Sonos, Inc. this week reported a strong first quarter for their 2020 fiscal year. In fact, the company says it had a record quarter with strong revenue and profit gains.

See more on the Sonos record quarter results

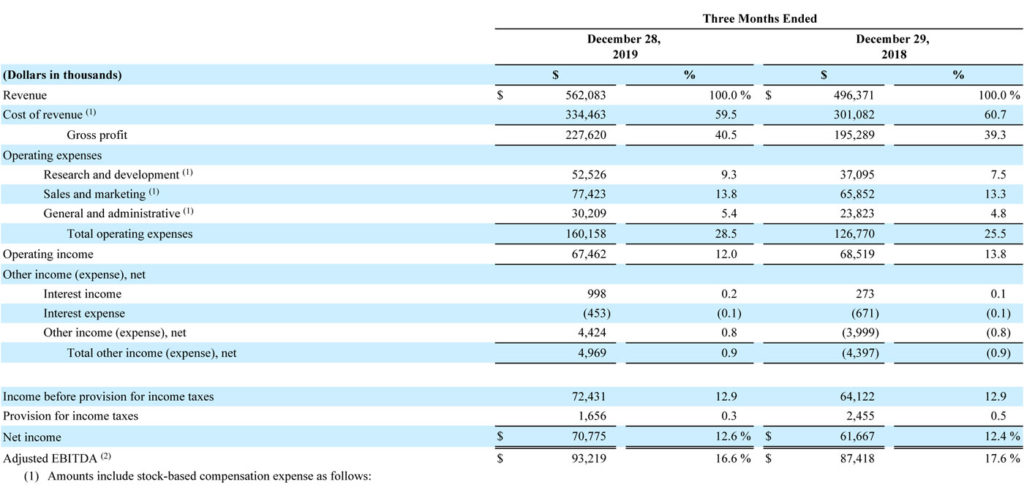

As is their typical approach, Sonos released an initial read on their performance in a letter to shareholders. In this letter, the company said revenues grew 13% to a record $562.1 million for the quarter, and GAAP net income increased 15% to a record $71 million as well.

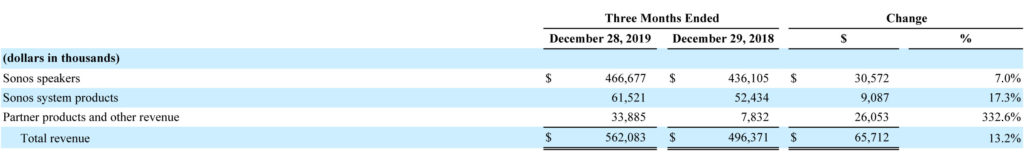

Growth came pretty much across the board, as the company noted each category of products showed decent growth. However, it is a little difficult to compare with previous reports, as the company has changed their product category definitions. Still, growth appears across the board, no matter how you slice and dice it.

Q1 Highlights

Revenues for the quarter rose from $496.4 million in 2018 to $562.1 million in 2019, a 13.2% increase. Operating income actually decreased slightly, coming in at $67.5 million or 1.5% below the $68.5 million the year before

However, the company showed net profits in the quarter of $70.8 million, or 15% higher than the net income of $61.7 million the same quarter the previous year. This is, of course, the proverbial “bottom line.”

The company sold almost 3 million units with sales increases across the board. Each of the company’s product segments showed growth, although there was a lot of variation in the percentage of growth between them.

New Product Segment Breakdowns

The three categories that Sonos now track are broken down as:

- Sonos speakers – Consisting of Play:1, Play:5, Sonos 1 SL, Playbar, Playbase, Sub, voice-enabled Sonos One, Sonos Move, and Sonos Beam)

- Sonos system products – Consisting of Sonos Port, Sonos Amp and Sonos Boost

- Partner products and other revenue – Consisting of modules units sold through partnership with IKEA, architectural speakers sold through their partnership with Sonance, accessories and other revenue associated with other software, services or licensing arrangements

The main driver of growth on a percentage basis is the “Partner products and other revenue” business segment. This is the segment that is largely defined by their Sonance partnership and their new experiment with IKEA.

Biggest Percentage Gain in Smallest Segment

While the total revenue growth rate was 13% overall, the Partner products category had growth of over 332% – from $7.8 million in 2018 to $33.9 million in 2019.

