Now completed, Strata-gee’s COVID-19 Impact on Tech II Survey is a follow-up study to Strata-gee’s original survey, COVID-19 Impact on Tech. If you haven’t read those original results yet, I would suggest you start there by clicking on this link as it will add context to the follow-up survey discussed here. And this time we learn that things have definitely changed in just five short weeks. In a nutshell, survey respondents report that the impact of COVID-19 this time around is much greater than in March.

See more of what the Strata-gee COVID-19 Impact on Tech Survey is telling us…

Just like last time, this survey consisted of five questions – four multiple choice and 1 open-ended – sent to subscribers of Strata-gee.com which covers a wide cross-section of the tech business. The level of participation for this second version was within 1% of the number of participants we had in the first iteration, helping to ensure that we are making apples-to-apples comparisons, statistically speaking.

Again, I want to start by saying THANK YOU, THANK YOU, THANK YOU to all of you who chose to participate. Through studies like this, we can all get a better sense of how our collective group is seeing this extraordinary, once-in-a-lifetime event. It is an opportunity to learn from each other.

Let’s Start Here

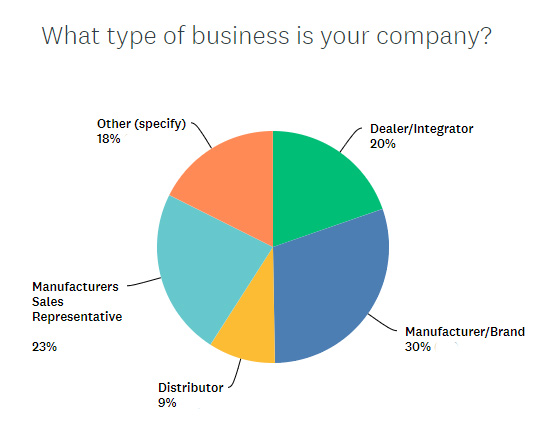

So let’s start here: this survey is identical to the survey that was originally distributed to subscribers to the Strata-gee.com content on March 16th. Strata-gee subscribers tend to break down into for major categories: Brands/Manufacturers, Infrastructure companies (distributors & manufacturer sales representatives), Dealers/Integrators, and Others. However, as I noted in a discussion after the last survey, the “Other” category was surprisingly larger than it had been in past Strata-gee surveys at 15% of all survey takers. I suggested that this indicates the expanding universe of Strata-gee readers.

That original survey was intended to establish a baseline reading on the situation in which we in tech (and the overall country) found itself. That situation, which probably goes without saying, is the spread of the Coronavirus COVID-19 pandemic and its effect on the tech industry. After establishing a baseline, the intention was to field one or more follow-up surveys to show the change in thinking as the situation unfolded.

First Survey Findings Delivered Some Real Surprises

I know, this is a long preamble, but establishing context for this new data is important…so please bear with me. At the time the first survey was distributed in Mid-March, it seemed a good point to take the temperature of the industry – as COVID-19 had not yet had as big an impact as it was to eventually have.

At that time, the U.S. Centers for Disease Control and Prevention (CDC) was reporting that in the United States, there were 7,038 confirmed cases of COVID-19 and 97 Americans had died from the disease. Compare that with the latest report (as of April 29, 2020) which now shows that 1,005,147 Americans are confirmed to have COVID-19, and 57,505 have died from it. That’s a tough six weeks!

That original survey delivered some “real surprises.” From that first survey we learned:

- A majority of respondents (53%) said COVID-19 has already impacted their business; with just under a quarter of them (23%) saying they had been impacted “A great deal.”

- Nearly half of all respondents (49%) said that their sales were already declining

- In looking at the impact of COVID-19 on their businesses in the near-term future, almost half (49%) said that in the next 3-6 months it will have a “negative” or “very negative” impact on them

So there’s our baseline, with respondents already reporting significant results in advance of the pandemic really taking off. So what does that mean for now?

So How About Now?

I can report that there were some new surprises in Strata-gee’s COVID-19 Impact on Tech II Survey. One of those surprises was that various elements changed more dramatically than I expected…while others changed less.

Keep in mind, we’ve all been dealing with this “new normal” for six weeks now or so. Back in March, there was a lot of fear of the unknown that crept into some of the open-ended comments. Now, while there is still plenty of concern for an still-uncertain future, we have more experience with COVID-19.

Q1 – What Type of Business is Your Company?

