Owners of Distributor DOW Technologies Launch Integrator SMARTSolutions

For years, many Tampa, FL-area integrators relied upon distributor Dow Technologies as a valued supply partner for the technology solutions they needed to complete their system designs and installations. But not long ago, the owners of Dow Technologies acquired an integration business and merged it with their existing satellite installation business to create a new Tampa integrator they call SMARTSolutions – and now many of those same integrators say a partner…has become a competitor. And they are quite angry about it…

See more on Tampa integrators and Dow Technologies

Recently, I was forwarded an email that contained a strange and interesting story from an integrator who was obviously angry. Maybe “anger” isn’t the right word. The passion shown in the email was really high, and the story it told was sufficiently strange enough, that it served to spike my curiosity. Would I be interested in looking into this story, the email “forwarder” asked.

The email was from a Tampa, Florida integrator who angrily told the story of how his once valuable distribution partner – Dow Technologies – had morphed into a competitor, in the form of an integration company they created called SMARTSolutions. To the integrator, this situation was an obvious conflict of interest and completely unacceptable.

So a couple of weeks ago, when that integrator received a telephone call from his Dow Technologies rep, he took advantage of the opportunity to inform him that his company would no longer be purchasing gear from Dow Technologies. Then, a day or two later, he received another call from the director of sales for DOW, Drew Fischer, who ostensibly called to address the integrators’ concerns. But when he tried to explain his decision to Fischer, the sales manager’s response seemed remarkably tone-deaf…and some of his claims – such as DOW not owning SMARTSolutions, or him not knowing who the corporate officers are – seemed really unbelievable.

The History of DOW

Launched back in 1959 as DOW Electronics, the name DOW is derived from the names of the three partners who founded the company – Doc Blower, Oscar Carter, and Bernie Wagman. It was a wholesale electronics distributor offering electronic repair parts and off-air radio reception gear to area retailers. In the mid-1990s it was known mostly as a major player in the satellite business as one of the largest DISH network distributors. You can see more on DOW’s history in another Strata-gee post at this link…

In 1999, another business was launched to install satellite systems called Digital Reception Services or DRS. That company was owned by the Yodzis family, the same family that now owned DOW Electronics but was under a different corporation. Keep this in mind as we move on with this story.

Entered Custom Integration by Acquiring Shifting Sands Stereo Distributing

Because DOW was a big Sony and later Samsung distributor, they began doing more and more business with integrators who were generally too small to qualify for a direct program with Sony, but needed the brand for their installations. The integration business didn’t come naturally to DOW, but sensing opportunity they began exploring ways to grow that part of their business.

In 2013, DOW Electronics acquired Shifting Sands Stereo Distributing, a custom integration-oriented distribution company that was owned by Mike Sajecki, who also owned a separate manufacturers sales representative firm. This was DOW’s first big step directly into the custom integration business.

DOW today has 8 warehouse locations serving 22 states, according to their website. Market segments served includes custom integration, 12-volt, satellite, marine, and UCAAS/VOIP. They claim to offer products from 105 brands – everything from Advent – to – Zuum. Major brands offered include Sony, Samsung, Sonos, Russound, AudioControl, Alpine, Ring, Roku, Lutron, LG, and many more. See all of the DOW brands here…

Events Unfolded to the Dismay, Then Anger, of Integrators

So how have events unfolded such that now several integrators refer to the company using expletives and have pulled their business out of DOW Technologies? Well, remember DRS? As the satellite business began to fade, the company made the decision to expand into other technology categories – shifting from satellites to cinemas…and other home technology gear.

In an email to an integrator from DOW Executive Chairman Chip Yodzis that was shared with Strata-gee, Yodzis tells the story:

SMARTSolutions is a successor company of Digital Reception Services, Inc. DRS was initially started and funded by my family back in 1999 to provide installation services for DISH in the State of Florida… In late 2017, when DRS was looking to diversfy from strictly the satellite installation business, a local integrator Media Savvy, owned and operated by Darren Thomas, approached DRS about taking over his business. We were able to consummate a deal and Darren joined DRS, and what is now SMARTSolutions, in early 2018.

