Resideo Technologies, Inc. (NYSE: REZI) reported its financial performance in the fourth quarter and full year of Fiscal 2024, the period that ended on December 31, 2024. The company showed good growth, much of which was thanks to its June 2024 acquisition of Snap One, which contributed $553 million to its net revenues.

However, that revenue win was not pain free…

See the details of the Resideo 4Q & FY 2024 financial results…

Resideo Technologies, the new owner of Snap One and all of its associated brands (such as Control4 and OvrC), released its results from Fiscal 2024 to great fanfare with almost an exuberant tone by the company and its executives. To be sure, after a down year in Fiscal 2023, this was a welcome rebound in 2024 and the sense of relief from the company was palpable.

After A Down 2023, A Sense of Relief in the Revenue Rebound in 2024

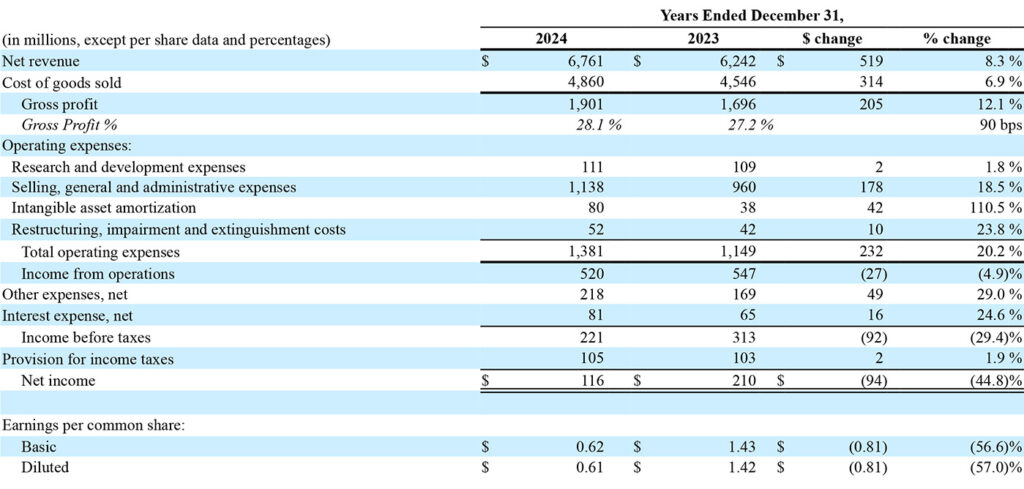

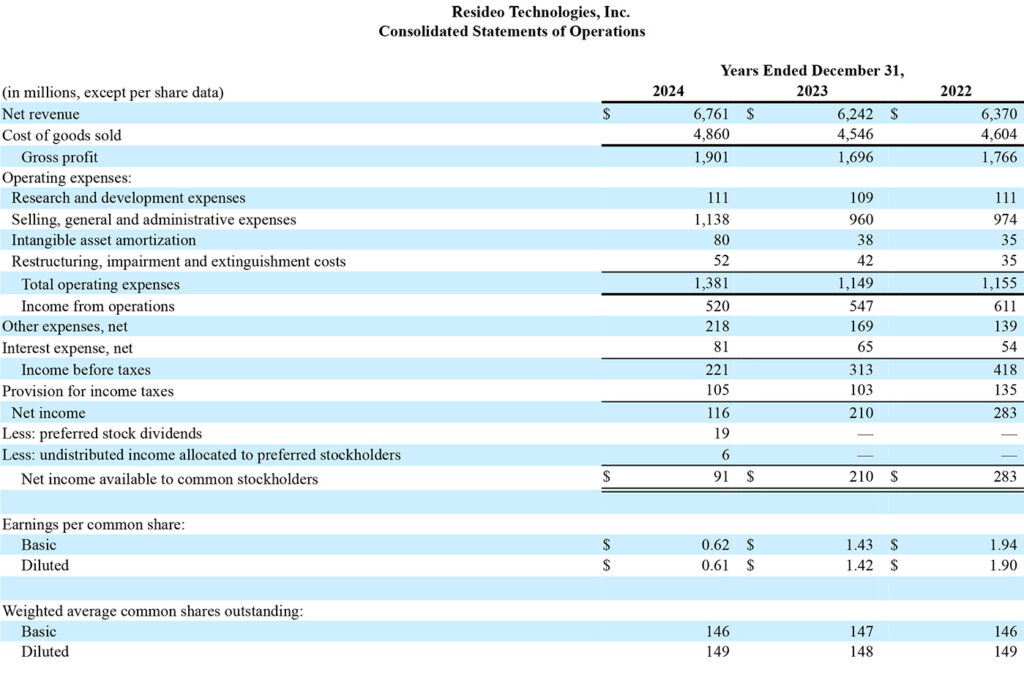

That sense of relief came from the fact that the company saw its full-year net revenues grow to a robust $6.76 billion, up $519 million or 8.3% as compared to revenues of $6.24 billion in Fiscal 2023. An 8.3% gain is respectable, but even the company notes this gain was largely due to its acquisition of Snap One in the middle of 2024.

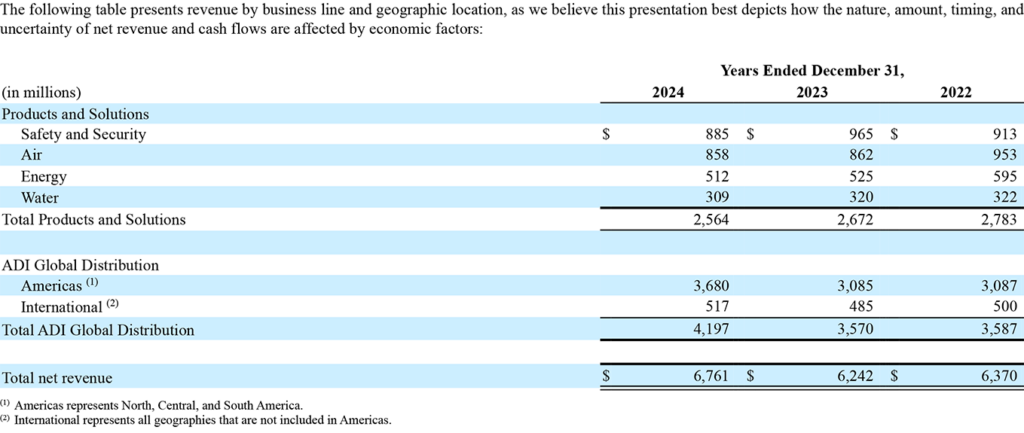

In looking at Resideo’s report, you really see a tale of two companies – its two operating business units. One is Products and Solutions, a manufacturer of “comfort, energy management, safety, and security” products. The other is ADI Global Distribution, “[A] leading wholesale distributor of low-voltage products including security, fire, and access control” that also participates to a lesser degree in “…related markets of smart home, residential audio-visual, professional audio-visual, power management, networking, data communications, wire and cable, enterprise connectivity, and structured wiring products.”

