Sonos, Inc. (Nasdaq: SONO) Chief Executive Officer Patrick Spence did his best to sound upbeat and exuberant recently as he discussed the company’s results for its fourth quarter (4Q) and full year of Fiscal 2024 on an earnings call with financial analysts. Although most expected poor results in the wake of recent challenges, the numbers were particularly rough as the company is struggling against market headwinds in the audio segment, a less-than-satisfying rollout of what it had hoped would be a blockbuster new product in a blockbuster new category (Ace headphones), and most vexingly, from its own self-inflicted wound with a horribly botched app rollout.

Spence faced a tough sell to analysts, even with reduced expectations, as the numbers were quite disappointing.

See the results for 4Q & full-year fiscal 2024 at Sonos

Sonos’ Fiscal 2024 fourth quarter and year end is the period that ended on September 28, 2024. Just by viewing the 8-K filing from the company announcing its results, I knew something was different this time. In the past, the company would put on a show with a special “letter to investors” that was a glitzy presentation with color photos and a whole lot of marketing speak on the great quarter that just ended.

But this time, the company release announcing its results was just a bare-bones, truncated, mostly textual – and highly selective – replay of the results, with little added panache. Oh sure, the text included a quote from Spence with his typical rah-rah rhetoric. In fact, the release announcing results – rather unusually – started with Spence’s quote as the first paragraph.

A Reality Distortion Field

This appeared to me to be an attempt at manipulating the reader into viewing the rest of the news through a rose-colored, reality distortion field – sort of a CEO-positivity filter, such that investors will only see the positives and ignore the negatives. Here is Spence’s full statement…

Thanks to our team going all-in on our app recovery efforts, we made significant progress in bringing the quality of our software to a level that we’re all proud of, which enabled us to launch our highly anticipated new products, Arc Ultra and Sub 4, in time for the holidays. Initial feedback on our new products has been very positive, which, along with the introduction of Ace earlier this year, makes our product lineup the strongest it’s ever been. Sonos is still the best home audio system, and we’re focused on using this industry-leading product lineup to acquire more customers and solidify our loyal customer base. The Sonos flywheel remains strong, as evidenced by the fact that the number of new products per home increased in Fiscal 2024. While the overall audio category continues to face headwinds, we are confident that we are well positioned to take more of it over time.

Patrick Spence, Sonos CEO

Sounds Like They Had a Good Quarter, Right? Um…

Reading this, you’d be excused for thinking the results must have been pretty good. But you would be wrong…and I would argue, you would be very wrong.

But to be fair to Spence, CEOs often feel they must be upbeat and present the best view of the case. So maybe this is a minor transgression? Well, let’s go through the numbers and you tell me what you think. I know what I think.

Financial ‘Highlights’?

The next part of the press release – which presents selected 4Q and full-year data – starts by offering certain financial “highlights.” Below is the unedited financial highlights the company presented for the full-year results in the official release.

“Fiscal 2024 Financial Highlights (unaudited)

● Revenue of $1,518.1 million

● GAAP gross margin of 45.4%

● GAAP net loss of $38.1 million, GAAP diluted earnings per share (EPS) of -$0.31

● Non-GAAP net income of $71.4 million, Non-GAAP diluted EPS of $0.56

● Adjusted EBITDA of $107.9 million”

Note that they list each item, such as revenues, as just a result without any context. So if you don’t happen to remember what the revenues were in Fiscal 2023, you can make no judgment as to whether this $1.5 billion is a good number or a bad number. Typically, companies would add the dollar and percentage variation between the revenues in this period and those for the same period last year.

Where’s the Rest of the Story?

The same can be said for each of these “highlights.” They don’t lie….they just don’t tell you the whole truth. This forces the reader to have to work at seeking out more information…something many of us don’t have the time for.

But I, dear reader, am here to help you out! I did the research, and it’s time to do a deeper dive into the real performance of Sonos in 4Q and full-year Fiscal 2024. You may or may not be surprised by what I discovered.