Chip Yodzis, Executive Chairmand of DOW Equity Holdings, inc. and SMART Equity Holdings, Inc., in an email

Suddenly, the Owners of DOW Now Owned an Integration Business

With this transaction in 2018, the owners of DOW Technologies were now also the owners of a full service integration company initially known as DRS SMARTSolutions, eventually dropping DRS to become simply SMARTSolutions. However, none of this was trumpeted to the marketplace, it was done quietly. Multiple integrators told me that there was no announcement of the acquisition and they were completely unaware of it…until they ran up against the company in bidding for a job.

As you can see in the above graphic, the corporate lineage goes something like this: On the distribution side: Dow Equity Holdings Inc. is the corporation that owns DEDC, Inc., which is the corporation that operates as DOW Technologies. And on the custom integration company side: SMART Equity Holdings, Inc. is the corporation that owns SMART Technology Ventures, Inc, which is the corporation that operates as SMARTSolutions.

Same Owners, Same Corporate Management

They all come together under the ownership of the Yodzis family. It is also noteworthy that corporate management is largely the same on both sides – so you have the same financial ownership and the same corporate management of both entities.

Listed corporate officers for DEDC, Inc. (DOW Technologies) are: John J. Yodzis (PCEO), Carolyn D. Yodzis (SVP), John P. Yodzis (EVP), Daniel T. Carr (CFO/VP), Stephen O. Decker (VP).

Listed corporate officers for SMART Technology Ventures, Inc. (SMARTSolutions) are: John J. Yodzis (Executive Chairman, President, Chief Executive Officer, Assistant secretary), John P. Yodzis (Executive Vice President), Carolyn D. Yodzis (VP, S, T), Stephen O. Decker (VP), Daniel T. Carr (VP), Donald J. Lawson (VP), Mason R. Fischer (VP).

I confirmed all of this information on the website Sunbiz.org – the official website of the Division of Corporations for the State of Florida.

Integrators’ Anger Builds

The integrator who reached out to the media was Jaret Nichols, owner of Tampa Bay Electronic Systems in Tampa, FL. Like many integrators in the area, TBES relied on DOW Technologies as a key supply partner for products used in their installations. So it was quite surprising one day a couple of years ago, when he got a call from someone who told him that DOW had gotten into the integration business. He didn’t think much about it at the time, but he did begin to notice trucks driving around town marked as DRS SMARTSolutions.

Integrators are a busy bunch and there was plenty to occupy Jaret’s brain, and from 2018 through 2019, he told me he really didn’t run into SMARTSolutions very often. He got the impression that they focused more on the lower end type projects, such as installing Ring doorbells and the like.

Things Started Heating Up in Summer 2021

And, of course, like most integrators, 2020 & 2021 were mostly a blur, as business during the pandemic took off. Then, this past summer, he heard from a client he worked with before and who had a new project…telling him that he had a quote from this other company, SMARTSolutions.

Jaret was surprised but the client sent him the quote (without prices) which consisted of a lot of Sonos, Google Wi-Fi, and other items that he felt were at a lower level than this multimillion-dollar home project deserved. After he provided his client with a quote using better gear like Araknis networks and Control4 control solutions he was surprised to learn that SMARTSolutions requoted using the same gear – apparently the client was playing both companies off of each other. Jaret won the deal, but was now on high alert about this new competitor.

Began Popping Up More Frequently

Over time, SMARTSolutions began popping up more frequently. Jaret told me that there is a good amount of competition in the Tampa area and he has no problem with competitors who are situated in businesses much like TBES. But he was really beginning to think hard about having to compete with an integration company that is connected to the distributor who is a supplier for him, and with whom he spends a lot of his hard-earned money.

Then Allnet, part of the Snap One distribution network, opened a warehouse in the Tampa area and Jaret began to shift his business from DOW Technologies over to them. With a new source for technology that is not also a competitor, to Jaret, it was a no-brainer. Then…DOW Technologies sales team began reaching out to him over and over.

