Sonos (Nasdaq: SONO) announced this week that it was issuing new quality and customer experience “commitments,” as it seeks to rebuild its deteriorating reputation in the wake of a disastrous app launch earlier this year that has caused many, if not most, Sonos systems to stop operating properly – if they operate at all. There has been tremendous upheaval among Sonos customers who have reacted angrily and negatively on Sonos-related message boards and other social media sites.

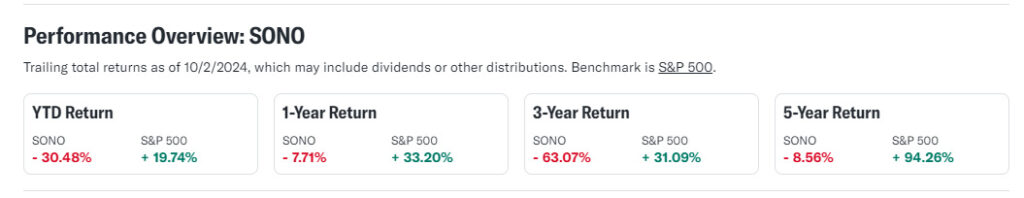

And now, just last week, Morgan Stanley analysts issued a rare “double downgrade” on Sonos shares – a significant ratings drop indicating that it expects the value of Sonos stock to underperform the market in the near- and mid-term future. Morgan Stanley’s analysis of why this double downgrade was necessary is pretty devastating.

See more on the Sonos slide and its attempts to turn things around

The news from Sonos hasn’t been good for quite some time now. Their financial performance has been deteriorating for several quarters; the company had to delay the launch of Sonos Ace, a headphone product it hoped would turn their fortunes around but hasn’t met expectations; and then they boldly launched a new app that exploded like a nuclear bomb – damaging them where it would hurt most…in their reputation with consumers.

CEO Takes the Blame

Since their defective app was launched, the company has frantically raced to get out updates – it says it gets new updates out every 2-4 weeks – to try to fix all that this new app broke. And while CEO Patrick Spence said he bore the blame for the situation – it seems likely that something systemic at the company broke down in both engineering and quality control – especially as it relates to testing.

I’m not sure that Spence can survive as the continuing CEO, as he was clearly the one driving the bus when it went over the cliff.

In any event, on Monday, the company released an announcement that it was instituting “New Quality and Customer Experience Commitments.” I’m sure that Sonos, or at least its marketing department, hopes that these new commitments will help to begin a rebuild of its reputation. But frankly, the company – which bills itself as the “Sound Experience” company, has already shockingly failed to follow its existing standards which should have prevented the defective app from launching in the first place.

The Problem is Not the Standards, It’s the Failure to Follow Them

The issue is not that Sonos didn’t have proper quality standards or customer commitments…it’s that it failed to follow them. There are multiple people involved in the process of quality hardware/software engineering and QC, and it appears that they all failed in this mission. New standards or “commitments” don’t fix that failure to adhere to them.

Our priority since its release has been – and continues to be – fixing the app. There were missteps, and we first went deep to understand how we got here, and then moved to convert those learnings into action. We are committed to making changes to get us back to being the brand people love by offering the best audio system for the home and beyond. We must always do right by our customers, and I am confident that, with these commitments, we will.

Patrick Spence, Sonos CEO

Sonos’ New Quality and Customer Experience Commitments

Here are the new quality and customer experience commitments the company has announced…

Unwavering focus on the customer experience – This was what the company was founded upon – offering consumers better sounding, easier installing, multiroom music systems that are wireless and app driven. But, it is now a new commitment for which the company says, “…we will always establish ambitious quality benchmarks…” and “…will not launch products before meeting these criteria.”

Increase the stringency of our pre-launch testing phases – Here the company says it will now “include more types of customers and more diverse setups for a longer testing period…” in its “beta testing program.”

Demonstrate humility when introducing changes – Here Sonos says that in the future, instead of a wholesale change to its app, “…any major change…will be released gradually.” This will allow them to collect feedback “…before it becomes the default.” The company also says it will add an opt-in for those who would want to volunteer to test “…new features smaller in scope.”

Appoint a Quality Ombudsperson – Although the company has had a round of painful layoffs recently, it is opening up at least one new position, a Quality Ombudsperson. This person gives employees a new touchpoint “…to escalate any concerns in terms of quality and customer experience.” He or she will be “…consulted by executive leadership throughout the development process” before any launch.

Commitments to Try and Regain the Trust of Consumers

The above commitments are theoretically based on “…addressing the root causes of the problems with the app release.” The next group of commitments are being offered for the purpose of “…regaining the trust of our customers.”