Let’s Dive into the Financial Performance of Sonos in Its Fiscal 2024

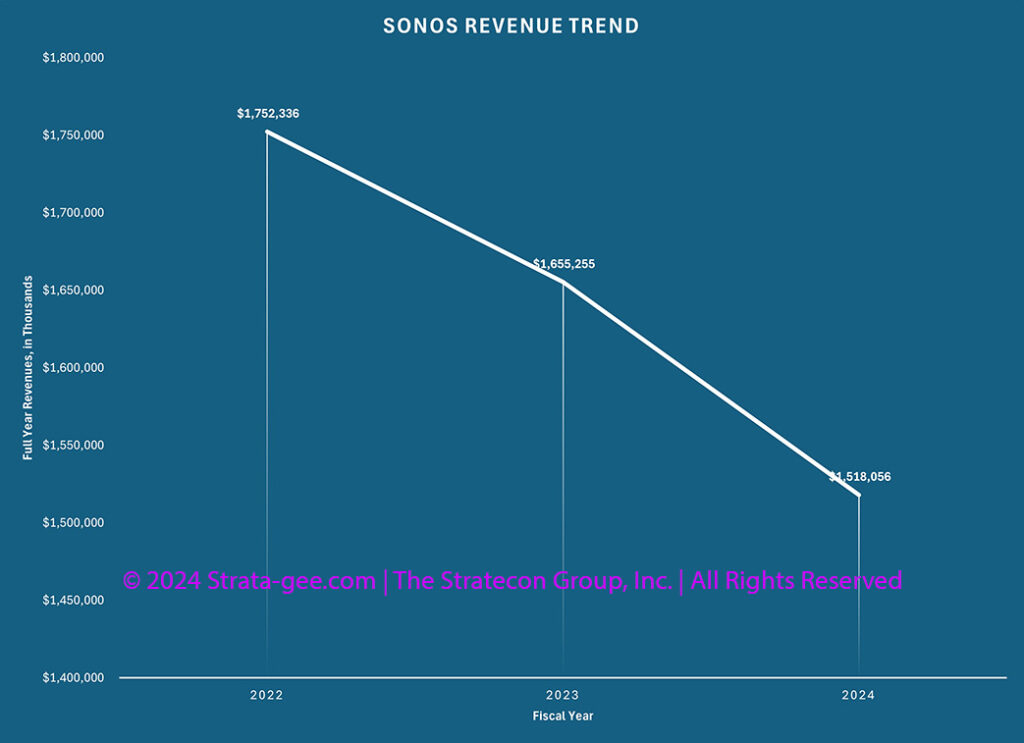

For this report, I’m mostly focusing on Sonos’ full-year results, although the company also reported its fourth quarter. For several quarters now, the company has been reporting declining revenues and so it was not a huge surprise that the final tally for 2024 showed the second year in a row of declining revenues. Sonos said revenues come in at $1.518 billion, a decline of $137.2 million or 8.3% as compared to revenues of $1.655 billion in Fiscal 2023.

In the release announcing the results, the company says this decline was “…due to softer demand across all regions [,] due to market conditions[,] and challenges resulting from our recent app rollout, partially offset by the introduction of Ace in June 2024, and the impact of favorable foreign exchange rates.”

On the conference call to discuss earnings, Spence and CFO Saori Casey told analysts that they estimate that the disastrous (my word, not their’s) app rollout cost the company about $100 million in lost revenues (as well as tens of millions of dollars to fix it). What they didn’t say – and what was driving me crazy during the Q&A session, as none of the analysts asked about it – is whether Ace delivered the $100 million in revenue that Spence had previously projected it would add to Fiscal 2024 revenues. I suspect that the fact Sonos management didn’t bring that up means Ace fell short of that projection.

A Problematic Profit Picture as Well

Unfortunately for the company, while revenues declined, operating expenses actually increased from 44.5% of revenue in Fiscal 2023, to 48.6% of revenue in Fiscal 2024. Most of that was due to an additional $26 million spent on sales and marketing for a total S&M spend of $287.8 million this year vs. $261.9 million in 2023. Consequently, the company generated an Operating Loss of $48.1 million in Fiscal 2024, up $27.5 million – for a 133.8% greater operating loss compared to the operating loss of $20.55 million in Fiscal 2023.

