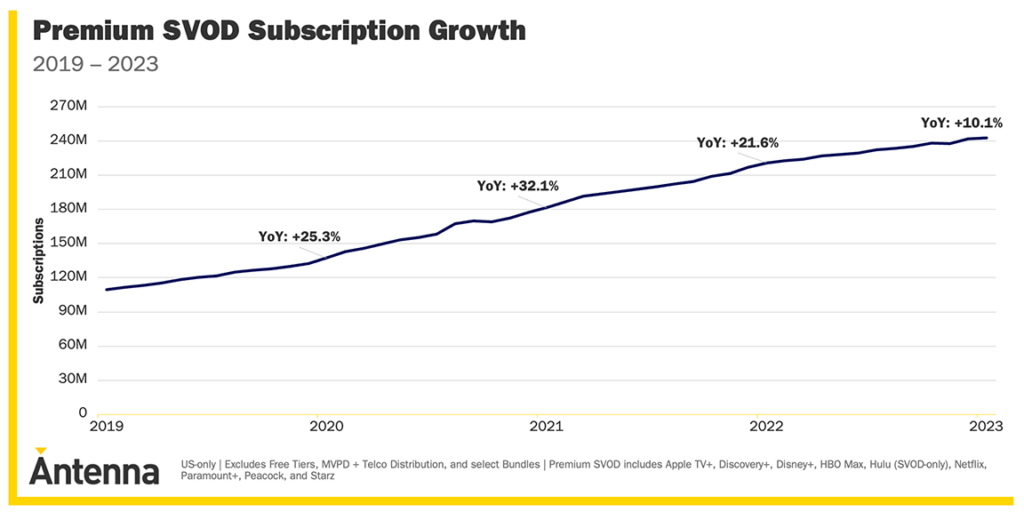

In what may be another sign of the post-pandemic blues, data published this week by research firm Antenna showed that growth in streaming service subscriptions in the U.S. dropped by 50% in 2023. Some are saying the boom in streaming is over…or could it be an over-adjustment that will correct itself and return to growth again soon?

See more on what’s happening with streaming service subscriptions

When the COVID-19 pandemic consumed the globe in early 2020, things looked bleak…like the end of life as we knew it. But then we in home technology, home health apps and gear, and streaming services were slingshotted into an insane level of business – more than many of us could keep up with. As consumers were stuck in their homes 24/7, they needed audio/video gear, home networks, and entertainment options to occupy their time. This environment propelled streaming service subscriptions into the stratosphere.

Now…COVID is essentially over and a correcting deceleration is impacting multiple industries. For some, life over the last two or three years has been an insane whipsaw – first really bad…then really, really good…to now bad again.

Emerging Services Offered Consumers More Choices Than Ever Before

Content providers like Disney+, Paramount+, Peacock, Discovery+ and many, many more all launched or expanded during this period, threatening the dominance of streaming king Netflix.

But that was then…and this is now. According to the report, growth in the premium subscription-video-on-demand category slowed to 10.1% in 2023…down from 21.6% in 2022. While that’s shocking, that is counterbalanced by the fact that overall growth has more than doubled in four years…which could suggest a “steady re-subscription trend.”

During their heyday, streaming companies were pouring money into acquiring and creating content to attract and retain subscribers. At the same time, customers had a voracious appetite for content and signed up for multiple services as theaters remained closed during the pandemic.

The Game is Changing for Streaming Service Providers

With the end of the pandemic freeing end users to reengage in out-of-home activities and two Hollywood strikes last year hitting content providers’ cost lines, streaming companies are changing their business model. Now they are looking to keep content costs low and pushing out lower ad-supported tiers to draw in more revenue and a wider audience base.

The winners during those heady boom times were Netflix, Peacock, and Paramount+ who collectively drove the most growth with 242.9 million subscriptions by the end of 2023. However, Netflix did lose share which was probably unavoidable with so many new competitors bursting onto the streaming scene. In 2019, Netflix owned almost half of all subscriptions, but that has now dropped to about 25% of the market. Don’t worry about them…it’s still a big number.

Paramount+ Surpassed Gold-Standard Disney+

Competition in the streaming wars of the day was fast and furious and gold standard Disney+ ended up being surpassed by Paramount+. The data also shows that Peacock and Paramount both saw a “slight increase” in their market share, while Discovery+, Disney+, and Hulu saw slight decreases in their share.

The researchers at Antenna are advising that streaming is entering a new phase of sobriety. The party, apparently, is over and it is recommending streaming service providers shift from a past hyper-focus on acquisition…to doing a better job of managing their subscribers to try and reduce churn – which is very high.

In another interesting finding – the report says that about 30% of all gross additions were “re-subscribes,” users who were previously subscribed to the service and had canceled sometime within the previous 12 months. They also noted that nearly 25% of “cancels” were won back within 90 days – and more than 40% were won back within 12 months.

With the increased subscription imposed by Apple – Netflix – Spotify – Amazon it won’t be surprising when the decrease will get worse.

Good point… People may reassess and trim back on the number of services they subscribe too.