No doubt about it, for the last few weeks, storm clouds have been gathering as many are seeing a darkening outlook for the U.S. economy. In just the last few days, three key pieces of data – red flags, really – suggest we all need to be vigilant in tracking where the economy is headed. These three pieces of data include: 1) another consumer survey showing eroding confidence; 2) key retailers warning of slowing sales from tariff increases; and 3) a new Fed estimation that the GDP will contract -2.8% in the first quarter of 2025.

See more on the gathering economic storm clouds

A confluence of data suggesting the economy may be headed towards a downturn have recently surfaced, reminding us all that we need to pay attention…forewarned is forearmed. They all seem to be intertwined with the new administration’s aggressive trade moves – especially related to tariffs.

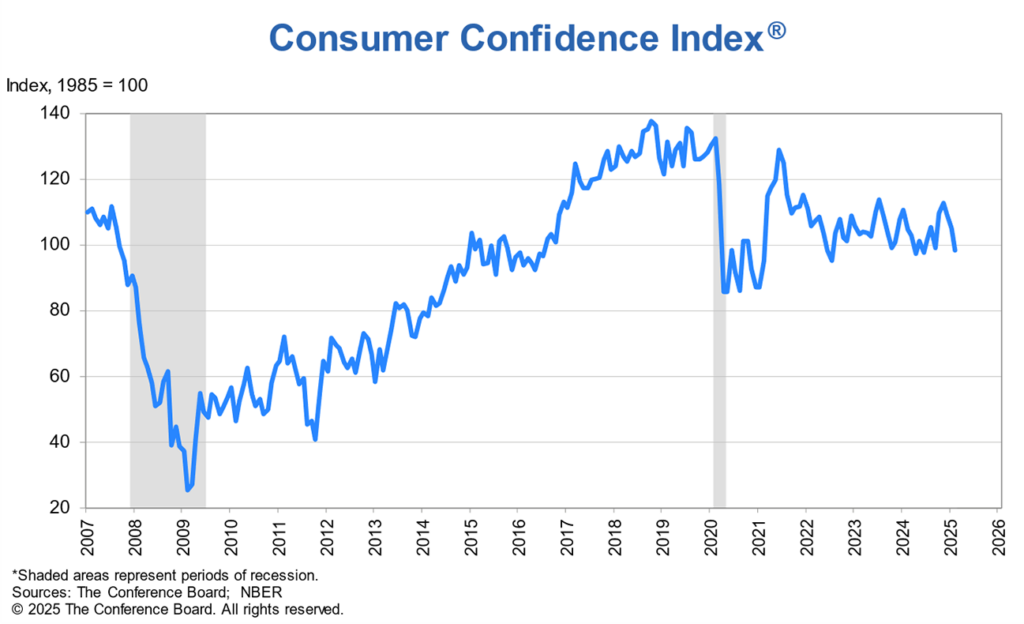

About a week ago, right at the end of February, a new consumer confidence report came out that reinforced its previous reports that consumers are in fact getting quite concerned about the direction of the economy. The Conference Board’s Consumer Confidence Index (CCI) – one of the gold standards of consumer research – had a very large monthly drop.

The Biggest Hit to Consumer Confidence Since 2021

The final February CCI declined by a significant 7.0 points to 98.3 (1985=100), its largest drop since August 2021 in the depth of the pandemic. Generally, a reading of 100 suggests stability, above 100 suggests conditions for growth, and below 100 suggests conditions are ripe for a recession.

The CCI has two main components: the Present Situation Index, which is consumers’ assessment of current business and labor conditions…and the Expectations Index, which is consumers’ short-term outlook for income, business, and labor market conditions. The Present Situation Index dropped by 3.4 points to 136.5, and The Expectations Index dropped 9.3 points to 72.9.

For the first time since June 2024, the Expectations Index was below the threshold of 80 that usually signals a recession ahead.