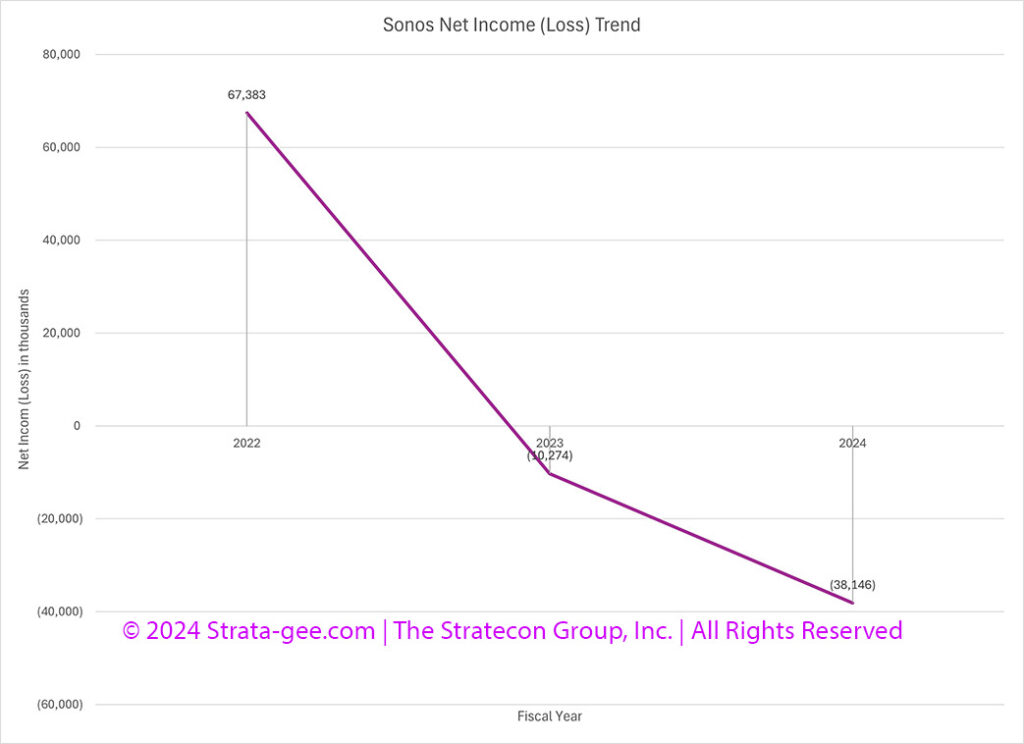

This year, the bottom line is starting to look like the bottomless line, as the company generated a Net Loss of $38.15 million, $28.9 million greater than the net loss of $10.27 million in Fiscal 2023. That’s a 271% greater net loss than the previous year. Yikes! On a diluted per share basis, the net loss went from a -$0.08 per share to a -$0.31 per share. Investors just can’t be happy with that result.

