Strata-gee’s COVID-19 Impact on Tech Study Offers Insights on Early Pandemic Impact

This week, Strata-gee launched a survey designed to get a sense of the level of impact on Tech businesses by the coronavirus COVID-19 pandemic now sweeping across the United States and the globe. Thinking that the timing of this survey was very early in the spread of the epidemic and likely to reveal a calm baseline reading, respondents surprised us with results that are fairly dramatic and showed that many are already feeling the impact.

See Strata-gee’s Survey: COVID-19 Impact on Tech…

These are unprecedented times in which we find ourselves. The coronavirus, otherwise known as COVID-19, has made its entry into the United States, and in just a few weeks has already shown itself to be relatively fast spreading…and deadly. Currently – literally, as of today – the Centers for Disease Control and Prevention report that there are 7,038 confirmed cases of COVID-19 in the United States, with many, many more cases reported and in the process of being verified. A total of 97 Americans have died from the virus so far.

Globally, according to the World Health Organization (WHO), there are 191,127 confirmed cases of COVID-19, with 7,807 deaths. Keep in mind that here in the U.S., the numbers are considered under-reported due to a critical shortage of testing kits. The actual number of people affected could be higher…perhaps much higher.

State & Local Govts Take Drastic Actions to Contain COVID-19

In an attempt to try and tamp out the community spread of COVID-19 and keep it from multiplying too rapidly – many states and cities have closed schools, shut down restaurant dining rooms, bars and even instituted curfews – times when all citizens must be off the street. Other states have banned gatherings of 250 or more people…and some ban even smaller groups. San Francisco has recently issued a Shelter-In-Place order, which shuts everything down (except essential services) and keeps all citizens in their homes.

In support of this effort to stop the spread of the virus, many private companies have closed their centralized office locations and are asking their employees to work remotely from their homes or apartments.

A Disruptive Pathway to a New ‘Normal’

What this all means is that there is a lot of disruption as residents and businesses try to adapt to this new “normal” of remote working, self-isolation (or self-quarantine if you’ve been exposed), and social distancing. What, I wondered, did this mean for the typical tech company? How is it going for them at this point?

To get a better handle on the evolving situation, Strata-gee created its COVID-19 Impact on Tech survey. This survey is a quick and easy five questions, and was designed to get a quick baseline reading on where things stand now. I wasn’t expecting much, as we’re really still early in this cycle of the pandemic’s impact.

Survey Yielded Some Real Surprises

However, there was a bit of surprise when viewing the results of the survey from Strata-gee (which are still coming in). This study, as you might suspect, brought in a range of responses – everything from what I call the blue sky-ers…to the doom-and-gloomers…and everything in between.

Collectively, the impact being felt at this time was much bigger than I anticipated…a legitimate majority of respondents (53%) said that COVID-19 has already impacted their business “a good bit” or “a great deal,” the two highest ratings of business impact.

Thank You, Thank You, Thank You!

So let’s dig in to the results. But first – THANK YOU, THANK YOU, THANK YOU to all who participated in this survey. This was the largest number of participants who have EVER contributed to a Strata-gee survey…and I GREATLY appreciate it. The more who participate, the greater the sample…the greater the sample, the more accurate the results. I feel good about these numbers.

In addition to this, many of you – and I mean a great many of you – took extra time to answer the open-ended questions thoroughly and thoughtfully. There are some great insights there from which we can all learn.

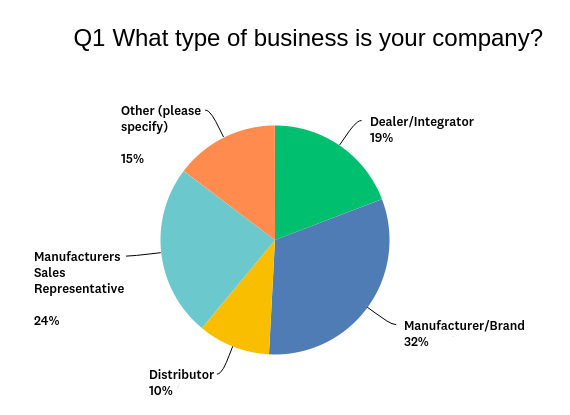

Q1 – Who Participated? A…Lot…of…Interesting…People…

So who participated in the Strata-gee survey? An invitation was sent out to all subscribers of Strata-gee. Respondents turned out to represent a wider cross-section of the industry than I expected. Of course, there are the usual suspects – fully a third of respondents were Manufacturer/Brand (32%), this was followed by Manufacturer Sales Representative (24%), almost one out of five respondents were Dealer/Integrator (19%), and one-in-ten were Distributor (10%). But the “Other” category, coming in at a robust 15% of respondents was larger in this survey than I’ve seen in our past surveys.