As I mentioned earlier, the level of participation was almost identical (within 1%) to the original survey, which I noted received the largest level of participation of any survey Strata-gee had conducted up to that point. In this question, we ask survey takers to tell us what type of business their company is. The breakdown they revealed was very similar to the survey last month – with one notable exception…the Other category which grew from 15% in the original survey to an even more robust 18% this time.

Survey takers choosing “Other” were able to write in their business types which were, for the most part, the same as last time. Lots of “consultants,” including: “business” consultants, “technology” consultants, “system” consultant & designer, consultant/ “product development,” “manufacturing product design engineering” consultant, and “consultancy and other businesses.”

Beyond consultants, this COVID II survey also included other types of businesses, such as: lawyer, press, research & industry analysis, Association, and more.

Q2 – To What Degree Has Coronavirus COVID-19 Impacted Your Business?

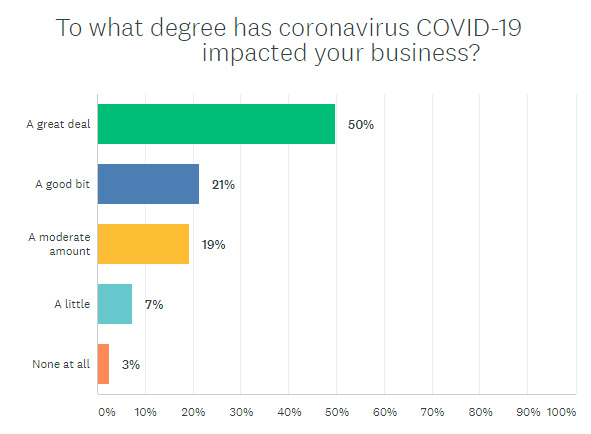

KEY TAKEAWAY: A majority of all respondents (50%) say their business has been impacted “A great deal” by COVID-19 – up from less than a quarter who said that in March (23%)

Respondents had five options to choose from, ranked from low- to high-impact: None at all…A little…A moderate amount…A good bit…A great deal. As we noted in the original survey in March, the largest group selected “A good bit.” When combined with “A great deal,” we had a majority of respondents (53%) saying they had already been impacted by COVID-19.

This time? Well, in this April survey, the largest number of respondents (50%), a majority of all survey takers, selected “A great deal.” The next highest response (21%) was “A good bit,” which when combined with the top response means that now more than 7 out of 10 (71%) respondents say that their businesses have been impacted by COVID-19.

This is a significant jump from the original survey and shows how the pandemic’s growth has taken a greater toll. Note that the number of folks who reported “None at all” grew slightly from 2% in March to 3% now. And the number who said that they had only been impacted “A little” has dropped from 18% in March to 7% now.

Q3 – In What Ways Has Your Business Felt the Impact of COVID-19? (Check all that apply)