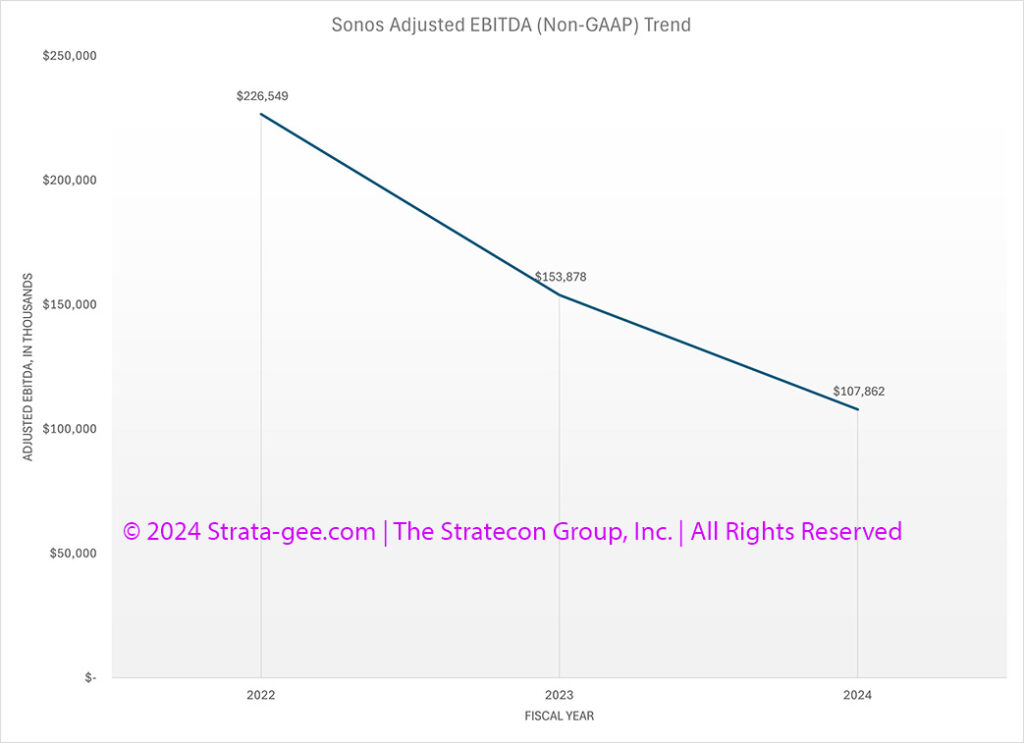

Even Its Own ‘Adjusted’ Numbers Show a Decline

One last point on profits…you know your business is not in a good place when your own customized non-GAAP profit calculations – which in Sonos’ case is known as Adjusted EBITDA – are showing a declining trend. As long-time readers of Strata-gee know, I’m not much of a fan of “adjusted” numbers which are non-GAAP (generally accepted accounting principles) figures that company management formulates and suggests give a more accurate picture of their performance. However, all public companies are mandated to report their data using GAAP formulas. If they offer non-GAAP analyses, they must provide data on how their non-GAAP formulations compare to actual GAAP numbers.

In any event, Sonos likes to refer to its non-GAAP profit calculation as Adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) which is an alternative measure of profits. This year, adjusted EBITDA came in at $107.9 million. This is down by $46 million or 30% as compared to the adjusted EBITDA of $153.9 million in Fiscal 2023. Even their own machinations are pointing to a declining business performance.

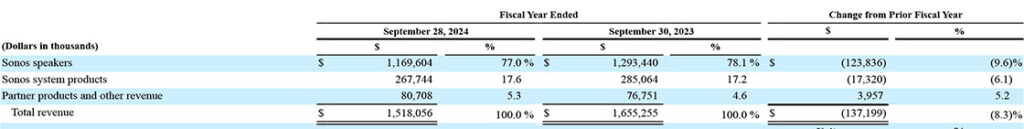

A Deeper Look Reveals the Depth of Sonos’ Problems – Revenues by Product Category

Looking at a disaggregation of revenues by product category shows that the company’s bread-and-butter product segment called Sonos speakers had revenues in fiscal 2024 of $1.170 billion. This is a $123.8 million or 9.6% decline from revenues of $1.293 million in fiscal 2023. Similarly, but to a slightly lesser degree, Sonos system products generated revenues of $267.7 million which is down $17.3 million or 6.1% compared to revenues in the category of $285.1 million last year.

Finally, in the Partner products and other revenue category, revenues this year were $80.7 million which was an increase of $4 million or 5.2% compared to revenues of $76.8 million in the previous fiscal year. This is the category for products sold through integration dealers and is the only one that showed growth. Unfortunately for the company, it is also the smallest product category…representing only 5.3% of the company’s overall revenues.