Digging into the “Other” category offered an interesting glimpse of the growing and diversified world of Strata-gee.com readers. So who are these folks? Unsurprisingly, we have several who identify as consultant…but beyond that other titles/roles included business coach…public relations professional…retired industry executive (pretty famous folks you likely know)…advertising…digital marketing…technology consultant…OEM/ODM manufacturer…buying group executive…internet solutions provider…engineering consultant…musical instrument retail…telecommunications consultant…service center & reverse logistics…and more.

Catching my breath to continue on…we even have tech professional (Disney), construction industry…expositions executive (international audio shows)…media executive…and…well, you get the idea. We have a big tent here at Strata-gee!

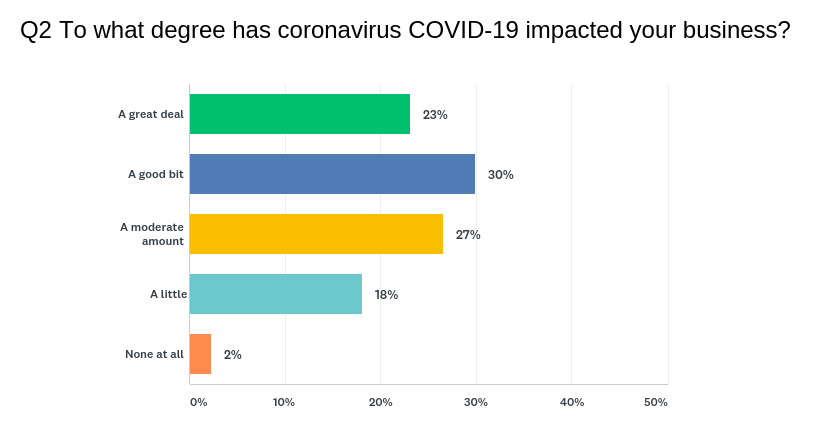

Q2 – To What Degree has Coronavirus COVID-19 Impacted Your Business?

One goal of this Strata-gee survey was to take a baseline reading – again thinking we were early in this assessment – of the impact of COVID-19 on tech businesses. So the second question, “To What Degree has Coronavirus COVID-19 Impacted Your Business,” offered five choices ranging from low to high impact:…None at all…A little…A moderate amount…A good bit…A great deal.

My expectation was that most of these initial responses would be in the “None at all” or “A little.” And perhaps there would be an occasional “A moderate amount. But this survey from Strata-gee turned that thinking on its head with most respondents picking “A good bit” followed by “A moderate amount.”

Most surprising, the number of respondents who said that, even now, COVID-19 has impacted their Tech biz “A great deal.” This means that a majority of the survey respondents – 53% – are being impacted now. Surprisingly, only 2% picked “None at all” in describing COVID-19’s impact on their business – with another 18% saying there’s only “A little” impact.