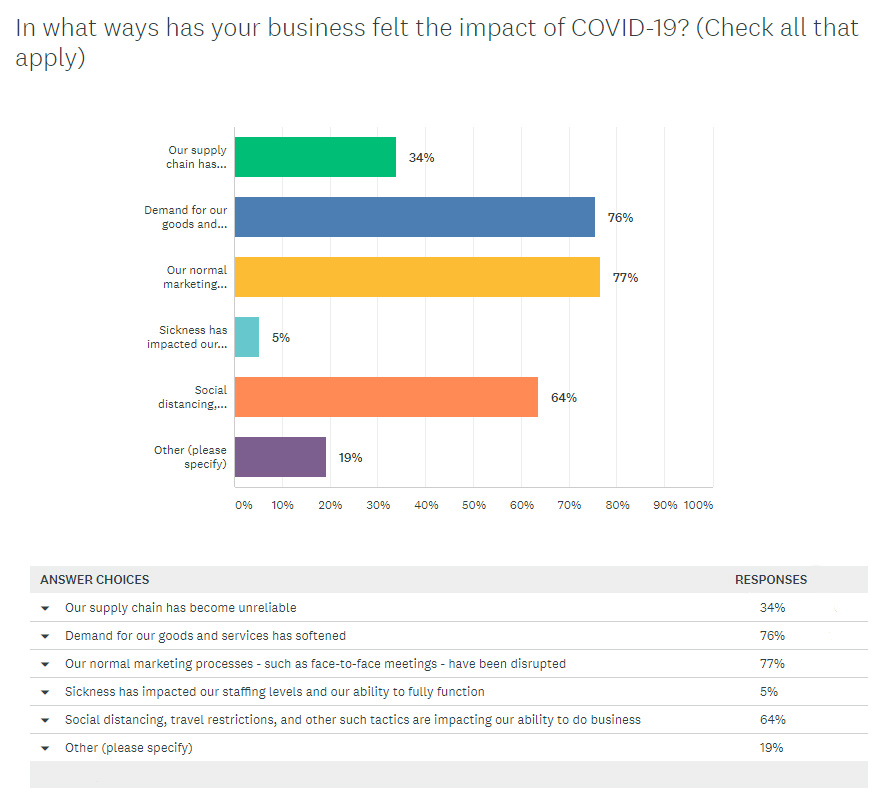

KEY TAKEAWAY: More than 3/4ths of all respondents say sales are declining, up from half who said that in March

Similar to the Question #2, we also saw a significant progression on this question, which asks for respondents to say specifically how their businesses have been impacted. Keep in mind, on this question, survey takers were offered five statements describing an element of impact related to COVID-19 and asked to select all those that apply to their situation. They were then offered an opportunity to write-in any other impacts they have felt that were not offered as an option in this question.

In the March survey, the most commonly selected impact was “Our normal marketing processes – such as face-to-face meetings – have been disrupted.” This was selected by 72% of all respondents then. But this was immediately followed by one of our “Key Takeaways” from that last survey – that almost half of all respondents (49%) said that “Demand for our goods and services has softened” or in other words, that their sales were declining.

Now, in our April survey, the number one response was the same one on disrupted marketing processes…only with a higher 77% of respondents selecting it this time. More importantly, the second highest response was about the decline in sales which in this survey was selected by more than 3/4ths of all respondents (76%).

These both are followed by “Social distancing, travel restrictions, and other such tactics are impacting our ability to do business” which declined from 67% in March to 64% now.

Additional Comments from Respondents on Type of Impact by COVID-19

As usual, there was a wide range of comments from those offering further examples of impact on their businesses. Many fell into groups…although a few truly unique ones stood out.

For example, there were many pointing out the hazards that are impacting their businesses…

- “This is an oblique response – but you need to highlight the fact that there are customers who feel ‘they are immune’ to Covid, or simply need to exercise their rights to get sick, observe no recommended guidelines and inflict this potentially consequential behavior onto others. Making myself or my staff sick is utterly unnecessary, and while ‘thinning the herd; may be the initial outcome, the disregard for others is abhorrent.”

- “Installers are afraid to work”

- “homeowners do not want installers in their homes due to social distancing, causing demand for CI products to drop off “

Others note that business is good…especially online business.

- “Commercial side of business is falling, but home side of business is growing”

- “Demand has surged”

- “Business has improved”

- “Seeing record-breaking, holiday season-like increases in demand for home audio products through e-commerce channels. “

Finally, there are those who note pipeline constrictions are dimming prospects for future business

- “Business is about 35% of what it was and no really large jobs are being added. However, the phone is still ringing and it seems like demand has been paused rather than wiped out.”

- “Major clients putting projects on hold or canceling”

- “The future jobs pipeline has softened. I believe the uncertain post crisis economy has made people uncomfortable with committing to future spending”

- “definite retraction in starting new projects that we have received deposits for. Our service department has noticed a slow down as well.”

Q4 – Whether or Not You Are Currently Impacted by COVID-19, of the Economic Activity You Anticipate in Our Industry in the Coming 3-6 Months, What is Your Best Guess for the Impact on Your Company?

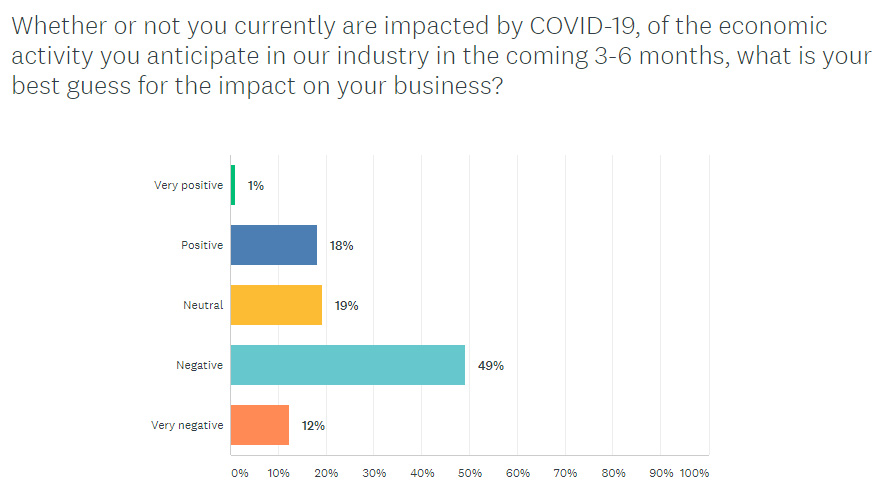

KEY TAKEAWAY – While the Majority Stays Negative, There is a Surprising Uptick in Positivity