More Integrators Speak to the Situation and a Pattern Emerges; Emotions are Raw

I reached out to more Tampa integrators to get their feelings about the common ownership of both Dow Technologies and SMARTSolutions. And within their responses, I began to see a pattern emerge. The smaller integrators relied more on distributors like DOW Technologies and found the situation wholly unacceptable, but often felt forced to have to live with it. Larger integrators had a bit of a different take, perhaps because they were buying most of their gear direct from their major brands and were less reliant on distributors like DOW. But the larger integrators still complained about what they perceived was the unfairness of the advantage that SMARTSolutions has on certain major brands, where they get access to products purchased at distributor pricing.

I also noticed that the integrators’ emotions were raw. It looked to me that some of these integrators felt incensed by the violation of their trust in DOW over the years. And many told me that thanks to Allnet entering the market, like Jaret they had pulled their business away from DOW.

“I think they’re a piece of shit and I stopped doing business with them as much as possible,” one integrator told me, not holding back his feelings. “I think that they’ve stepped way over the line. I’ve told my people to pull all purchases away from DOW.”

Another integrator who focuses more on the high end echoed Jaret’s comments, saying that for quite a while he didn’t feel any competitive pressure from SMARTSolutions at all. But now? “I’m starting to run into them quite a bit,” he admits. “But we’re higher end, so it’s not as big of a problem as it could be.”

Still, even those integrators who can buy direct, feel that the situation is unfair. “I buy Samsung direct,” one integrator told me, “but I’m not getting it at distributor cost. I think it’s ridiculous that the larger brands sell to them.”

“It’s absolutely a conflict of interest,” said Nick Jannuzzio, owner of Sound Tech AVL, about the common ownership of DOW and SMARTSolutions. “That’s why I don’t do business with them anymore. I buy everything from Snap One now.”

DOW Answers the Objections

Note that I made several attempts to get a comment on this story from DOW management, but multiple messages left for them were not returned by the time this story was posted.

DOW salespeople appear to be well aware of the unpopularity of the presence of SMARTSolutions with area integrators and have developed several responses meant to defuse the criticism – although integrators have told me that these phrases just make them angrier. If you raise the conflict of interest objection to a DOW Technologies salesperson or executive you can expect to hear any one – or – all of these responses.

- I assure you that DOW does not own SMARTSolutions

- These two corporations function as totally separate corporations

- DOW offers no pricing advantages to SMARTSolutions

- DOW gives no preferential product allocation to SMARTSolutions

- We [DOW] will let you see our invoices to SMARTSolultions to prove our statements are accurate

- The finances of DOW Technologies and SMARTSolutions are kept completely separate

- SMARTSolutions does not compete on price, but rather on quality, value, and expertise

Playing with Semantics

While certain of these statements may be technically correct (DOW does not own SMARTSolutions), to integrators, this feels like DOW management is playing with semantics. While it may be true that DEDC, Inc. (DOW Technologies) does not own SMART Technology Ventures, Inc. (SMARTSolutions), the Yodzis family owns Dow Technologies and they own SMARTSolutions – and that fact, in the integrator’s mind, is a clear and obvious conflict of interest.

Furthermore, several integrators expressed to me that they feel the company has been irresponsible and unethical in the way DOW management and sales have handled the conflict surrounding an obvious violation of the trust placed in them by their customers…the integrators. Only when sales began dropping off, did DOW’s sales staff make an effort to reach out to integrators and ask for more business. Given the circumstances, integrators felt it took a lot of gall for DOW to take that approach, and then to simply, in effect, deny there is an issue. Telling integrators that these are two different companies was, in their minds, an insult to their intelligence.

They just kind of kept bothering me. So finally I said, ‘Look, I’ll be honest with you. Now that all of this is out in the open, I’m not gonna buy anything from you guys anymore. This issue with SMARTSolutions has been has been kind of something I’ve been aware of for a while. But it’s also become a bigger issue now. And I’m just I’m not interested in supporting you anymore.’