Major Takeaway – Nearly Half of All Respondents Say Sales are Already Falling

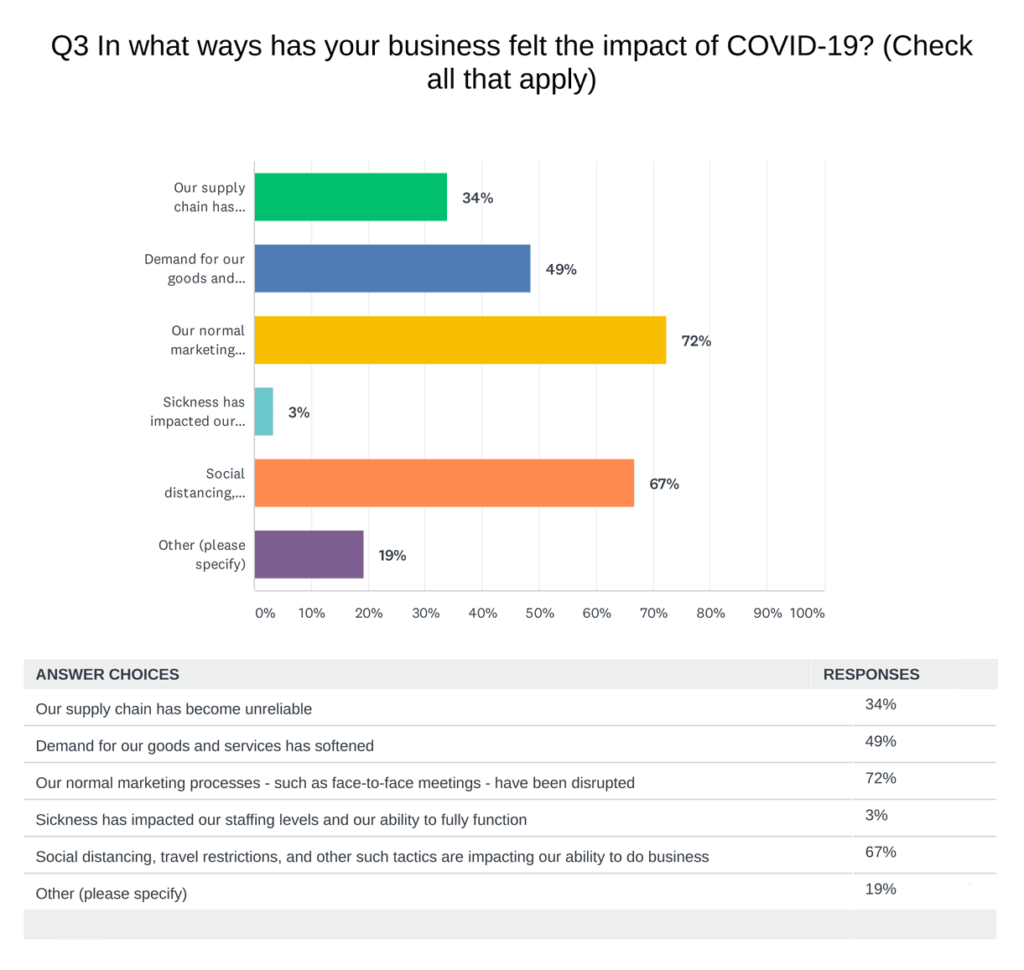

Seeking to better understand not just the degree of impact of COVID-19, but also the nature of that impact, multiple choice question #3 asked those taking the survey from Strata-gee, “In what ways has your business felt the impact of COVID-19?” To make it easy, the survey offered a range of five options to choose from for quick-click ease of selection.

The totals add up to more than 100%, because we asked those taking the survey to select all of the options that applied to their situation. A few people clicked all five of them, saying that each played a role in one way or another. But most selected the two or three options that had the greatest impact.

This question yielded our second greatest takeaway from the Strata-gee survey – nearly half of the respondents say that the COVID-19 epidemic is already causing their sales to decline...with 49% selecting “Demand for our goods and services are softening.” Again, a result that surprised me.

The ‘REALLY GOOD NEWS’ About Sickness

The top response was “Our normal marketing processes – such as face-to-face meetings – have been disrupted.” Given all of the various buying group and trade show event cancellations recently, this was an obvious option to offer – and 72% of respondents selected it as an impact.

Following this, with 67% of respondents selecting it, was “Social distancing, travel restrictions, and other such tactics are impacting our ability to do business.”

A little over a third of respondents (34%) pointed to supply chain disruptions as another major impact. But the REALLY GOOD NEWS to emerge from this Strata-gee survey is that only 3% of respondents noted that employee illness was a factor impacting their business by selecting “Sickness has impacted our staffing levels and our ability to fully function.”

“Other” Option Offers More Color on Types of Impact

Importantly, this question also offered an open-ended “Other (please specify)” option, giving respondents the opportunity to name other impacts not previously enumerated. And thanks to the diligence of our survey respondents, we got a treasure trove of ways they are feeling the impact of COVID-19. Below are a sample of some of the top responses we received:

- It’s too soon to tell [NOTE: A few folks responded in this manner]

- Job sites have been closed (integrator)

- Some of our dealers were exposed and are self-quarantined (sales rep)

- Most clients have canceled or postponed projects that had been approved (integrator)

- To date we have not had much of a problem with business. Only one builder is slowing things down. We are doing Face Time videos with client meetings rather than having them in our show room. The installation department has not slowed down on project work and our service team is still running full steam with a slight uptick in folks wanting to update their network infrastructure. Traffic on has been great too!!! (integrator)

