to expand gross margins to 46.1%, up a solid 374 basis points over the gross margin of 42.4% in the same quarter the previous year.

How Did Sonos Improve Gross Margins in a Challenging Economy?

How did they pull that off in a challenging macroeconomic environment? Sonos says it is largely the result of “a decrease in product and material costs, reduced spot market component costs due to normalization of the supply chain, a decrease in inventory-related write-downs, as well as the impact of favorable foreign exchange rates.”

This means that even with a $60 million drop in revenues, the company actually had a higher net profit and generated more free cash flow. Believe me, this lit up the Wall Street analysts. Net income came in at $80.9 million, an increase of $5.76 million or 7.7% over net income of $75.2 million in the same quarter last year. Also helping net income this year was a lower tax rate for the company.

‘We Are Winning’

We are pleased to report first quarter revenue of $612.9 million and Adjusted EBITDA of $115.2 million. Despite the challenging environment, we are winning in the market and outperforming the competition. We are just months away from announcing our highly anticipated new product in a multi-billion dollar category, which will be the first major milestone of our multi-year product cycle. Our full attention is dedicated to successfully executing on our plan and positioning our business to return to top and bottom line growth. Great things are happening here at Sonos and the best is yet to come.”

Patrick Spence, Sonos CEO

The fact is that the factors that drove Sonos’ margin expansion, which led to greater cash generation, and improved net earnings, were all things that were out of their control. Most were supply chain related, such as lower component costs, no need for (higher cost) spot component purchases, fewer inventory adjustments, lower logistics costs (container & shipping), and a favorable currency exchange trend. In fact, the company even noted lower litigation costs during the quarter, as the company is waiting for various court judgments.

Operating Income was Down 7.7%

It was all so transient that then-acting CFO Eddie Lazarus noted that they were sort of a surprise, “…it turned out that this time, the surprises were a little bit in our favor.”

The company had a total operating income of $79.7 million, which is down $6.6 million or 7.7% lower than the operating income of $86.3 million in the same quarter a year ago. Most of their expense categories increased, except for General and Administrative, which at $39.8 million was down 7.7% as compared to G&A expenses of $43.1 million last year. Spence commented on how “focused” the entire company was on keeping expenses down. This category declined largely due “to a $2.5 million decrease in legal fees incurred in connection with our IP litigation.”

Continuing Sales Declines are a Continuing Cause for Concern

Wall Street loved this report and rewarded Sonos on Wednesday by driving its share price to a close of $19.28 per share or over 17% higher than the closing price on Tuesday of $16.46. The excitement apparently passed and on Thursday, shares settled back down a little, closing at $18.19/share or down 5.7% from Wednesday’s close.

To me, the unanswered question is what is happening with sales. On a conference call with analysts, Spence sounded like a conquering hero telling them that it ran “an extended pre-Christmas promotion on select products.” He explained, “This is relatively atypical for us, but we felt it was necessary to meet consumer expectations of discounting throughout the holiday season…”

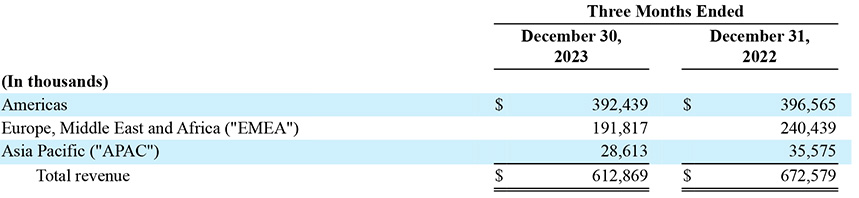

Revenues by Region – Every Region Declined

After that setup, he proclaimed, “Customers responded in force. We exceeded our own sales expectations and saw market share gains in key categories…” I’d like to remind you all that Sonos’ sales declined 8.9% in the quarter. And that was after spending $5.1 million more on marketing than they did the previous year.

That sales decline, by the way, was pretty broadly reflected throughout their report. Every region in which the company does business saw revenues decline, with the hardest hit being EMEA where revenues dropped $48.6 million or 20.2% to $191.8 million versus $240.4 million the year earlier. The softest blow regionally was the Americas which only saw a $4.1 million drop to $392.4 million or just 1.0% below revenues of $396.6 million last year.

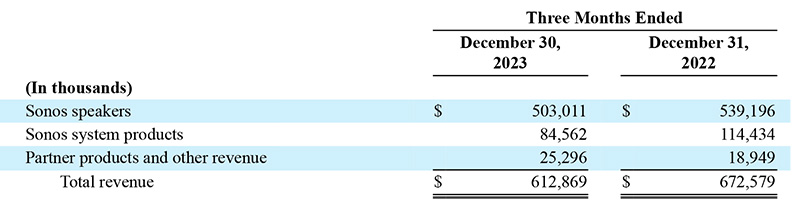

Sales by Product Segment Breakdown

Further breaking down revenues, we find that two out of the three product segments the company offers showed declines. The biggest decline in dollars was the Sonos speakers category, which had revenues of $503.1 million or down $36.2 million (6.7%) compared to revenues of $539.2 million in the quarter in fiscal 2023. The biggest percentage decline was in Sonos system products which came in at $84.6 million or down $29.9 million compared to revenues of $114.4 million last year…a decline of 26.1%.