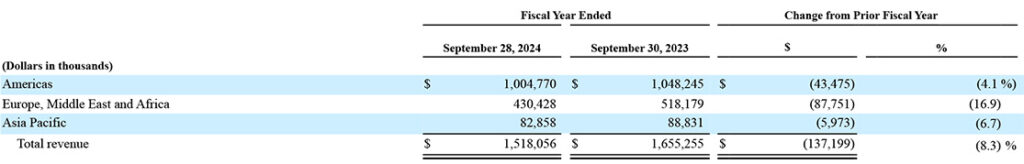

Revenues by Geographical Region

Disaggregating revenues by geographic region reveals that Sonos’ revenue declines were global. The company tracks revenues in three main regions: Americas; Europe, Middle East, and Africa (EMEA); and Asia Pacific. All three regions saw revenues decline. Americas revenues came in at $1.0 billion, down $43.5 million or 4.1% compared to $1.05 billion last year…EMEA revenues were $430.4 million, down $87.8 million or 16.9% versus revenues of $518.2 million last year….and Asia Pacific revenues were $82.9 million, a decline of $6.0 million or 6.7% compared to $88.8 million in revenues the previous year.

In addition to reporting product revenues in dollars, the company also revealed revenues by units shipped. In 2024, Sonos shipped a total of 5 million units of all products combined. This was down by 725,000 units or 12.7% compared to shipments of 5.725 million units in fiscal 2023. Thanks to a shift in the mix of products shipped to slightly higher-priced models, the 12.7% decline in units shipped equated to the slightly better result of an 8.3% decline in dollars.

