New data shows that consumer content consumption trends are changing dramatically…and at a quickening pace. Fresh reports from eMarketer and separately from Axios show that people are unplugging from traditional cable and satellite TV in huge numbers. If traditional pay TV is losing, who is winning? And what does this mean for the Tech industry?

See the latest data on consumers cord cutting…

Over the next year or so, we will likely see a rash of new studies coming out looking at the impact of the COVID-19 pandemic on consumers. How did it impact their lives? What changes did they make? Which of those changes will continue? How can we – as an industry – learn from that data and adjust our approach accordingly?

This week, using data published by eMarketer, Axios did a study on shifting media habits for consumers. And they came to a surprising conclusion – more on that later – but first, consider this…

Consumer Preferences in a Time of COVID-19

So COVID-19 imposed quarantines and other restrictions forced Americans to make the dramatic shift from spending a third or more of their day away from home – to spending 100% of their time at home. New patterns emerged as work lives shifted to a work-from-home (WFH) model and our children’s patterns changed as they shifted to a learn-from-home (LFH) environment.

The pandemic has taken a huge toll on the pay TV industry, and with the near-term future of live sports in question, things will only get worse…”

Sara Fischer, Axios Media Trends

And in our off-hours, our entertainment shifted from eating out at restaurants, going to movies or concerts, or travelling around the world…to entertaining at home. All of which put pressure on our home networking solutions and entertainment systems.

A Dramatic Shift on Content Consumption

One by-product of this change, was a dramatic shift in how Americans consumed content – whether written, audio, or video. With more time at home, there was more time available to consume our favorite content – including television. From this, we have seen a dramatic upswing in the success of various streaming services, the most successful pioneer of which was Netflix.

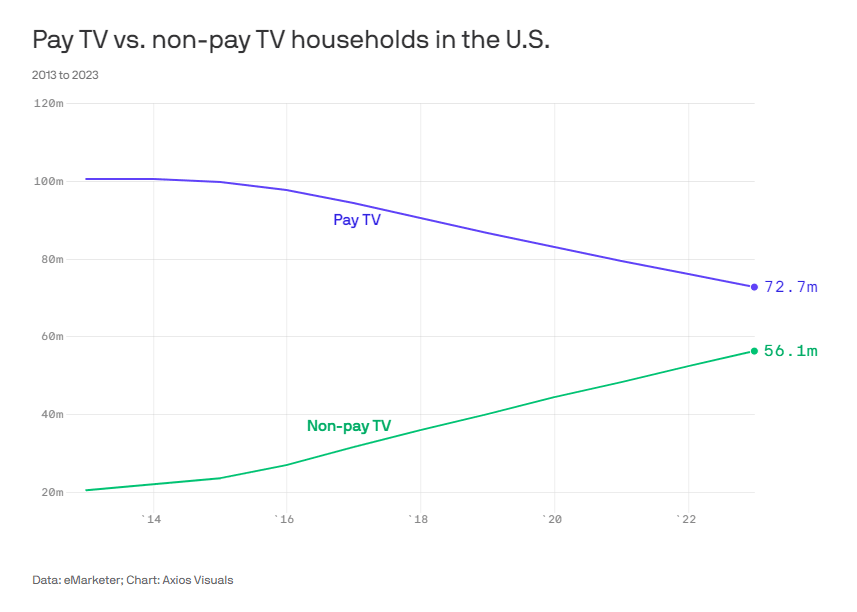

Yet another long term trend is cord cutting – the rate at which consumers are dropping their subscriptions to pay TV options, such as cable TV and satellite TV. What we now know is that, the pandemic appears to be accelerating that trend, with more consumers shifting from the traditional pay TV model to multiple streaming services.

While the rate at which consumers killed their pay TV subscriptions moderated a little in 2020, new forecasts suggest that the ultimate impact will be an acceleration away from pay TV, as subscriptions to streaming services really blossomed in 2020. That exposure, if you will, is expected to hasten the demise of the pay TV model.

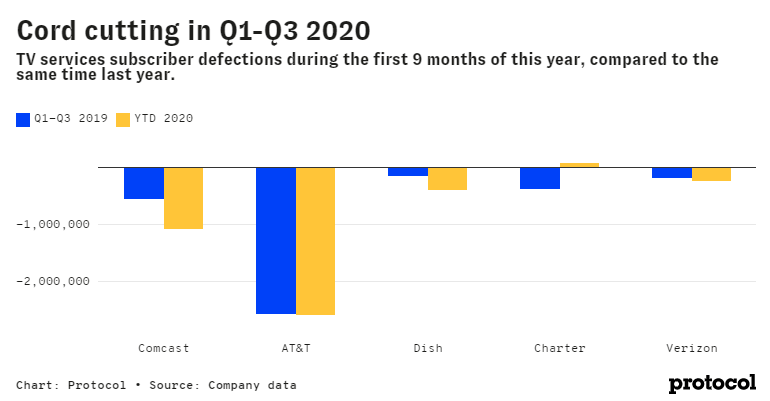

The Pandemic Has Taken a Huge Toll

From the Axios analysis: “The pandemic has taken a huge toll on the pay TV industry, and with the near-term future of live sports in question, things will only get worse…” The data suggests that the loss of live sporting events on pay TV in the first half of 2020 only helped convince more consumers they didn’t need their pay TV anymore. While sporting events began to return in the second half of 2020, eMarketer says cord cutters did not commensurately reactivate their pay TV subscriptions.

In 2020, an estimated 5 million households dropped their subscriptions with pay TV providers. At the end of day, it appears that the pandemic has caused the pace of cord cutting to accelerate. One new forecast showed that pay TV subscriptions declined 9.5% between 2015-2019 – but over the next five years, they forecast it will decline 36%.

What to Watch For

What do media analysts say will be the final nail in the coffin of pay TV? The minute one of the major streaming services scores exclusive streaming rights to a major sports franchise – such as, for example, the NFL.

Since several of those rights are coming up for renewal over the next couple of years…keep your eyes peeled for something like that to happen.

What This Means for Tech

Well, first of all, I know a lot of technology integrators who would cheer the removal of Comcast or other pay TV providers from their systems through cord cutting…as they tell me that the headache factor is high with this bunch. But as this trend continues, this will put more pressure on the home networking structure.

Most integrators have already adapted to this trend, literally resorting to installing enterprise-grade networking solutions with maximum throughput to accommodate multiple streams of high-definition video distribution and the such. So for many, there is not much else to consider.

However, internet service providers can sometimes offer their own share of headaches. That it seems, will become more acute as we head down this road.

See the Axios report on this trend by following this link…

Leave a Reply