The only product category to show growth was Partner product and other revenue which came in at $25.3 million for a gain of $6.3 million or 33.5% as compared to revenues of $18.9 million in the same quarter last year. The company said growth in the Partner product and other revenue segment was largely driven by increased sales of accessories. While that 33.5% growth looks nice, this is the company’s smallest product category representing only 4.1% of all segment sales.

One final interesting note about revenues, the company said that unit sales of its products were down 15% – more than the dollar value. They said that this was due to fact that the more recent models introduced enjoyed a higher average selling price.

Sonos Seems to be Banking on New Category

The company explained the decline in revenues for the other product segments as I’ve already reported above. Largely, they say it is due to declines in retail and other channels as “channel partners’ normalized ordering levels.” They also point to “softer demand” and to “challenging market conditions.”

When asked about the company’s view on what’s needed to see a pickup in the industry demand broadly, Spence answered very generally. He suggested that TV sales have been down, but when that turns around they see some pull through with that.

Spence also said that what is needed is “general consumer sentiment towards buying goods versus services.” With interest rates poised to decline, perhaps stimulating the housing market…these things should all help drive more overall demand.

A Three-Pronged Approach to Driving FY24 Growth

In his presentation to analysts, Spence said the company will take three significant steps to ensure it continues to drive growth no matter the condition of the market. These three steps are:

EXPANDING PRODUCT CATEGORIES – The company is betting big on this launch of a new product category…expanding its overall product offering. While they are not yet ready to reveal just what that category is, it is widely expected to be headphones. “This launch will give us a foothold in a new multi-billion dollar category…further diversifying our business.,” Spence said. Though this category will launch in the back half of the year, Sonos says it will add no less than $100 million to fiscal 2024 revenues.

EXPANDING MARKETING BUDGETS– The Sonos CEO says the company is upping its marketing game – and budget spend – for 2024. He noted, for example, that it had recently partnered with the Recording Academy to host “immersive experiences” at the 2024 GRAMMY House – connecting the brand to culture. Clearly, it looks to marketing to help drive revenues…an expensive way to grow sales.

EXPANDING DISTRIBUTION – And in what I would say is a new concept brought up in their earnings call, the company says it plans to expand distribution for Sonos products. Spence said it directly and plainly, “…we plan to expand our distribution footprint meaningfully.” He added, “This means signing agreements with a few key distribution partners to broaden our reach…”

Guidance for Fiscal 2024

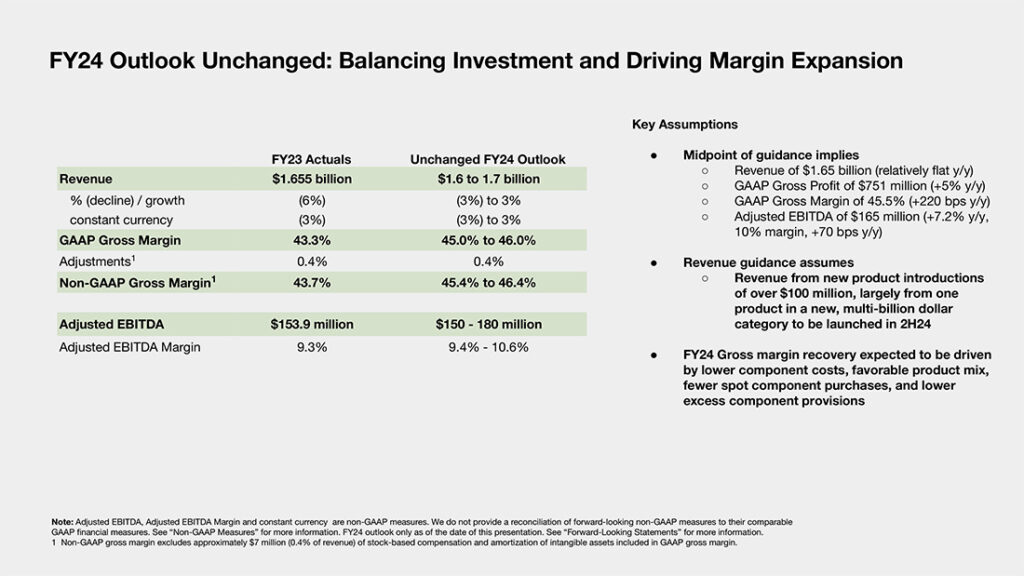

Finally, Sonos told investors that it was maintaining the guidance it previously provided for expected financial performance for the remainder of fiscal 2024. They have some concerns about disruptions from world events, including attacks on shipping in the Red Sea impacting the price and availability of goods. But overall the company remains optimistic for its 2024 plans.

Interestingly, some of the analysts questioned the guidance, suggesting that perhaps the company was being too cautious. For example, the guidance for fiscal 2024 revenues is based on flat results at the midpoint when compared to fiscal 2023. I suspect some analysts think Sonos may be sandbagging – holding back on what they really expect so they can easily exceed their guidance. After all, did they forget that they are entering a new multi-billion dollar product category this year?

For more information on Sonos, visit sonos.com.

Leave a Reply