- [International] orders put on hold by customers (manufacturer)

- Adapting to a more remote way of working with dealers and replacing traditional face to face meetings, trainings, etc. to a more web-based approach (manufacturer)

- While our people can work from home (as it’s software development) it’s hard to imagine people are being as efficient or productive. Good work depends on face to face collaboration. We’re using tools like go to meeting to compensate but it remains to be seen if that does the trick. People are quite distracted right now. (software developer)

- We’ve seen more the need for communications services around Covid-19 – a positive for us. (public relations)

- People are afraid to spend [their] money now (integrator)

- completely altering our day to day operation to minimize employee interaction. (manufacturer)

- About to be told to close our retail operations (Australian dealer)

- News is being dominated by the virus making it harder for our clients to be heard through the noise. We are strongly suggesting holding irrelevant product news from being launched until concerns start to die down. (public relations)

- Take care of your employees or give them unpaid time off…. Hard decisions as clients are canceling/postponing installs

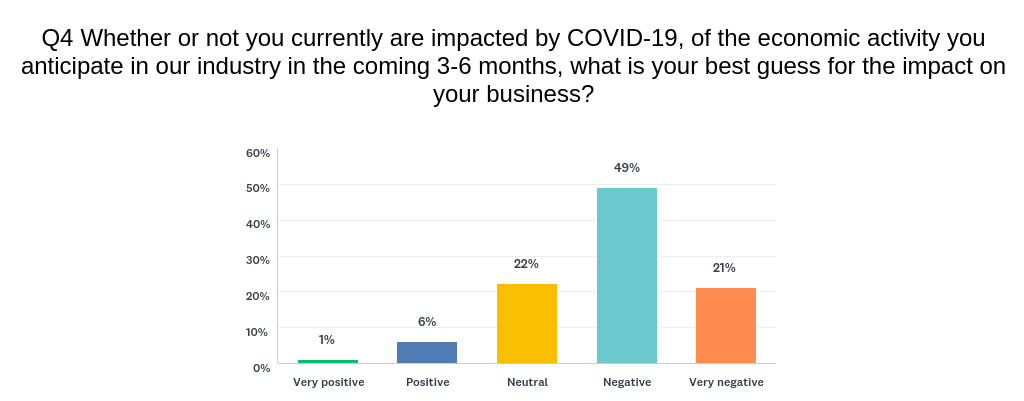

Q4 – Another Key Takeaway – Almost Half of Respondents Say The Future Looks Bleak

Our next question, question #4, asked those taking the survey from Strata-gee to look into the near-term future (I originally mis-typed that as the “near-germ future”…seriously!) of the next 3-6 months – to a period of time between now and the summer and the Fall – and asked them to project the impact on their business. The question was: “Whether or not you currently are impacted by COVID-19, of the economic activity you anticipate in our industry in the coming 3-6 months, what is your best guess for the impact on your business?”

Again, survey takers were offered five options to choose from, including: very positive…positive…neutral…negative…very negative.

The greatest number of respondents (49%) chose “negative.” In fact, 7 out of 10 respondents (70%) say this near-term future is either negative or very negative. About 2 out of 10 say this period of time will be “neutral” (22%). Only 6% said they expected the near-term to be “positive” and a tiny 1% characterized these coming days as “very positive.”

Q5 -Does the Impact of COVID-19 Change your Outlook for 2020?

There was an almost overwhelming response to this last question of the Strata-gee survey. Thankfully, most who took the survey, left a comment on this last question of some type. Some were short and sweet, and a couple were long enough that they could be converted into short novels.

The responses ran the gamut from blue sky-ers to doom-and-gloomers…and everything in between. We had passionate responses along the lines of: this is going to be (ultimately) great! And we had the equally passionate, if on the other end of the scale along the lines of: this could be the end of the world (or at least my business)!

Some even argued both the positive and negative case…in the same response, almost as though they were still working it out in their minds as well.

What Will Happen in 2020? Contemplate Patience; Or Is It Patients?

But it was hard not to juxtaposition responses from two different respondents for a bit of irony. For example, one respondent suggested that we all need to stay calm and persevere…trying to inspire us by exhorting the word “patience!” Just a couple of comments later, another respondent saw a bleak future that all should consider will get bleaker as the epidemic continues to spread. In explaining the dire impact of that future, he tried to drive the point home by exhorting the word “patients!”