This question asked survey takers to look forward and make their best guess on what is going to happen over the next 3-6 months. Of course, no one can possibly know what the future holds, but how they respond will give some insight into their thinking.

In March, I noted that the majority (49%) said the future would be “negative.” When combined with those saying it will be “Very negative (21%),” fully 7 out of 10 respondents seemed to be describing a bleak short term future.

Now in April, we get a bit of a surprise. We are now a month later…and a month wiser…and the same number, a majority (49%) say the next few months will be “negative.” However, the number of those who selected “Very negative” actually dropped to 12% of respondents. So that means that now, 61% of respondents see a negative short term future, down from 70% who said that in March.

And in the meantime, the percentage of respondents who say this short-term future looks “Positive” jumped from just 6% in March to 18% now. There could be multiple explanations for this – perhaps people feel we are getting closer to some kind of bounce-back, or maybe they’ve determined that things are not as bad as they thought they would be…or perhaps they are just engaging in some wishful thinking.

Whatever the force driving this shift, clearly there was a noticeable uptick in positivity in this April survey!

Selected Comments on the Next 3-6 Months

- Softer demand and less traffic. Dealers in cities cannot do installs and in suburbs we hear fewer and fewer that are being allowed into homes. Still optimistic as we hear jobs are being paused and not canceled, but there are definitely concerns about the pipeline. Installed channel faring better than retail though.

- In general terms, economic downturns cause less spending on discretionary items. In narrow terms, changes in consumer behavior will boost some product categories while others drop dramatically.

- Many affluent homeowners are adding/upgrading their Systems as they are in lockdown.

- I believe when the residential client feels comfortable to the new normal,3 months?, our mid to higher business will rebound. Hang and Bangs will lessen. We will pick and choose our project wisely. The interview process now and in the future will include some sort of screening from a health perspective. “Are you in the Health Care sector or has anyone you know been diagnosed with the virus? Now or in the past?[“] Money, …is it worth the risk? We are lucky that we have low overhead and a model that can sustain.

- 3-6 months is short-term. I don’t see this unwinding, UNLESS both an effective treatment AND possibly a vaccine can be resolved. Our customers are affluent and less impacted, but future pipeline is pretty thin. LONGER-TERM, I am VERY, VERY, VERY bullish.

- Some deferred purchases are lost purchases. Although the pipeline seems stable, there will be a dip after the initial surge of resumed jobs. We think our segment will recover faster because we are not selling to the demographic that was most profoundly affected but there will be a ramp up time to the new levels of commerce. Staffing will continue to be a problem for our custom installing customers.

- Unemployment will hurt spending on luxury goods

- I expect that we will lose some retailers in the US, where they are hard to find and replace in the first place. It will take a long time to put Covid-19 behind us, much longer than what many people expect: we cannot just “reopen” the country. I expect consumers to be cautious for a long time, which will affect their buying decisions, particularly for expensive products. If there are significant changes in socialization, it is possible that our business could improve. It is still much too early to know what will happen, all we can do for now is to “go with our gut.”

- We expect 75% decrease in next 3-6 months in nyc area. Backlog projects will return in that time, however new starts are completely unknown. That being said, i think in 12 month, all will be back to previous levels.

- Until a vaccine is developed and implemented I believe people, especially the elderly or those with underlying medical conditions, will be reluctant to shop in stores or have people in their homes. If store personnel and integrators have a positive antibody test that might make it easier for customers to shop or allow others into their homes.

- We are feeling a retraction in both new work and service work for sure. The longer this plays out, the more unsettled our client base seems to be getting. We are keeping our installation crews busy with project work that customers are willing to move forward with and the service team is experiencing a bump in network/internet and Wi-Fi service calls and upgrades. Not exactly high margin product, but it’s work and we are happy to have it.

- I do believe the overall impact of forced closure, mass layoffs and loss of consumer confidence will ultimately lead to global recession similar to 2008/2009.