Snap One Had a Big Impact…on Revenues

The company acquired Snap One and put it under the auspices and control of its ADI division. This latest earnings report shows that Snap One added $553 million to revenues in its ADI division in 2024. That works out to an 18% increase in 2024.

Growth of 18% is impressive, but to look at “organic” growth for more of an apples-to-apples comparison, you need to deduct the Snap One numbers to see how the organization itself performed over that period. When you do that, you get just 2% in organic growth…a much more modest performance.

But let’s move on to take a deeper look at the company’s performance.

A Deeper Look at Resideo’s Fiscal 2024 Results

In announcing its results for Full Year Fiscal 2024, the company offered the following bullet points for the “highlights” of its performance. I’ve added some emphasis to point out those items I found particularly interesting.

- Net revenue was $6.76 billion, up 8% compared to $6.24 billion in 2023

- Net income was $116 million, compared to $210 million in 2023

- Adjusted EBITDA was $693 million, up 17% compared to $590 million in 2023

- Fully diluted EPS was $0.61 and $1.42 and Adjusted EPS was $2.29 and $2.19 for 2024 and 2023, respectively

- Cash provided from operating activities of $444 million

That Gain was Accompanied by Some Pain

My headline teased the fact that the company achieved good growth, but not without some pain…and this is what I was referring to. The fact is these gains came with some pain in the form of lower profits. That being said, clearly, management was very pleased with the results.