However, this is the spot in the Strata-gee survey where the optimists came out and pitched their rosy viewpoints, sometimes fervently. A few seemed like someone who is whistling in the dark – trying to sound brave when actually frightened. One person even admitted to holding on to hope…”I hope my optimism comes to fruition.”

Blue Sky-ers Share Their Vision in Study

For the most part, optimists – or as I called them at the beginning of this post, blue sky-ers – see a rough near-term with a breathtaking bounce back. Most of them suggest the forced self-isolation will cause consumers to better appreciate their home electronics and business will be better than ever. Some examples follow:

- Once through the darkest hours, we will shine.

- The companies that will survive will use this opportunity to review their business practices. Improve what can be improved and be ready the second things show [a] sign of [improvement]. Treat the glass as half full and take advantage of the down time.

- While we certainly will not have the big growth year we were expecting prior to the crisis, we still expect to have a growth year nonetheless. We are in the growth stage as a company so while we won’t grow as much as we thought we would, I am confident that we will still have a growth year.

- My company (I’m an employee, not an owner) is as well prepared as any. Inventory in the barn, supply chain no more interrupted than at any other post-Chinese New Year period. Leveraging comm technology like Slack, zoom, etc. to keep in touch with our dealers and distributors.

- There will be pent up demand by luxury consumers who will become luxury buyers after the stock market rebounds post COVID 19. They will have been deprived of quality entertainment long enough to motivate them to secure their present and future entertainment. A key element to our dealers continued success, is to provide a memorable experience so the dealer is not forgotten when the consumer decides they want to upgrade their home entertainment.

- Short term 3-4 weeks things look uncertain, after that the demand seems high.

- We’ve been fortunate to see very solid 10% growth pace in the first quarter of this year. I will be taking a stronger look at increasing our marketing and overall consumer awareness about our company.

- Cautiously optimistic that we will weather the storm in Q2 and be back on track in Q3 and Q4

- I’m optimistic. We have the best medical resources on the planet. I live in Houston, the largest medical center in the world. It is only a matter of time for a resolve. People with the virus are recovering, the media doesn’t seem to mention that often enough. A lot of fear in the air. Take precautions certainly.

- …changes 2020 and will linger into 2021 this is going to make people think different. in my view 9/11 while super tragic had a long term [positive] on our industry. [I] feel the same here.

- Frankly we are heading into the great unknown. Should the quarantines work or there be a cure or vaccine in the next 30-60 days (as is being reported) then I feel this will overall, be but a hiccup. If it becomes as rampant as we are seeing in Italy then, who knows what the effect on the overall economy is. I feel the CI/home A/V channel could be in a position to thrive as people will be stuck at home. Retailers who tackle this head on with free shipping, or free delivery to their local area could combat Amazon and the internet. This could take a negative and make it a huge positive. We have told our factories that travel into the territory is temporarily suspended. We will be business as almost usual. We will be conducting more webinars and video conference calls, this will change the definition of face to face for the time being. Time will certainly tell on this one.

- I am of the mindset that we will see a slowdown for a month or two but the demand for our products and services won’t diminish. It will just be delayed.

- I worry about my clients who are at the beginning of a challenging 2-5 months. Fundamentally, I believe this will be a relatively short but very deep shock to most businesses. Revenue will fall below plan due to labor and worksite closure issues, and expenses will remain roughly constant in the short run due to continual pay programs to maintain a trained work force (as opposed to layoffs). Assuming reaching an inflection point in the virus spread in the next 4-8 weeks, the economy and financial markets should stabilize over the summer with demand and consumer sentiment rebounding near the end of the year.

- Short term 3-4 weeks things look uncertain, after that the demand seems high.

Doom-and-Gloomers Have a Darker Vision

Doom-and-gloomers see things quite a bit differently – with the speed of the current COVID-19 impact causing them to extrapolate a much more dire circumstance down the road. Interestingly, there were almost twice as many contributions from this group in the Strata-gee survey as compared to the blue sky-ers, which could be a reflection of the emotional impact of this situation that is still so new for all of us.

Not all of these comments are doom-and-gloom, with some respondents adopting a more moderate negative views. So here then, are some examples respondents shared with us:

- I have to assume this survey is more than a few days old. The impact on our business (and all others) will be catastrophic. This cessation of all revenue will continue for 6-9 months. I do not see how any small business can survive with no revenue during that amount of time.