The Conference Board, in a press release titled ‘US Consumer Confidence Dropped Sharply in February‘

The Third Consecutive Month of Decline in Consumer Confidence

In February, consumer confidence registered the largest monthly decline since August 2021. This is the third consecutive month on month decline, bringing the Index to the bottom of the range that has prevailed since 2022. Of the five components of the Index, only consumers’ assessment of present business conditions improved, albeit slightly. Views of current labor market conditions weakened. Consumers became pessimistic about future business conditions and less optimistic about future income. Pessimism about future employment prospects worsened and reached a ten-month high.

Stephanie Guichard, Senior Economist, Global Indicators at The Conference Board

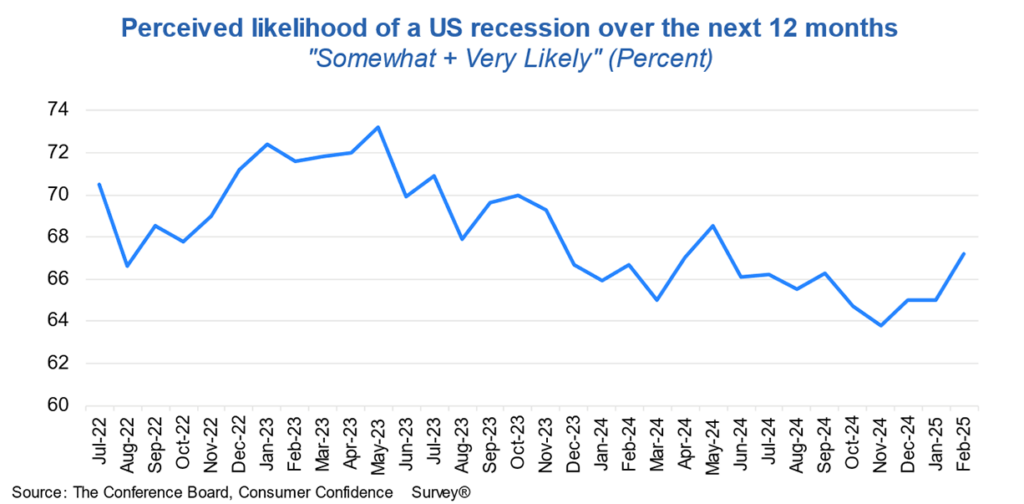

Consumers told the Conference Board they expect inflation to increase to 6% within a year. This is double the current rate of approximately 3%. There was also a significant uptick to over 67% of consumers who said a recession was “somewhat” or “very likely” within the next twelve months.

Finally, The Conference Board’s report noted what topic appeared to be weighing heavily on consumers’ minds, “There was a sharp increase in the mentions of trade and tariffs, back to a level unseen since 2019. Most notably, comments on the current Administration and its policies dominated the responses.”

Retailers Warn that Tariffs Will Cause Slowing Growth

Two major national retailers independently warned that price increases resulting from the administration’s latest tariff plan are imminent. The CEOs of Target and Best Buy said tariff-connected increases are will come quickly, with the Target CEO saying that increases on “fruits and vegetables” are just days away.

And America’s largest retailer, Walmart, told the media that it too “will not be immune” from the impact of tariffs.

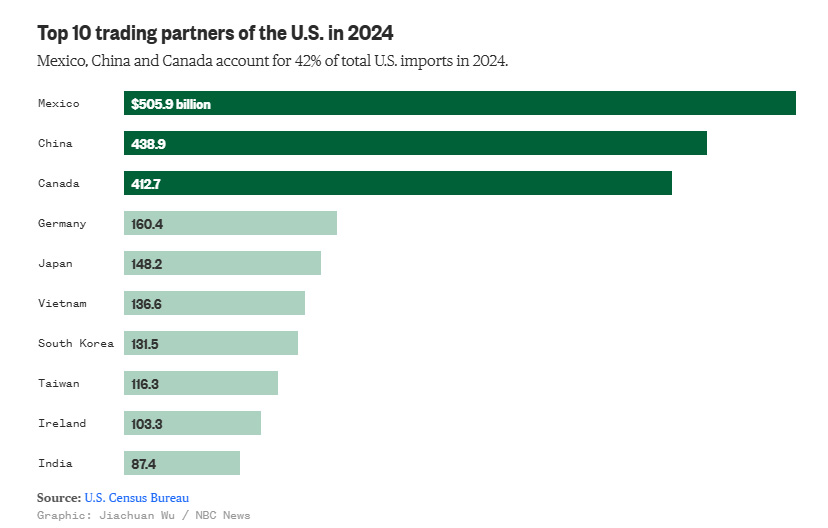

The fact is that many goods in the US come from either Canada (>50% of lumber used in home building comes from Canada), Mexico, and China. Given the national scale of these retailers, with their significant levels of imported inventories, they are warning that it will be impossible for them to absorb the size of these tariffs as proposed by the administration.