Resideo finished 2024 in a strong position, exceeding the high-end of the range for all four of our key financial metrics. The ADI and Products and Solutions teams drove excellent operational execution, generating organic net revenue growth in both segments, continued gross margin expansion, healthy Adjusted EBITDA growth, and record operating cash generation. As we look ahead to 2025, Resideo remains focused on growing organically and expanding the company’s margin profile. With the Snap One integration well underway and synergy capture ahead of schedule, ADI has momentum from its broad-based product category strength and positive returns from its strategic ecommerce and Exclusive Brands investments. And within Products and Solutions, we are excited by the continued gross margin expansion and the new product introductions to come in 2025. We believe Resideo is well-positioned to capitalize on the profitable growth opportunities ahead of us.

Jay Geldmacher, Resideo President and CEO

Revenues Disaggregated by Product Category and Geographic Region

Looking at more of the reported results – with Snap One included in the numbers – disaggregated sales were provided by the company on two different bases…Products and Solutions by product category…and ADI by geographic region.

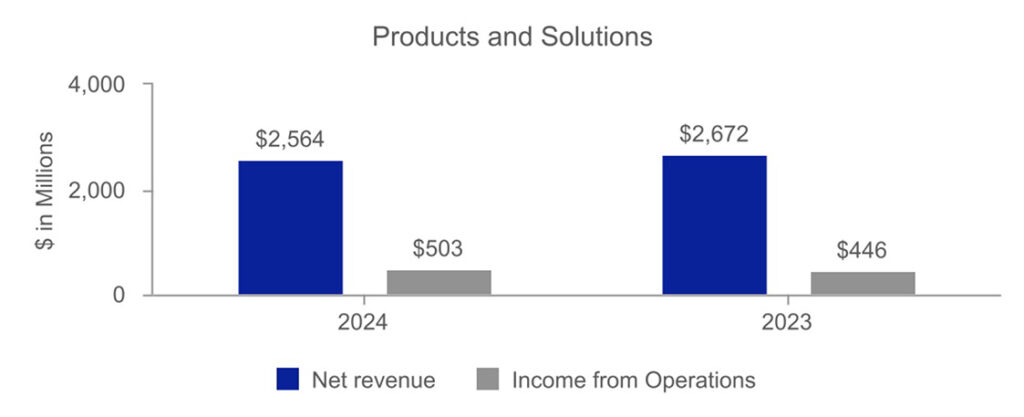

As you can see in the top table, Total net revenue at Products and Solutions have declined in both 2023 and 2024, as compared to 2022 results. And in 2024, each product category registered a decline compared to Fiscal 2023. The company really didn’t offer an explanation for this decline but noted that P&S sales hit a record high in the Retail channel thanks to First Alert and BRK products.

P&S – Revenues Down, Profits Up

P&S did work hard, the company says, at “structural improvements” that led to “increased operational efficiency.” Consequently, Selling, general, and administrative expenses (SG&A) were down $12 million and Research and development (R&D) declined $14 million compared to the previous year. The division also passed along price increases on several products. This expanded gross margin and improved profits in the division. The company also said P&S is working on several new models, which should help to reignite revenues…but then how did R&D expense decline?