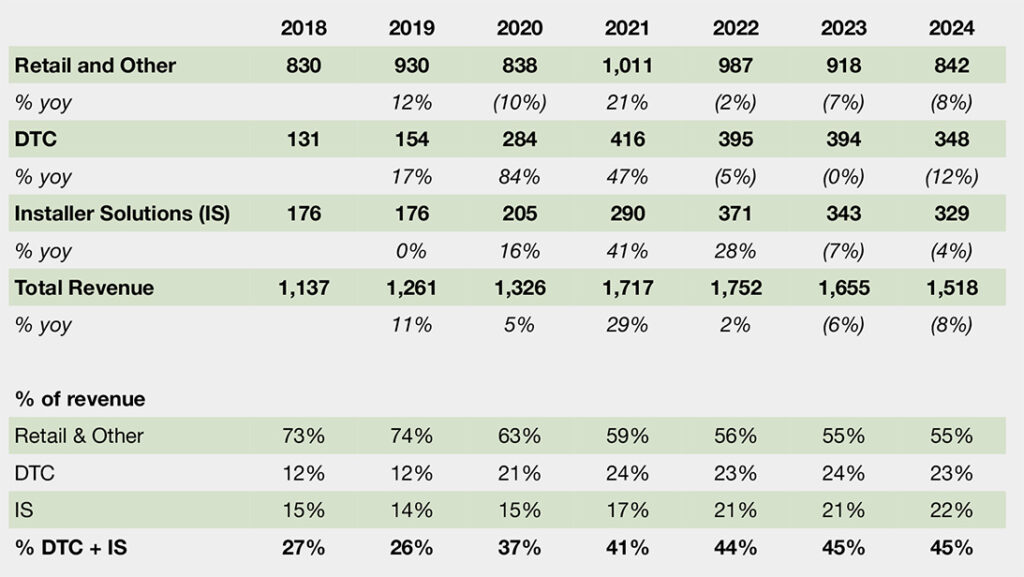

Let’s Talk Trends

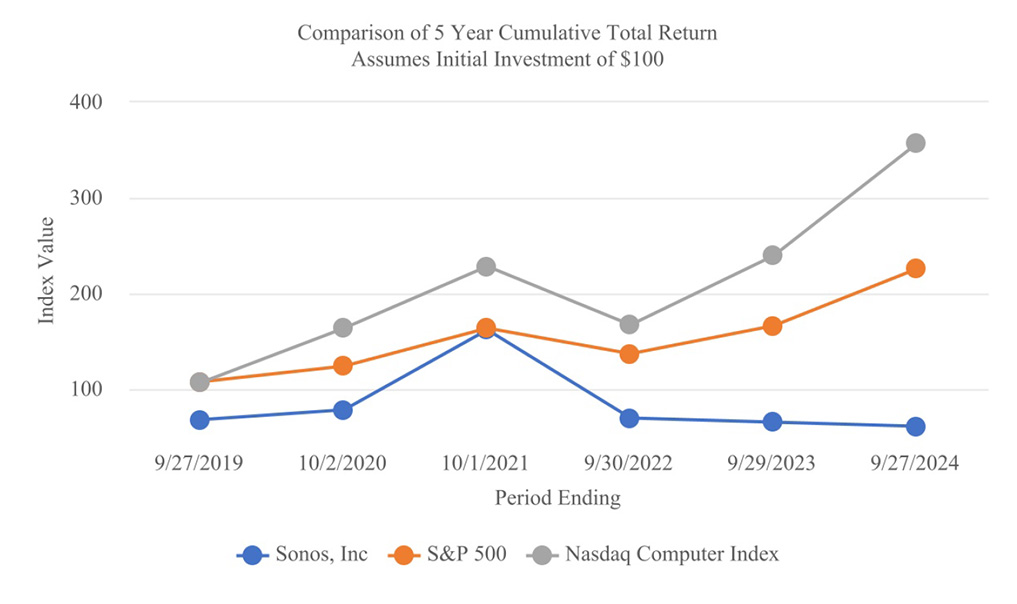

After reading and reviewing literally hundreds of pages of Sonos financial documents and SEC filings, I think it might help the reader to better understand Sonos’ situation by looking at some charts that will show the trend of key results. Some of these charts I have custom-created and are based on data from the company’s filings, while others come from the company itself.

Did you notice something interesting and consistent about each of these key trends?

What Will Fiscal 2025 Hold for Sonos?; Guidance for 1Q of Fiscal 2025 Performance

So the ominous trends my analysis above delineates make me wonder what we will see in Fiscal 2025 for Sonos. I anxiously searched through the documents for the company’s guidance for the first quarter of Fiscal 2025, the period that began on October 1, 2024 and that we are in now. And that is when I discovered another interesting thing about this Sonos Fiscal 2024 report – it includes no guidance for future performance. This is something that the company has always provided.

However, this time, Sonos noted that it would only be announcing the guidance verbally on the earnings call. Say what?!?! Towards the end of her prepared presentation on the earnings call, CFO Casey revealed that the company would be changing its approach to providing guidance on future performance.

A Step Back from Transparency and Towards Opacity

[This new approach]…is reflective of our collective experience and lessons learned over the past few years. We need to be able to nimbly adapt to the uncertain market dynamics of our categories, while also focusing on our transformation initiatives to optimize our investments to drive long term sustainable growth.

Saori Casey, Sonos CFO

Then Casey revealed that from now on the company will only be providing guidance on a quarter-by-quarter basis – a reduction in transparency, I’d say. ALSO, Casey added that guidance will only be offered verbally “on our earnings calls.” In the past, the company has provided guidance on both a quarterly and a full-year basis. And they have provided it in writing. I guess their crystal ball is getting a little cloudy – and they don’t want analysts to know that.

Starting Fiscal 2025 on the Wrong Foot

Finally, the CFO turned to guidance for the first quarter of Fiscal 2025. According to Casey, Sonos expects Fiscal 2025 Q1 revenue to be in the range of $480 million to $560 million. I was stunned to hear this forecast. Keep in mind that the Sonos first quarter period runs from October to December, which obviously includes the holiday selling season – a key time of the year for a consumer brand like Sonos. And this year, I have noticed that Sonos is being highly promotional.

Yet at the midpoint of this guidance – $520 million – this would mean revenues will decline again by $92.9 million or 15.2% in this Fiscal 2025 first quarter compared to revenues of $612.9 million in the first quarter of Fiscal 2024. Keep in mind, this result not only includes the most vigorous selling season of the year, but Sonos will have multiple new products this year that they did not have in 1Q of Fiscal 2024 – Ace, Arc Ultra, and Sub 4. A fourth new product, the Era 100 Pro will roll out in January – too late for 1Q, but there for later quarters.