A Positive Earnings Report Spoiled by Price Increase Warnings

Ironically, Best Buy had an earnings release this week in which it delivered substantially better than expected results. But the company’s warning on tariff-linked price increases spooked investors and the value of its stock dropped a significant 14%.

Now that these tariffs are coming into play, the cost of many of these products are going to go up quite substantially. There’s no way that retailers can afford to absorb all of this cost increase themselves and keep prices the same for the customer.

Neil Saunders, Managing Direcotr at GlobalData, a retail consultancy, to NBC News

NBC News says, “Wall Street investors, retail industry leaders and economic forecasters are sounding growing alarm that the Republican administration’s trade policies could pinch households’ wallets and slow down the economy — two-thirds of which is fueled by consumer spending.”

Getting Fed Up…Federal Reserve Bank Projects a Q1/2025 Drop in GDP

Lastly, a widely watched gauge of Gross Domestic Product (GDP) maintained by the Atlanta Federal Reserve Bank, known as GDPNow, is projecting that GDP in the first quarter of 2025 will contract to -2.4% (the original estimate was -2.8%). This will be the first contraction in GDP since the first quarter of 2022.

For comparison, the initial reading on GDP for the fourth quarter of 2024 came in at +2.3%, down from +3.1% the previous quarter. The final reading for 2024 will come out later this month.

The Atlanta bank’s GDPNow system uses a forecasting model that “mimics” the models used by the Bureau of Economic Analysis for the official GDP forecast and assessment. GDPNow aggregates the statistical model forecasts of the 13 subcomponents that comprise GDP.

Factors Contributing to an Economic Decline

GDPNow first issued a Q1/2025 forecast of a -1.5% contraction of GDP at the end of September. It is clear that the potential impact of the administration’s tariffs, weakening consumer sentiment, which is leading to declining consumer spending, are all factors combining to cause the economy to decline after the last year-and-a-half of growth.

If the economy does, in fact, contract in the first quarter, then the stage is set for an official proclamation of an economic recession if the second quarter sees GDP decline again. The official definition by government agencies is that two consecutive quarters of negative GDP is considered a recession.

The Biggest Concern – Stagflation

What has many economists concerned is that this “witches’ brew” of ingredients impacting the U.S. economy could lead to stagflation. We’ve been there before, back in the 1970s, and it is a particularly difficult situation for economic policymakers to resolve.

Stagflation occurs when economic growth stalls, but inflation climbs. Often, unemployment will peak as well. The problem for government policymakers is that actions taken to resolve any one of these variables tends to exacerbate the others. You can get stuck in a vicious cycle.

Back in the 1970s, interest rates were ultimately increased to 21% before the cycle of stagflation was finally broken.

Good analysis, thanks. The NASDAQ is down another $1T in value today.

Since 2008, we have a new fiscal playbook, run entirely by the oligarch class. When things get bad, the FED is instructed to print more QE debt, which temporarily gooses asset values and causes all assets (stocks, real estate, etc.) to soar again. Pandemic? Print more debt. Stock market downturn? Print more debt.

The neoliberal justification is always the same: Japan is doing fine with 280% debt-to-GDP ratio, and the USA is only at 130%, so we have decades of runway available for more debt! This will actually work for many years. It’s a clever grift. Here’s why: eventually all of that new federal debt will find its way onto the positive side of oligarch balance sheets, while increasingly worsening the debt load and purchasing power of our middle-class.

At some point (10-20 yrs?), this immorality will all come crashing down.