The Days of Sound United as Part of Masimo are Likely Numbered

Masimo Corporation’s [Nasdaq: MASI] 2024 Annual Stockholders Meeting concluded yesterday, September 19, 2024, to the surprising news that the battle for control of the company’s Board of Directors was over…and there’s a new sheriff in town. According to a public statement released from Politan, activist investor Quentin Koffey, and his Politan Capital Management group’s nominated candidates, both won election to the two open Board seats – guaranteeing that the new independent directors are a majority of…and control…the Board.

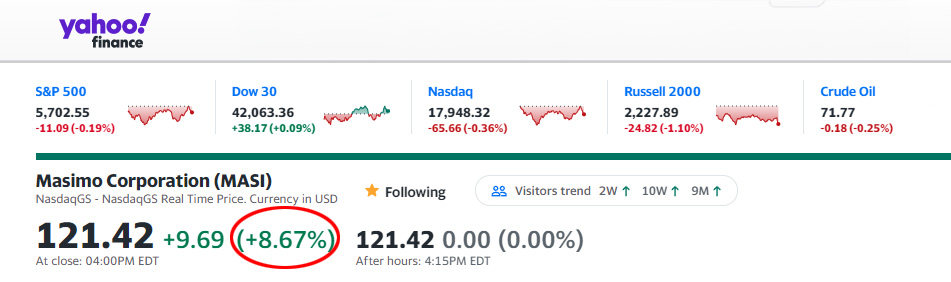

Investors reacted to the news…and it was a strong reaction.

See more on the investor reaction to the Politan directors gaining control

On Thursday, the day of the Masimo stockholders meeting, after the close of financial markets the news emerged that Politan’s nominated candidates were elected to the Board. This news generated an almost immediate reaction from investors, as I reported in my story yesterday. In after-hours trading, the value of shares in Masimo stock began immediately to begin trading higher, up more than 2.3% in early evening trading.

On Friday, The Day After the Announcement, Investors Celebrated by Driving Up MASI Stock

On Friday, the day after the dramatic announcement of the change in control at Masimo, investors were continuing to celebrate the news. The value of MASI stock continued to climb, finally closing up at $121.42/share, +8.67%.

This is clearly a sign that investors are interpreting the impact of developments at Masimo positively. Investors are cheering that with a majority of independent directors on the Board, the company will now begin making better, more sound business decisions. Given that the company is facing several impending major business decisions, a more thoughtful analysis and careful planning…with better strategies…are bound to lead to improved results.

A New Board More Sensitive to Issues Important to Investors

There is some thinking in the investment community that this new Board is likely to be more conscious of – and responsive to – investors, a key stakeholder of any public company. Many investors had come to believe that former Chairman and CEO Joe Kiani seemed to pay little mind to the situation, needs, and thinking of the company’s investors.

That thinking created a powerful magnetic attraction among investors – even institutional investors – to Quentin Koffey, who spoke the language of investors…fluently.

Interesting and Ironic Bookends to Masimo’s Sound United Acquisition

The action in Masimo’s stock price today poses kind of an interesting…and ironic…bookend to Masimo’s dalliance with Sound United. The day after Kiani and Masimo announced its acquisition of Sound United back in late 2022, the value of MASI stock crashed nearly 40%. And even though today’s result isn’t quite that dramatic, the day control of Masimo’s Board switched to the team committed to selling off Sound United, the value of MASI stock jumped 8.7%.

It’s almost poetic – and some would say predictable…

Learn all about Masimo Corporation by visiting masimo.com.

See more on Politan Capital Management at politanmgmt.com.

Leave a Reply