Extend our home speaker warranties – The company has decided that on home theater and plug-in speaker models, they will extend the warranty an additional year.

Relentlessly improve the app experience with regular software upgrades – Sonos intends to continue on with the process they are currently pursuing of new app (and software) updates “…every 2-4 weeks to optimize and enhance the software experience.” They say this process will continue even after every defect in the app has been resolved.

Establish a Customer Advisory Board – The company provided no details on this commitment other than to say it will create such a board that “…will provide feedback and insights from a customer perspective” to help future product development.

We’ve made good progress on addressing many of the software issues, and these new commitments will drive us to emerge from this period with an even stronger commitment to quality,

Patrick Spence

We May Not Pay Executive Bonuses…Next Year

There is one more quasi-commitment that Spence offered, “To demonstrate the significance of these commitments…” The CEO announced that to show the world just how committed the team is, “…no member of the Executive Leadership Team will accept any annual bonus payout for the October 2024 – September 2025 fiscal year unless the company succeeds in improving the quality of the app experience and rebuilding customer trust.”

So let me translate that bit of corporate-speak for you. He is saying, in essence, we may not pay bonuses a year from now, unless things improve. So apparently the Executive Leadership will receive their full bonuses for Fiscal 2024, the year they totally screwed up the app rollout, damaged the company’s reputation with consumers and watched the company’s financial performance fall into the mud.

Does this make sense to anyone? Am I missing something??

Wall Street’s Love Affair with Sonos is Waning Quickly

In the meantime, Wall Street is on the cusp of getting over its love affair with Sonos. Last week Morgan Stanley analysts issued a rare “double downgrade”…and I do mean this is rare. The financial advisor rates Sonos as “underweight.” It is a clear sign of a loss in confidence in Sonos’ efforts to resolve the app issue.

Couple that with the fact that the analysts have also cut their price target for Sonos. An analyst price target is his/her best guess on where the stock will be in the next 12-18 months. Previously, Morgan Stanley analysts had a price target on Sonos set at $25. They have now cut it to $11, which is about where it sits now. This suggests that they see no growth in the value of its stock for the next year.

Morgan Stanley’s Analysis is Damning and Forecasts a Darkening Future

But perhaps even more devastating than the rating and price target downgrades is the research, analysis, and reasoning the analysts offered behind their decision to double downgrade Sonos. Morgan Stanley clearly did a lot of research into the situation and had a lot of damning evidence to support their darkening view that Sonos’ future is negative.

According to the analysts, they “…see a greater-than-anticipated negative impact of the company’s recent app redesign on its financial performance.” Morgan Stanley analysts have recast their forecast for the company’s fiscal year 2025 – which just started this Monday – in terms of revenues and adjusted EBITDA and now believe Sonos’ numbers will be 5% to 13% below “the Street’s consensus.”

When Morgan Stanley’s report was circulated last week, the value of Sonos stock dropped by 6%.

Sonos Drops Revenue Forecast for ‘September Quarter’ by 40%

The financial firm’s report noted that Sonos launched its app in May 2024 and almost immediately “faced criticism from existing users,” which led to “a public apology from Sonos’s CEO” and a “delay in product launches.” Sonos was forced to lower “its revenue guidance for the September quarter by 40%.”

Ironically, the Morgan Stanley report notes that “Sonos shares have paradoxically risen with the broader market.” This has taken the stock to trading to “nearly one standard deviation” above its historical average. But they say that this represents “…a valuation the analysts find unwarranted.”

Current Sonos Valuation ‘Unwarranted’

We believe this divergence between valuation and fundamentals is unwarranted, and new data sets we’ve been tracking on net promoter scores, brand favorability, and purchase considerations show that the impact on Sonos users is likely to linger into FY25, something we don’t believe Consensus estimates have fully accounted for.

Morgan Stanley, analyst report

So the analysts are unpersuaded by the fact that, at this moment, other analysts on Wall Street (the Consensus) don’t seem to see what they see. They added, “…we see a more challenging N12M [next 12 months] setup for the [SONO] stock.”

Sonos’ Growth Model is at Risk

The Morgan Stanley analysis goes on to note that Sonos’ “key strength” is “its ability to attract and retain customers within its ecosystem,” according to a report by invest.com, which saw the Morgan Stanley analysis. This key strength of the customers in its ecosystem leads “…to repeat purchases and new customer acquisition through word of mouth.” But, as the analysts go on to note, “…the recent negative feedback from users, who account for approximately 44% of annual Sonos product registrations, presents a risk to this growth model.”

The firm believes that the negative sentiment could result in more substantial near-to-medium-term challenges for the company than the market currently expects.