Q5 – Please share any other thoughts you may have on the impact of COVID-19 on your business, including whether it changes your outlook for 2020

So this question is a completely open-ended question. Interestingly, when we specifically asked survey takers to tell us what the COVID-19 impact meant for their outlook for 2020, comments ran largely negative, by a pretty wide margin. Some of those negatives were only slightly negative, i.e. expecting a 10% decline, for example.

But many of them were quite negative, with multiple commenters suggesting that they have moved beyond 2020 (or giving up on it), and are now working on putting plans together for a return to growth in 2021. Now certainly, not all comments were negative, and the positive camp certainly showed up in this survey. But it was decidedly more difficult – at least at this moment – to draw solidly positive conclusions from this experience.

Mostly, the positive camp was largely manifesting their enthusiasm for what they believe will be a big bounce back to normalcy…some suggesting it is almost to that point now.

Respondents’ Comments on the Outlook for 2020

Here then, are some of the top comments on the impact of COVID-19 on their 2020 plans.

- 2020 is a bust. The very small amount of showrooms in the region will be reduced by half or more.

- High earners will have little if no impact on spending, however mid to lower end family’s will spend more money on local holidays [vacations] than luxury electronics

- We have reduced our forecast for [t]he rest of 2020 and are now focusing solely on planning for 2021. Both from a roadmap and forecasting standpoint

- I know for sure it has impacted our projections for 2020, though I remain positive in the long-term for the CI industry. Never before have so many been asked to stay-in-place. People will want their home technology to be better than ever so their homes are more enjoyable and safe to live in. This bodes well for integrators, as they sell the best networks and the excellent entertainment systems. I think people will spend less on vacations and move that into making their homes better, including the tech aspects of their home.

- As a manufacturer our business is directly related to retailers and integrators being able to sell our products. Until customers are ready to shop in stores and allow integrators into their homes business will suffer. The remainder of 2020 will be an attempt to regain losses from Q1 and Q2. 2021 will be the year of recovery.

- Since our products are primarily sold to a fairly wealthy clientele, I think we will be going gangbusters once the restrictions are lifted. When that will happen is the $64,000 question.

- 2020 is a complete loss, we will pay expenses however profits will be near zero at end of year.

- I’m an optimist and believe that while consumer habits may change that a ‘demand exists to return to normalcy’, enjoy restaurants, live concerts, shop in retail establishments, and best of all for our custom residential channel to spend money in the home for upgrades on a wide variety of levels. I also think that deep discounts extended by auto manufacturers on new 2020 cars will further stimulate the economy.

- I am feeling extreme trepidation for the rest of 2020 especially if the crisis creeps deeper into the summer

- Just a short pause!

- In general people are spending less and I feel that will continue for the foreseeable future. Particularly if a significant second wave hits.

- I do think that business will rebound since all the projects that were in the works are simply delayed. I just hope people can make it work in the meantime and hold on.

- It will be at least a year before we are out of this [NOTE: there were many whose comments were along the lines of this comment.]

- Over all, with smart short term decision making we should be able to weather this for a while. Pre-virus, we were on tract to have the best first quarter the company has ever had, it remains to be seen how this will play out but we are keeping a positive outlook for the time being.

- 2020 is dead in the water. The country (and business’s) will reopen in stages late in the year.

- Impact will last @ 2 years before recovery.

- Business has been slow even though some dealers have continued to work on existing projects, especially where distancing can take place such as new construction. New business has been hard to come by and business in the pipeline has been postponed or cancelled. There are too many variables currently that inspire homeowners to spend on luxury items.

- Outlook for 2020 is extremely negative. I am not confident that my small business will survive

- There really is no 2020. I think this is a year of self-preservation and hopefully we can regroup and resume business in 2021.

- We will plan to be at least 50% of the 2019 business.

- We believe the impact will be significant to the industry, some dealers and some brands will not recover. There will be big shakeup

- I hope to survive 2020. This year is not even close to what I had planned.

- We have cancelled this year. No trips, no exhibitions. Just doing what we can until it looks normal again.

In answering this Question #5 – comments describing negative outlooks for 2020 exceeded positive ones by a ratio of greater than 3-to-1.

So there you have it – Strata-gee’s COVID-19 Impact on Tech II Survey was a significant update to the original study with meaningful changes both great and small…both positive and negative. Clearly, respondents see challenges ahead and we are all just trying to figure it out.

Thanks again to all that participated! I really appreciate it!

Leave a Reply