- At this point i would expect 25-50% total decline in overall sales

- Changes a positive outlook for the year from a couple of months ago to a challenging year.

- COVID-19 + 2020 Election = Perfect Storm

- We’re speaking with dealers who are calling their clients, pending that outcome we are in a stand still don’t push, support the dealer’s efforts to work through this. It’s going to hit the bottom lines of many.

- It will have to change the outlook for 2020. The impact to the stock market alone will impact housing starts, amount of discretionary spending and the attitude of buyers.

- The market was in decent shape before COVID-19 but it has caused a significant downfall and thus a complete change on the outlook for at least the first half but possibly even the remainder of 2020. It’s a worldwide pandemic and will take a while to recover from.

- By restricting many other businesses, I’m sure the impact on our business will be felt for years.

- it is going to hurt big time globally business is non existent

- The first half will be a bust. 2nd half will most likely be in a recession. If infections continue but death rates are low we might see a relatively quick bounce back. If death rates are high the recession will be severe.

- Bye bye bonus.

- business will follow the uncertainty of the stock market. New projects will be put off. Supply chain will be caught off guard. Some vendors could close their doors.

- It’s hard to say. This will have dramatic short term consequences and those will start to kick in quickly. The long term recovery will be slower and graduated. Hiring and business expenditures will be delayed.

- Yes, she has change[d] my outlook. When this become[s] more manageable, I do not think that the customers will be looking to buy mid audio toys.

- It has already significantly impacted our ability to secure AV products (AV receivers, speakers, projectors) that have are sourced or least have critical parts from SE Asia. We have orders but no ability to fulfill those orders and in some cases no ETA information on when we might get stock again.

- COVID-19 will impact everyones business including retail, custom and professional sales/installs as the supply chains have failed, and customer traffic is horrific.

- What can I say … we may be facing the closure of our business and the loss of our jobs …

Seeing the Silver Lining, Having It Both Ways

We had several comments that didn’t necessarily seem to fit fully into one camp or the other. Rather, they seemed to recognize both the challenge and the opportunity. While this was a smaller subset of the overall responses – I include a few here for your consideration.

- As a direct to the consumer brand, we expect stronger than usual sales. But our supply chain costs are up and tariffs are negative.

- Covid-19 will have an impact, to what degree is yet to be determined. When you look at history, as a species we seem to have these events thrust upon us every so often, as time has progressed we have been able to (medically) respond faster and with more potency. Things may get worse before getting better but the time in which this happens may be much quicker than many expect, especially those who look for an apocalypse in every event. The question most forget to ask is “what is the reality of this situation and what is fact from fiction”. we have an event, take precautions, wash your hands, give up the hugs for a bit, but know this will pass, unfortunately some will not make it, be in all likelihood with compromised immune systems it be something else if it wasn’t this.

- 2020 will be a very poor year. We just have to ride it out Fortunately, I have a small business that can withstand the downturn

- I suspect a significant slowdown in orders and purchasing in general until the situation stabilizes, and I expect a 90 day minimum window for recovery at best 180 days at worst if nothing else goes sideways or is impacted. Uncertainty in supply and recovery in China AND EAST ASIA IS A huge UNKNOWN

- The impact on my business will be negative but I’ll make my best so my company becomes stronger.

- We all know our business is mostly a luxury. If you have a new home under construction or renovation then most likely the monies are already in place. Otherwise. people will think twice when their income is affected.

- History unfolding, amazing. I followed the outbreak in China, and now how it is affecting us in this country. Truly amazing, we will adapt.

- I believe business will be delayed not lost. The only long term negative effect could be the additional expense incurred by customer companies and how that may impact their capital spending later in the year. AV projects that use our products could be put on hold or cancelled.

- Our existing forecast and plans will be impacted. This will require us to work harder to make this up via other sources of business.

So there you have it – the first Strata-gee COVID-19 Impact on Tech survey. I am considering launching a second phase of the study in 30 or 60 days and will let you all know when that decision is made.

WHAT DO YOU THINK OF THIS STRATA-GEE SURVEY?!?! Let us know in the “Comment on This Post” box below. Has YOUR business been impacted? Do you relate to any of the results shown here? Share your thoughts below…

Leave a Reply