But Is Everything Really as Good as It Looks?

Sonos, Inc. [NASDAQ: SONO] released their fourth quarter and full year financial results for fiscal 2020. Their performance pleasantly surprised Wall Street and their stock value exploded well over 20% in Thursday trading as the company exceeded analysts’ estimates for both revenue growth and profits. But is everything as it appears here?

See more on Sonos financial results…

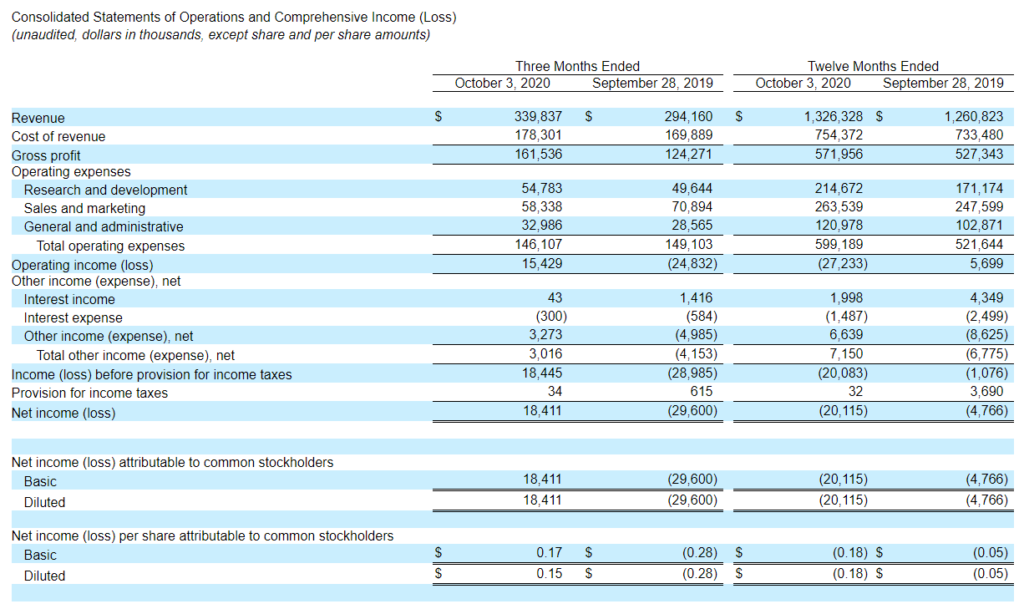

On the face of it, Sonos turned in some impressive numbers in their fourth quarter results with double-digit percentage revenue growth of 16% coming in at $339.8 million as compared to $294.2 million in the same quarter in fiscal 2019. Not only that but the company generated a net profit of $18.4 million, versus a net loss last year of $29.6 million.

However, as is usually the case in these kinds of announcements, some of this was not exactly apples-to-apples comparison. If you dig into their materials, you see that there was an added week in the fourth quarter this year as compared to last year. Taking that added week out of the numbers (in search of apples-to-apples) you get a still impressive, but much more moderate result of a 7% increase in sales…NOT 16% as is widely reported.

This IS NOT lying…it’s truthful. But IT IS misleading.

Sonos Direct-to-Consumer Business Offers Most Growth

Potentially more concerning to Sonos’ dealer and integrator partners is the fact that the company saw a 67% YoY increase in their direct-to-consumer business (D2C) in the quarter. These are sales to consumers directly on their own website. This rate of growth far outpaces the rate of growth through their other channels.

When the company releases their official 10-K annual report, we will get more detail on all of their results. As usual, the devil is in the details. So for today, we can only comment based on their initially released information.

Does D2C Provide More Margin Muscle as Well?

But when that additional information is provided, I would not be surprised to discover that the company credits a big part of their growth in gross margin – up 530 basis points to 47.5% in the quarter – to the growth of their direct sales. Think I’m overplaying their shift to D2C as compared to their business with custom integrators? Well, consider the following statement on their channel strategy from their most recent 10Q from the third quarter results.

We are investing in our e-commerce capabilities and in-app experience to drive direct sales. We believe the growth of our own e-commerce channel will be important to supporting our overall growth and profitability as consumers continue the shift from physical to online sales channels.”

Sonos, Inc. Form 10Q for the quarterly period ended June 27, 2020

Yes, after that quote shown above, they go on to say that they’d like to grow sales with dealers as well, but clearly they are seeing their D2C growth as both important to their future as it is punching way above its weight. And potentially, a great driver of their gross profit margin enhancement as well.

Fiscal Year Numbers are More Sobering; Sonos Loses $20.1 Million

Interestingly, while the quarterly report was quite positive, the results for the full fiscal year has some sobering elements to it. For example, in fiscal year 2020, Sonos saw revenues increase 3% (they say 5%, but again I’m pulling out that unusual 53rd week they include) coming in at $1.326 billion versus the $1.260 billion last year.

But the thing that caught my attention for the fiscal 2020 year, the company booked a net loss of $20.1 million…a markedly higher loss as compared to the net loss of $4.77 million in fiscal 2019.

