Now What?

On Wednesday, the Trump Administration unveiled its long-anticipated tariff policy, the details of which showed tariff rates turned out to be much higher than expected and a rollout plan that turned out to be much faster than expected. Overseas markets dropped as investors feared the onset of a trade war was brewing. Thursday morning, U.S. markets followed the rest of the world and saw stock values collapse in the wake of the announcement.

What happened? And…now what??

We knew this day was coming for quite some time now as the Trump administration has been clearly projecting its assessment that international trade policies are generally unfavorable to the U.S. After an initial blast of 25% tariffs lodged against our nearest neighbors – Canada and Mexico – the administration has rolled out a much more substantive list of tariffs for the top 100 trading partners around the world. The numbers were shocking. For example, the White House rolled out an additional 34% tariff on top of the recently announced 20% tariff on China for a total of 54% in total tariffs on this large trading partner.

All items coming into the U.S. will have at least a 10% tariff applied, no matter where they come from. This is the largest levy of tariffs by any country in the world in over a century. By the way, the historical learnings here are not very reassuring.

A Historically Significant Tariff Plan

One report in Politico noted:

According to multiple analysts including Evercore ISI and JP Morgan, America’s weighted average tariff under the Trump regime will now be higher than under the infamous Smoot-Hawley Tariff Act of 1930, which plenty of historians — though not Trump himself — believe helped deepen the Great Depression.

Politico (Trade) War on the World

JP Morgan went on to warn of a “global macro-economic shock,” with this move potentially lighting the fuse to set off an explosion of a worldwide recession, as the result of the severity of the tariffs now implemented. Beyond the 10% universal tariff rate, an additional schedule was announced with dramatically elevated tariff rates, some described as reciprocal tariffs, of up to an additional 40+%.

Tariff Plan is the Equivalent of a Tax Increase on Consumers of $3,800 or More

Multiple financial companies produced reports estimating the impact of this tariff program, viewing it as an additional tax on U.S. consumers. One analysis from the Yale University Budget Lab calculated that the administration’s tariff plan will work out to, in effect, an additional tax of $3,800 on the average American household. Actually, the way that Yale worded it was that this was a “loss of purchasing power of $3,800 per household on average…” Another analyst put out an assessment that calculated the amount of increase in additional taxes at $4,400 per household.

As I mentioned, the tariffs announced by the White House turned out to be much larger (and to have a much quicker planned implementation) than most industry analysts had expected. As a result, stock markets around the world, including in the U.S., collapsed on investor concerns over a protracted trade war, a slowing of global growth, and concerns of reigniting inflationary pricing. On Thursday, the Dow opened down over 1,200 points and by the end of the day, it closed down 1,679.39 points or -3.98%. This is a huge decline in a major index.

NASDAQ Drops 6% in One Day

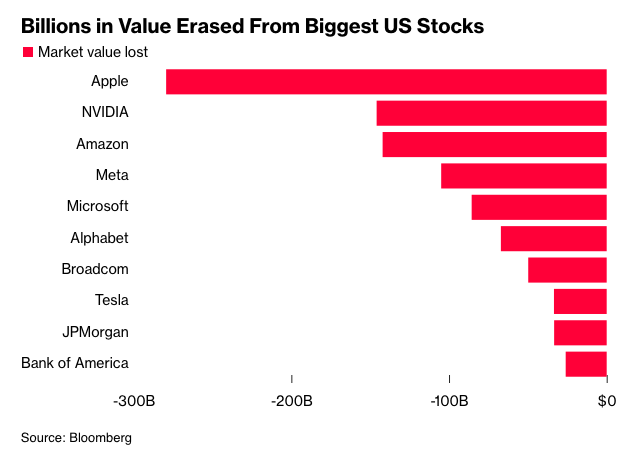

Not only that, but the Nasdaq, the exchange that is heavy with technology stocks, dropped 1,050.44 or 5.97%, the biggest loser of the day. This is because tech stocks got hammered – it was a real tech wreck. Some examples: Apple -9.25%, Amazon -8.98%, Best Buy -17.84%, Garmin -15.01%, HP -14.71%, Masimo -11.14%, Meta (Facebook) -8.96%, Netgear -14.10%, Resideo -11.76%, and Sonos -17.36%.

The Tech Segment lost more than one trillion dollars in market capitalization on Thursday. It was the single greatest decline in stock values since the onset of the COVID global pandemic.

The Tech segment lost more than one trillion dollars in market capitalization Thursday.

CNBC

Just How Big Are the Tariffs?