I have been reporting for a few quarters now that the company was struggling with a decline in sales for their original wireless music system products. Now in their Sonos speaker segment, that decline seems to have been offset by the success of new models in the grouping and the company particularly notes success with the One SL, Move, and Port. Still, the growth in this, their largest segment by far, was a much smaller, single-digit 7% growth.

Gaining Market Share, Even in ‘Premium’

The company says it continues to grow market share in most major markets such as the United States, United Kingdom and Germany. They note, “when looking more specifically at premium price points in the categories we serve in the U.S., Sonos gained disproportionately more share compared to the rest of the market – further illustrating the power and premium nature of our brand and the strength of our products and platform.”

The company’s cheerful letter takes a serious turn when it notes that they intend to “work towards realizing the value of our intellectual property assets. Based on the information we have, we believe many companies with multi-room, audio product offerings infringe on our IP.”

More Lawsuits are Coming

Yep, much as I had predicted during my coverage of their litigation with Denon (over their HEOS line), Sonos is rattling their sabers and putting the industry on notice that they are coming for you. They had a huge win in their Denon litigation and it is yet to be determined how they’ll fair against Lenbrook who took some pretty good defensive swings back at the company – but the big magilla is their litigation with Google.

Clearly, if you feel ready to take on one of the world’s richest and most powerful companies, you are brimming with confidence. However, unlike their competitive combatants up to now, Google is very IP savvy, has strong legal counsel, and the resources to do whatever it takes.

Yet, if Sonos manages to prevail over Google…the world is their oyster.

Learn more about Sonos by visiting: sonos.com.

Easy to have a great 1/4 when you announce a price increase on two key skus and dealers buy in as much as they can.

Yes Ted, we will learn the strength of their IP due to these actions, but it could take quite some time. There is little doubt that Google never reviewed their inventions as this is the practice to avoid any “intentional infringement” which is where the big money is awarded.

As well, you speculate on the Denon issue as that was settled privately without disclosure prior to the Sonos IPO. It may be a big win, or not and we are not likely to know.

As well, while it is clear they have many inventions, it is not clear at all they have fundamental utility or original patents. Most portfolios have lots of design patents, or their specific design approach and features of their products not to be copied, but few own the original idea.

We need to keep in mind that multiroom systems existed long before Sonos or Rincon their original name. They pioneered a smart speaker that could handle wireless networking and act like in Mesh networks both as sender and receiver. They have added features like room correction (which others have as well pre-existing), Alexa, etc over time. However, it is also true that WiFi chip makers had most of these features on their product roadmaps at the same time.

Much of the founding work of WiFi was and is done at the University of Australia where several of the original engineers were educated. This is also true of the HEOS engineers and others. In the case of Lenbrook, much of their approach was done by Simple Devices whose Squeezebox was available prior to 2000, meaning prior to Rincon or Sonos. This was also an existing multiroom wireless system called Boom marketed by Logitech well before Sonos entered and though Sonos certainly beat them in the market and Logitech moved elsewhere this is a basis to take claims with appropriate point of view.

Sonos is a well run firm. They have made great progress, but this is early days and there is a lot of innovation and product range growth for the category.

In reviewing their sales it should be noted that they delivered the new Move and other items in the period and channel fill is always a friend. There is reason to think their original multiroom product is not growing or not much.

With IKEA now expanding downward in Audio with the new Teenage Engineering items just announced, this expansion too is a to be seen development.

Meanwhile, some customer unfriendly mistakes, still no support of all uncompressed files, others with larger systems and much much bigger ecosystems means it is still a race to be run. They certainly do deserve to compete, so it will be fascinating to watch.

Thanks as always Ted.

Thanks Robert,

My comments on Sonos’ total win over Denon stems from the fact that the jury found in favor of Sonos on every claim. Sonos even prevailed in getting a couple of Denon’s patents invalidated. The only thing kept confidential was the royalty rate Denon must pay to Sonos.

I admit I’m not a patent attorney, but looks like a total win to me.

On the other hand, I’m told Google has a massive and powerful patent portfolio as well. So we’ll see how it plays out. But I wouldn’t be surprised if this doesn’t just end up in a cross-licensing agreement.

Thanks again for sharing your insights.

Ted