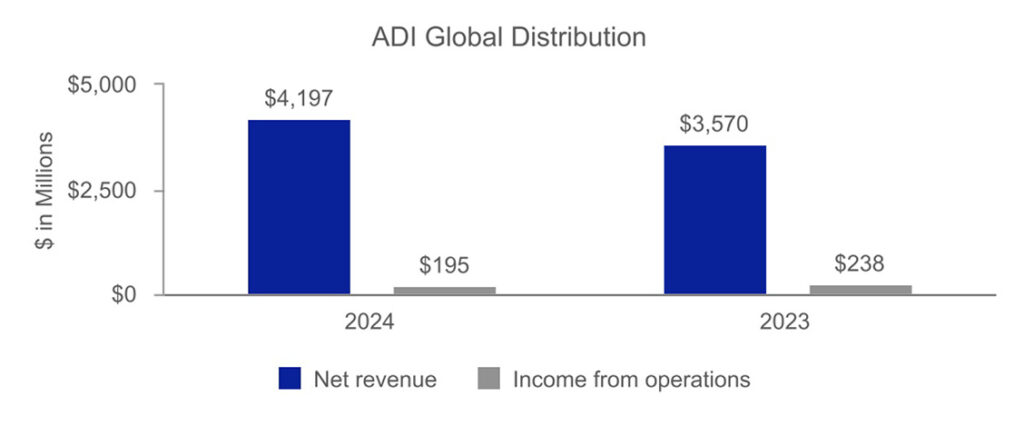

If profits were the story in the P&S division, revenues are the story in the ADI segment. In the bottom table, we see that ADI saw both its domestic and international revenue decline in 2023, but rebound this year thanks largely to the acquisition of Snap One. Revenues in the division came in at $4.20 billion, up 17.6% or $627 million compared to revenues of $3.57 billion last year. Again, this growth was largely driven by the $553 million added by the newly acquired Snap One business. As I mentioned before, without Snap One, organic revenues would have only increased 2%.

ADI – Revenues Up, Profits Down

Categories doing well for ADI “include video surveillance, residential security, and fire and access control.” But it said the first half of 2024 saw “soft market conditions.” At ADI, gross margin increased 160 basis points to 20.3%, “driven by the inclusion of Snap One and higher margin e-commerce and Exclusive Brands sales.”

But on the other side of the coin, income (profits) from operations declined in both 2023 and again this year in 2024…coming in at $195 million, down $43 million or 18.1% from $238 million in Fiscal 2023. This was due, in part, to a significant increase in Selling, general, and administrative expenses to $566 million, up a truly significant $176 million or 39% from SG&A expense of $407 million the previous year. Of that $176 million heavier SG&A expense, the company says that $158 million is Snap One expenses.

Zooming Out to 30,000 Feet

So let’s get out of the weeds of the individual divisions and see what all this means for the combined company by zooming out to 30,000 feet. The top line for the company is good – an 8.3% increase in revenues to $6.76 billion, up $519 million compared to $6.24 billion last year. But of this amount, $553 million is attributable to the new addition of Snap One…organic growth was minimal.

The expense picture is a little cloudier up here. Take these points for example…

- SG&A expenses – Were $1.14 billion, up $178 million or 18.5% worse than last year’s $960 million. Note that $158 million of that $178 million increase are costs directly attributable to Snap One

- Intangible asset amortization – Came in at $80 million, up $42 million or 110.5% versus $38 million last year. This is all due to the Snap One acquisition with new intangibles that need to be amortized

- Restructuring, impairment, and extinguishment costs – Reported at $52 million, up $10 million or 23.8% as compared to $42 million in the same period last year. These are “primarily due to debt extinguishments and related costs…”

- Other expenses, net – Totalled $218 million, up $49 million or 29% compared to $169 million last year. These are costs largely associated with payment to Honeywell, which Resideo was once a part of

- Interest expense – Was $81 million, up $16 million or 24.6% versus $65 million last year. This is due to an increase in long-term debt to acquire Snap One

The Pain – Operating Income Declines 5%; Net Income Collapses 44.8%

The first three expense items in the list above, along with R&D expenses (up 2%) served to cause a 20.2% increase in Total operating expenses. And that resulted in a 4.9% decline in Income from operations to $520 million versus $547 million last year.

So think about that for a minute… An 8.3% gain in revenues, a 12.1% increase in Gross profit dollars yielded 5% less income from operations.

Not only that, but Net income for 2024 came in at $116 million, down $94 million or 44.8% compared to Net income of $210 million in Fiscal 2023. On a fully diluted basis that works out to an earnings per share of $0.61, down $0.81 or 57% compared to earnings per share of $1.42 last year.

Summing Up 2024 for Resideo

Certainly, the company experienced solid growth in 2024 and at $6.8 billion in revenues, Resideo has grown its influence in the industry. But that growth came at some pain, as it booked its lowest Net income in three years to get that growth.

Resideo says that it has achieved about 40% of its run-rate synergies it expects to enjoy as part of its acquisition of Snap One…so these expense areas may continue to decline for more profit enhancement down the road.

Learn more about Resideo by visiting resideo.com.

Leave a Reply