Jaret Nichols, Founder of Tampa Bay Electronic Systems, relaying when he told his DOW rep to cancel his account

DOW Technologies & SMARTSolutions: Two Different Companies?

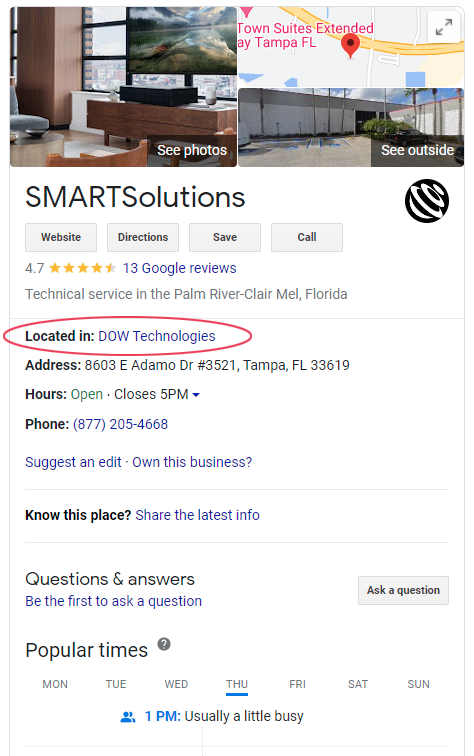

Two different companies?…integrators huffed. “They work out of the same facility,” one integrator told me…adding that the current SMARTSolutions showroom is in the DOW Technologies warehouse and was the distribution company’s previous showroom.

I attempted to confirm this fact and it appears to be true. When you Google SMARTSolutions and Tampa, you are given the address for DOW Technologies. So SMARTSolutions does operate out of the DOW Technologies facility. Nichols tells me that when he mentioned this fact to sales manager Drew Fischer, he responded that DOW just rents space to SMARTSolutions. “Would you like to rent space in DOW?” he says Fischer asked him.

What Do Vendors Think?

I reached out to a couple of the brands listed on the DOW website, and what I found out surprised me. In both cases, the vendors were completely unaware of the DOW/SMARTSolutions connection. When informed of the situation and told of how some of the integrators feel about it, one of them said, “That’s not a good look for DOW.”

See more about DOW Technologies by visiting: dowtechnologies.com.

Learn all about SMARTSolutions at: makingtechsimple.com.

Come on guys, really? This reminds me of the days when Sony/Bose/Yamaha/ and you name it, opened up their direct sales via web-site. We all became blithering idiots! Remember when Mitsubshi opened up Best Buy? You would have thought there was nuclear war – who cares. Do a good job and your clients swill always return

“Just sell stuff”

