On Eve of CEDIA Expo, Show Owner Admits Reduced Attendance at ‘Near-Term Events’

Emerald Holding, Inc. (NYSE:EEX), owner of the CEDIA Expo show, reported its results for the second quarter of fiscal 2021 confirming that the company lost $46.5 million in the quarter as it continues to struggle with the impact of COVID-19. Clearly, the pandemic slammed the live event and exposition industry and even as coronavirus begins to wane, the industry is finding it difficult to return to normal.

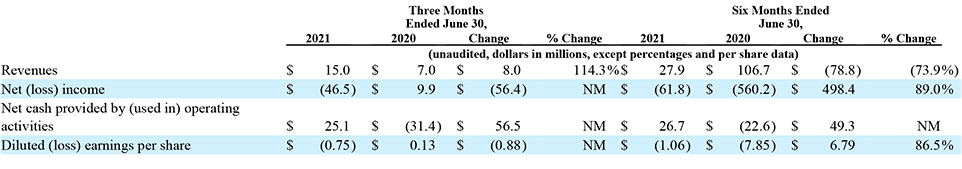

See more on the results for Emerald in the quarter

A business doctor would look at Emerald’s situation and suggest that the prognosis is guarded, at best. On the positive side of the case, the company is excitedly anticipating the reopening of the country and the return to live, in-person events. But on the negative side of the case, the company is finding early results at events already restarted are “mixed” with lower attendance at “near-term” events, resulting in continuing low revenues, and has been forced to sue their event cancellation insurance providers to force payment of monies already owed.

The company’s report started with this highlight: “Second quarter results continue to be negatively impacted by event cancellations due to the COVID-19 pandemic.” A statement from Emerald President and CEO Hervé Sedky reinforced the point with his admission of their continuing COVID challenges. He said, “There is not a day that goes by that I am not reminded of the extraordinary times we are living in.”

Not Much to Cheer Investors Here

There was little for investors to cheer in this report. Quarterly revenues came in at just $15.0 million up 114.3% over the $7.0 million booked last year during the heart of the pandemic. Perhaps helping to illuminate the severity of the situation, the results for the first half of the year for Emerald showed revenues of just $27.9 million, or down -73.9% as compared to the revenues of $106.7 million in the first half of 2020.

How did investors feel about this quarterly report? In mid-day trading Friday after the early morning release of the Emerald report, shares in their stock dropped more than 7%, while the Dow was only off a little more than three-tenths of a percent.

Insurance Reimbursement is Key to the Revenue Story

Why are revenues down in the first half of this year as compared to last year – the year of the pandemic? The reason is that their revenues include reimbursement from their event cancellation insurance, reimbursing the company for revenues lost from shows canceled due to the pandemic.

For 2020 canceled events, Emerald submitted claims worth a total of $167 million. So far, they have received$124.7 million – $89.1 million received in 2020, and $35.6 million in 2021 (received or “expected”). The company has further submitted claims for canceled or impacted 2021 events worth an additional $75 million, of which they haven’t received any at this point.

There is not a day that goes by that I am not reminded of the extraordinary times we are living in. The COVID-19 pandemic has undoubtedly affected our business but it has also brought out the best in us – our creativity, our ingenuity, our resilience. While we will always put safety first, the roll out of the vaccine has allowed us to move forward with in-person events in all states where we host our shows. As a result, we are set to stage 86 live events through the second half of the year, representing the most active show schedule in Emerald’s history.”

Hervé Sedky, Emerald Holding, Inc. President and Chief Executive Officer

Emerald is Suing the Event Cancellation Insurance Carriers

In the second quarter, the company received a total of only $2.3 million in insurance claims – which seems pretty paltry, considering how much the insurance companies owe them. In fact, on February 22, 2021, Emerald filed a lawsuit in a Federal court in California against their insurance carriers alleging their “insurers have acted in bad faith and failed to timely pay amounts due and owing on submitted claims.”

That is not a good sign and may be why insurers put the brakes on payments in the second quarter. Regardless of whether Emerald succeeds in forcing full payments from the insurers the reality of litigation is that it is slow – two or three years slow in most cases – and costly. And while in theory Emerald can sue for reimbursement of their legal fees, courts do not often honor such suits. All the insurance carriers have to do is show reasonably legitimate questions surrounding the veracity of submitted claims and the court will be less likely to ding them with legal fee reimbursement.