Analysts’ report for Morgan Stanley

Ongoing Weakness in the Audio Market

The report by analysts also notes that Sonos’ app engagement “…has dropped to pre-COVID levels, new user growth is down 9% year-over-year, and upcoming product launches are unlikely to expand the market.” When you add these negative factors to all of the headwinds listed above, “…coupled with the ongoing weakness in the audio market” – and the underperformance of Sonos Ace – you get the reasoning behind the surprisingly negative Morgan Stanley assessment.

In a final note, the analysts say that they “no longer expect Sonos to achieve consistent 10% revenue growth and 20% Adj. EBITDA growth in the near future.” This is significant because 10% revenue growth and 20% adjusted EBITDA is what Sonos’ guidance has been for a couple of years now.

The Sonos party, Morgan Stanley seems to be saying, is over.

Ouch…

Learn more about Sonos by visiting sonos.com.

I concur…the CEO cannot remain in charge after such a heinous blunder. A white knight will probably be required to right the long list of wrongs under Spence to hopefully restore the goodwill lost under his lead. I, for one, will not purchase anything from Sonos until they repair what was an upcoming leader in this field.

Sonos always had a “you need us more than we need you” attitude towards the CI channel. Their products were always better than their people. Nice to see them humbled though this is probably too little too late.

Many in the CI channel have experienced the smugness of Sonos’ leadership and perhaps there is some satisfaction in seeing an ample supply of humble pie on the menu at the company cafeteria in Santa Barbara.

I’m actually saddened that gross incompetence has probably destroyed Sonos, as at their current market cap, an Apple, or Samsung, or … can now swoop in and purchase them for a mere rounding error from their balance sheet.

I’m now retired from the industry, but before I did, our Sonos rep repeatedly told me that the CI channel was their primary growth engine. With a myriad of competent streaming competitors swooping in to pick off business, that has probably turned into a net negative for Sonos.

On the consumer front, they are being crushed with negative consumer reviews, so ANY potential new customer, after reading those reviews will run away.

Finally, many existing customer (a long-time growth engine for add-on sales) want nothing more to do with Sonos, so that avenue is also endangered.

As a nearly two-decade consumer of Sonos, I’m saddened this this MAJOR, company ending screw-up almost certainly will result in the end of an independent Sonos.

Last comment. Although I’m not a stockholder in that company, I would be enraged if management received a bonus for just concluded FY 2023-’24.

As a dealer/installer/home user myself, I’ve always had a love/hate relationship with them. They’ve always led with usability, as I could show an 80 year old couple how to use it and it was no problem. Now this new app, fortunately it’s stabilizing after nearly six months of headaches, but I can’t as easily explain the basics to my clients. On my system at home it went from Pick a Room, Select Music, to alright, how do I get from here to the rooms? Swipe down or arrows back, oh, OK, here we go. Usability is not as simple for me to explain to people.

But the long standing issue has always been them selling to my clients after I have signed them up. I understand their need to add on, but it has traditionally been the place of suppliers to the trade to not sell directly to my customers. But since the product has always been dramatically better than Heos or MusicCast or any other imitator, I have stayed on board. They have tried to walk on both sides of the line by giving us resources so we would go back and upsell our own clients, but yet their relentless pushing of products and offering direct discounts through the app goes on. There are many installers that will never sell Sonos for that reason. So if CI indeed drives their growth, that will always be a hindrance for them.

I have always felt it was a feather in their cap to be largely an American company with decent tech-support, even though I know everything is built overseas. It will be a shame when they get taken over by some other larger company that is less liked in the installer community, and less likely to be supportive of our efforts as installers and salesman for their product.

I completely agree with Tom C. – Like Tom I am also a CI Retailer and Integrator for the past 34 years. We were one of the first Sonos dealers in California and have begged Sonos to create a Custom Integrated centric product that could easily be installed in equipment racks but Sonos has refused to do so ( For a company that touts they are CI friendly for the life of me I don’t know why )

Personally I think we should give Sonos a second chance, they have been a strong provider for over 22 years. There is just to many end user’s out there and the product for the most part is fine –

I think you should go back to the basics and ask the Founder John MacFarlane to return to get Sonos back on track. Producing more inexpensive products isnt working –

This situation is just a continuation of past tone-deaf policies that disenfranchise existing users and integrators.

Remember the ‘your old products (some out of production less than a year) will no longer work with our shiny new app’ debacle? But we’ll give you a discount and then hobble your old product, creating tons of e-waste and leaving integrators hold the bag? That was several years ago and after massive customer pushback ended up with the S1 S2 app bifurcation. A disaster for integrators.

It turned me from a supporter to someone who doesn’t trust them and won’t buy anything new from them’. Ever.

Too bad, their app experience was top shelf, but that was a long time ago.

Now it’s like catching a falling knife.