Peter,

With all due respect, your analogy is dated and incomplete. I offer a few points. 1. Your Best Buy point re: Mitsubishi. Mits had their own consumer financing program along with their dealer programs that motivated dealers to stock up on their big screens, aka: sell more. Those programs created a kind of brand loyalty with small and medium-size dealers that did not have consumer financing available. They also rolled out continuous national ads that helped drive consumers into those dealers. There were few dealers that needed to discount that line so all were happy as Mitsubishi expanded their sales channels. 2. Bose is and has been the industry’s anomaly in the speaker business. The first national brand that created a legal retail pricing schedule for all dealers/distributors to adhere to while Bose vigorously enforced it. So, few cared how they went to market at that time as everybody made respectable profits as the brand awareness was considered to be the highest in the industry for years. They were the first consumer electronics brand to advertise in Reader’s Digest. Decades ago, Bose created a self-service demonstration kiosk where salespeople didn’t have to do anything, just point to the Bose room. Thereby almost eliminating the need for salespeople. Again no one cared as Bose sales continued to grow, with consistent, reliable profits for everyone. 3. Yamaha entered the rack system category around the same time which meant they had to increase their dealer network to achieve their lofty sales goals as they continued to push their separates and support independent dealers through a dedicated network of independent representatives. 3. Your premise to “just sell stuff” is nothing new, I agree. However “HOW” brands go to market has radically changed in the past 15 years or so, in terms of their distribution policies. 4. Our industry is commoditized. When any industry reaches that point, the rules change. Brand positions change, vendors make broad changes to their sales teams, either terminating independent representatives and going direct to dealers with their own factory sales staff or selling to distributors who will inventory their products, provide full service to dealers, shipping, longer counter hours, demos, sales education and more. In doing so, factories shift their go-to-market expenses to their distributors rather than their independent sales representatives who are always looking out for their favorite vendor to drop commission rates without prior notice, just when the rep firm has established a strong dealer base, In effect, establishing new brands across the U.S. All sales channels are going through major changes. Undoubtedly, we will continue to see other changes that many of us will scratch our heads about. My final point: Today, dealers have many more choices to buy the products they need from those suppliers they trust. Enter Snap One. Buying and selling consumer electronics today – due to many dynamic factors will never be the same as it was 20-30 years ago. No business is. Just like other industries that reach the volatile point when they consider selling their company and reach out to attract private equity firms, or open up to the idea of a merger or private investors (not equity companies.), acquisition due to aging founders, As stakes are higher than ever, many companies disappear. If anyone is serious about analyzing the market, I suggest you look at Porter’s Five Forces. A great tool to make sense of our industry in terms of competition, fantom competitors, and more. Finally, without alternative choices to DOW, we might hear complaints but dealers would think twice before moving to a different supplier altogether. Choices allow dealers to move their business from the now not-so-popular distributor who appears to be taking money out of the dealers’ pockets. With running lanes not so clear any longer, vendors need to take careful consideration using a fresh perspective of this industry before allowing their brand to expand in ways that leave the independent dealers, and rep firms behind, Potentially destroying any market position, (aka Value Proposition), they may have spent years in the making.

Peter…Peter…Peter,

To quote you…really? All those decades of experience and all you can come up with is – in essence – “Suck it up Buttercup”? Really? Is that what you did back in the day?

With all due respect, your analysis offers an apple-to-oranges comparison…or maybe apples-to-broccoli.

Here’s where your analysis runs foul. First: you compare today’s situation with integrators and a value-added distributor to events of…what?…20 or 25 years ago? The world was very different back then. And the industry is in a very different place today. When you harken to “retailers,” “independents,” “big boxers” you tip your hand. You are living in the past.

The dynamics of an integration business bear almost no resemblance to the dynamics of a retail business of those days. So the impact on Sound Advice of Yamaha selling their products at MSRP in their online web “store” is not the same thing as what DOW is doing here in integration. No comparison.

So let’s adjust this scenario to more equalize the comparison and see if you still feel the same way. Go back to your days at Sound Advice [a regional chain of AV retail stores in Florida in the past of which Peter Beshouri was a cofounder]. Let’s say you open up your TWICE magazine one morning to see an announcement that Yamaha has decided to launch a chain of AV specialty retail stores in all of your markets. These stores are as nice or nicer than the local Sound Advice store. They of course carry the entire Yamaha assortment, as well as every other brand that SA carries. They tell customers, yeah, Sound Advice is OK but we can offer everything they offer, at their price or better…AND we are a global electronics powerhouse, which they aren’t.

Your sales start to decline. Customers are attracted to the idea of buying from Yamaha. You begin to see the writing on the wall…things are getting tougher. And then, to cap it all off – your Yamaha rep calls you up at the end of every month to beat you up for an order.

What do you think? Suck it up and give your supplier/competitor an order? Tell your salespeople to “just sell stuff?” Or push back – and replace Yamaha with another brand not in the retail business? I’m pretty sure I know what the Peter Beshouri I knew back then would have done.

And finally, your thought of “the more [things] change the more [they] stay the same,” is what all of us old-timers like to say to make ourselves feel still relevant. But the fundamentals of this industry have changed dramatically. There are some really interesting issues here. You have two distributors each engaged in disintermediation from two different perspectives – DOW Technologies acquiring an integrator (perhaps as a test to buy more?)…and Allnet Distributing (Snap One) which is owned by a manufacturing conglomerate.