A Dramatic Swing to a Net Loss in the Quarter

Emerald’s second-quarter net losses came in at $46.5 million versus a profit of $9.9 million in the same quarter back in 2020. The company says this increase in net loss is largely due to the drop off in “Other Income” which is mostly the insurance reimbursements category. As mentioned above, this came in at just $2.3 million as compared with $48.2 million in insurance reimbursements received in the same quarter last year.

Finally, the company said that it acquired Sue Bryce Education in the quarter which – in addition to their acquisition of The PlumRiver, LLC in the fourth quarter of 2020 – added $3.4 million to the quarterly revenues. Pull those out of the numbers for “organic” growth (growth from continuing operations) and revenues for the quarter were $11.6 million or 84% over the $6.3 revenues during the pandemic in 2020.

Hoping to ‘Show’ Success, with Shows

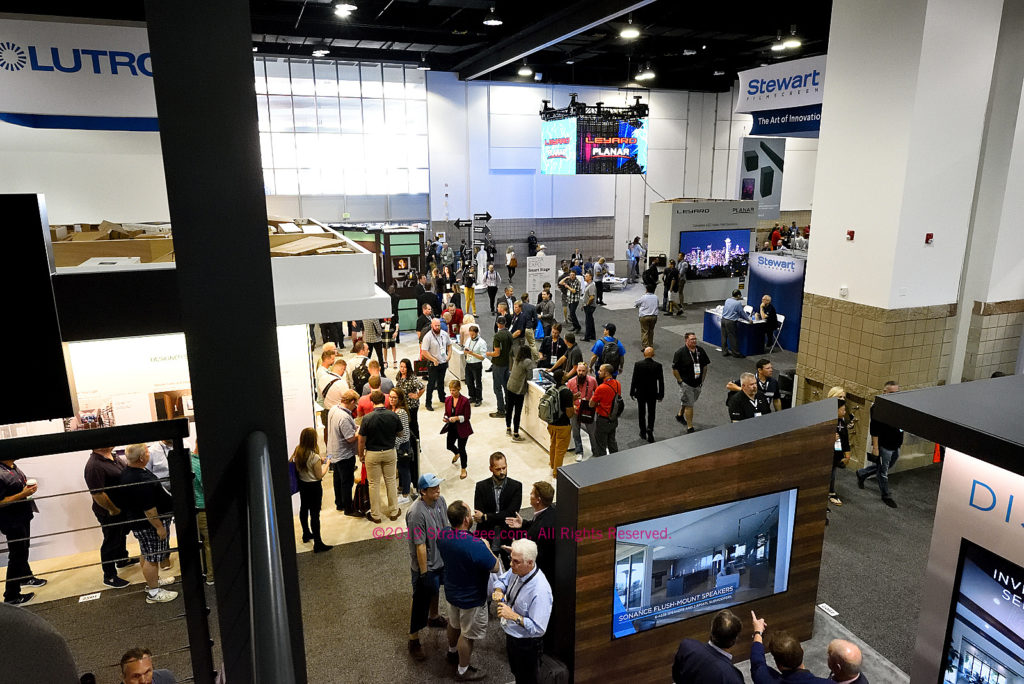

The company expects to see a dramatic turnaround in its fortune as they ramp up its show schedule in the second half of the year. Emerald will field a total of 86 shows and live events in the last six months of 2021. But even their CEO admits that results at shows they’ve produced so far in 2021 have been “mixed.”

Our clear goal is to deliver high quality events that meet and exceed our customers’ expectations as we focus on our shows’ brands and the value that our customers achieve by attending. The early results have been mixed, with some positive trends. For example, we experienced a significant increase in our Digital Dealer event’s Net Promoter Score based upon the quality and value of the event to attendees following the show’s staging in June. Additionally, while near-term events are coming back at reduced attendance levels, our bookings for our 2022 first quarter events are tracking much closer to pre-COVID-19 levels.” [Emphasis added]

Hervé Sedkey

Learn more about Emerald Holdings at: emeraldx.com.

I wish them well, but this doesn’t sound promising.

Does CEDIA want to buy back the show? Hmmm

Considering the rapid spread of the Delta Varient attendance at shows is up in the air. I wonder if RMAF 21 will still go on?

My risks as a fully vaccinated person seem to be going up.