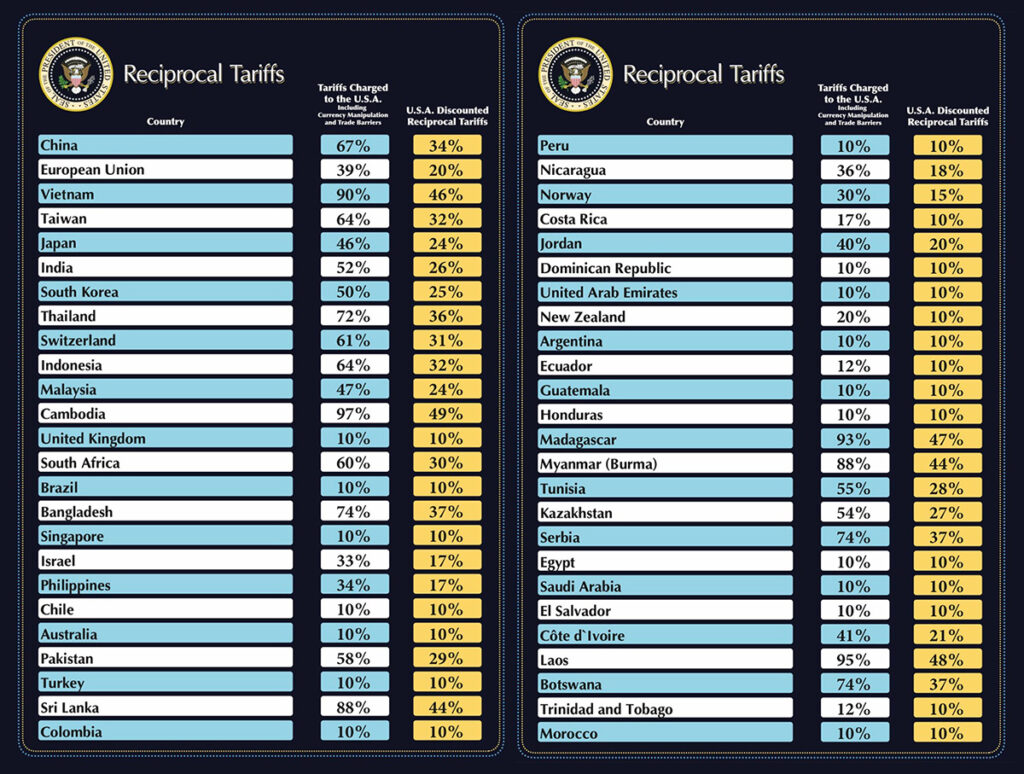

How big were the tariffs announced yesterday? It was a wide range of amounts seemingly randomly set (but there was a calculation behind them) from 10% on the low end and up to 49% (Cambodia) on the high end. But that is a little misleading. Take China, for example. The tariff rate shown on the latest chart for China was 34%, but the country had already been hit with a 20% tariff, so this resulted in a new combined tariff rate of 54%.

Two Columns: Tariffs Charged to the U.S.A….and U.S.A. Discounted Reciprocal Tariffs

Other examples of new sky-high tariff rates include Vietnam (46%), Japan (24%), India (26%), South Korea (25%) and on. On the chart used by the White House to announce the tariffs, there were two columns: U.S.A. Discounted Reciprocal Tariffs and Tariffs Charged to the U.S.A. That second column purported to show the tariffs that each country was charging the U.S.

There were some shocking tariff rates shown in that column. For example, it showed that China has a tariff rate of 67% on U.S. imported goods. There is just one problem with that. It isn’t true. There are no countries in the world imposing a tariff rate that high on imported U.S. goods…including China.

Administration Created Its Own Calculation of Trade Impact

It turns out that the administration used a custom calculation that purported to factor in non-tariff factors to create an “effective” tariff rate. Many disagree with this calculation, which is a non-standard method of analyzing international trade rates.

It since has emerged that the White House used a custom calculation involving dividing the trade deficit with a country by its imports from the U.S. to suggest a rate. Then this number was divided by 2 to create the new tariff rate. Again, a very non-standard way to set trade rates.

So…What To Do?

So what should you do about this turn of events? There is not much anyone can do about this situation other than to sit tight and let the scenario play out. After the market closed, after-hours trading showed a continued downward trend.

If these tariff rates hold, be prepared for more price increases from your suppliers. Many of the products we sell and install in tech come from China in whole or in part.

If Tariffs Hold, More Price Increases and Bigger Price Increases are Coming

Some brands have already passed along modest price increases in the weeks leading up to this moment. In fact, some have even absorbed increases they were already hit with. But these new tariff rates are likely too great for US importers to absorb.

Is a recession imminent? There are many in the financial community who feel this development means a recession is imminent. However, they’ve been wrong before. In any event, it is too early to tell yet just how this drama will play out. It is possible countries will negotiate with the administration to obtain lower rates. Initially, administrative officials denied the purpose of this announcement was to encourage countries to reach out for negotiations.

However, late in the day, President Trump told the media he would be open to negotiating with countries.

In October of 2024 Wall Street was booming. Stocks bumped up after the November election, and bumped again after a new President took office

Today the stock market returned to October 2024 levels, the level that everyone was giddy & hopeful about.

Suddenly the press is talking gloom and doom. If this administration collectively cured cancer, the press would condemn the administration for devaluation of pharmaceutical companies stocks for cancer related medicines and healthcare facilities closing and staff that no longer has a job at a cancer center. GFYS.

American Made’s value proposition just got better. Not a bad thing IMO.

A $3800 tax on the American people?

If there is no context and perspective here, then that is indeed all we have.

When I was growing up in lower Michigan, the country was thriving and everyone had good jobs. That’s because we made all of our cars here, our appliances here, our medicines here, pretty much everything.

“Free trade” took that away. It is one thing when something is made in China for less than it costs to make it in the United States. It is another thing entirely when China in particular subsidizes their industries to a point where the costs are even below their cost of production. The result is, we have shipped all of our best jobs, the manufacturing sector overseas.

In a nutshell we are drunk on cheap products from China. When you buy an electronic gadget for $20 that might cost $35 if it was made here, you are buying at artificial prices. We are drunk on artificial pricing.

Perhaps more serious, and something very few people even mention, is what happens to the dollars that we send overseas. You don’t have to be an economist to understand that hundreds of billions of dollars going to China will be put to use somewhere. They don’t just sit in some Chinese bank. They use it to purchase our farmland, purchase Sony Pictures, purchase our industries. Do you want our country to be owned by a foreign country?

Getting trade and pricing in balance will be painful because it has not been addressed for decades. But it has to be done if you want to have a country.