Dow’s take is different. Smarter? Not as smart? Is this the trend of the future? Will more distributors begin acquiring integrators? Will more manufacturers acquire distributors? Which model will prevail? Or will each of these models ultimately fail?

I for one would be really interested to hear readers thoughts on these issues.

BUT PETER, I will grant you this point. Having said all that, I grant you that experiments such as these have been tried at times before…and failed. I’m thinking about Circuit City who bought an integrator for an adventure that didn’t pan out. Or Best Buy who bought integrator AudioVisions only to eventually sell it back to the original management. For these superstores, moving into integration was a bridge too far. Of course, both of these were also decades ago.

Integrators should know that just because somebody tries something, doesn’t mean in the final analysis…it will work. But I cannot fault integrators for taking a stand.

This story contains – IMHO – some really interesting themes.

Thanks all who respectfully contribute to the discussion.

Ted

You cannot be a consultant and a vendor. DOW should be brand agnostic (or that is what they probably tell Samsung and Sony to keep their buisness). Having a sales team who pushes a brand to an end user for a greater gain over the companies your other company is selling to is very concerning. I would say to them respect the channel. Be better partners. Be happy with the money you are making and move on. Very disappointed. Thanks for the article. .

Mark, thanks and excellent writing but honestly I am not sure what your point is? So, again I say “really?”

For starters, nobody but nobody was happy when Best Buy became a Mitso dealer – nobody. And, nobody was happy when the small independents were granted access to Mitsubshi. Having said that, no retail high-end chain was happy as their well trained staff left them and began what used to called the “trunk slammer” business. Plus, nobody was happy when furniture stores began selling electronics. Lest we forget that the esoteric retailers used to soil themselves when a retail chain was granted access to a high end brand. The “protocol” of retail life I suppose.

By the way, as an aside, it was the department stores that taught us all how to use finance in the early eighties – not Best Buy or Mitsubshi. Regarding Bose. Respectfully, if you were not discounting or disparaging Bose, you probably didn’t belong in the business! Ha!

May I also point out that today, Best Buy brags about how many Independents have accounts with them… Don’t worry about Dow, look in your rear view mirror or next to Shell, Best Buy is everywhere…

Simply put, the market continues to evolve and the more it changes the more it stays the same.

Finally, vendors, retailers, Independents, Distributors, and big boxers, all play a role that shifts continually – who cares? Dow is an average Distributor who likely wants to see more upside and opportunities for new brands but sure as i sit here, the Independent is more likely to turn into a Distributor than Dow is likely to become a successful re-seller.

Finally, I would always tell Independents that a new competitor is like a new boyfriend or girlfriend, it’s never better than the first 90 days and then you go back to ham sandwiches and donuts….

Get better. You don’t own your lane of the business, you are simply a “trustee.”

Good Selling

Nice article. Bad look for DOW for sure. The transparency for this is good for dealers to know (spread the word) as they will surely stop purchasing from DOW and many will hope Brands pull out from DOW because of this “burning the candle at both ends” business practice. But at the end of the day, the customers are the ones who will end up winning as the more “Smart Solutions” markets and bids against us, it can make or break some. Dealers/integrators need to step up their game and provide a higher level of service each day as these guys have added another wrinkle to the market. Healthy competition is good but unhealthy competition such as this sours the market for all.

Depending on what makes more money for DOW, If/when a large majority of dealers stop using DOW and goto say, Allnet or other distributors, it may force DOW to sell off or stop their Service side. Only time will tell.

I’m sad I just wasted ten minutes of my time reading this article. This “angry” dealer could have better spent his time strategizing on how to make his own business succeed and maybe generating some unique and original tactics so he too could “be the fastest kid on the playground”. I agree with Peter on this one. Desperate news day I guess.

two companies…owned by the same people. so? does anyone know if dow gives the other company any special deals for products over other integrators? if so…shame on them. if not…then why the tears? article sounds like people are upset over the competition, without showing that the smart solutions integrator has any unfair advantages. be better than that company and take the jobs back from them.