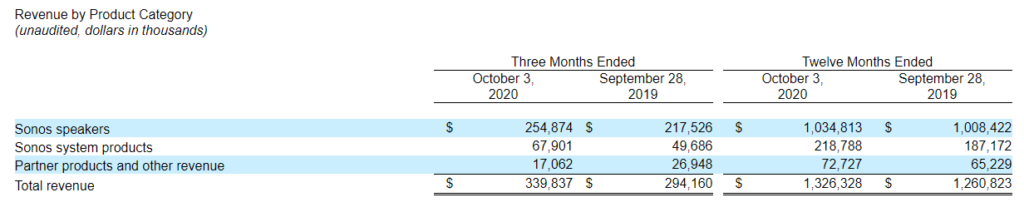

An Amazing 84% Growth in D2C Revenues

Then again, the company noted as a highlight that their D2C sales increased 84% for the year and came to represent 21% of their total revenue. That is significant – more than a 5th of their total revenue and well over the 12% of revenue that D2C represented in 2019.

We reached an inflection point in the fourth quarter that demonstrated the power and profitability of our model. As our customers recognize, Sonos product operate seamlessly together, with more products improving the experience. That’s why year in and year out, our existing customers add more products to their systems – every new household that we gain starts teat cycle anew.”

Patrick Spence, Sonos CEO

Number of Items Per Household Not Growing

In materials supporting their announcement, Sonos made a big deal about the fact that customers are continuing to add more and more products to their systems. They noted, for example, that existing households accounted for 41% of new product registrations in 2020, up from 37% the year before.

One of their bullet points in their “Highlights” for the fiscal year is, “Average number of registered products per household at 2.9 in fiscal 2020.” Gee, they called that out, so it must be improved I thought…so I looked it up. Yeah, you guessed it, it was 2.9 last year as well.

A Lot of Launches and Initiatives in Fiscal 2020

I’m not raining on their parade. Given how weird 2020 was, as the year of COVID, Sonos’ performance was quite respectable. But I note that many in Tech are having a good year as consumers, now forced to quarantine at home and needing to upgrade their home systems, are clearly buying tech. to me, it seems likely that Sonos should be a prime beneficiary of all of this.

Also, consider the fact that the company: launched three new products (Arc, Five, and Sub), launched an all-new operating system & app (Sonos S2), launched a multi-layered and aggressive marketing campaign with Disney (based on The Mandalorian), and launched Sonos Radio.

Revenues Grew 3%

For all of this, sales increased 3%. Not bad, but – at least to me – not particularly impressive either. Let’s see what their more detailed findings show.

Lastly, let me mention that in a breakdown of sales by category – sales of “Partner products and other revenue” – the category of product partnerships with people like Sonance, and IKEA dropped 37% in the fourth quarter. At one time, Sonos had expected great thrust in growth from this category, but it doesn’t appear to be happening.

Are Partner Sales Slowing?

For the year, this category did show an 11% increase, but that included a significant ramp up with some partners. Apparently, that business has slowed substantially over time.

Sonos says a key goal for 2021 is, “Strengthening our direct-to-consumer efforts.” Whoa…gettin’ a little chilly in here…

Learn more about Sonos by visiting: sonos.com.

Thanks Ted. First of all, you have to admire Sonos for making very fine, if not the highest performance audio products. They are undeniably popular and seem to satisfy a whole lot of people and business partners. They seem to know their customer base and keep to their knitting (my comment on performance range) and so have drawn a raft of competitors often trying to simply copy their efforts.

On the other hand, nothing is perfect and many do not like their business model with them trying to own internet sales, re-marketing directly to the customer, offering what many consider “short” margins, etc. That said, they are a public company with all that comes with it, so they must aim for big markets or become irrelevant.

Now all public company statements are full of claims, numbers and other data that needs interpretation such as you are giving. Of course, they are trying to impress and “magnify” results while keeping things “factual”. We see this in these statements and Wall St today seems to like them.

Like you, I have a bit of a different view of these. I also note the extra week and so when we see only 3% growth in the “core” multi-room speaker system sales even with an extra week my eyebrow is raised. That category was hot! Not only did other firms such as Denon, Blue/Lenbrook and even Bose, Samsung and others grow their sales (however big or small) more than that, one also has to consider surging results from Amazon, Google and Apple in the same field as they also offer this capability whatever we may think of performance. It is clear Sonos lost share in the market.

While “system” product sales were strong, we have to think that the majority, perhaps most all of these were sold to existing customers as why else would you want the capabilities? You can stream the services on most all of the other devices nowadays as that function is now wide spread. So while the Arc, Beam, Move or Amp are all beautifully executed they all also compete in much wider sets of competition than even the core wireless speakers.

Speaking of that, while I am sure they have a defendable assumption on how they arrive with a 92% share in wireless speakers, do any of us actually see that considering the earlier note on Amazon, Google et al? Is this even true in the CEDIA space?

And blaming brick and mortar partners also seems a bit “disingenuous” when Best Buy has had record results, and many integrators have been booking into next year, and physical retailers such as we know say the year has been playing out. While Wall St investors may simply consume that language this too is not what we see on the ground.

Again, I think any of us would love to own this firm. Their work is highly impressive, but nothing is perfect or forever. This space is becoming much more diverse and competitive. Many of us would like to see and offer much higher performance products to consumers, and today we can. Some customers would like more integration with other items such as their displays, and this too is now becoming available.

All of this to say that public companies while disclosing what is supposed to be factual are really just spinning a tale. Just as valuations now look more like the casino than based on fact, “winning” can become “losing” overnight. As is said, the “invisible hand” of the market in the end adjusts to reality over time so we will see how this plays out

Thanks for sharing your thoughts Robert. I seek not to demonize Sonos, simply to call out their “sleight of hand” misdirections whenever I see them. My goal is to deliver to Strata-gee readers, to the best degree I’m able, the honest truth – which sometimes requires wielding a machete to hack away at the tangled jungle of spin.

But like you, I have a lot of respect for what they’ve created.

Ted