Sonos Rushed New Products to Market to Drive Sales, Yet It Forecasts Further Revenue Declines

Sonos rushed its app rollout in order to be able to quickly get these new products into the market in what appears to be an overt effort to drive revenues. Rumors have abounded that Ace sales have fallen well short of expectations and Spence so much as admitted that the ramp-up has been slower than anticipated. Although, unsurprisingly, he is confident that a new endcap promo at 171 Best Buy stores now, with another 50 stores to be added in January, will help drive Ace sales.

However, in the wake of these new model rollouts, I am stunned to see that the company expects revenues will continue to decline into Fiscal 2025. Remember, the first quarter is the company’s biggest quarter of the year.

Sonos CFO: 1Q Fiscal 2025 Revenues Will Decline 9% to 22%

Casey went on to confirm that point, telling analysts, “On a year-over-year basis, our Q1 guidance calls for a -22% to -9% decline in sales. This reflects a number of factors, including headwinds from the market weakness in our categories, ongoing challenges related to app recovery, and our proactive efforts to end leaner on our overall channel inventory versus last year, which is a 5-to-7 point headwind to our year-over-year growth. These headwinds are partially offset by having Ace and a new generation of products in our lineup like Arc Ultra and Sub 4.”

It would seem that despite the fact that Spence touted “the significant progress in bringing the quality of our software to a level that we’re all proud of…” the company still has a ways to go. Spence told analysts that after months of work, (and no doubt thousands of engineering hours of effort), and millions of dollars of investment, the app is still only about 90% complete…or in their words “recovered.” There are many more months of work ahead – and many more millions of dollars of “app recovery investment” to be made ($5 million to $10 million in Q1 alone) before the app is fully operative. The company invested $7 million in Q4 of 2024 in app recovery.

Looks Like a Bumpy Road Ahead for Sonos

Casey also provided guidance on Gross Margin, which the company expects to be in the range of 41% to 43%. Finally, she pegged Adjusted EBITDA to be in the range of $35 million to $79 million.

It looks like the road ahead for Sonos is still quite a bumpy one.

Learn more about Sonos by visiting sonos.com.

Ted, why were you surprised by the financial analysts not asking questions? I’ve always considered them among the most gullible people I’ve encountered in my professional life.

Hi Steve,

The reason I was surprised is because I felt it was such an obvious question. Spence had been throwing that $100 million incremental revenue gain figure around for several quarters. Some of the analysts were becoming, like me, skeptical of that forecast, especially when they were also talking about how challeged consumer spending had become. It was hard to reconcile those two data points. Now was the time to confirm whether Sonos had delivered on this promise or not.

No one asked the question. It blew my mind.

Ted

Ask those kinds of questions and you won’t be covering Sonos for long.

If you believe Futuresource Consulting and I do (I’ve read their financial statements) audio as whole is growing slightly, the HiFi sector is declining like Sonos, but Luxury Audio ($5,000 plus components) has been growing. The market with projected growth is party audio. I don’t think Sonos is tapping into this market.

It looks to me as if the middle of the audio market is headed for a long struggle and maybe permanent decline. The cheap stuff is just too good now.

Ted, this was an amazing deep dive… I had no idea I was clicking on 30-40 minutes of reading :). Your analysis is spot on… but… I was expecting MUCH worse numbers from them. I realize that in our business (or in most industries) two consecutive years that look like this get people fired, but frankly, there are other segments of our industry (car audio, for one) that is still measuring themselves against 2019. I understand that businesses go out of business with that kind of mindset, but we can not ignore the covid bump. They had a half a billion dollar increase from 2019 to 2022. Our industry simply doesn’t have numbers like that available to get. It is clearly a gigantic factor and looking at the state of our industry, Sonos has accomplished a greater than 4% CAGR in revenue over these past 5 years. As a consumer, I had to live through this period of the app disaster (man, I was pissed), but I would’ve thought things would be worse. Perhaps, we’re not done seeing the nasty side affects of the app just yet since the annual books closed on September 30. Anyway, keep up the great reporting.

Partner products and other would not necessarily be the integrator products but would be IKEA, Sonos by Sonance, and the recurring revenues from the professional subscription.

Amp and Port would fall into “Sonos system”